How to use VIX & SQQQ to Profit From a Down Market

Since the beginning of 2022, the US stock market has experienced significant downside risks. Last week, the top 5 hot stocks in the Tiger Community all declined by varying degrees.

You can short one stock or the broader market.

When you short one stock, you need to analyze the company performance, the industry characteristics, and the market trend. Instead, it’s easier to bet against the broader market because all you need to do is predict the overall trend.

This article will tell you how to short the US stock market by using two strategies.

Trading the VIX and SQQQ are two different strategies for shorting the broader market.

When you predict a declining market in the short term, you can choose VIX; and for the medium-term trends, you can choose SQQQ.

ⅠHow to use VIX

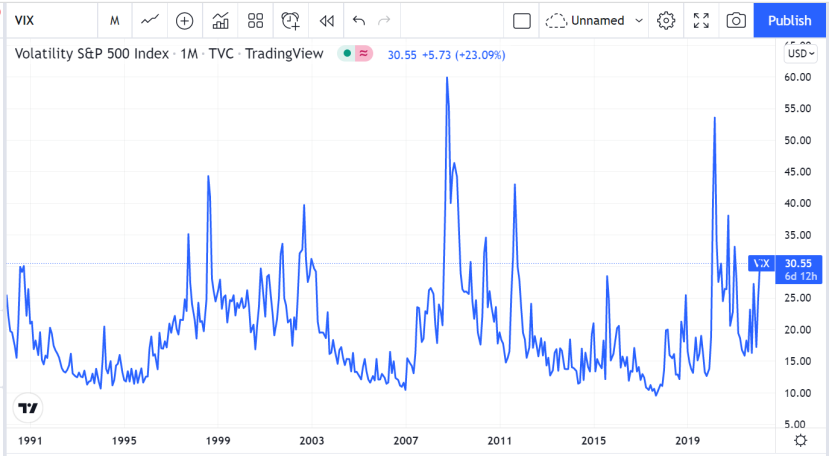

The $Cboe Volatility Index(VIX)$ , commonly called as "Fear index", is a real-time market index representing the market's expectations for volatility over the coming 30 days.

The VIX is an index and cannot be traded. Investors can trade "VIX futures contracts" and "VIX options". Generally, retail investors can only trade "VIX options".

You need to be cautious about its mean reversion characteristics: if the VIX falls to 15, it’s highly likely to rebound, meaning that the broader market will fall in the short term; if the VIX surges to 30, it may start to go down and the broader market will rise.

You can buy VIX "call options" to short the market in the short term. With its mean reversion tendency, you may sell these "call options"when the VIX is close to 30.

When the market plunges, the high volatility of the VIX means high returns. So by using the VIX to short the broader market, you can efficiently use your money in a down market. VIX "call options" with leverage will bring you especially considerable returns.

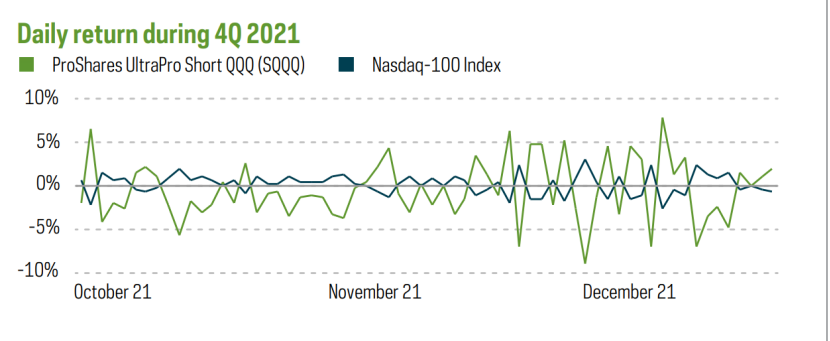

ⅡHow to use SQQQ

The reason for shorting the broader market with SQQQ is very simple. If the broader market plummets, growth tech stocks will be badly hit.

Here are some points I’d like to inform readers of:

1. You choose SQQQ when you anticipate the broader market will go down in the medium-term.

2. As I mentioned before, you can use “call options” to increase your leverage.

3. However, it is important to note that long positions generally can be held for a long time, while short positions can’t. Therefore, you should be particularly cautious about using medium-term shorting strategies.

Share anything you want to discuss in the comment section and I will reply to your message.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Sing Options·2022-02-24situation can get worse or it may oso get better anytime. imagine Russia reach agreement for pullout. vix will tank and stocks will rise. unless it's a hedge, no point short market for profit.9Report

- Oldhead·2022-02-23Short selling is NOT a sure thing. Need to be alert and fast.7Report

- luckyone·2022-02-23Good strategy but guess best to use only money you can afford to lose and not lose sleep over5Report

- Jason1616·2022-02-24Short with available funds.Dont short with margin And get yourself into financial mess. Trade with Risk Management7Report

- Maky·2022-02-24Interesting but are you able to give an example on how to do it? Then possibly we would so a paper trade first to try as such trades are risky4Report

- Stingaling·2022-02-23thanks for sharing this article. The difference between VIX and $ProShares UltraPro Short QQQ(SQQQ)$ is one is a measure of volatility while the other is stock prices going down.2Report

- Bulltrader·2022-02-25index will up and down. u need a short term2Report

- Yoko Titan·2022-02-24thank you for sharing [Like]2Report

- Katee·2022-02-24Thanks for sharing2Report

- yong168·2022-02-22[邪恶] [强]2Report

- MBE·2022-03-06Please share more on the medium-term shorting strategy risks.LikeReport

- JosHi5·2022-03-06what is difference with $ProShares Ultra VIX Short-Term Futures ETF(UVXY)$ ?LikeReport

- Barbarazhao·2022-02-25Thanks for sharing1Report

- ming22·2022-02-25Good to know, can start buy or dca1Report

- Valerie6888·2022-02-25Thanks for sharing2Report

- BillyWu·2022-02-25Good time to buy in if got extra cash.1Report

- OO_898·2022-02-24Thank for sharing.1Report

- stsockli·2022-02-24this is a good piece of sharing. nice!1Report

- Reaper709·2022-02-24make ❤️ not war🙏1Report

- JTC·2022-02-24not bad not bad1Report