🚀Key events in the coming week, share your trading plans!

Hi, Tigers!

Welcome to Daily Discussion! This is the place for you to share your trading ideas and win coins!

Click here to join the Topic & Win coins >>

[Rewards]

- You will be given 100 Tiger Coins according to the quality & interaction of the post

(NOTE: Comments posted under this article WILL NOT be counted)

2.You will be given 10 Tiger coins if you tag more than 3 friends in the comment area

Meanwhile, we will be listing the stocks mentioned by those selected Tigers for your reference every day (not investment advice though)

Is there anything you would like to share about your trades today?

Click to join the topic & win tons of Tiger Coins here >>

[Winners Announcement: 10th Jun]

1.Here are the 9 Tigers whose post has the best quality & interaction yesterday:@Bonta @HelenJanet @Axekay @Ultrahisham @koolgal @Jo Tan @Lionel8383 @Big Cat @pekss

Congratulations on being offered 100 Tiger Coins!

Beware when politicians talk & play politics

$Prime US ReitUSD(OXMU.SI)$shares continue to trend downward

2..Here are the stocks mentioned by the above Tigers:$Applied Materials(AMAT)$$Apple(AAPL)$$NVIDIA Corp(NVDA)$$Taiwan Semiconductor Manufacturing(TSM)$$S&P 500(.SPX)$$KIMLY LIMITED(1D0.SI)$$SINGAPORE EXCHANGE LIMITED(S68.SI)$$TENCENT(00700)$ (Not investment advice)

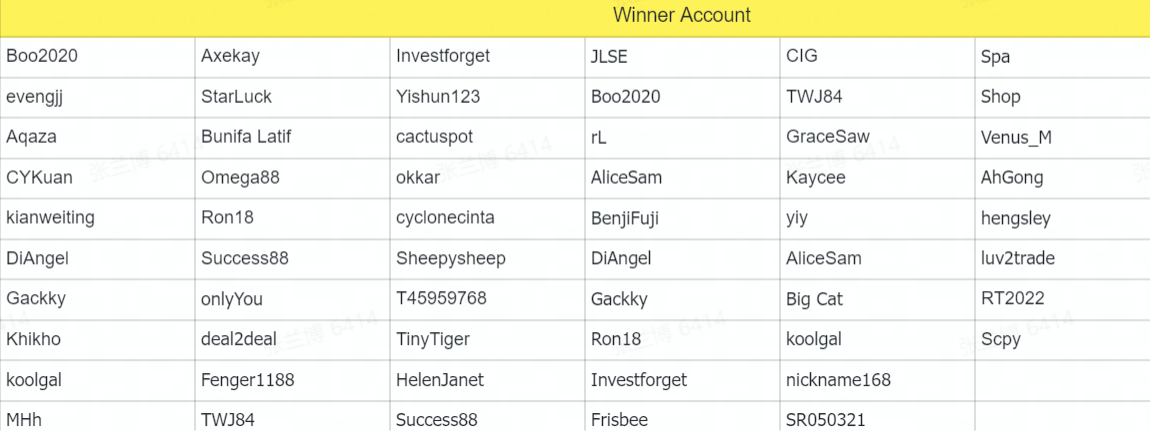

And let's congratulate these Tigers for winning 10-50 Coins:

Below are Today's Key Takeaways.

Below are Today's Key Takeaways.

Top News Move the Market

Global Markets Weekly Update

- Hotter-than-expected inflation drags stocks down.Stocks finished with steep losses despite some early-week strength. The equities market turned south on Thursday afternoon, and the selling accelerated on Friday following the release of hotter-than-expected consumer price index (CPI) data for May. At the beginning of the week, trading volumes were light, and volatility measured by the Chicago Board Options Exchange (CBOE) Volatility Index, known as the VIX, was relatively low, but volatility turned sharply higher at the end of the week.

- Oil prices climbed for most of the week before falling on Friday, finishing the week modestly higher and supporting energy sector stocks to some degree. Losses in the tech-heavy Nasdaq Composite were worse than in the broad market as higher interest rates reduced the appeal of companies that may not generate meaningful earnings until well into the future. Value stocks held up better than growth stocks.

- The May CPI release was the focus of the week’s economic data. The report showed that headline inflation was 8.6% from a year earlier, topping consensus estimates. May’s headline CPI was also higher than April’s 8.3% reading, disappointing investors who had been looking for price increases to slow. Core CPI, which excludes food and energy, climbed 6% from a year ago, also faster than consensus estimates.

The week ahead:Jun 13 -17

Tiger Community TOP10 Tickers

⭐For The Daily Most Active Stocks in S&P 500 & The Top 10 Popular Stcocks on WallStreetBets please turn to @TigerObserver

Click to Post in the Topic >>

Or tag the topic when you make a post

Share your ideas on the trading opportunities or the market trends, and you will win coins!

Stay safe and good luck with your investing!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

哈哈哈

[Cool]