Nvidia|Net Income Surged Up But Shares Prices Fall Down?

Hello everyone, I'm Stone.On February 17, 2022, $英伟达(NVDA)$ announced its fourth quarter earnings for fiscal 2022 (2022Q4), with net income up 125% year-over-year, 53% year-over-year and 8% year-over-quarter.

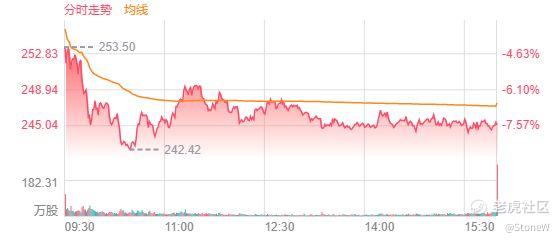

Looking at the financial report alone, this financial report is already thought of good, but how come after the release of the financial report, the opening fell 4%, by the end of February 18, 2022 Beijing time in the morning, the American market closed, the company's share price is down 7.56%, what happened to the company?Or is there something hidden in the earnings statement that we're not reading?

Note:

- Nvidia calculates its fiscal year differently from other companies, showing Q4 2022 instead of Q4 2021 in its earnings report. Please note that this is not a clerical error.

- Most of this article is machine translation, and more proofreading will be used in the future

- The original article can be accessed:https://www.laohu8.com/post/638125704

It's not the only time in 2022 that the market has been plagued by bad results.So a lot of voices are talking about "killing valuation", which is a common feature of tech stocks, but in fact we can see that the phenomenon did not occur in $苹果(AAPL)$ , a giant tech stock, which rose 7% after earnings, as well as $谷歌(GOOG)$

According to the shape of the nvidia day K line, the shares belong to direct drainage opening, and almost all day is hard on the - 7% to this place, on the day of the nasdaq fell 2.88%, the s&p 500 fell 2.12%, and the shape of the nvidia is greatly run lose the market, if the market, that also can't drop so much ah, feeling a little strange?

Let's take a look at Nvidia's earnings to see if we can find any clues as to what the results were like and how the stock is trading right now. Let's read the results first:

Nvidia Earnings Highlights For The Q4 of 22nd Quarter

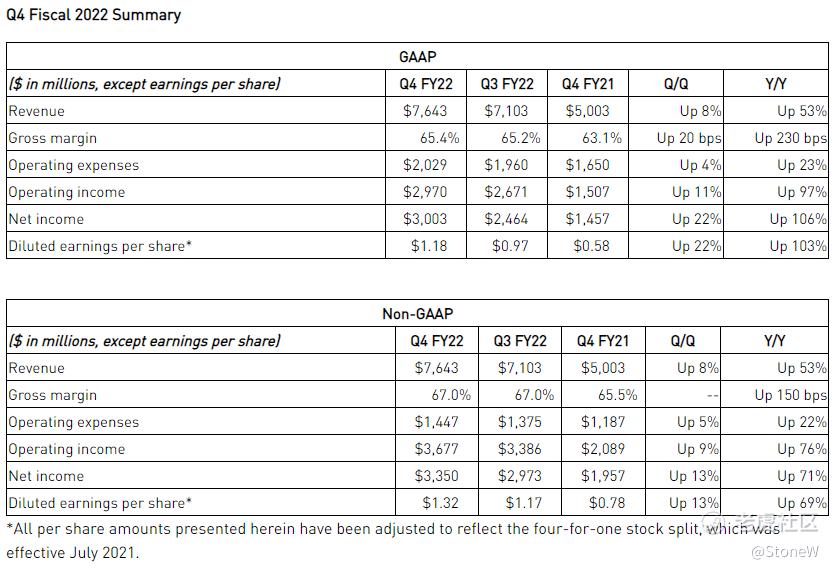

Nvidia announced on February 17, 2022 (Beijing time) that revenue for the fourth quarter ended January 30, 2022 reached a record $7.64 billion, up 53% from a year ago and 8% from the prior quarter.Gaming, data center, and professional visualization marketplace platforms delivered record revenues for the quarter and year.

- GAAP earnings per diluted share for the quarter were $1.18, up 103% from a year ago and 22% from the prior quarter.Non-gaap diluted earnings per share were $1.32, up 69% from the year-ago quarter and 13% from the prior quarter.

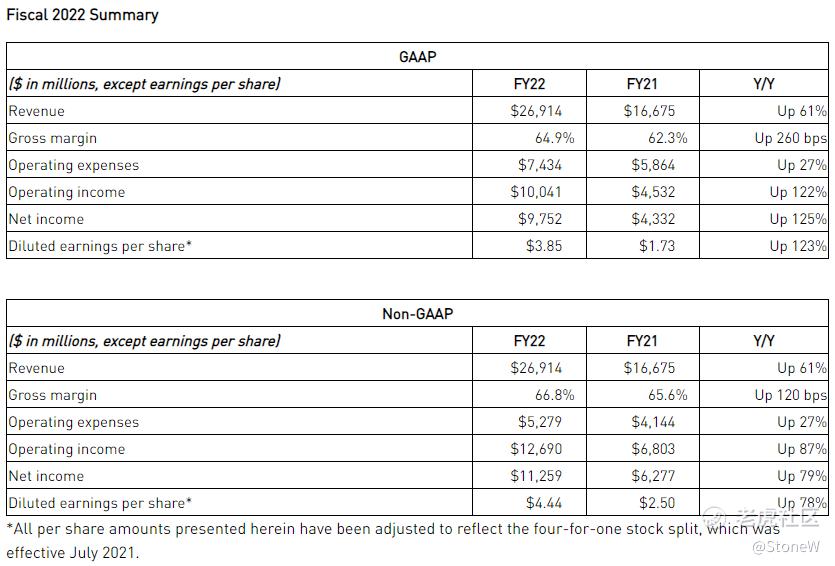

- Revenue for fiscal 2022 hit a record $26.91 billion, up 61 percent from $16.68 billion a year earlier.GAAP earnings per diluted share were $3.85, up 123% from $1.73 a year earlier.Non-gaap earnings per diluted share were $4.44, up 78% from $2.50 a year earlier.

- Nvidia paid a quarterly cash dividend of $100 million in the fourth quarter and $399 million in fiscal 2022.It will pay its next quarterly cash dividend of $0.04 per share to all shareholders of record on March 24, 2022, on March 3, 2022

After the earnings announcement, Nvidia founder and CEO Jensen Huang said:

We're seeing extraordinary demand for Nvidia's computing platform, which is driving advances in some of today's most influential areas, including artificial intelligence, digital biology, climate science, gaming, creative design, self-driving cars, and robotics.

Our business is entering the New Year with strong momentum and excellent traction from our new software business models including NVIDIA AI, NVIDIA Omniverse and NVIDIA DRIVE.We will be announcing a number of new products, applications and partners related to NVIDIA computing.

In the year-over-year comparison, revenue, profit, operating expenses, operating income, etc., are all on the rise, and these growth rates are all on the rise, which means that the company is in an "explosive growth" cycle, according to the chart below.

Rescinding the Arm Shares Purchase Agreement

On February 8, 2022, Nvidia and SoftBank Group Corp. announced the termination of their share purchase agreement to acquire Arm Limited from SoftBank.The parties agreed to terminate the transaction due to significant regulatory challenges that prevented its completion.NVIDIA plans to record a $1.36 billion operating expense (Arm charge) in the first quarter of fiscal 2023, reflecting an upfront charge charge provided at the signing of the agreement in September 2020.

Nvidia Revenue By Segment

How do you define Nvidia as a graphics card company, a chip company, or a company selling the future?Currently, Nvidia is a graphics chip company, primarily graphics processing, according to earnings guidance.By far the biggest revenues come from games and data centers.

Gaming

- Fourth-quarter revenue hit a record $3.42 billion, up 37 percent from a year earlier and 6 percent from the previous quarter.

- Revenue for the fiscal year rose 61 percent to a record $12.46 billion.Release of GeForce RTX 3050 desktop GPU to bring the performance and efficiency of RTX and NVIDIA Amp architectures to more gamers. MSRP from $249.

- Introducing the GeForce RTX 3080 Ti and RTX 3070 Ti Notebook Gpus, offering new levels of performance to computer game players and creators.

- Released more than 160 gaming and Studio GeForce based laptops designed by leading manufacturers.

- Over 30 new RTX games and titles were released, including COD: Vanguard, Horizon Zero Dawn, God of War, Icarus, and Rainbow Six Extraction.

- Integrated NVIDIA Reflex technology, low latency games more AAA games, including Call of Duty: Vanguard, God of War and Rainbow Six Extraction.

- Added 65 games to the GeForce NOW library, bringing the total to more than 1,200, and announced partnerships with AT&T and Samsung to offer GeForce NOW to their customers.

The Data Center

Fourth-quarter revenue hit a record $3.26bn, up 71 per cent from a year earlier and 11 per cent from the previous quarter.

Revenue for the fiscal year rose 58 percent to a record $10.61 billion.Announced that Meta is building its ai research super cluster with the NVIDIA DGX A100 system.

In the latest MLPerf training results, Nvidia and its partners, including Microsoft Azure, set records on eight popular workloads, extending its leadership position in AI.

Release of NVIDIA AI Enterprise version 1.1 with updates including production support for integrated AI with NVIDIA software on VMware vSphere and Tanzu.The open-source NVIDIA FLARE is an SDK that enables healthcare, manufacturing, and financial services groups to collaborate on a common AI model, leveraging joint learning in situations where data is sparse, confidential, or lacking diversity.

Using sequencing technology from NVIDIA Clara, Google DeepVariant and Oxford Nanopore, a Team at Stanford University has set the world record for the fastest sequencing of DNA from the human genome.

Visualization

- Fourth quarter revenue reached a record $643 million, up 109 percent from the same period last year and up 11 percent from the previous quarter.

- Revenue for the fiscal year rose 100 percent to a record $2.11 billion.

- NVIDIA Omniverse creator launched, making it freely available to millions of individual creators.

- Introduced Omniverse Universal Scene Description Connector Blender, the world's most popular open source 3D creative application.

- Researchers at the University of Illinois at Urbana-Champaign used NVIDIA GPU-accelerated software to build what is believed to be the longest and most complex 3D cell simulation.

Autonomous Driving And Artificial Intelligence

- Automotive industry revenues for the fourth quarter were $125 million, down 14% from the same period last year 👇 and down 7% from the prior quarter 👇.

- Revenue for the fiscal year rose 6 percent to $566 million.

- Has established a multi-year partnership with JAGUAR Land Rover to jointly develop and deliver the next generation of autonomous driving systems, as well as AI services and experiences.

- Nio's ET5 sedan, Xpeng's G9 SUV and Pony were announced.

- Ai's robot taxi uses NVIDIA DRIVE Orin.

- Desay, Flex, Quanta, Valeo and ZF are using the NVIDIA DRIVE Hyperion platform to produce safe and reliable AV systems for car manufacturers.

- Launched the Isaac Autonomous Mobile Robot platform for building and deploying Robot applications.

To sum up, Nvidia generated $7.64 billion in revenue for the year, with gaming accounting for 44.76% and data center for 42.67% of total revenue

Assets

For the big tech companies, it's more about revenue growth.The balance sheet only exists as a small part of the financial statement.Nvidia reported a healthy cash flow of $21.28 billion in cash and cash equivalents, up from $11.56 billion a year ago.Total assets were $44.187 billion, compared with $28.791 billion in the same period last year.

Looking Ahead To Nvidia's Fiscal Year of 2023

- Based on the company's financial guidance, financial outlook, data growth, etc., the above data are summarized as follows:

- Revenue for fiscal 2023 is expected to be in the $7.9 billion to $114 range, plus or minus 10%

- GAAP and non-GAAP gross margins are expected to be 65.2% and 67%, plus or minus 50%, respectively.

- GAAP operating expenses are expected to be $3.55 billion, including Arm's $1.36 billion write-off.

- Non-gaap operating expenses are expected to be $1.6 billion.

- Both GAAP and non-GAAP other income and expenses are expected to be charges of approximately $55 million, excluding gains and losses on non-related investments.

- GAAP and non-GAAP tax rates are expected to be 11% and 13%, respectively, plus or minus 1%

Summary And Evaluation

The biggest destabilizing factors in 2022 are interest rate hikes, inflation and shrinking of the balance sheet, which are weighing on the market.A lot of imaginative companies, companies that used to look as far as the sky and not even see the ceiling, are starting to see the ceiling, and the ceiling seems to be falling and crushing people.As the market becomes more and more "valuation killing", some companies like Nvidia (NVIDIA), which are highly valued, are getting worse and worse, with their shares falling as if they were trapped in a deep hole.

High valuation companies in the encounter kill valuation or have the opportunity to try to calculate, but some technology companies annual losses, there is no valuation, and how to "kill valuation"?When the market is howling, try not to touch these "unvalued" companies.

After the interpretation and analysis of financial statements, we can conclude that the current revenue of Nvidia in fiscal year 2022 is 7.64 billion USD, about 49.6 billion RMB, equivalent to 3.1 Ningde times in the current A-share market. However, as of early February 18, 2022, Beijing time, the total market value of nvidia is 612.675 billion USD.About 3.88 trillion yuan.

Compared with the A-share market, it is equivalent to 2.28 INDUSTRIAL and Commercial Bank of China and 4.14 Bank of China. It is also equivalent to 22% of Apple, and its revenue is only 2% of Apple.

There is no denying that Nvidia is a good company. I have bought a lot of its products, grown older and older, and changed graphics cards again and again, but I am still afraid to buy shares.

Nvidia is a very good, high-growth company.In the disease cycle, nvidia accounts for the outbreak of dividends, right place, right time and accounts for almost all, unfortunately, 2022 in theory is used to "drop" of money in the event of an outbreak caused a chain reaction of repair, many need to take back to the once threw money, now lost days nvidia has become to one of the "kill valuation".

If the company's earnings in 2020-2021, it is worth, but in 2022, has been rising out of the "no one" explosive nvidia also need to have a rest, the company has announced several blueprint plan hasn't been fully show, especially "autonomous" and "artificial intelligence" part,Despite the revenues, but most of the blueprint still belongs to the "minds", from minds to implementation, still need some time, and during the period of waiting, is bound to some investors feel "impatient" or "concern", under such a high market value, unstable factors is higher than the growth, continue to charge up there are still a lot of difficulty.

There is value in both tech and traditional sectors;

It is unusual to exceed the value range and stay away from value, even substantially exceeding reported revenue.According to nvidia's financial report, its revenue in fiscal year 22 was 61% higher than that in fiscal year 21, but its stock price rose 767%. For me, this is a crazy stock price trend. If we fail to seize the high growth stock in the early stage, it is not a good choice to consider "chasing higher" in 2022.The risk probability of buying such stocks exceeds the return probability.

For companies that deviate, it is not accurate to refer to the company's financial statements and extrapolation of future financial statements, and it is anyone's guess where the stock price of a company that loses measurement will go.Stock prices have moved out of the earnings guidance range and the future direction of the stock price has become a "sentiment" factor, which in value investing is extremely risky and the target price is almost impossible to deduce and predict.

Therefore, the current "kill valuation" of the market is more like a return to value;

In fact, the market is also buyers and sellers. When there is scarcity of an item, the number of buyers is greater than that of sellers, and the price will rise. When the number of sellers is higher than that of buyers, the price will fall.People also have what is called "brain hot" price, that is, when the head is hot, no matter how much money, even if the extra money will buy.

For example, in the current second-hand car market, many brands of second-hand cars are sold at the new car price, due to the long waiting time of new cars and the market rumor of "lack of core".It is very painful for buyers who just need it, and it is also the most likely to appear "brain fever".Vehicles belong to "consumables". With the use of wear and tear and the iteration of production years, most cars are depreciated. Therefore, the phenomenon of second-hand cars being sold to new cars is also an abnormal phenomenon.After some time, when the market returns to normal, the "loss rate" of the car purchased during this period is higher than during other normal periods.

Do you believe that used car prices can be sustained for a long time to come?In a "brain fever" market, would you prefer to wait and see or "buy early, enjoy early, buy late and get a discount"?There are a thousand Hamlets in a thousand readers' eyes, so what do you think?You are welcome to share your thoughts in the comments section.

According to the market situation this year, personal speculation (market situation is changing rapidly, do not rely too much on deduction data) :

- Nvidia 23Q1 Support: between $178- $190

- Nvidia 23Q1 Stock Target:?

High valuation, high risk, high return; investment needs to be cautious.

REFERENCE

- NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2022

- NVIDIA February 26, 2021 - 10-K: Annual report for year ending January 31, 2021

- NVIDIA February 16, 2022 - 8-K: Current report

- What Is Edge AI and How Does It Work?

- Reimagining Modern Luxury: NVIDIA Announces Partnership with Jaguar Land Rover

- Jaguar Land Rover Announces Partnership With NVIDIA

- Atos Previews Energy-Efficient, AI-Augmented Hybrid Supercomputer

- Peak Performance: Production Studio Sets the Stage for Virtual Opening Ceremony at European Football Championship

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- antiti·2022-02-18Thx for your technical and insightful analysis of NVDA. This strange trend really makes me confused and your article helps me a lot!!! Looking forward to your more stock analyses :)8Report

- Moonshot·2022-02-18Thank you for sharing this insightful analysis of Nvidia. Definitely look forward to more of your opinion in the future. Happy Surfing!5Report

- NancyZhang·2022-02-18Thanks for your sharing! I am glad to see such a clear and specific Nvidia earnings analysis! Nvidia has been on my watchlist long time~5Report

- Ben137·2022-02-22While the company fundamentals may seem strong, geopolitics also has an impact. The markets seem spooked by the US-Russia situation escalating. The overall market is affected.3Report

- xuero·2022-02-22I saw in a report that a safer price to enter is below 230. with so many stocks on huge discount, this may not be the choice as I have limited capital. [Duh]2Report

- RedpillBluep·2022-02-22好文章!好的研究和写作!思想也很激动人心。3Report

- Kraken 1·2022-02-21好时机在这段时间左右进入imo,不需要时间行情…就元宇宙而言,未来将有巨大的上升空间2Report

- angkw·2022-02-21Thank you for the detailed analysis and sharing. It helps alot.2Report

- Desumond·2022-02-23interesting read. appreciate the detailed breakdown. perhaps its gotta dip abit due to fear among investors securing profits first.1Report

- Uncrowned·2022-02-19long nvdea2Report

- Hoys·2022-02-23I stone at this article1Report

- Desna10·2022-02-23pe ratio so high, pb ratio so low.... dividend yield so poor... i think over value1Report

- Bobjojuki·2022-02-23Nvda still can hold?1Report

- Wgey·2022-02-23market behav also play a significant part in pricing.LikeReport

- Reaper709·2022-02-21great buying opportunities 😜1Report

- KennethLim·2022-02-20go go go1Report

- Reaper709·2022-02-28NVDA to the 🌙😎💪🚀LikeReport

- bukit timah·2022-02-23please like1Report

- Mericula·2022-02-23像请LikeReport

- Lee_Chanz·2022-02-23makes me wonder how worth is Nvidia buying nowLikeReport