Why did Buffett buy a lot of oil stocks

When most people are paying attention to the sharp rise and fall of US stocks, have you noticed that crude oil has quietly broken through the previous correction range? More interestingly, Warren Buffett has been bargain-hunting oil-related stocks recently.

In early May, Mr. Buffett bought another 5.9 million shares of Occidental Petroleum Corp. in two trading days, according to the latest data.

Since the end of February, Buffett has repeatedly increased his holdings of Western oil companies. According to documents previously disclosed by the SEC, Berkshire bought 18.1 million shares of Western Oil Company, worth nearly $1 billion, in the three days from March 14 to March 16 alone. Moreover, Buffett himself said at the shareholders' meeting that within two weeks from the end of February this year, they bought 14% of the shares of Western Oil Company, when only 60% of the shares of the company were in circulation.

Why did him suddenly fall in love with oil stocks? Is there still a chance for crude oil to rise in an explosive trend? Let's have a brief talk today

Let's talk about oil prices first

Out of concern about the interruption of supply chain, crude oil began to break its position and rise sharply at the beginning of the Ukrainian-Russian war, and the price of US crude oil futures once rushed to a high of more than 130. After that, it quickly fell back, and a typical flag-raising finishing form emerged in the price range between more than 90 and more than 100.

This is the market, When people tend to agree on an expectation, Often, the price will rise rapidly in the extreme direction. In the absence of negative interference in the news, the price will usually rise to a very outrageous position.

Prices are generally driven by fundamentals, but they are far away from fundamentals and swing greatly within an expected range. Therefore, the market price is usually determined by three forces: the expected force, the fundamental force and the expected realistic result after landing.

Why did crude oil soar and plummet?

Why did crude oil rise unilaterally at the beginning of the war, so that the price rose above 100 and touched 130?

We have analyzed the reasons before, Because this year's fundamentals are inherently short of oil, with the gradual liberalization of economic activities, the demand side has risen, but the major oil-producing countries have not increased production significantly, which makes the gap between crude oil supply and demand widen rapidly this year. According to EIA's previous assessment, at the beginning of the war, the global crude oil supply gap reached an average of 4 million barrels a day in 2022.

When the war broke out, the contradiction of tight supply became more intense. With the gradual implementation of European and American sanctions against Russian energy, Europe, which was already short of oil, fell into a more serious energy shortage. However, after Iran's nuclear talks restarted, it gave up halfway,;and the major oil-producing countries stood still. The supply-side bad news occurred one after another, which made the situation that crude oil was in short supply more and more serious.

Therefore, from the beginning of this year, when there were signs of conflict between Ukraine and Russia, crude oil began to soar all the way, and this wave of unilateral pull-up continued to a high of 130 US dollars.

I don't know if you invested in crude oil or stocks related oil in the first half of this year. If so, your profits must be very rich. But the good times don't last long. If you don't escape from the top at the high level of 130, then there will be a huge retracement of nearly 30 percentage points.

Why did it plummet?

Quite simply, from the trading level, when there are fewer and fewer holders of short position in the market, there must be fewer and fewer short orders opening positions at the same time, because multiple orders cannot be traded without counterparties, and when liquidity dries up, the jump and fall of market prices will become more and more serious.

As a result, when the market expectations tend to be consistent and the price is pushed to the extreme upward direction, it will be very rapid at first, because there is no resistance level above, and once there is resistance, it will be a strong resistance position many years ago, and when the price touches this position, it will collapse.

From a fundamental point of view, see in crude oil At the top, it was also the time for the temporary truce negotiations between Ukraine and Russia. The easing of major contradictions and the announcement by the United States that it was about to release the strategic reserve of crude oil led to a rapid warming of market sentiment.

The reason why trading is difficult is that we have to look not only at fundamental changes, but also at technical changes, because technical forms reflect market sentiment, and when market sentiment is formed, you often don't know what news has happened.

Then, will crude oil rise again after breaking through?

To solve this problem, we should analyze it from three aspects: fundamentals, emotions and reality.

Fundamentally, there is no doubt that the market is still extremely short of oil, and the bad news on the supply side is still increasing.

According to the latest news, Europe's sanctions on Russia's energy exports are ready to take another step: pushing forward the European-wide Russian oil embargo, it seems that Europe is really going further and further on the road of death. This is the sixth round of a series of European sanctions against Russia, which also means that Russian oil, which accounts for one-fourth of Europe's oil imports, will be prohibited from being transported to Europe.

But the proposal has not yet been unanimously adopted by European countries, and six countries have concerns: Hungary, Bulgaria (Slovakia according to Reuters), Czech Republic, Greece, Malta and Cyprus.

But now that market prices have responded, the sanctions will not be just cosmetic. If Russian oil is really embargoed by Europe, the total supply of crude oil in the global market will drop sharply as expected.

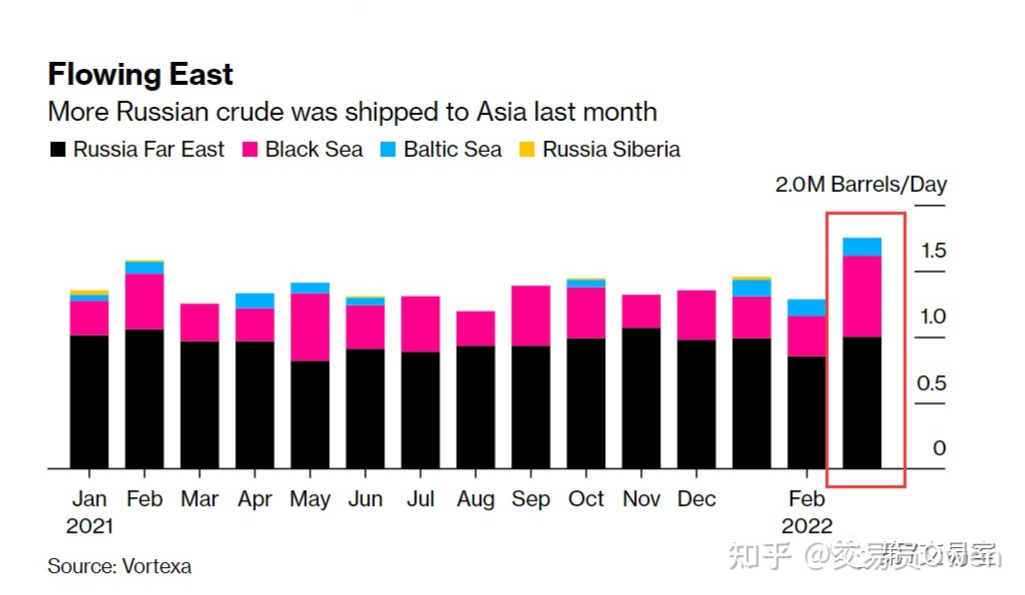

You should pay attention, the expectation is expected, but the actual landing data is not necessarily. Let's look at the total crude oil export volume of Russia in March. Even though Europe and the United States want to cut off Russia's oil and gas imports with great fanfare, the total crude oil export volume of others has not decreased but increased.

Rystad Energy, an overseas research firm, predicts that Russia's national tax revenue may even increase by more than 45% this quarter, which is the actual effect of desktop action.

If this sixth sanction is unanimously passed by Europe, crude oil will definitely have a certain chance to rise, but the question is, when Russia's crude oil exports increase in May, will crude oil drop sharply? We must be careful about this risk.

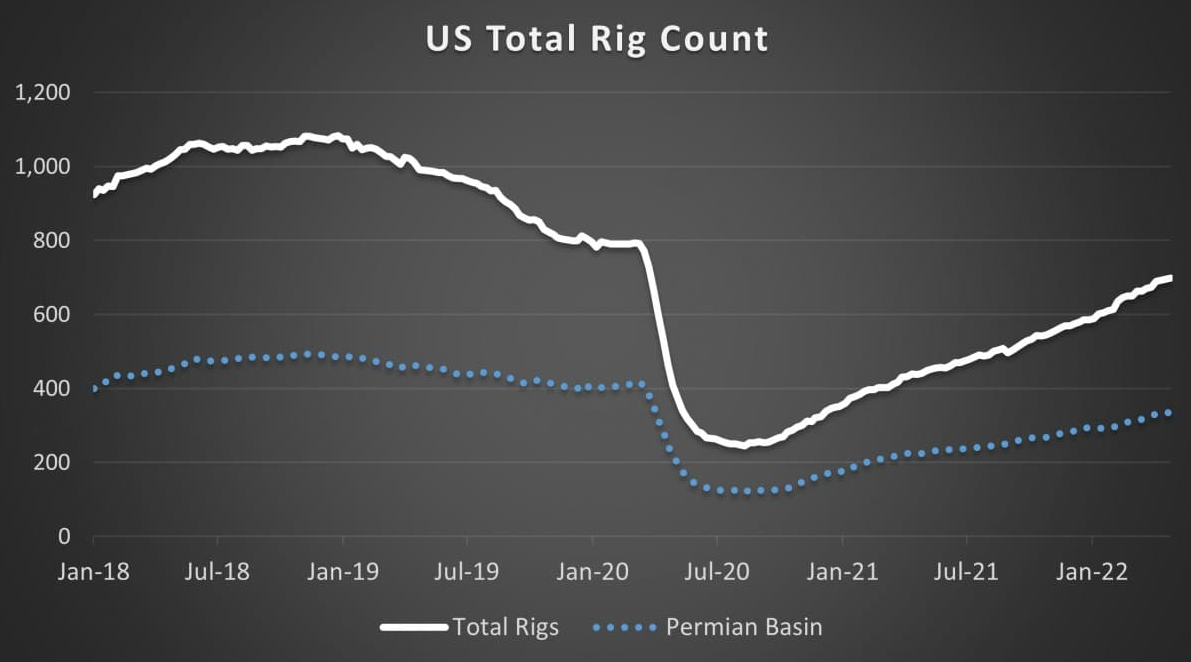

Let's look at the fundamental data on another side. Although the number of oil wells drilled in the United States is constantly increasing, the crude oil production is always hovering at a low level. From the United States, the only major oil-producing country that hopes for a drop in oil prices, we seem to see no hope that the crude oil supply can be greatly improved.

Number of US crude oil drilling platforms:

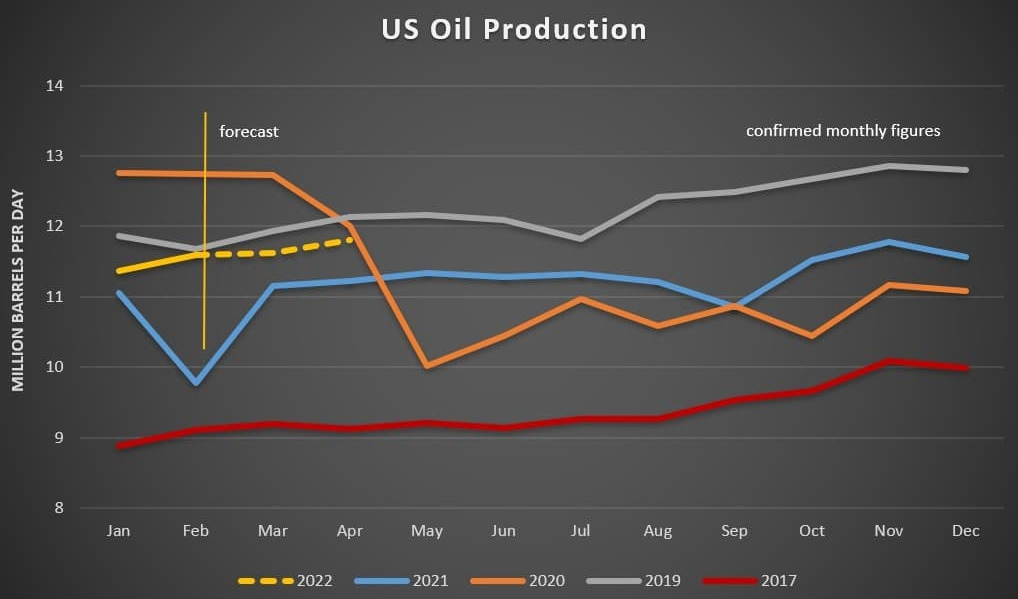

However, US crude oil production is still very low. Look at the yellow line in the figure below, and it is not expected to increase much

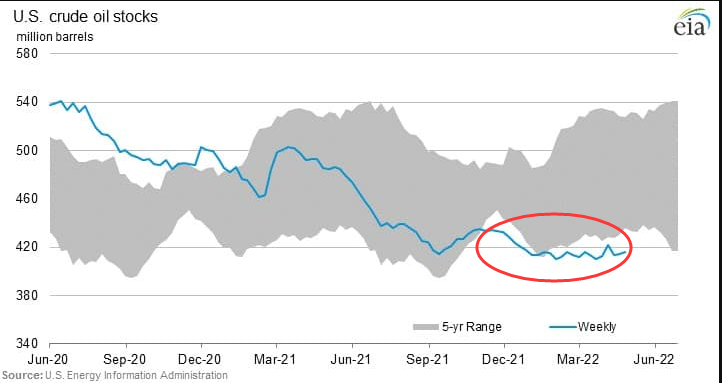

Looking at US crude oil inventories, it has fallen below the lowest inventory range in five years, and I am afraid it will bottom out

After Biden announced the release of the largest crude oil reserve in history, the shortage of crude oil finally made the US government start to buy back. To make crude oil prices fall, it is impossible to increase production or release supply in the United States.

What about OPEC? According to the latest data, OPEC + countries agreed to increase their production target in June 2022 by 432,000 barrels per day. Compared with the expected gap of millions of barrels per day, the production of more than 400,000 barrels per day certainly has no impact.

Therefore, fundamentally speaking, it is unlikely that crude oil will fall.

What about the expectation

Crude oil has two major negative effects, one is the influence of The pandemic, and the other is the approaching recession.

The pandemic is too sensitive, so we won't talk much. If the blockade of economic activities increases, the expectation of demand side will definitely be hit, and crude oil will fall sharply. The previous wave of decline was hit by The pandemic.

Recession is also very sensitive, As the Fed may have to raise interest rates and scale down beyond expectations, As a result, US stocks and US debt may fall sharply, which will affect economic development. After a serious stagflation situation, it may be a recession. We should know that prices in the United States have reached a new high for many years, but the economy has experienced negative growth. If we push forward a sharp interest rate hike and scale reduction, there may be a recession in the future.

However, it is a bit early to talk about this topic. After all, the US stock market has not collapsed and the risk sentiment is still stable, but this risk is still being discussed by most people. If the recession cannot be avoided, crude oil may retreat sharply. If it is determined to hide in the past, crude oil will still rise.

Therefore, combined with the above multi-angle analysis, the bullish sentiment of crude oil may be stronger, but the market sentiment will be more fragile, and any bad news will make the crude oil price fall back.

So finally, why did Buffett buy a lot of oil stocks at this time?

In fact, we can look at this matter from four angles.

First of all, if you have absolute confidence in the US economy, crude oil will continue to rise in the future, and even if it retraces, it will keep a high level of more than 100 and make a big shock. Then oil companies will still have good financial report data after expanding production, and now is naturally a good time to buy oil stocks.

Secondly, the current dilemma of stagflation in the US economy is very obvious. In a stagflation environment, apart from holding cash, only commodities are worth investing in, because with the rise of CPI, the prices of commodities will remain high. At this time, it is of course a good choice to abandon technology stocks with high valuations and start with oil stocks with relatively low valuations but great value-added space.

In addition, we should pay attention to, Oil companies don't just produce crude oil, Natural gas is also his main product, Oil-producing companies are often accompanied by natural gas, and the price of natural gas is very bullish. Natural gas is more widely used than crude oil on the demand side, and it is facing the same tight situation as crude oil on the supply side. That is to say, even if a recession does occur, the overall increase of natural gas is likely to be higher than that of crude oil. Therefore, starting with oil stocks is tantamount to bullish on a series of industrial energy prices such as oil and natural gas. There is no problem in this bet.

Finally, maybe Buffett is really optimistic about the price of crude oil, and thinks that the US economy will tide over the difficulties, and the current situation of short supply is difficult to alleviate, so the price of crude oil will rise for the second time. The reason for this is that there are some gambling elements in it.

Clever you, which of these reasons do you think is right?

$NQmain(NQmain)$ $YMmain(YMmain)$ $GCmain(GCmain)$ $CLmain(CLmain)$ $ESmain(ESmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

But many of us do not exercise the same common sense as him.