Why did These Stocks Rise When the Market Crashed?

Stocks were mixed across the board but notched fresh 2022 closing lows last week. However, these three stocks didn't fall with the indices.

Let’s recap and look to the week ahead.

$FedEx(FDX)$

Shares of FedEx have gained 3.5% over the past three months against its industry’s decline of 16.7%.

Zacks Investment Research

Earnings Estimates:

The Zacks Consensus Estimate for current-quarter earnings has been revised 1.6% upward over the past 60 days. For fiscal 2022, the consensus mark for earnings has moved 0.44% north in the same time frame.

Upbeat Demand Scenario & Favorable Pricing:

The penchant for online shopping remains strong even with economies reopening and people going out for work. The e-commerce demand strength bodes well for FDX’s ground unit, which handles e-commerce deliveries for many retailers.

Revenues at the ground unit are likely to have been strong owing to upbeat e-commerce demand in the fourth quarter of fiscal 2022. Detailed results will be out on Jun 23, 2022.

Dividend Hike Affirms Financial Strength:

In June 2022, FedEx raised its dividend by 53% to $1.15 per share (annually: $4.60). The dividend is payable Jul 11, of record as of Jun 27. The move underscores the company’s sound financial health as it utilizes free cash flow for enhancing shareholders’ returns.

FedEx's liquidity position is solid. FDX’s the company's current ratio, a measure of liquidity, was pegged at 1.39 at the end of the third quarter of fiscal 2022. A current ratio of more than 1 indicates that the company's assets will be able to cover its debts that are due at the end of the year. Moreover, FDX exited the third quarter of fiscal 2022 with cash and equivalents of $6,065 million, much higher than its current debt of $116 million.

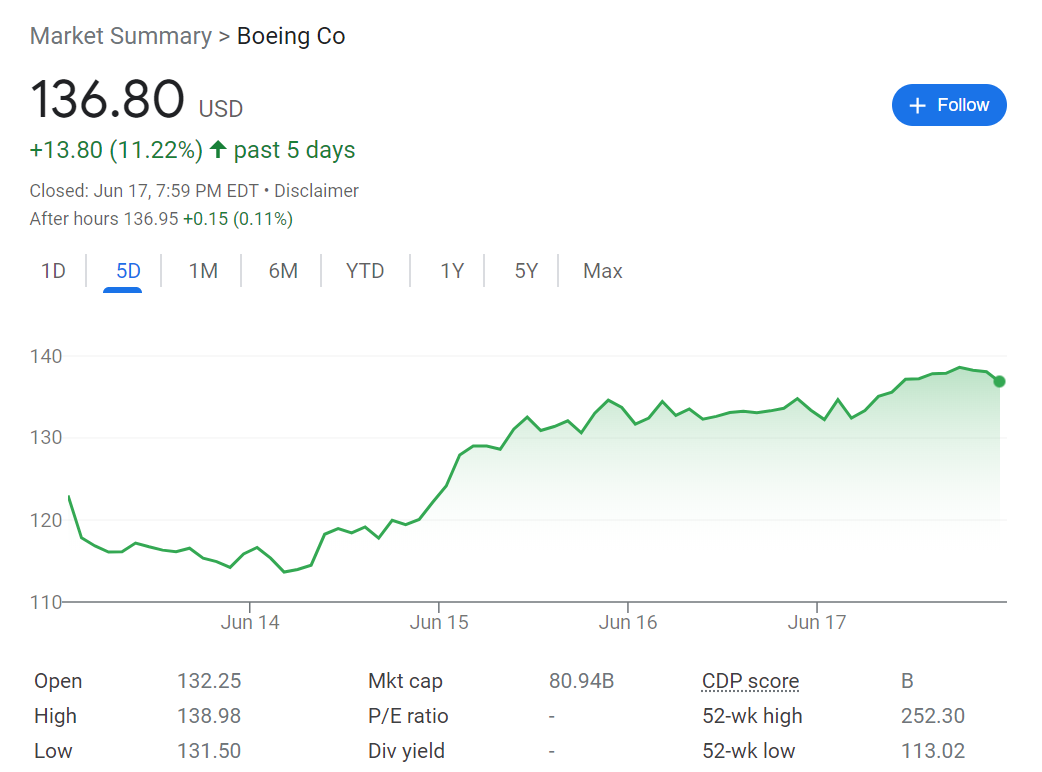

$Boeing(BA)$

Accordig to Citi, Boeing shares could soar 56% from here if the company’s three commercial aircraft programs maintain projected levels of profitability — though the buying opportunity is high risk.

Analyst Charles Armitage upgraded shares of Boeing to buy/high risk from neutral, saying in a Thursday report that the outlook for the company’s 737 Max, 777X and 787 aircraft programs would have to sour significantly to justify the current stock price. The company’s shares are down 34% this year.

Should all three aircraft programs maintain Citi’s projections for production and profitability, the analyst believes the fair value of Boeing should be $209 per share, representing roughly 56% upside from Wednesday’s closing price. This is also Citi’s new target price, trimmed from $219 previously.

$Monster Beverage(MNST)$

Morgan Stanley:

The shares of Monster Beverage Corp have received a $117 price target from Morgan Stanley. And Morgan Stanley analyst Dara Mohsenian increased the price target on Monster Beverage from $111 while maintaining an “Overweight” rating on the shares.

Analyst Dara Mohsenian and team have increased conviction in an EPS growth inflection for MNST after reviewing topline growth drivers, including strong long-term category growth in both the U.S. and internationally. The firm expects sustainable growth for MNST aided by demographic factors which skew to younger consumers, continued international share gains, improving recent U.S. share trends, expanding Numerator household penetration data in the U.S. for MNST and the category, and Morgan Stanley's analysis of historically low demand elasticity to pricing.

Looking ahead, Monster Beverage also expect pending U.S. price increases to drive both topline growth, as well as margin recovery.

On a valuation look, Monster Beverage is said to look compelling, with the 12% long-term topline growth forecast above the 9% rate the market is pricing in from an implied discounted cash flow standpoint and consensus forecasts.

SHARE YOUR THOUGHTS

Which stocks perform best in your portfolio?

You may be rewarded with Tiger Coins for sharing your thoughts in the comment💸💸💸

Follow me! Don't forget I am the richest tiger in this community😎😎

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

But you need more money to invest for long term…

This stock has the potential to perform

JEM after being fully acquired will be cash cow, as the area around it develops