The Commodity Report #71

The oil crisis will only become worse // Shipping rates continue to decline // USD Sentiment Check

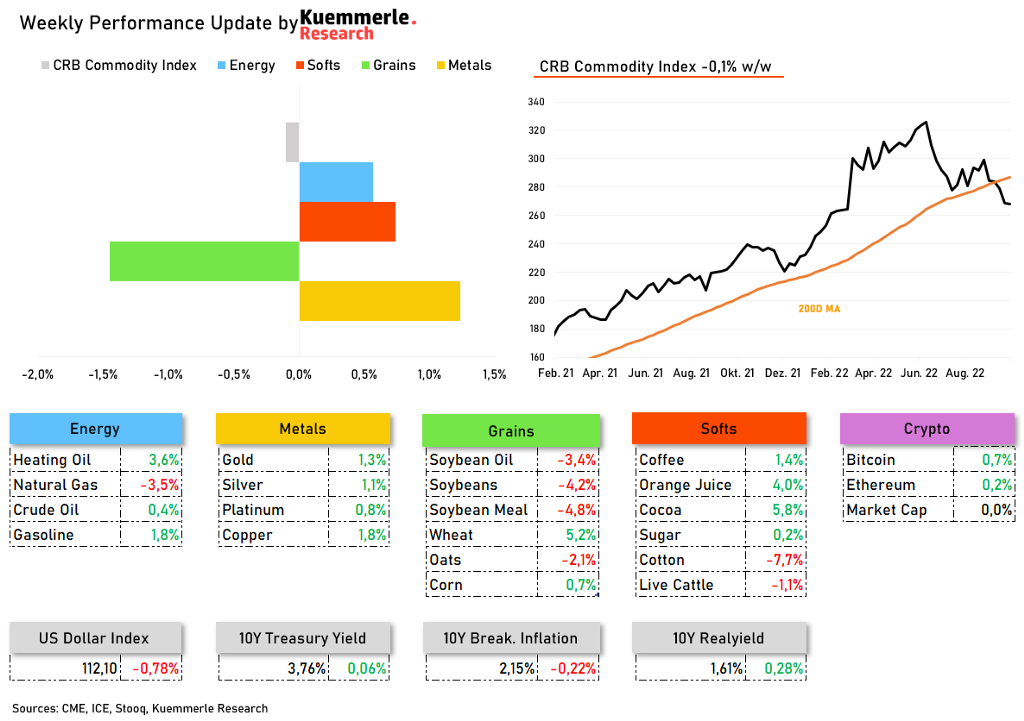

The benchmark, CRB Commodity Index, ended the week -0,1% lower

Welcome to another 93 people that subscribed to the Commodity Report during the last week, bringing the total subscriber count up to 2.319 people!

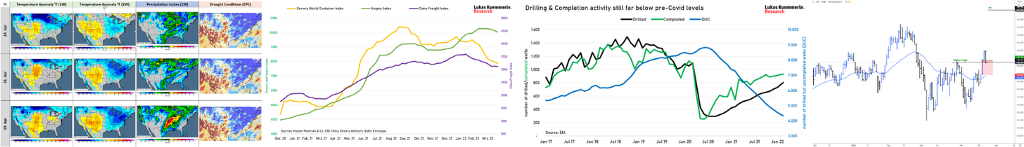

The oil crisis will only become worse (in 2023)

We expect the oil crisis to worsen once economic activity resumes again. Till then some months will probably pass. Nevertheless, the industry hasn’t increased production significantly enough, and the SPR release by the Biden administration veiled the actual grim picture in the oil market.

Those stories from Bloomberg show how relaxed the sentiment seems to be again. I have the feeling that this sentiment won’t age well at all.

Keep in mind that OPEC+ will be meeting in person in Vienna on Oct 5, changing its original plan for a video-conference call. It’s obvious one doesn’t call the in-person meeting at the very last minute unless the group is planning for big oil production cuts. Everything adds up for a major rebound in energy prices during 2023!

Shipping rates continue to decline

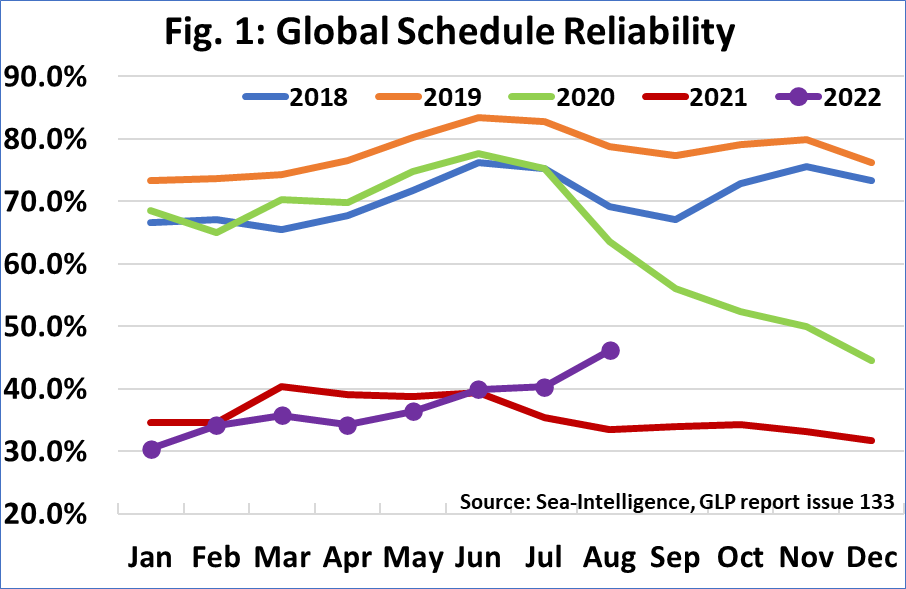

As sEa Intelligence reported, global schedule reliability improved strongly during the last month, reaching 46.2% in August. Nevertheless, there is still quite a gap between now and pre-covid reliability values. This confirms the view that supply-chain issues remain in place. Meanwhile, all kinds of shipping and container rates continue to decline fast.

It would mean the world to me if you leave a like or share The Commodity Report if it brings you any value. It helps the community to grow further and to provide more people with practical commodity research.

Good signs out of China

Good news from China if you’re a commodity bull: According to PetroChina the economy is expected to be “much better” during the final three months of the year compared with the third quarter. Moreover, they believe that next year we will see much more robust growth. In our opinion this makes sense. The credit impulse from China is still affecting all kinds of markets overseas. Therefore we expect commodity demand from China to rebound strongly towards the end of Q1 2023.

Subscribe to The Commodity Report for free and receive these updates every Monday morning!

Dollar strength will abate soon (read the sentiment)

Cover stories tend to signal peaks of enthusiasm and fear. We do think that last week such an event occurred again.

The Economist published this pessimistic cover for the UK and GBP. Meanwhile, Bloomberg published a very bullish cover story for the USD. We smell some peak bullish momentum for the USD here!

This week look out for:

- Manufacturing PMI data on Monday (we expect a large drop)

- OPCE+ meeting on Wednesday (we expect significant supply cuts)

- Service PMI data on Wednesday (we expect a large drop)

- Job market report on Friday (we expect the first signs of a weakening job market)

Subscribe to The Kuemmerle Report

Commodity Metrics, Futures Activity and Trading Opportunities

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- JC888·2022-10-27Instead of ploughing thru heaps of reading materials, sometimes after lunch I will just walk to any Money Changer a d take a look at the exchange rates between SGD n RMB. This immediately gives me an inking of how the chin economy is really doing.. Agree? Just a tip...LikeReport

- Carolq·2022-10-03Hope USD will go down1Report

- prestomanik·2022-10-03i guess the usd will weaken too?1Report

- Shinji Ong·2022-10-06okLikeReport

- lionfish·2022-10-06ok1Report

- Waka Tiger·2022-10-03😀1Report

- Tingling·2022-10-03C1Report

- AhLim·2022-10-03ok1Report

- IcyAlchemist·2022-10-03OkLikeReport

- RabbitNg·2022-10-03Ok1Report