Can the A50 and Hang Sheng index still go up?

Today, there was a big counterattack between A shares and Hong Kong stocks. Everyone knows the reasons. Our government issued the latest news, and it seems that the bottom of the policy is approaching.

For the specific content, you can look at the news by yourself,:

This news seems to be a response to the downgrade of 28 Chinese stocks by JP Morgan a few days ago, and before that, Morgan Stanley said seriously that the geographical and regulatory risks of China were rising.

Wall Street slashed the rating of China Stocks! What happened here? !

So the question now is, after the violent rebound exceeds 10 percentage points, can A50, Hang Seng Index and Hang Seng Technology Index futures still bargain-hunting?

$China A50 Index - main 2203(CNmain)$ $Hang Seng Index - main 2203(HSImain)$ $Hang Seng Tech Index - main 2203(HTImain)$

From the technical form, A50, Hang Seng Index and HTI are all properly engulfed by the bottom rebound, and the bottom bullish mood is very obvious.

In addition, the rebound in Hong Kong A, driven by a big rise, the US and European stocks will have a small rebound opportunity

$E-mini Nasdaq 100 - main 2206(NQmain)$ $EURO STOXX 50 Index - main 2206(FESXmain)$

We should know that the current uncertainty has been greatly eliminated, and what the financial market needs is certainty, which means rising!

The fact that the Federal Reserve will raise interest rates by 25 basis points one day later is already certain. If this risk falls to the ground, will the staged uncertainty be eliminated, and will there be a small rebound opportunity for global stock indexes as the Ukrainian-Russian war draws to a close?

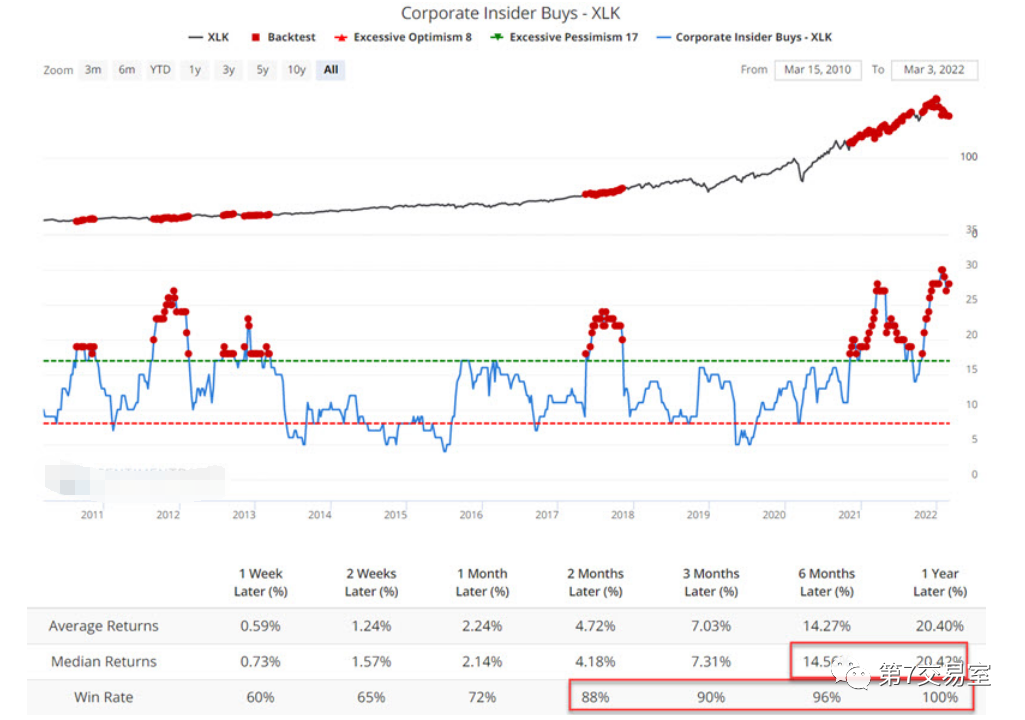

Let's take a look at the technology companies in the US stock market, which have already made a large number of internal purchases, and every time the internal purchases of these XLF constituent stocks exceed 15, it will make the US stock technology etf: XLF have a big rebound:

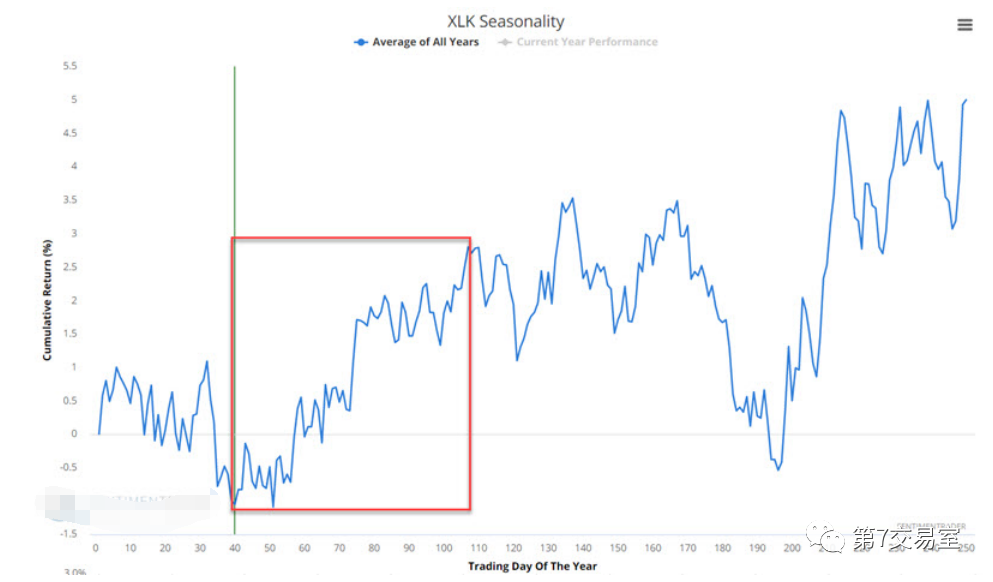

From the seasonal trend, US technology stocks also ushered in a relatively more optimistic quarter,

So can we think that the risk of the Fed raising interest rates by 50 basis points may fall in May or June? If there is no big friction between China and the United States during this period, the market will usher in a relatively optimistic period, especially a rare bargain-hunting opportunity for A shares and Hong Kong stocks?

Offer a reward

Offer a reward of 1000 tiger coins. Let's talk about our views? Good comments give a minimum reward of 20 tiger coins

$Gold - main 2204(GCmain)$ $Light Crude Oil - main 2204(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- tigjun21·2022-03-17HSI is attractive below 20,000. Once the pandemic has stablized, it would be even more resilient. But one still needs to be aware of political tension. Can consider small DCA into EWH etf (Hong Kong).5Report

- BellaFaraday·2022-03-17The decision by the People's Bank of China to cut interest rates in the future is undoubtedly a big plus.4Report

- HilaryWilde·2022-03-17Yesterday's trading volume was very large, indicating that large funds were buying.3Report

- Maria_yy·2022-03-17Yesterday's big rally would see shorts unwind today, and that unwinding would send the stock market higher.2Report

- zingzy·2022-03-17不出意外,A股和港股今天再度上涨。我希望它能这样继续下去,哈哈哈2Report

- MHh·2022-03-18Can begin to bargain hunt but save some bullets for later. Seems like the tension between China and US is not over yet. Recovery would be bumpy.2Report

- BurnellStella·2022-03-17I will choose to wait and see for a while before making a decision.2Report

- EvanHolt·2022-03-17Yesterday's meeting gave strong support to Chinese concept stocks.2Report

- ElvisMarner·2022-03-17The Hang Seng Index is already undervalued, so it can continue to rise.2Report

- JLKang·2022-03-18This is a counter trend rally. Hit and run to stay nimble1Report

- Mundoo·2022-03-18Hope bootom is here3Report

- LouisLowell·2022-03-17I think it might just be a brief bounce on the way down.2Report

- PandoraHaggai·2022-03-17我认为当前的上涨需要谨慎对待。1Report

- DonnaMay·2022-03-17Yes, the current situation has completely reversed.1Report

- CaseyChang·2022-03-22[Smile]LikeReport

- CaseyChang·2022-03-19[Smile]LikeReport

- iamted·2022-03-19去吧去吧LikeReport

- Jinwei.·2022-03-18huat u1Report

- Sam Ang·2022-03-18阅2Report

- tiggerteh·2022-03-18Ok3Report