10 Most Watched U.S. Stocks in H12022 By Tiger Community

$Tesla Motors(TSLA)$

- Price close: 673.42 (June 30)

- Market cap: $697.9 billion

- YTD change: -36.3%

- PE Ratio (TTM): 90.7

2021 is a wonderful year for Elon Musk, successfully being the richest man in the world due to soaring market cap of Tesla, while in 2022, his words aroused criticism to some extent, and Tesla also needs improving. Due to the tremendous sales amount of Model 3, Tesla posted a record 310,000 deliveries and an operating margin of 19% in Q1, leading the whole EV market booming. However, due to inflation and supply chain crisis, Tesla has to raise prices several times, At the same time, it also started dedundency and moved its headquarters to Texas with lower tax rates for the coming recession.

Tesla's valuation in the secondary market has been high, and its share price falling by more than 40% from the 52-week high this year. With Elon Musk officially announced the intention to acquire Twitter, Investors are also worried that he will sell more Tesla shares. Recently, the company has submitted a 1: 3 share split plan, which is expected to be implemented in the second half of the year.

$Apple(AAPL)$

- Price Close: 136.72 (June 30)

- Market Cap: $2,212.8 billion

- YTD Change: -23.0%

- PE ratio (TTM): 22.2

Apple's innovations stucked recent years, mostly tiny updates in some people's opinions, but in fact, Apple has focused on Self-developed Chips. The latest M2 launched this year is quite competitive in the industry. This is also Apple's strategy in the time of "chip shortage". In the first quarter of 2022, Apple's iPhone revenue increased by 5.5% year-on-year, the better the iPhone market sells, the greater the market base for Apple's services. Its service revenue increased by 17% in Q1 2022.

Apple is almost the benchmark in the market, and its share price was strong supported by repurchase, but still retreated by 21% due to the market downside this year.

$Alibaba(BABA)$

- Price close: 113.68 (June 30)

- Market cap: $308.2 billion

- YTD change: -4.3%

- PE ratio (TTM): 15.8

The situation for Alibaba facing this year is sensitive, a big threat for E-commerce business is increasing marketshare of video platform, its overall consumption demand growth is not as strong as of previous years. Offline business, on the other hand was affected in some cities, but it starts to recover since June.The company is also realizing expenses cut, especially after revenue growth rate dropped to a single, it is trying to pay more attention to operational efficiency. As China's macro policy is still on easing, the expectation of recovery is getting stronger and stronger.

Alibaba stock price in the secondary market has taken a roller coaster in the first half of 2022. It was sold to about $73, close to the IPO price in 2014. Even Charlie Munger lost money on Alibaba. And the market's willingness to buyback Chinese assets is becoming more and more obvious after May, it has risen to about $110 now.

$NIO Inc.(NIO)$

- Price close 21.72 (June 30)

- Market cap: $36.3 billion

- YTD change:-31.4%

- Price-earnings ratio (TTM): N/A

As one of the representative EV enterprises of China's,NIO delivered 25,768 vehicles in Q1 in 2022. While delivery on Q2 may decline due to some restrictions. On one hand, the competition with the domestic new energy vehicle market is becoming more and more fierce, on the other hand, it is also related to the suspension of production in Shanghai in the second quarter. At the same time, NIO also released the second generation technology platform in its new SUV car ES7, expected to be delivered in the second half of the year. However, the recent accident of a test vehicle also caused public opinion.

NIO is an active stock in the secondary market, after Tesla in EV industry. Recently ,a short seller Grizzly accused it of exaggerating revenue and improving profit margins to achieve its goal, but did not generate much declines. However, NIO's share price has also been adjusted back by 31% this year. Fortunately, it has realized the listing in Hong Kong and Singapore.Become the first EV company listed in three exchanges.

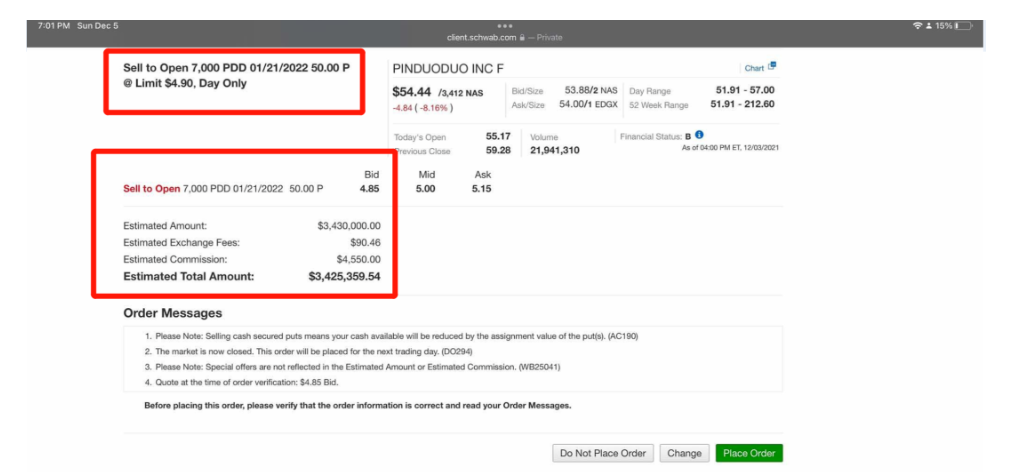

$Pinduoduo Inc.(PDD)$

- Price close: 61.8 (June 30th)

- Market cap: $78.1 billion

- YTD change: 6.0%

- Price-earnings ratio (TTM): 42.0

Like most Internet companies in China, Pinduoduo also gave up the active and expansive development and sought more stable mode. Business concerntration, layoffs, and supply chain integration are all there. From the overall performance point of view,The attitude of increasing revenue and reducing expenditure is very obvious. Although the growth rate of active users and active buyers has dropped to single digits, the company has reduced its self-employment and focused on agriculture and digital technology. The income growth outside Q1 self-employment is still 40%. In addition,Advertising revenue reached 18.2 billion.More importantly, marketing expenses declines and turn losses into profits, we believe this trend will continue. Perhaps it is the change of macro environment makes Pinduoduo paying attention to operational efficiency.

In the secondary market, Pinduoduo's prices has risen to 6% this year, after a huge decline in 2021. Besides, some big KOL's investment through Sell PUTs has also strengthened investors confidences. In the past month, it has also rebounded greatly because the overall Chinese assets are favored.

$DiDi Global Inc.(DIDIY)$

- Price close: 2.95 (June 30)

- Market cap: $14.3 billion

- YTD change:-40.8%

- Price-earnings ratio (TTM): N/A

After last year's shelf rectification, Didi has been in low-key since 2022.The market share of its shared travel business has dropped to 70%or so, But demand is still relatively stable. However, the outbreak of the pandemic in some cities in the first half of this year also had a great impact on its revenue. So Didi's taking more steps to improve efficiency. After the special shareholders' meeting in the first half of the year, the company also successfully delisted from NYSE, changed its symbol from "DIDI" to "DIDIY", trading in OTC market, but it still has high activity.

Didi in the secondary market lost nearly 40% of its market value this year. However, after the news of delisting landed, the market's expectation its App Store online became more and more obvious, so it also got a good rebound.

Related reading:Didi is approaching "delisting". What is the impact of investors holding positions

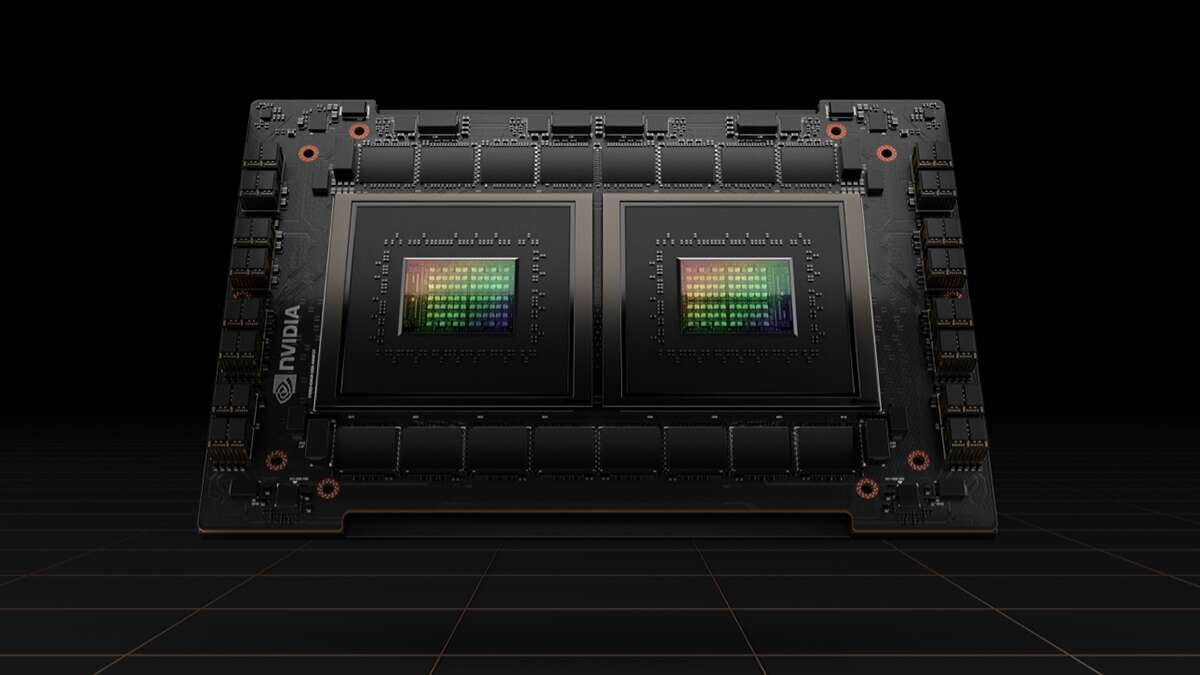

$NVIDIA Corp(NVDA)$

- Closing price: 151.59 (June 30)

- Market value: $379 billion

- Return so far this year:-48.5

- Price-earnings ratio (TTM): 36.0

The chip market is still highly tense in 2022, almost all the industries generate demands. Although game business is pessimistic, and the demand for cryptocurrency has also been greatly reduced due to the decline in crypto market, the development of telecommuting infrastructure, energy vehicles and short video industries also need its assistance. NVIDIA's data center's revenue exceeded the game business for the first time in Q1, The company also launched the first data center-specific CPU expected to start supplying next year. All in all, NVIDIA still maintainning high growth.

Nvidia in the secondary market retreated by 47% this year, to the level of begining of 2021.the market risk has reduced in 2022, growth stocks are not favored Although NVIDIA's growth rate is still fast, but not as strong as last year. The company's price-earnings ratio is still 36 times, which of course has the impact of $1.35 billion in losses caused by regulatory opposition to the ARM acquisition with SoftBank.

$Meta Platforms, Inc.(META)$Facebook

- Price close: 161.25 (June 30)

- Market cap: $436.4 billion

- YTD change: -52.1%

- Price-earnings ratio (TTM): 12.2

Facebook's biggest move this year is to change its name to "Meta", which not only changed its company name, but also changed its stock symbol. Metaverse was proposed by Zuckerberg, and this next generation scenario does not have enough infrastructure to support at present, so this concept is not mature yet.The company's revenue also fell to single digits in Q1 this year with most of which are advertising, but due to the upward cost brought by inflation, the company's profits have dropped significantly. Meanwhile, The growth of short video competitor Tik Tok is obvious. Besides, COO Sanderberg's departure was also controversial and makes a lot to Facebook.

Facebook's share price in the secondary market plunged by a quarter after the financial report at the beginning of the year, and has not recovered since then. It has dropped by more than 50% since 2022 and has returned to the level of 2019. At present, the main supporting force of the company's stock price is repurchase.

- Price close: 106.21 (June 30)

- Market cap: $1,080.6 billion

- YTD change: -36.3%

- Price-earnings ratio (TTM): 60.1

Inflation in the United States has lowered the overall consumption desire. In addition, the pace of post-pandemic liberalization is faster than expected, which also makes offline consumption recover faster.High supply chain and logistics costs, also affected the profits of e-commerce companies like Amazon, so Amazon also raised the prices of some logistics and transportation. So, since 2022, Amazon'sThe whole business has changed from "online" to "offline"From the performance of Q1, the revenue of online stores decreased, while that of offline stores increased significantly. In addition, the revenue of subscription and advertising related to promotion increased significantly.And its AWS cloud business still maintains a growth rate of over 35%.However, due to the serious inflation problem, the market is not expecting it well.

Amazon's share price in the secondary market hardly changed last year, but now it has retreated by 36%. Although it completed a 1:10 share split in June and more retail investors entered the transaction, the overall mood is not high. The company's current valuation is not very attractive.

- Price close: 37.39 (June 30th)

- Market cap: $28.6 billion

- YTD change: -13.5%

- Price-earnings ratio (TTM): N/A

Since the absence of Trump, Twitter's biggest online celebrity has become Musk. He, who is ambitious in the communication industry, also wants to buy Twitter and has already become the second largest shareholder. The company's performance mainly depends on advertising. With the double-digit growth of active users, Q1's advertising revenue has also increased by more than 20%, but its profit in the past 12 months is still negative. Musk's claim on Twitter's "fake account" also brings uncertainty after offering $54/share. Whether it is the richest man's price reduction or not, it is still notable for the second half of the year.

In the secondary market, Twitter's share price is mainly affected by the acquisition news, so the fluctuation is not very sharp. It has only fallen by 12% since 2022.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

我祝贺10%的获胜者👌👍👏👏👏

[Smile]

All giant share here