Check all the Stocks, ETFs that benefit from Banking Crisis?

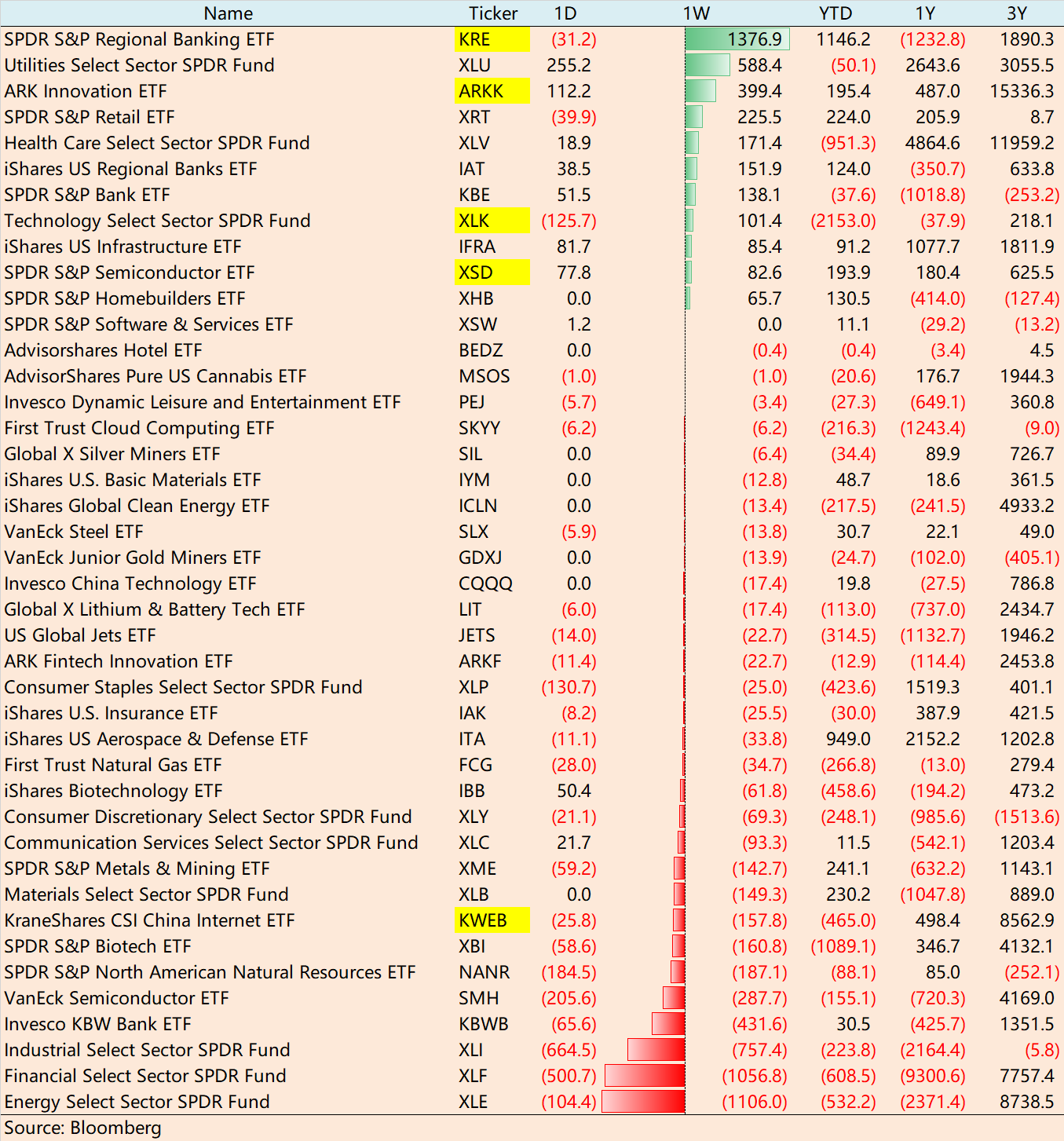

Who is the biggest winner in the week of banking crisis?

In terms of weekly returns, technology, healthcare, consumerand staples, utilities have benefited the most. Among them, the consumer staples, utilities and healthcare sectors are defensive, but the technology sector usually aggressivem, has interestingly become a winner.

What provides support for the technology sector is mainly the update of ChatGPT. The exponential growth of its users, from application to computing power, will also ignite infrastructure demand.

From the perspective of the sub-sectors of the science and technology sector,

1. Directly related to OpenAI, aka, $Microsoft (MSFT)$, has increased by nearly 10% in the week. At the same time, it announced at the developer conference on March 16 that it will embed ChatGPT into Offices, which will greatly change the current work efficiency of people;

2. In the semiconductor industry related to infrastructure, there are a large number of individual stocks and chip giants with a single week increase of more than 6%$NVIDIA Corp(NVDA)$ $Advanced Micro Devices(AMD)$ $Intel(INTC)$ are leading the gains, the market expects that deep learning with AI will accelerate the expansion of computer performance, and the computing power used for AI training will double about every 6 months;

3. Equipment and material infrastructure companies related to this, such as$Applied Materials(AMAT)$ $Lam Research(LRCX)$ $KLA-Tencor(KLAC)$ And so on also achieved an increase of more than 6%;

4. The software industry will also benefit in general, because the efficiency after embedding AI will be greatly improved, for example$Salesforce.com(CRM)$ $Intuit(INTU)$

5. Companies that provide information services may lose some market share or be replaced to a certain extent because of the addition of AI, so the market feedback is more negative, such as$Accenture (ACN)$ $IBM (IBM)$ $Fande Information Technology (FIS) $$Gartner (IT)$.

The market's performance of the whole technology sector is very intuitive, and it can basically judge the most potential direction in AI era.

On the other hand, the capital flow of ETFs in the secondary market has always confirmed this fact.

1. The energy sector has been falling since it reached a high point last year, and funds have been flowing out$Energy Select Sector SPDR Fund(XLE)$

2. After receiving the impact of the banking crisis, the outflow of funds from the financial sector was obvious $Financial Select Sector SPDR Fund(XLF)$, But regional bank ETF$SPDR S&P Regional Banking ETF(KRE)$ $iShares US Regional Banks ETF(IAT)$ ushered in a lot of bargain-hunting funds, but there was a net inflow;

3. $Health Care Select Sector SPDR Fund(XLV)$ $Utilities Select Sector SPDR Fund(XLU)$ $Consumer Staples Select Sector SPDR Fund(XLP)$ are safe havens;

4. Semiconductors $SPDR S&P Semiconductor ETF(XSD)$ lead the whole information technology sector $Technology Select Sector SPDR Fund(XLK)$ Strong performance;

5. China Science and Technology Index $CSI China Internet ETF(KWEB)$ There was a net outflow, which greatly erased the inflow trend since the beginning of the year;

6. Representing the trend of cutting-edge technology investment $ARK Innovation ETF(ARKK)$ There was a net inflow, with a single-day inflow of US $112 million on March 16th. After this week's inflow, the inflow since the beginning of the year has returned to positive.

This may also provide a new trading trend for the FOMC interest rate meeting next week.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

$2X Long VIX Futures ETF(UVIX)$ $Financial Select Sector SPDR Fund(XLF)$ $iShares MSCI Brazil ETF(EWZ)$

Great ariticle, would you like to share it?

JJ

Noted