Options Trading and Settlement—what should we know before trading options?

Actually, we still need to familiarize ourselves with the operation of the trading software. Next up, we will use the Tiger Trade app to demonstrate the key steps as well as dos and don'ts of actual operation.

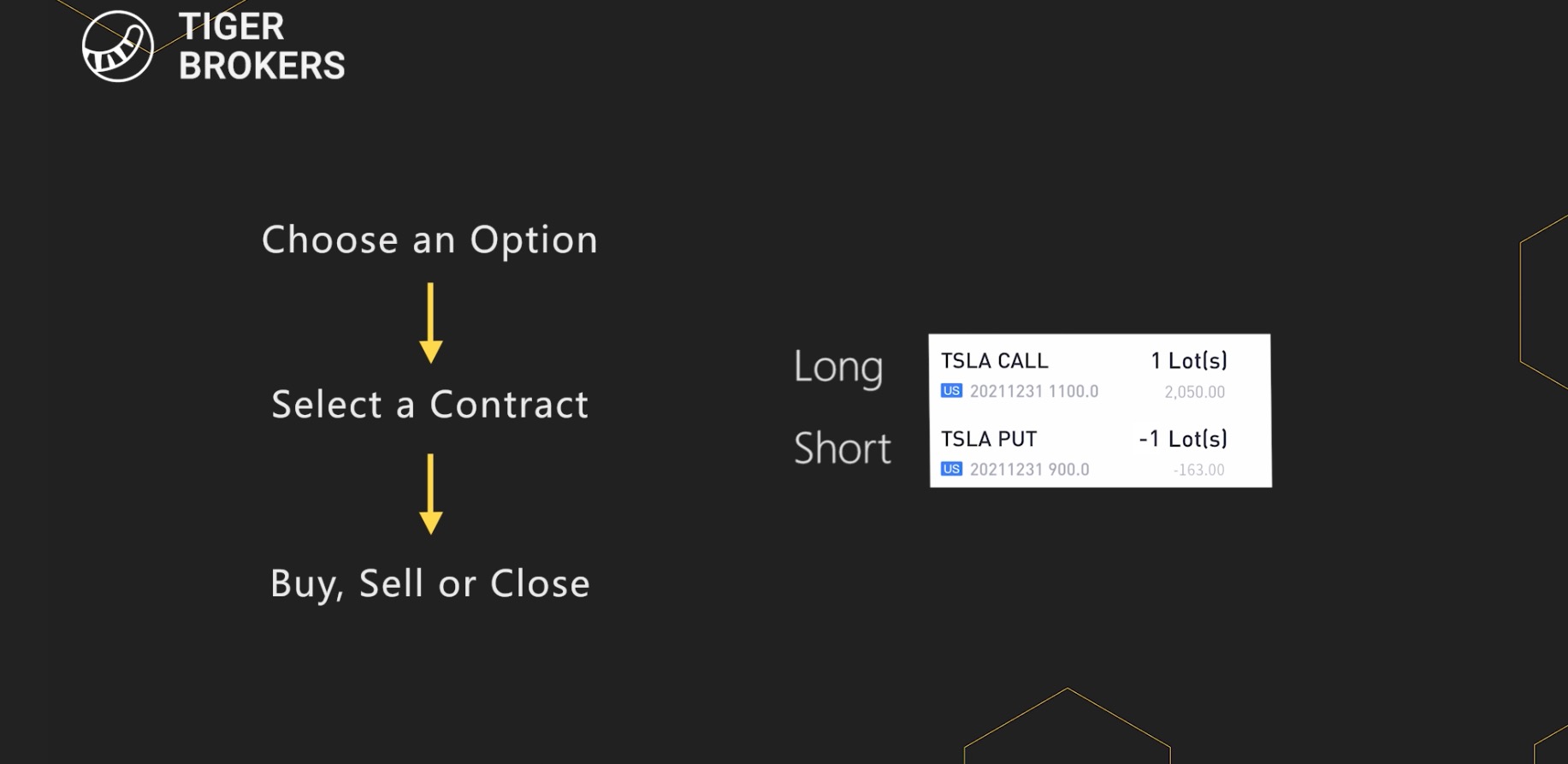

As with buying stocks, first you must choose an option. After entering the option chain, select a contract to see the details. At this time, you can see that there are three trading options: buy, sell and close. When you don't have any contracts in your account, you can only buy or sell. Both directions are called 'opening.' After you have opened a position, you can choose to close it. Closing is the opposite of your original position. If you hold a long position, closing is selling. If you hold a short position, closing is buying.

Generally speaking, after opening a position and buying an option, there are three modes of operation.

The first way to operate an open position is to sell and close the position before the expiration date. Assuming that Tesla's share price stands at $1,000 USD on October 1, Tim is very optimistic about the future and buys a Tesla call with expiration date on December 31 and strike price at $1,100 USD. The total cost is $1,000 USD. Tesla's share price subsequently rises, as does the call price.

There are two ways you need to know about operation, you can learn them from the next video.

Related Articles & Videos

Valuation of Options—How are options priced?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

I typically found seeing the high and low of premium in 1st hr and then queue to sell puts at 50% to 100% higher.

Sharing for save keeping on my published page too for future reference

[smile]