Is Heng Seng Index finally on an upward trend?

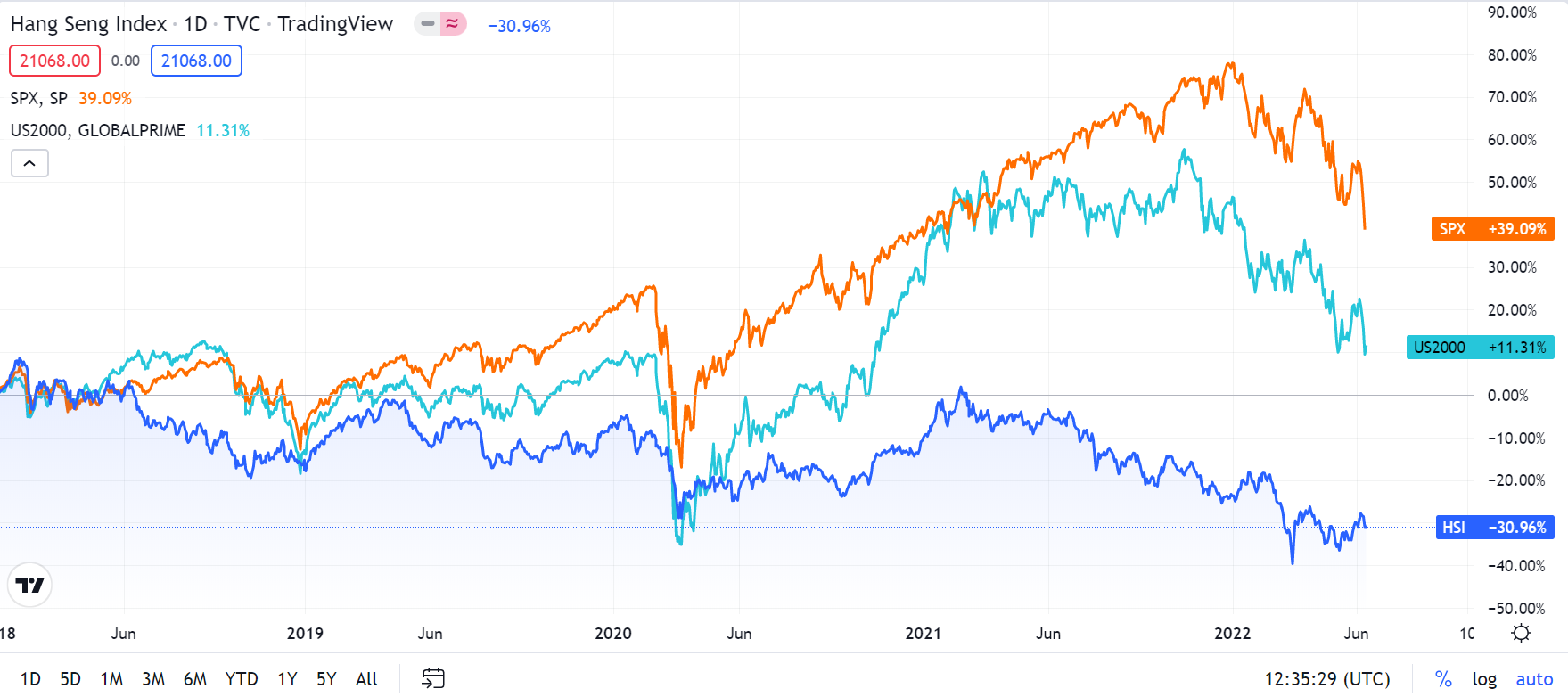

Investors always regarded the Hong Kong market as undervalued. An important reason is that it represents the performance of the Hong Kong $HSI(HSI)$ trades in a lower valuation multiples, and the fact underperforming most of major market stock indexes since 2018.

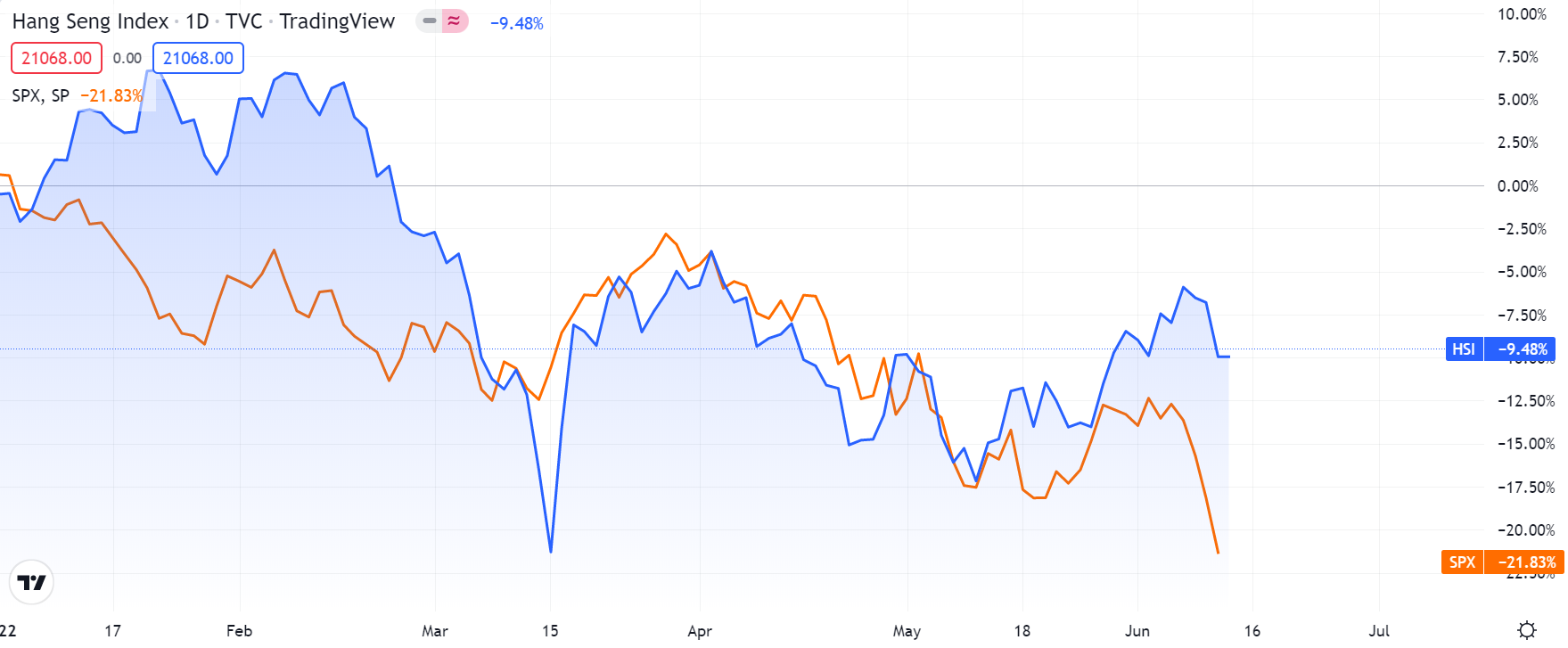

Hang Seng Index has retreated by 9.96% year to date, while the S&P 500 has down 21.33%; Since June, $S&P 500(.SPX)$The retracement reached 9.26%, while the Hang Seng Index was only 1.62%. Many investors began to consider whether the Hang Seng Index has out of its depression and on an upward trend?

Look at the graphics, After the "crisis" in March, every correction of Hang Seng Index did not seem to be lower. On the contrary, the S&P index kept hitting new lows.

This year's bear market really reflects the market differentiation.

So, is the Hang Seng Index performing"good enough"?

To be fair, Hang Seng Index has less retraced this year, is mostly due to that it has risen less in previous years.

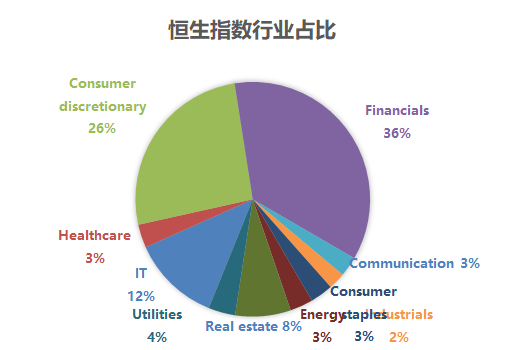

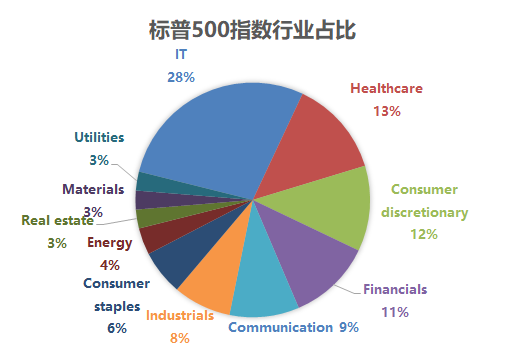

Why S&P 500 is a benchmark when you mention US stocks? Because it collects companies from various industries, and is representative. Relatively speaking,The biggest problem of Hang Seng Index is "leaning branch question", that is, some industries weights too much while others are not reflected at all.

From the comparison,Financial sector weights 36% in Hang Seng Index (the highest in previous years can exceed 50%), Consumer discretionary weights for 26%, and these two industries alone exceeded 60%. Although this is very Hong Kong, it will obviously not be an intuitive embodiment of any economy.

If the industry ratio of the S&P 500 is used to push back the Hang Seng Index, the retracement this year should be much larger, for example,$HSTECH(HSTECH)$This year's retracement reached 18.96%, which is better than this year's Nasdaq index (which is more representative of the technology industry).

From the perspective of correlation, from 2019 to 2020, we obviously benefited from the prosperity of the global secondary market. The correlation between Hang Seng Index and S&P 500 Index exceeded 0.3, but in 2021 and 2022,The correlation dropped by half to 0.15. On the one hand, the Hang Seng Index failed to keep up with the increase of S&P in 2021; On the other hand, it failed to fully echo the decline since 2022.

First of all, after 2018,The global market's appetits for technology stocks makes funds risk-on, In 2018, external capital went to the stock market, and the capital of the stock market also piled up more and went to the industries of growing companies. Therefore, big weights led a big bull market.

Secondly, after the pandemic in 2020,The divergence of macroeconomic policies between the United States and China has played an important role in the divergence of the stock markets of the two places. The Federal Reserve and the US government have adopted very loose economic policies, and a large amount of funds have flowed into the real economy and financial institutions, which has also pushed up the stock market by the way; China, on the other hand, is very "restrained" and has not adopted large-scale water release, so Hong Kong stock market, which relies on the domestic economy, has no more external capital inflow.

Then, Since 2022, the US market has been tighteningIt also accelerated the outflow of funds flowing into US stocks in the previous period, so the decline of US stocks was even greater; In contrast, China's policy is more relaxed, which has the basis to alleviate the sharp decline of the stock market.

In addition, the largest outflow of funds from Hong Kong stock market isThe China Stock Crisis that Began in the Second Half of 2021In the past year, the exchange of chips has made investors who are eager for such risks disappear almost. As things ease and emotions improve,This month, a lot of funds began to bargain-huntingAnd the environment that may be faced next may be more friendly, which will become an important opportunity to stimulate the development of enterprises.

Therefore, we believe that the completion of a healthy bottom has finished in Hang Seng Index and is actually supported by macro-fundamentals.

However, the economic environment tightening caused by global inflation and various uncertain geopolitical risks will also bring continuous pressure to the highly internationalized Hang Seng Index, at least for now,The pricing power of most constituent stocks of Hang Seng Index is determined by international investors.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Raychan·2022-06-15这篇文章不错,转发给大家看8Report

- Ra007·2022-06-15When everyone is scared is the time to….9Report

- SteadyDoesIt·2022-06-14Doubt it, most likely rangebound9Report

- CatFished·2022-06-15HSI has really performed lower than S&P the past few years and it seemed to me the impact from US inflation didnt hit them as hard. Hopefully that is a good sign1Report

- deathdevil·2022-06-15Great ariticle, would you like to share it?4Report

- Songa·2022-06-15No i dont see it yetLikeReport

- Lord Tan·2022-06-15Continue towards doom1Report

- Chchong·2022-06-18GoodLikeReport

- 愛我幸福满满·2022-06-17[微笑]LikeReport

- Planter26·2022-06-17Good1Report

- 百汇·2022-06-16[暗中观察][暗中观察]LikeReport

- bunnyy·2022-06-16WaLikeReport

- 小熊家族·2022-06-16good1Report

- BenWong78·2022-06-16😀1Report

- ichigowei·2022-06-16hiLikeReport

- XiaoZ·2022-06-16[微笑]LikeReport

- RaysonWong·2022-06-16嗨LikeReport

- 魔鬼王·2022-06-15666LikeReport

- 888Investor·2022-06-15👌🏻LikeReport

- 888Investor·2022-06-15👌🏻👌🏻LikeReport