One article reviews the earnings of FAAMG.

The five tech-giants have all handed in their earnings results. Let me review the performances. The first one in this quarter is Microsoft, the result makes Wall Street impeccable. Apple and Microsoft can be said to be hale and hearty. Due to geopolitical influence, the advertising industry as an economic barometer that was not going well. And the performance of Google and FB is not satisfactory. However, the META stock price is extremely swing, and Amazon got first loss by Rivian's investment loss.

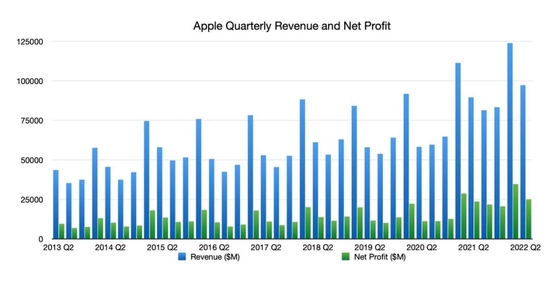

Apple's financial report is as stable as ever, and all data exceed market expectations. However, its CFO warned that the challenges in this quarter may affect Apple's sales, causing Apple's share price to fall by 3% in after-hours trading.

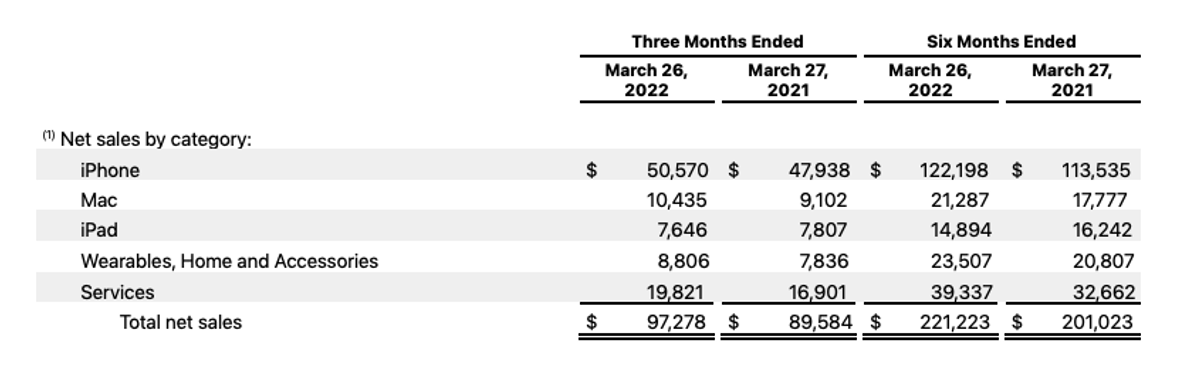

The earnings shows that Apple's revenue in the second quarter of fiscal year 2022 was 97.27 billion US dollars, a year-on-year increase of 8.59%; Earnings per share was 1.52 US dollars, exceeding the market expectation of 1.43 US dollars; Gross profit margin was 43.7%, exceeding the market expectation of 43.1%.

Revenue from major products such as iPhone, Mac, iPad and services also exceeded market expectations. In Apple's second quarter, that is, the first quarter of this year, the company's product lines were not affected by geopolitics.

However, in the conference call after earnings, tApple CFO made the market turn around. He said that although Apple's sales were strong this quarter, Apple could not be immune to COVID-19 pandemic, supply chain crisis and Russia-Ukraine war, which are expected to bring 4-8 billion US dollars in sales impact to Apple.

This quarter, Apple still didn't give the performance guidance for the next quarter under the uncertain environment, which also made everyone worry about whether Apple can maintain the strong sales momentum to a certain extent.

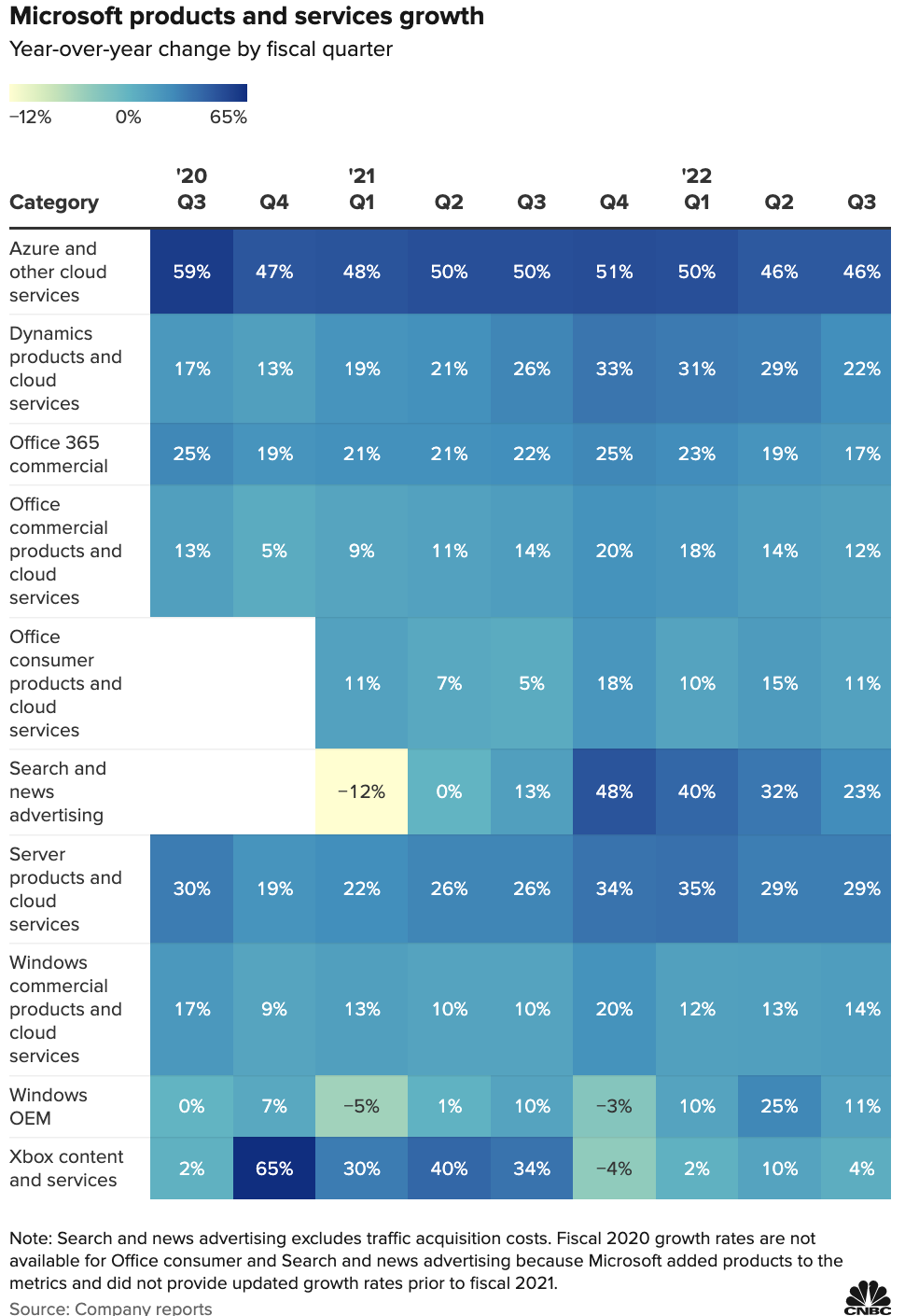

Microsoft can be regarded as the savior of the market this week. After the Nasdaq plunged nearly 4% on Tuesday, it showed the steady manner of Big Brother. All financial indicators exceeded market expectations, and the share price rose by more than 5% in the after-hours.

The financial report shows that Microsoft's revenue in the third quarter of fiscal year 2022 was 49.36 billion US dollars, an increase of 18% year-on-year, which was higher than analysts' expectation of 49.04 billion US dollars. This is also the sixth consecutive quarter that Microsoft's revenue exceeded 40 billion US dollars; The profit was US $16.7 billion, a year-on-year increase of 8 Net earnings per share was $2.22, higher than analysts expected $2.19.

Separately, the continued strong growth momentum of "intelligent cloud" business income is the main reason for boosting market confidence this time. In this quarter, the business revenue of "intelligent cloud" including Azure, GitHub, server products and cloud services was US $19.05 billion, which was higher than the market expectation of US $18.9 billion and increased by 26% year-on-year. Among them, Azure cloud services maintained a high growth rate of 46% year-on-year. Microsoft CEO Nadella said on a conference call that the number of Azure transactions over $100 million more than doubled this quarter.

More personal computing business, including Windows, Xbox, search advertising and Surface, posted $14.52 billion in revenue, up 11% and above StreetAccount's $14.27 billion forecast.

Microsoft announced plans to buy video game publisher Activision Blizzard for $68.7 billion in the first quarter, the biggest deal in Microsoft's 47-year history, but the financial report did not update the progress of this acquisition.

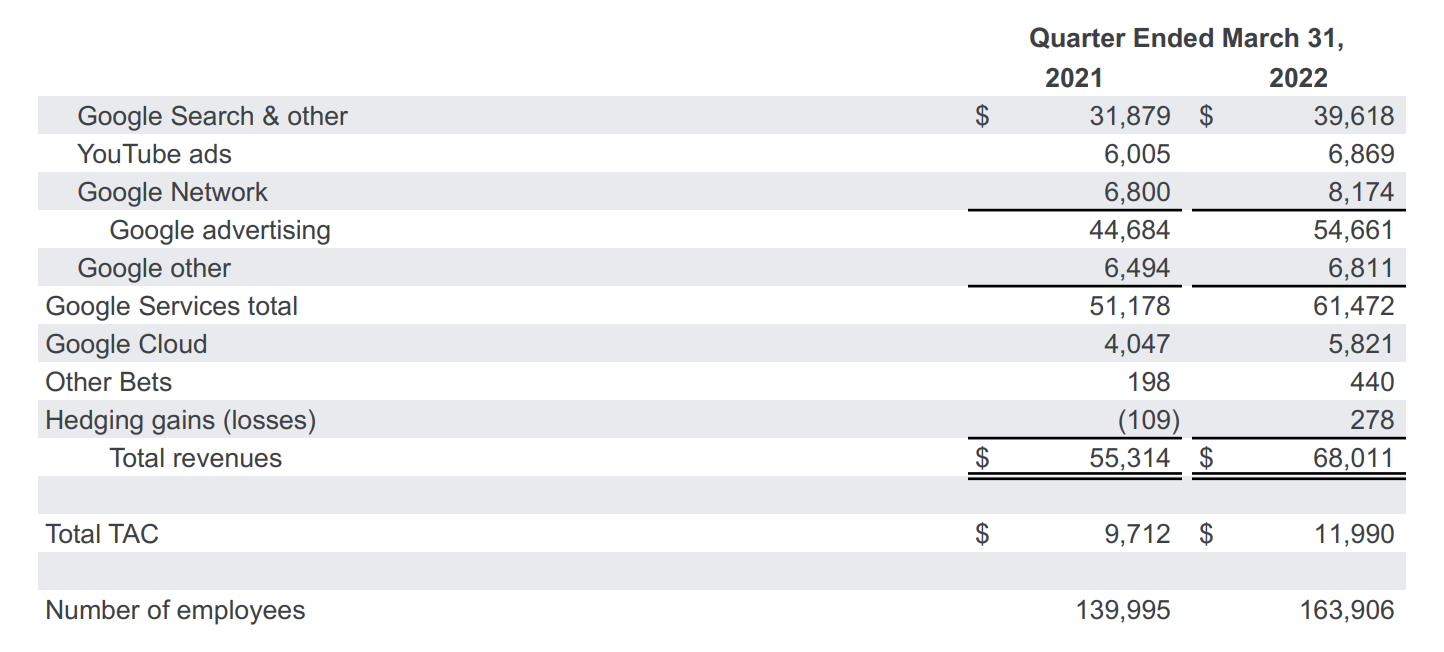

Google always make investors sleep at ease, but this time it missed due to advertising industry headwind. In first quarter, Google halted most of its operations in Russia, while revenue growth in Europe, which also includes the Middle East and Africa, slowed to 19% from 33% a year earlier because of the geopolitical war.

The report shows that Google's total revenue in the first quarter of 2022 was 68.011 billion US dollars, a year-on-year increase of 23%, slightly less than the expected 68.11 billion US dollars; The net profit was 16.436 billion US dollars, down 8.3% compared with 17.93 billion US dollars in the same period of last year; Diluted earnings per share was $24.62, which was less than the expected $25.91.

All major indicators are lower than market expectations, and the revenue growth is also the lowest in the past two years.

What is quite good is the business in intelligent cloud, with revenue of USD 5.821 billion this quarter, up 43.8% year-on-year. However, its expenditure is also rising simultaneously, and the cloud computing division is still in a loss, with an operating loss of $931 million this quarter, almost the same as last year. That is to say, although cloud computing has become larger, it still does not contribute any profits to Google.

Other Bets began to pick up, with revenue of $440 million this quarter, compared with $198 million in the same period last year and $181 million in the previous quarter, which may reveal that Google's years of hard work are finally coming to fruition.

In addition, Google also announced a $70 billion stock repurchase plan at the financial report meeting. On the other hand, Google's upcoming share split in July is still expected.

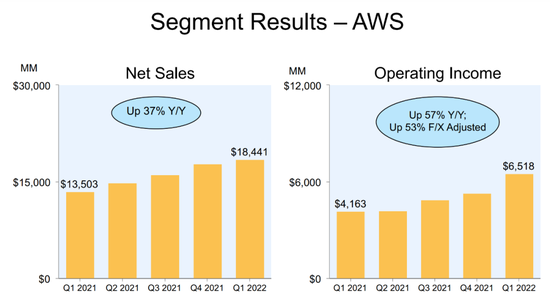

Arguably, this is Amazon's ugliest financial report in recent years. However, Amazon's loss this time is mainly caused by the investment of Rivian, an electric vehicle company. In the past quarter, Amazon lost a total of 7.6 billion US dollars due to Rivian's investment, which directly pulled Amazon's overall profit into negative numbers. In the last quarter, 12 billion of Amazon's $14.3 billion profit came from Rivian's return on investment. Success is also Rivian, and defeat is also Rivian.

Amazon's net sales revenue in the first quarter was US $116.444 billion, which was basically the same as the market expectation of US $116.3 billion, but the year-on-year increase was only 7%, which was the lowest growth rate of Amazon since 2001; The net loss was $3.8 billion, the first quarterly loss since 2015; Adjusted earnings (excluding investment losses) of $7.38 per share were still lower than the market expectation of $8.37.

Despite the huge losses caused by this investment, the performance of Amazon's major businesses is also worrying. First of all, under the conflict between Russia and Ukraine and the pressure of supply chain, the e-commerce business showed obvious weak growth, and sales declined in many markets. At the same time, the growth rate of subscription services and third-party services has declined. The advertising business, which was first disclosed last quarter, did not continue to soar in this quarter, falling from 33% growth in the previous quarter to 25%.

AWS cloud service, which is most concerned by the market, also performed fairly in this quarter, with revenue of 18.44 billion US dollars and 37% year-on-year growth rate basically in line with market expectations, failing to save Amazon from fire and water.

Amazon is about to usher in Prime Day in the second quarter. I don't know if it can stimulate the performance. In addition, Amazon also has a 1:10 share split plan in June.

Meta in fact, this financial report is really bad, but it fell too much before, and everyone knows that the result is ugly. Zuckerberg said that users are still growing, then the stock price immediately rebounded and jumped. Meta's financial report is just not worse than the previous quarter.

Meta's Q1 revenue was US $27.91 billion, up only 7% year-on-year, which was lower than expected. This is the first single-digit revenue growth in FB's past 10 years. Net profit was $7.465 billion, down 21% compared with the same period last year. Earnings per share were $2.72, higher than analysts expected $2.56.

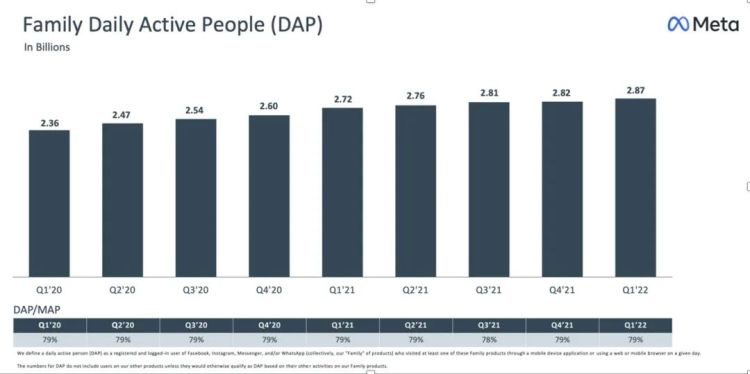

Meta's daily active users (DAU) increased slightly in the first quarter, from 1.93 billion to 1.96 billion, and the market expectation was 1.95 billion, just match. Last quarter, the daily active user data declined for the first time in history.

For the next quarter, Meta once again gave ultra-low performance guidance, and expected revenue to be between 28 billion and 30 billion US dollars, while the average market forecast was 30.6 billion US dollars.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great