Which Company will be the First to Hit a $5 Trillion Market Cap?

If the shares soared and reached $4,600 in 2026 as predicted by Ark Invest, the market cap would be $4.65 trillion.

Which company do you think will be the first to hit the $5 trillion cap?

Time as 4/18/2022

There are four tech giants ahead of Tesla: Apple, Microsoft, Google and Amazon. Share with us which company you are most bullish on and why!

Let's see ARK's analysis of Tesla.

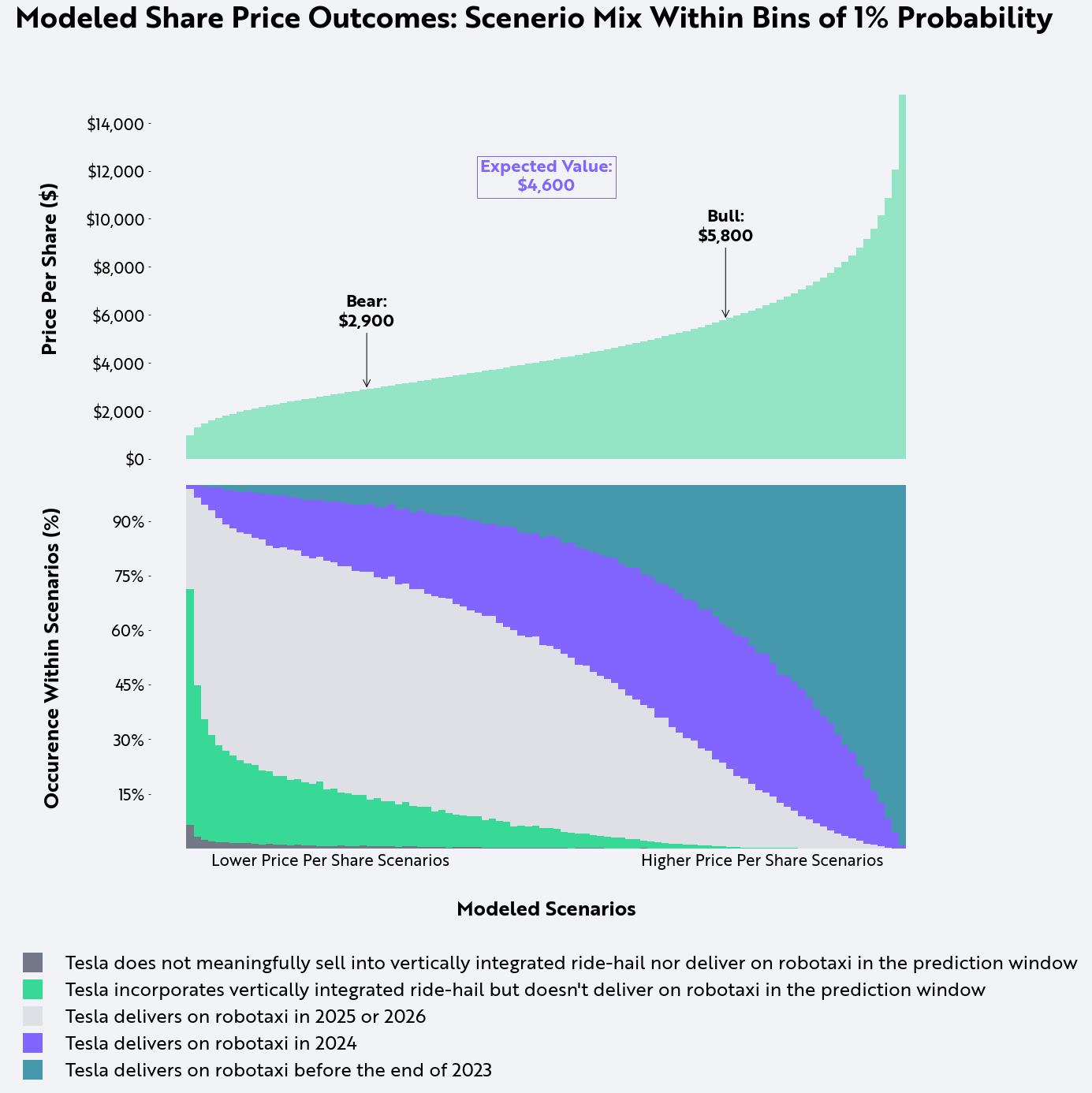

The bull and bear cases, tuned to the 75th and 25th percentile Monte Carlo outcomes respectively, are approximately $5,800 and $2,900 per share:

Source: ARK Investment Management LLC, 2022

Tesla’s prospective robotaxi business line is a key driver, contributing 60% of expected value and more than half of expected EBITDA in 2026. Across the simulation set, ARK expects electric vehicles to constitute 57% of the company’s revenue in 2026, albeit at substantially lower margins than robotaxi revenue.

Source: ARK Investment Management LLC, 2022

Example Bear and Bull Outcomes

Key Model Inputs

Source: ARK Investment Management LLC, 2022

Forecast of 2026 Share Price

The simulation is highly sensitive to the year in which Tesla launches robotaxis, as shown in the charts below. The upper chart represents the likely distribution of all possible price targets from our Monte Carlo analysis and identifies the bear and bull cases as the 25th and 75th percentile outcomes, respectively. “Expected value” is the average of all 1 million simulations.

Tesla 2026 Price Per Share Scenario

Tesla 2026 Price Per Share Scenario

More Assumptions Of Tesla Price Estimates

Insurance

- Insurance increases the 2026 market capitalization estimate by roughly 2%.

Bitcoin

- Tesla’s bitcoin holdings are included in the model, along with potential upside or downside swings in price. Though Tesla cannot mark bitcoin up given current accounting standards, ARK assumes that investors will incorporate bitcoin’s impact on enterprise value at its market value in 2026. Bitcoin increases our 2026 expected price per share by less than 5%.

Balance Sheet:

ARK has made conservative assumptions about strategic financial decisions. ARK does not believe these decisions will be the primary drivers of the appreciation in Tesla’s stock price.

- Aside from bitcoin, Tesla keeps cash on its balance sheet and does not invest in any yield-generating assets.

- With more cash than debt, Tesla does not use its cash to pay down debt.

- Tesla will not repurchase shares.

- The interest rate on Tesla’s debt will remain at 4%.

For more details of ARK's analysis: https://ark-invest.com/articles/analyst-research/arks-tesla-model/

SHARE YOUR THOUGHTS

Which Company will be the First to Hit a $5 Trillion Market Cap?

You may be rewarded with Tiger Coins for sharing your thoughts in the comment💸💸💸

Follow me! Don't forget I am the richest tiger in this community😎😎

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

We can’t even forsee why R-U war can happened & worst still, when it will end.

it is pervasive in every aspect of daily used s/w and suits.

Here's why

1. leasing Hardware for all product range: the game plan, account for 40% Rev, product sold 20%

2. Video content Stream 30%

3. Low costs iPhone 10%😊

4. Ads &others 10%