What should investors worry about most now?

The market reacted strongly after the FOMC meeting. Indeed, Powell's statement is the most "eagle" since taking the office.

More importantly (giving bears the chance to fight back), It is FEDs' uncertain follow-up policy makes the market frightened.

The market is not afraid of eagles or surprised(can be fixed in short time, such as "sell the fact"). But the most annoying thing is uncertainty.

There is almost no update information at this meeting. The market has priced-in raising interest rates, balance sheet runoff, and adjusting the assets holding. Although the Fed is responsible for a large part of the current awkward situation as they neglected inflation and misjudged in the second half of last year, the current is not being as expected.

As for now, What should we worry about??

An unexpected tightening.

What actions may have exceeded expectations?

- Starting balance sheet runoff in advance;

- Raising interest rate exceeds 25 basis points in one time;

- Immediately process runoff in the first interest rate hike meeting;

- The proportion of bonds assets has further increased;

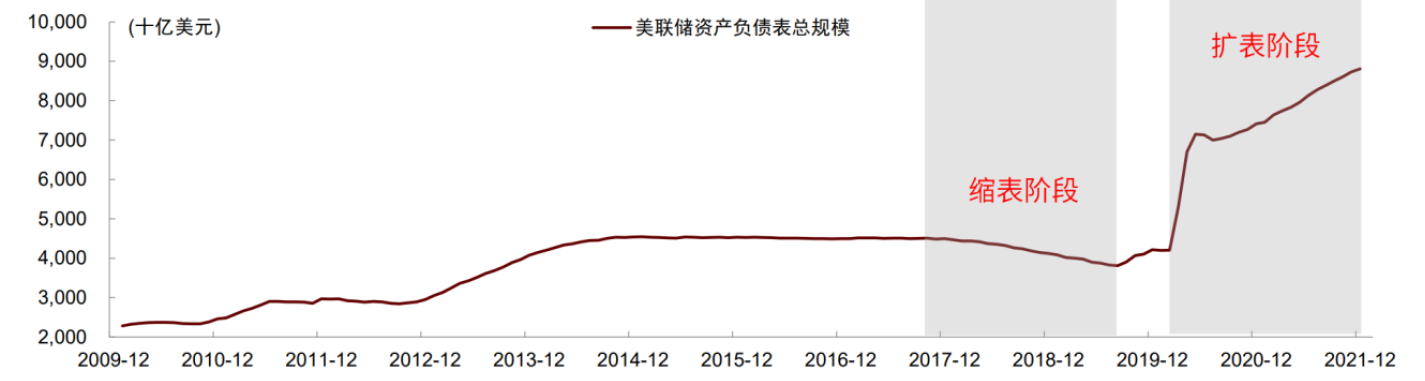

In fact, the market is more worried about balance sheet runoff than raising interest rates. In our previous article,"How the Fed Stings the Nerves of the Market"In, has been analyzed:

The impact of raising interest rates on the economy is more comprehensive, and balance sheet runoff will affect market liquidity to a greater extent. For example, the stock market. In 2018, the Federal Reserve balance sheet runoff, and the S&P 500 index honestly became the biggest year of retracement since the financial crisis in 2008.

So, what is the impact of the unexpected tightening policy on the market?

- Accelerate the reduction of market liquidity,That is to say, there is no money that could have been used to increase positions and bargain-hunting, or positions that did not need to be sold should also be sold.

- More intense uncertainties,That is to say, the market is always worried about what the next action will be and when it will come, so that "holding money" is greater than "holding positions"

- Give the market a sense of frustration that "the Fed can't control the situation".This is very important. Once the market thinks that the Fed's actions can't solve the problem, it is an economic crisis. See 2008.

Attachment: Comparison of Policy Statements of Federal Reserve Meetings in December and January:

$S&P500 ETF(SPY)$ $NASDAQ(.IXIC)$ $NASDAQ 100(NDX)$ $S&P 500 (. SPX)$ $DJIA(.DJI)$ $ARK Fintech Innovation ETF(ARKF)$ $Tesla Motors(TSLA)$ $Apple(AAPL)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- IamZhong·2022-01-30actually all the policy makers have some shares in companies right..2Report

- Oldhead·2022-01-30甚至在利率实际上升之前,市场的反应就如此剧烈。我觉得这个过度反应是一个机会。2Report

- powerbert·2022-01-30Don't need to worry so much, but don't borrow money to buy shares, share dropping is a good opportunity, just buy a bit now, when drop some more, can continue to average down.1Report

- Yani94·2022-01-30Every trader or investors are afraid of a dip/loss.2Report

- Sporeshare·2022-01-30all waiting for fed decision whether 1 or 2 interest rate hike for this year.LikeReport

- CY Tan·2022-01-30Uncertainty on Fed rate increase frequency to curb inflation is worrisome.2Report

- sook·2022-01-30Have a diverse portfolio and make sure there is cash2Report

- DinoLim·2022-01-30Investors have to be greedy when people are fearful and be fearful when people are greedy. There is a difference between investor and trader.LikeReport

- spdrwb·2022-01-30Do u think buffett got worry?[Surprised]2Report

- TeckLeong·2022-01-30Nothing is certain except that cash is king when market goes down1Report

- Assassin008·2022-01-30Uncertainty is bad for the market2Report

- Olegarki·2022-01-30Like back please2Report

- Trainman·2022-01-30美联储新政策将提高银行负荷率1Report

- Henryee18·2022-01-30Gosh leep on invedting!2Report

- EL1296·2022-02-11👍//@EL1296: 👍1Report

- surfer guy·2022-01-31AThat last Friday was a short squeeze and market might go down again after hitting next resistance1Report

- AnT·2022-01-31Investors should be worried about the irrational minds of the masses.LikeReport

- invinsor·2022-01-30worry about the potential fighting between N and S Korea and Russia vs Nato countries.LikeReport

- pangspurs·2022-01-30No fear, just buy more on the dip1Report

- EthanShawn·2022-01-30wait and see2Report