Top 10 Stocks for Trading Options in the Financial Report Season

The 2022 Q4 earnings season is drawing to a close amid expectations of a soft landing for the US economy. Profit margins for S&P 500 companies have fallen for the sixth straight quarter since peaking at 13% in 2021, and inflation is taking a real bite out of profits across industries.

But by the end of February the S&P 500 was up 3%! The stock trend has been positive against pessimistic expectations. Tiger Community compiled a list of the top 10 stocks by options trading volume to see what kind of options trading characteristics they had during earnings season.

1. $Tesla Motors(TSLA)$

Tesla was arguably the hottest stock option trade of Q1 earnings season. Through February, Tesla shares closed at $205.71, up more than 73% this year and 102% since their intraday low of $101.81 on Jan. 6.

On the one hand, Tesla's previous massive price reduction campaign brought about a significant increase in sales; On the other hand, strong fourth-quarter earnings reports added to the bullish sentiment.

According to data from the Chicago Board Options Exchange, Tesla options volume has reached an average of 3 million contracts changing hands a day in January, more than any other company's stock, accounting for about 7% of all options trading and double the average of 1.5 million contracts a day a year ago -- less than the market's bets on the broad ETF SPY.

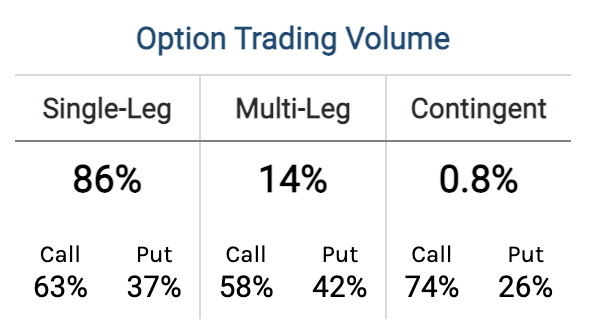

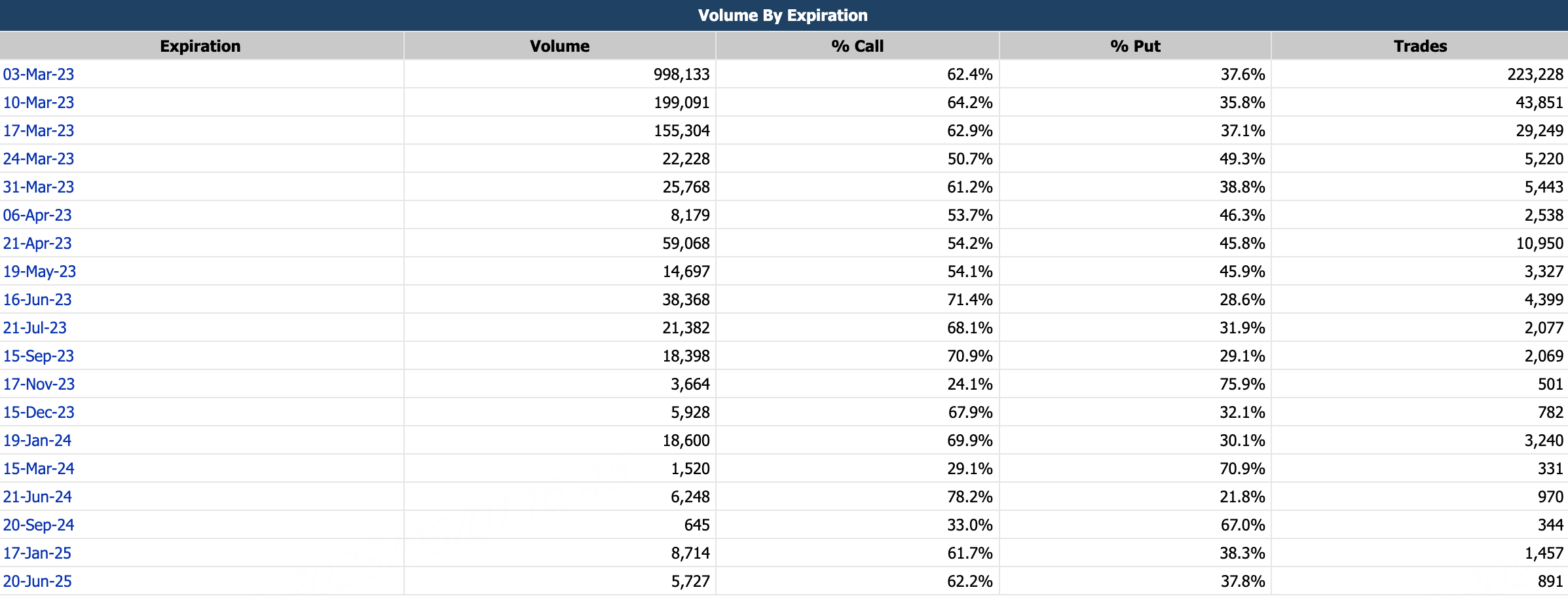

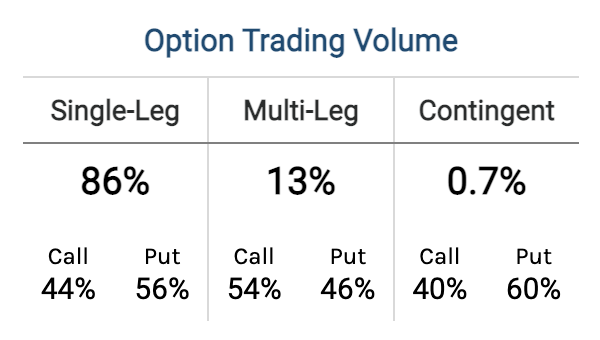

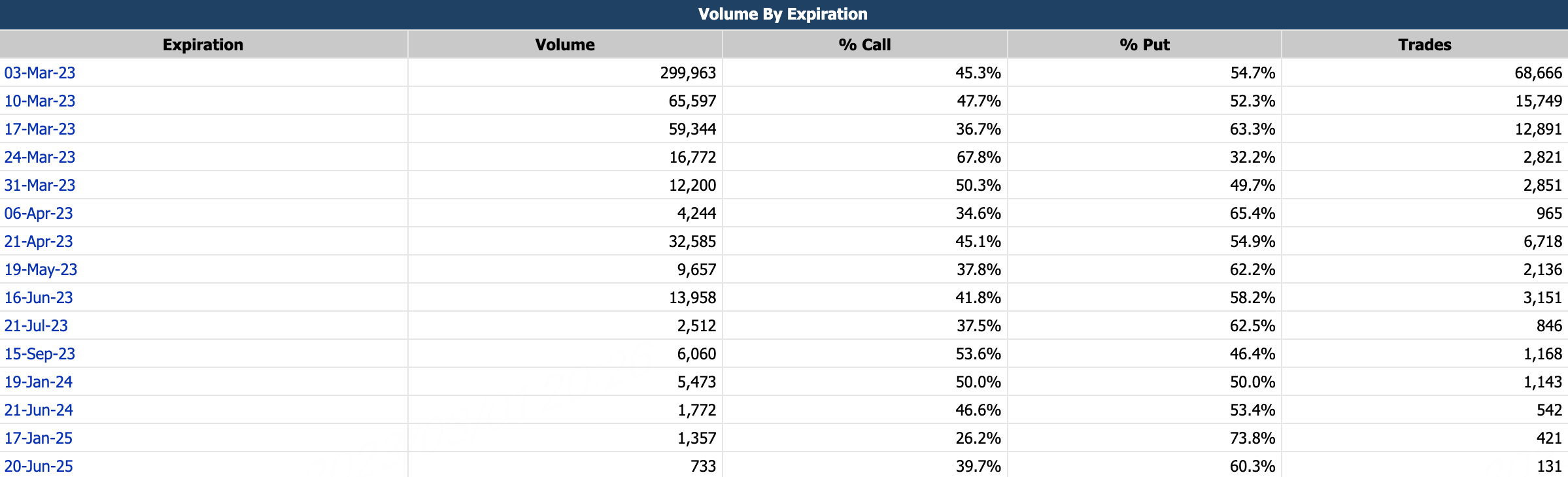

In the direction of strategy, 86% of investors choose single-leg option strategy and 14% choose multi-leg strategy. Single-leg strategy calls account for a larger proportion, which reflects that bullish investors are more aggressive.

By the end of February, Tesla's most open CALL option was $TSLA 20240119 825.0 CALL$ with 78,944 open options.

The most open PUT option was $TSLA 20230317 200.0 PUT$ , with open interest reaching 45,034.

2. $Apple(AAPL)$

By the end of February, Apple's stock had closed at $147.41, up more than 13% for the year. Apple shares rose 3.7 percent after the earnings report on Feb. 2. Results showed that in the fourth quarter of 2022, Apple Inc., affected by macro and exchange rate factors, total revenue declined for the first time since 2019, and the biggest quarterly decline since 2016. It was far below analyst expectations, and earnings per share fell below market expectations for the first time in nearly seven years. But with the Fed winding down and the dollar sputtering, the two negatives are becoming less of a problem for Apple.

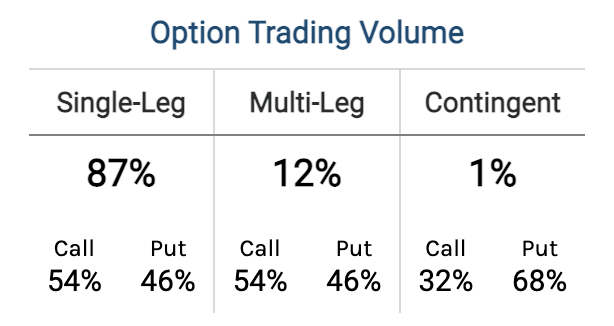

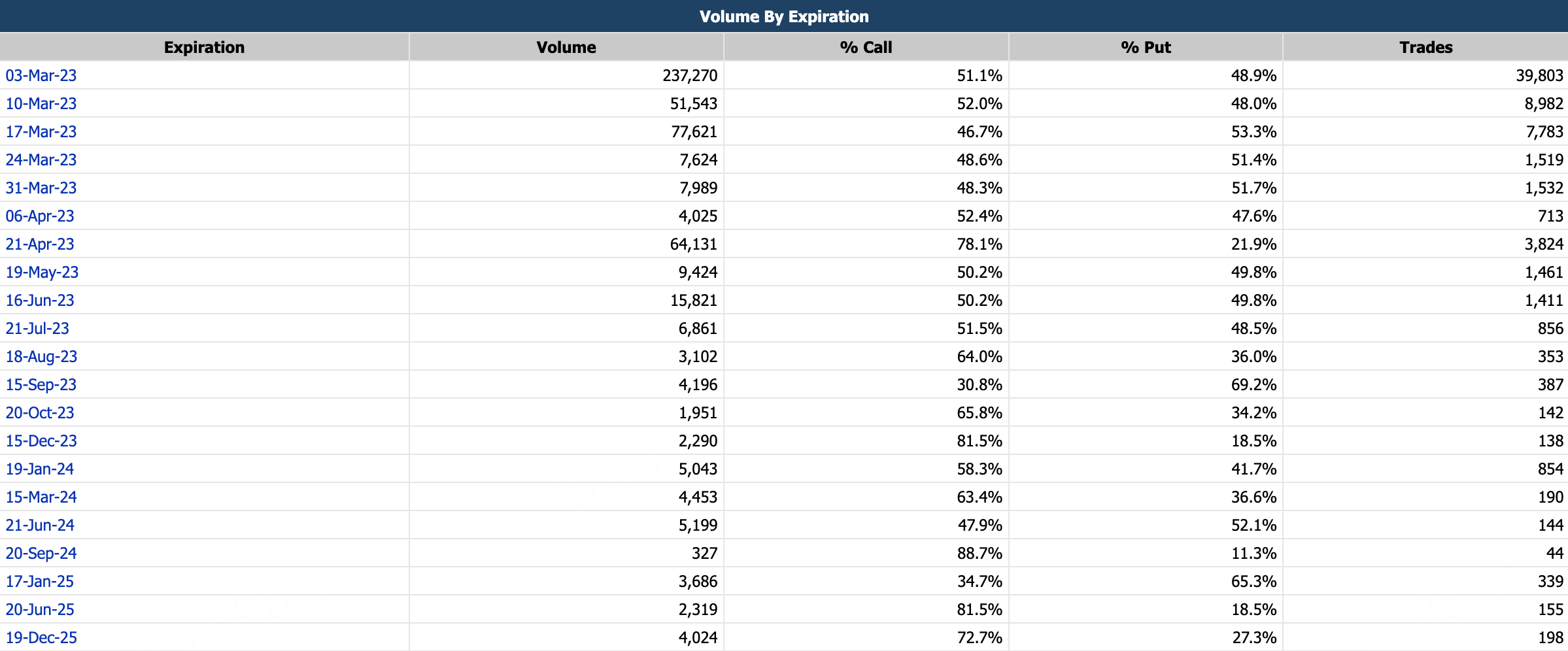

In terms of strategic direction, 87% of investors choose the single-leg option strategy and 12% choose the multi-leg strategy. The proportion of bullish and bearish options in both single-leg and multi-leg strategies is relatively balanced.

As of February, the most open CALL option on Apple was $AAPL 20230317 150.0 CALL$ with 84,661 open options.

The most open PUT option was $AAPL 20230616 130.0 PUT$ , bringing the open interest to 91,871.

3. $NVIDIA Corp(NVDA)$

Thanks to ChatGPT's explosion, Nvidia has significantly benefited from the AI wave as a powerful GPU. Shares of chip designer and maker Nvidia closed at $232.16 in February, up more than 56 percent this year. Nvidia shares rose 14 percent after the Feb. 23 earnings report. While the Q4 results were not strong, they were still better than expected. A bull may decide to focus on a sequential improvement in expectations, while a bear may decide to focus on deteriorating performance from year to year.

In the strategic direction, 86% of investors chose the single-leg option strategy, 13% chose the multi-leg strategy, and the single-leg strategy put a larger proportion of investors, reflecting investors' doubts about the short-term hype in ChatGPT.

As of February, Nvidia's most open CALL option was $NVDA 20230616 600.0 CALL$ , with open interest reaching 31,563.

The most open PUT option was $NVDA 20230317 140.0 PUT$ , bringing open interest to 44,093.

4. $Amazon.com(AMZN)$

Through February, Nvidia shares closed at $94.23, up more than 10% this year. The stock rose as much as 33 percent in mid-February to $114. Amazon shares fell 8 percent after the company reported earnings on Feb. 2. Amazon's Q4 results seemed to be higher than market expectations to some extent, but in fact the market did not think it was positive. The retail business was not optimistic in the expectation of recession, and the stock price only rose on February 2, one day later fell back. But as inflationary pressures abate, the retail market is also likely to slowly recover and e-commerce activity in the international sector picks up.

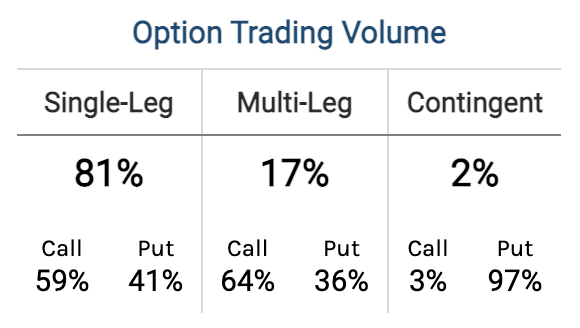

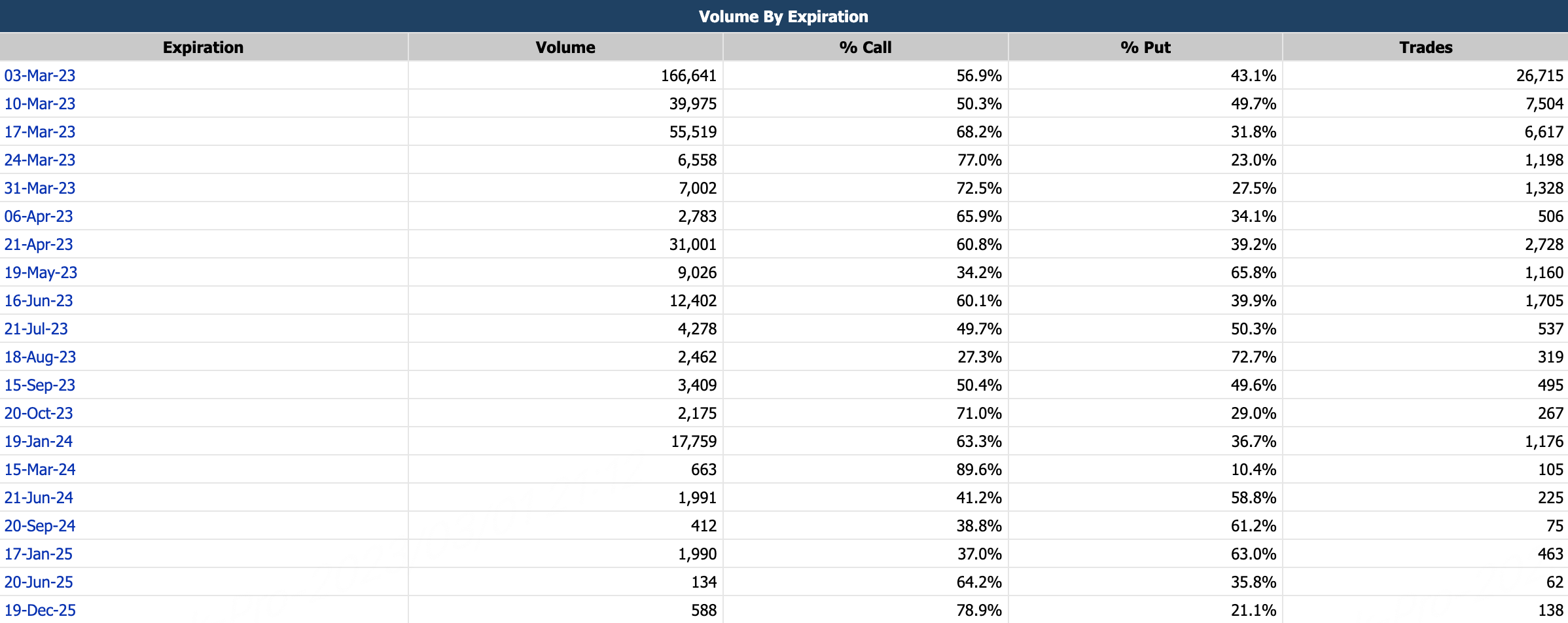

In the direction of strategy, 81% of investors choose the single-leg option strategy and 17% choose the multi-leg strategy. The multi-leg strategy traders are more optimistic about Amazon, and the call option accounts for a larger proportion.

As of February, the most open CALL option on Amazon was $AMZN 20230616 95.0 CALL$ , which reached 82,165.

The most open PUT option was $AMZN 20230317 100.0 PUT$ , bringing open interest to 58,827.

5. $Alibaba(BABA)$

By the end of February, Alibaba shares closed at $87.79, down more than 3.6% this year. It rose as much as 33 percent in mid-February to $121.3. Shares of Alibaba fell 0.65 percent after the company reported earnings on Feb. 23. While the third-quarter results beat analysts' expectations, Alibaba did not provide revenue guidance for the next quarter amid questions about its growth. Although the results didn't drive the stock up, Alibaba's valuation is cheap, at 2 times sales, a historic low.

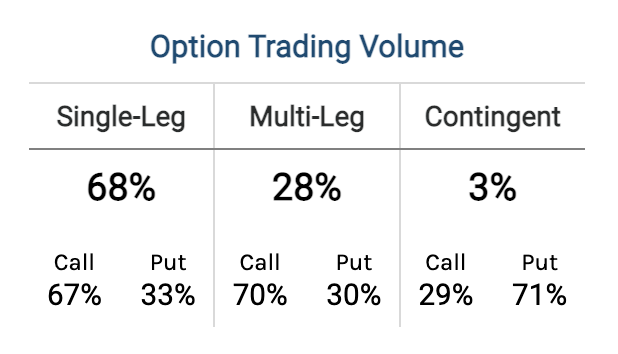

In terms of strategy direction, 68% of investors chose the single-leg option strategy and 28% chose the multi-leg strategy. In the single-leg and multi-leg strategies, the proportion of call options was twice that of put options. It reflects Alibaba's ability to attract money as a leading Chinese concept stock.

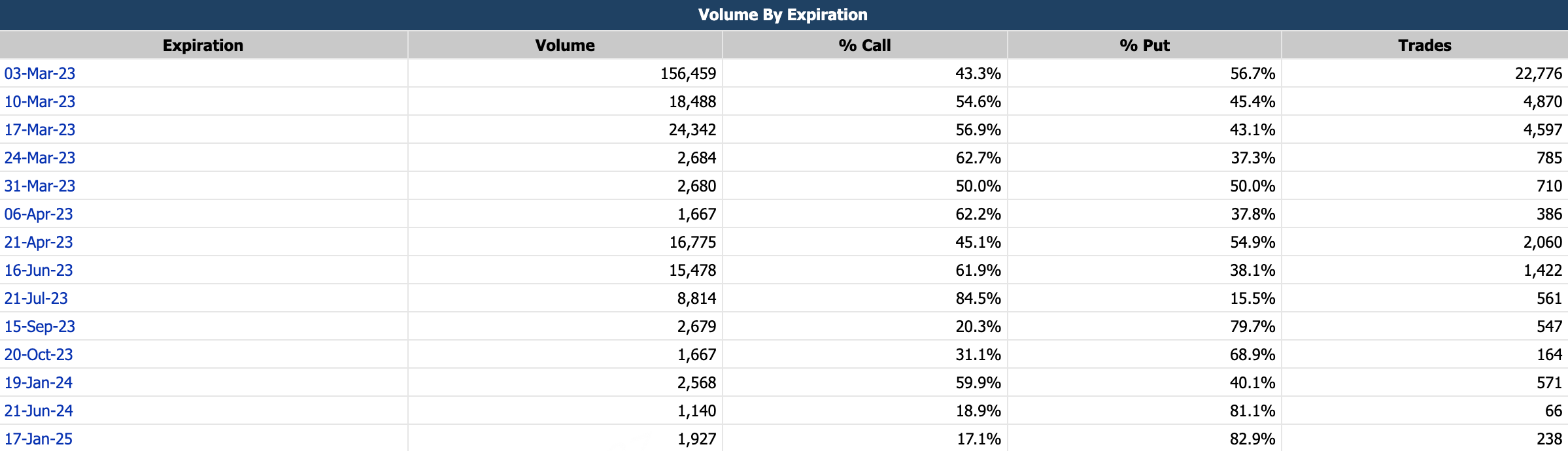

The hottest options in the market right now:

As of February, Alibaba's most open CALL option was $BABA 20230317 120.0 CALL$ , with 51,588 open calls.

The most open PUT option was $BABA 20230317 95.0 PUT$ , bringing open interest to 27,949.

6. $Meta Platforms, Inc.(META)$

By the end of February, shares of Facebook parent Meta closed at $174.94, up more than 42% this year. Meta shares rose 23 percent after the earnings report on Feb. 1. While all advertising-focused social software is facing the threat of an expected recession, Facebook is clearly better positioned to weather the downside. Average revenue per user (ARPU) reached $10.86, the highest level in 2022. The market has once again recognized Meta's leading value in social networking.

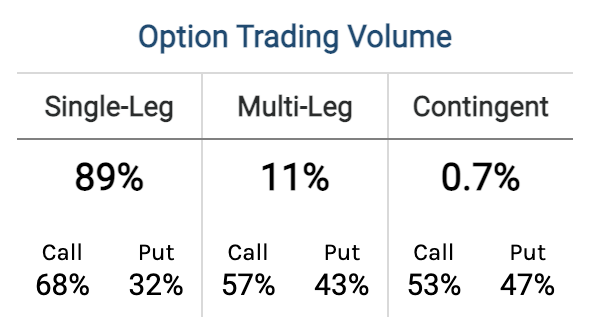

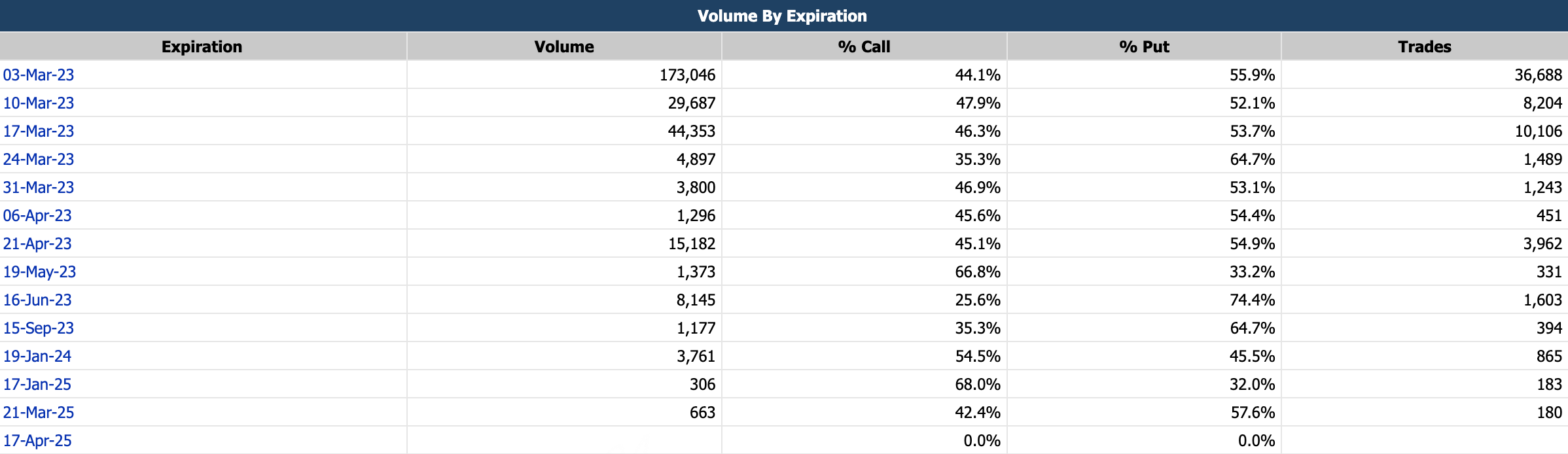

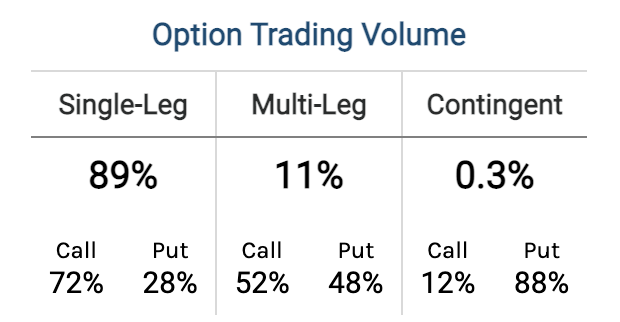

In terms of strategy direction, 89% of investors chose the single-leg strategy and 11% chose the multi-leg strategy, with twice as many calls as puts in the single-leg strategy.

As of February, Meta's most open CALL option was $META 20240119 420.0 CALL$ with 56,502 open options.

The most open PUT option was $META 20240621 5.0 PUT$ with 36,114 open options.

7. $Palantir Technologies Inc.(PLTR)$

By the end of February, Palantir's stock closed at $7.84, up more than 19 percent for the year. It rose as much as 56 percent in mid-February to $10.31. Shares of Palantir rose 21 percent after the company reported earnings on Feb. 13. The company posted its first quarterly profit and revenue topped consensus estimates, though analysts pointed to volatile business and guidance for 2023 revenue growth that fell short of Wall Street estimates.

In the direction of strategy, 88% of investors choose the single-leg option strategy and 6% choose the multi-leg strategy. In the two strategies, the proportion of the call option is twice that of the put option, indicating high bullish sentiment.From the overall data, from January to February, the average daily open interest of Palantir call options reached 1.31 million, the average daily open interest of put options reached 610,000, the average daily total open interest reached 7.52 million, and the average put/call ratio was 0.49. The overall bias is to trade with call options.

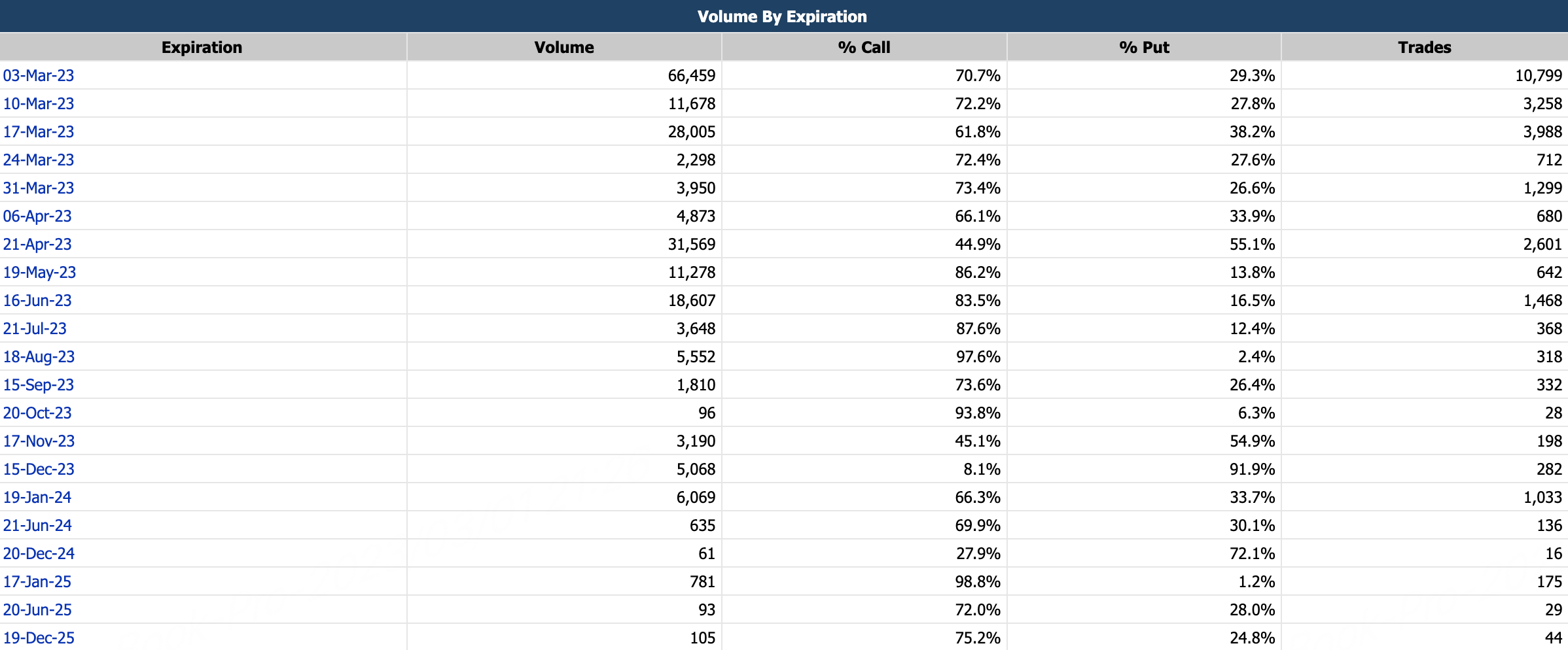

The hottest options bets in the market right now:

As of February, Palantir's most open call option was $PLTR 20240119 10.0 CALL$ , with 74,677.

The most open put option was $PLTR 20240119 10.0 PUT$ , which has opened 45,934.

8. $Coinbase Global, Inc.(COIN)$

By the end of February, cryptocurrency trading platform Coinbase shares closed at $64.83, up more than 77 percent for the year. Stock moves were muted after the Feb. 21 earnings report, with analysts noting that Coinbase's January trading revenue far exceeded market expectations and that most metrics in its first-quarter guidance beat Wall Street's expectations. Trading activity at Coinbase deteriorated from the third quarter, though the revenue decline was offset by an increase in interest income.

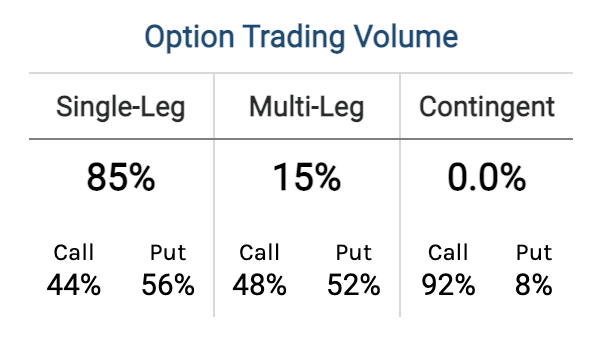

Strategic direction, 85% investors choose single-leg option strategy, 15% investors choose multi-leg strategy, put option volume is slightly higher than call option, reflecting investors are cautious about the performance of digital currency market in the interest rate hike cycle.

As of February, Coinbase's most open CALL option was $COIN 20230317 75.0 CALL$ with 10,092 open options.

The most open PUT option was $COIN 20230310 55.0 PUT$ , with open interest reaching 13,445.

9. $Alphabet(GOOGL)$

By the end of February, Google shares closed at $90.06, up more than 0.5% for the year. But the CHATgpt concept attracted a lot of hype money. It rose as much as 20 percent in mid-February to 108.18. Google shares fell 2.75 percent after the company reported earnings on Feb. 2. Weaker-than-expected Q4 results, negative video advertising, strong peer competition and expectations for core advertising growth in the single digits at best until 2023. At the same time, AI chat tool ChatGPT caused competitive pressure on Google search engine.

Strategic direction: 89% of investors choose single-leg option strategy, 11% choose multi-leg strategy, and those who choose single-leg strategy are crazy bullish on Google. The bullish option accounts for a large proportion, 3.5 times that of the put option, which reflects investors' pursuit of the concept of AI.

As of February, Google's most open CALL option was $GOOGL 20240119 225.0 CALL$ with 109,810 open options.

The most open PUT option was $GOOGL 20230317 100.0 PUT$ with an open interest of 52,325.

10. $Advanced Micro Devices(AMD)$

AMD has overtaken Intel to become the industry leader in processors, completing a reversal of position. By the end of February, AMD shares closed at $232.16, up more than 56% this year. AMD shares rose 12.6 percent after the company reported earnings on Feb. 1. AMD management expects the first half of the year to be a low point, and the second half to be better than the first half. The forecast is in line with those of Micron Technology, Taiwan Semiconductor Manufacturing and AsML, which could mean a near-term bottom for the semiconductor industry.

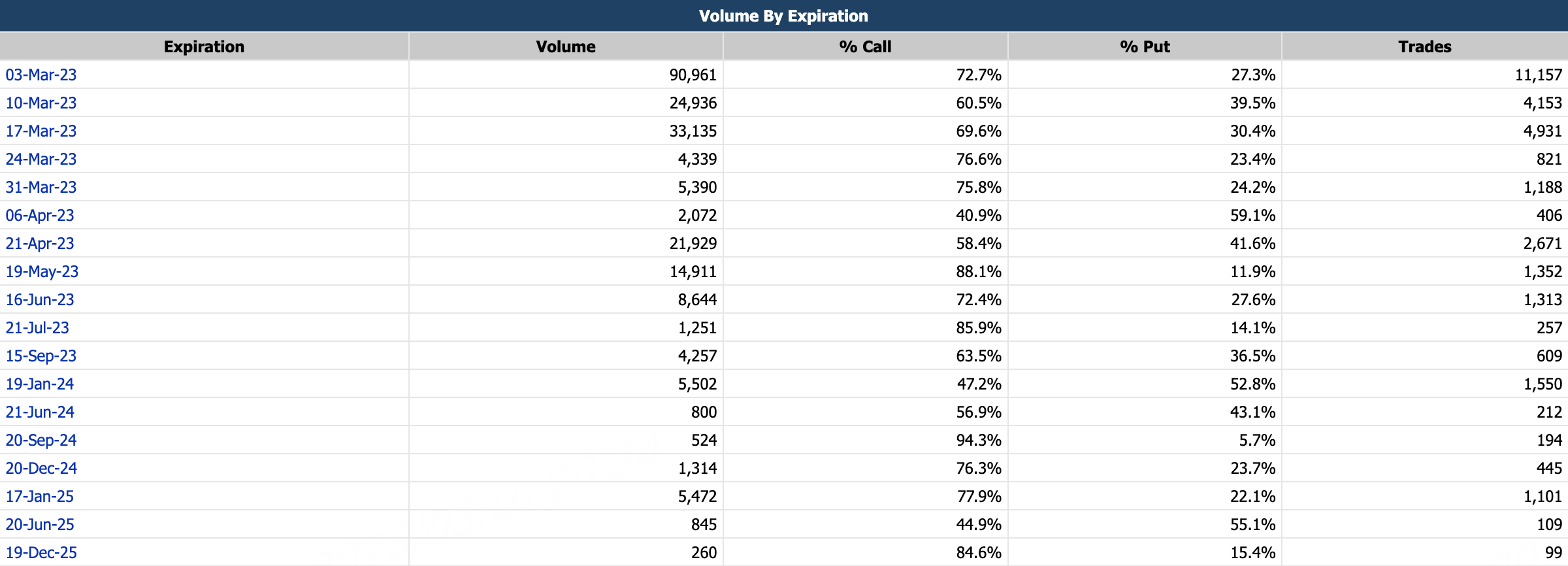

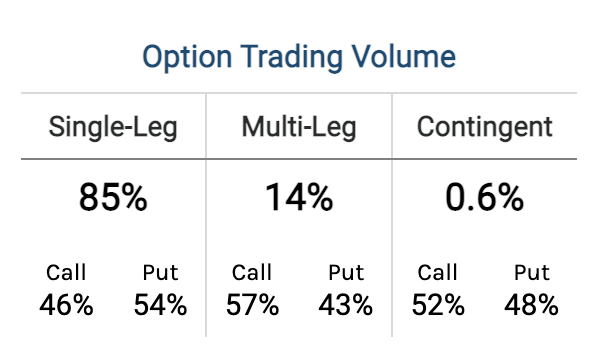

Strategic direction, 85% of investors choose the single-leg strategy, 14% choose the multi-leg strategy, like Nvidia this quarter investors are on the sidelines of the chip industry, call and put options are evenly distributed.

As of February, AMD's most open CALL option was $20230616 110.0 CALL$, with open interest reaching 32,838.

The most open PUT option was $AMD 20230317 75.0 PUT$ , with open interest reaching 34,884.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

pls advice..thank you

Great ariticle, would you like to share it?

这篇文章不错,转发给大家看看

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?