About Nov CPI & Dec Rate Hike, All You Should to Know

Summary:

- Institutional Perspectives:

- Key economic data last week:

- Key focus on this week:

- Two points that the market is worring about?

- Institutional expectations of market:

- Tips on investment opportunities:

The FED's interest rate resolution is getting closer, in addition to the pressure of PPI data higher than expected last week, investors put their chips in their pockets last week, and the three major US stock indexes plunged in the late afternoon.

Regarding this week's rate hike resolution, many institutions believe that the FED will increase around 50 bps, According to the "FED Tool" of Chicago Mercantile Exchange, the probability of the FED rate hike by 50bps this month has risen to 77%.

Institutional Perspectives of Rate Hike:

Source From Web

Key economic data last week:

Last week, 230000 people applied for unemployment benefits for the first time in the United States, which was in line with market expectations. However, the number of people who continued to apply for unemployment benefits rose to 1671000, the highest since the beginning of February this year. This shows that with the initial signs of cooling in the labor market, it is difficult for unemployed Americans to find ideal new jobs, which may help the FED to slow down the pace of rate hike at this week's interest rate meeting.

The consumer confidence index for December released by the University of Michigan last Friday rose to 59.1 (the previous value was 56.8), which was unexpectedly optimistic, indicating that the US economy is more flexible than the policy makers predicted in the face of the FED's interest rate hike. This not only reflects the improvement of the current economic situation and the resilience of the economy, but also reflects the expectations for the future. Analysts expect that the FED will cut its unemployment rate forecast and raise the final forecast of the federal funds rate in the lattice.

Key Focus this week:

November CPI: Economists generally expect the US November CPI released on Tuesday to grow 7.3% year on year, down from 7.7% last month. Although the growth rate of inflation has slowed down, it is still far higher than the 2% target value of the Federal Reserve, and still at an all-time high level. Although the overall CPI tends to slow down, some economists believe that core service inflation is still quite strong, and this data may again be effectively supported by strong housing inflation, so it is necessary to focus on whether the core CPI has dropped significantly in the future. Economists expect the core CPI in November to grow by 6.1% year on year, up from 6.3%.

About December Rate Hike, Analyst Steve Goldstein, wrote that

the market's expectation is that the FED will continue to raise the interest rate until it reaches 5%, and then suspend it for a period of time. But the FEDmay think that 5% is not enough. If the US economy continues to grow at a steady rate and inflation does not cool down significantly, this will be the case.

JPMorgan strategists led by Nikolaos Panigrtzoglou decided to study a situation where the Federal Reserve would raise the benchmark interest rate to 6.5% in the second half of 2023.

Two points that the market is worring about?

Recession: The continuous warning that the US economy is sliding towards recession has finally touched the nerves of Wall Street. After the most serious reversal of the US bond yield curve in 40 years and the collapse of the sharp rise in oil prices in 2022, investors now seem to be betting that under the aggressive tightening policy of the Federal Reserve, the biggest threat facing risky assets is that economic growth will slow down.

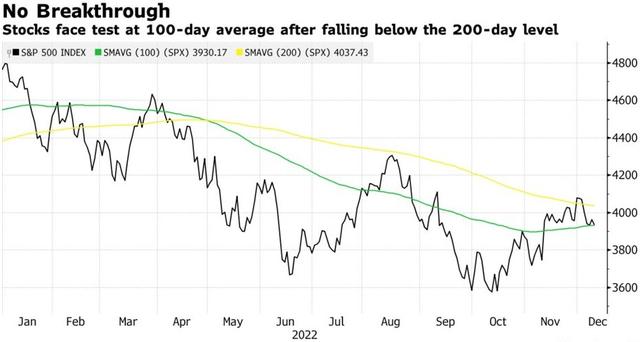

US equities fell: US equities $S&P 500(.SPX)$ fell 3.4% last week after the index failed to maintain above the 200 DMA. Although the optimism that the FED will slow down the pace of rate hike has driven the US stock market up 14% since the middle of October, the sentiment of investors has become gloomy. They are worried that if the FED does slow down the pace of interest rate increase, it will mark that the US economy is in a downturn.

Institutional expectations:

Peter Tchir, macro strategy director of Academy Securities, said:

"We will change from 'bad data is good news' to' bad data is bad news', because this is a signal that the economy is weakening faster and worse than most people expected."

The market has begun to view a series of depressing economic news as bad news, rather than as a reason for the rise brought about by the prospect of the Federal Reserve's easing policy.

The media survey of global fund managers also shows that stubborn high inflation and economic recession are the main risks facing the global stock market in 2023. However, after experiencing the worst year of stock market performance since the global financial crisis, the data shows that most of the interviewed institutional investors are relatively optimistic about the low rise of global stock market slightly higher than 10%.

Tips on investment opportunities:

Fund managers predict that the stock market will usher in a relatively optimistic year in 2023

Hartnett's team of strategists from Bank of America suggested

buying assets that performed well under the background of relatively high inflation but stable values, such as bargain hunting when commodities, banks, small cap stocks and value stocks, and European and emerging market assets fell. In his report, he stressed that investors should avoid technology stocks, private equity and private credit.

The latest survey of BofA Data Analytics on its equity clients shows that its clients mainly buy stocks and ETFs, while increasing efforts to buy small cap stocks and large cap stocks. Among them, ETFs focusing on small cap stocks (such as $VBR(VBR)$ , $SCHA(SCHA)$ and other hot small cap ETFs) ushered in the largest ETF capital inflow since June. From the perspective of the investment scale of ETFs, the trend of the bank's customers to continue to buy value based and hybrid ETFs remains unchanged.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

👌