"Systemic Banking Crisis" not end yet, will follow to short?

If you will continue to be bearish on banking stocks, what stock or related ETFs will be your target?

1. The banking stock crisis is getting worse?

The US banking industry is beginning to face pressure due to the rising deposit cost and the impact of potential recession. As a classic case of value investment, banking stocks were once Warren Buffett's heavy positions. However, Buffett's confidence in the financial industry is weakening.

According to public data, $Berkshire Hathaway(BRK.A)$ has been a seller of the banking sector since 2020.

Bisides to $Bank of America(BAC)$ , Buffett has already cleared his position in $Wells Fargo (WFC) $,$Goldman Sachs (GS) $And$JPMorgan Chase (JPM) $, and reduced its 91.4% holdings of$United Bank of America (USB) $ to 6.7 million shares, reduced nearly 60% holdings of $Bank of New York Mellon (BK) $ to 25.1 million shares. The bank's equity weight fell for five consecutive quarters.

After $Silicon Valley Bank (SIVBQ) $ and$Signing Bank (SBNY) $ ‘s collapse in March, Buffett said in April that depositors could rest assured that their funds were still safe, but he criticized the banking system for failing to punish those involved in enterprises in history, even during the financial crisis in 2008.

At the upcoming Buffett shareholders' meeting, we will sure to hear Buffett talk about the banking crisis, inflation, recession and other key points.

This past week, with the collapse of the crisis-stricken $First Republic Bank(FRCB)$ (the second largest bank in American history) being acquired by $JPMorgan Chase(JPM)$ , Some financial experts still pointed out that the acquisition is only an expedient measure, and the problems in the US banking system still exist in the long run.

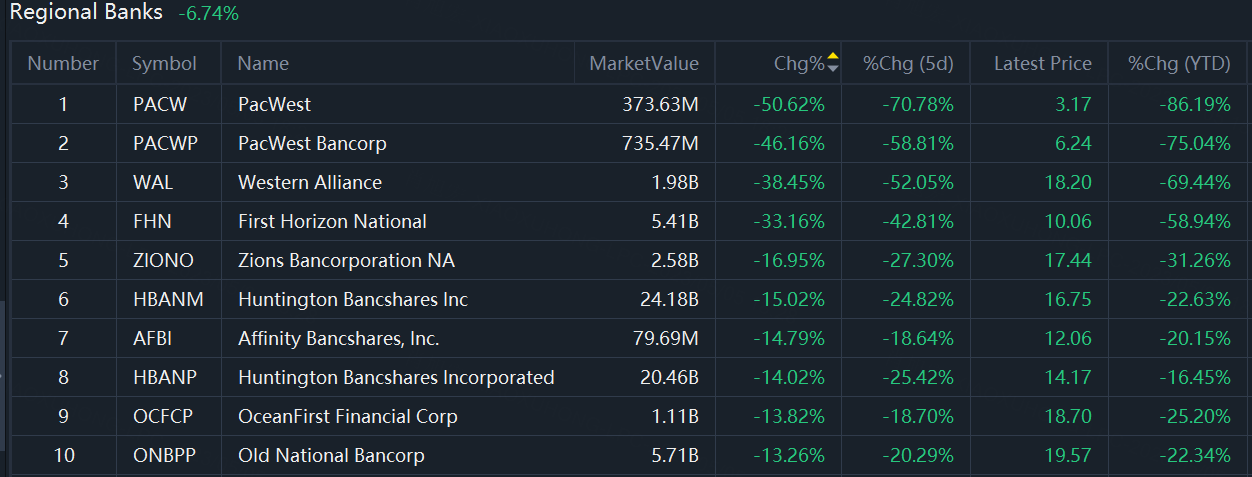

On May 4, including$PacWest Bancorp (PACWP) $,$Alines Western Bank (WAL) $$First Horizon Bank (FHN) $Including banks, fell sharply by more than 30%.

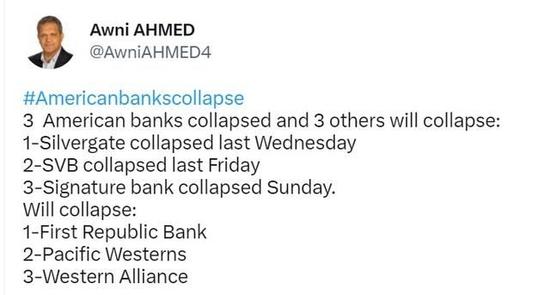

Coincidentally, Awni Ahmed, CEO of Nexies, publicly stated in March on Twitter that "as long as 3 banks fail,$First Republic Bank (FRCB) $,$Alines Western Bank (WAL) $As well as$Western Pacific United Bank (PACW) $ will also collapse behind. "

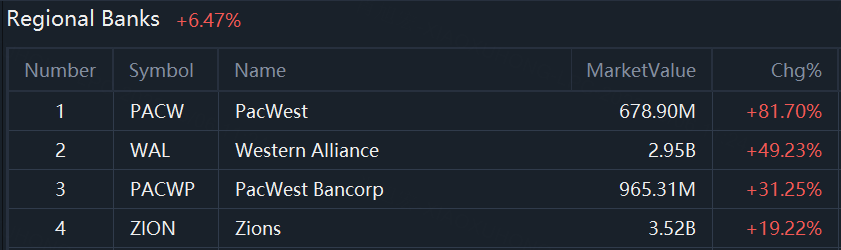

As of May 5, except for$First Republic Bank (FRC) $suspension of trading,$Western Pacific United Bank (PACW) $rebounded by 81.7%,$Alines Western Bank (WAL) $rebounded by 49.23%.

To be honest, I was extremely panicked the trading day before, it was really difficult to have the courage to bargain-hunt. I believe most people were on the sidelines as the fear that the crisis will continue to spread.

2. Regarding the current banking industry, there are two hot charts:

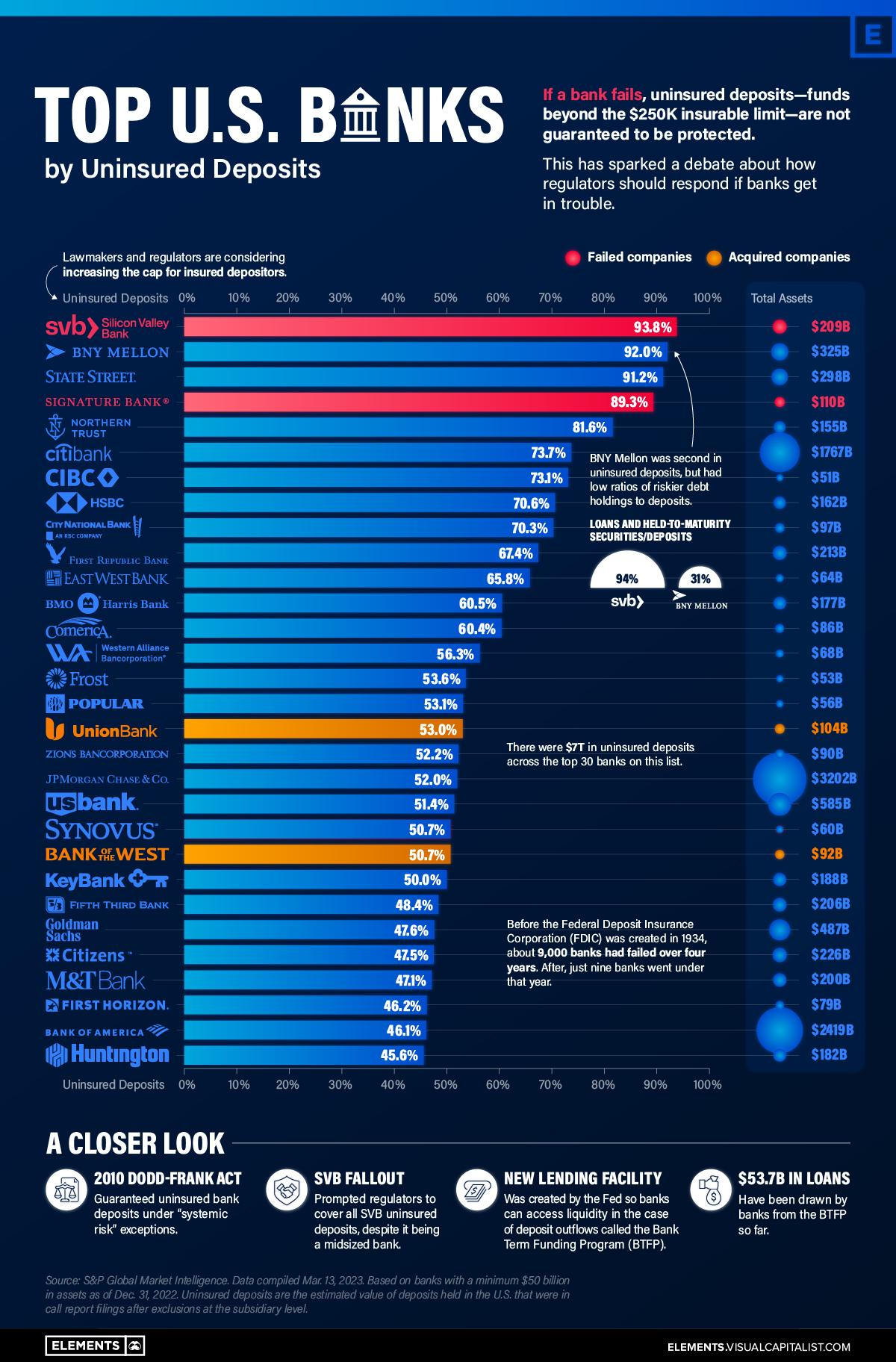

A data chart from Visual Capitalist shows the data of deposits, loans and other assets and liabilities of the US banking industry.

According to the data, the total deposits are $17.17 trillion, of which $5.41 trillion is from real estate loans and $2.77 trillion is from commercial loans.

At the same time, there is a ranking of the proportion of uninsured savings of each banks:

It is obviously tha the banks that failed first or being shorted sharply by market on the list.

Data from analytics firm Ortex also showed that short sellers made $378.9 million on Thursday alone by shorting certain regional banks.

Data provider S3Partners estimates that bears have made nearly $7 billion this year betting on regional banks, they are using these profits for new goals, even some banks with good fundamentals-including stable deposits, sufficient capital, reduced uninsured deposits.

Wells Fargo CEO Charlie Scharf said on May 2 that most banks are still very strong, and no more bank failures are expected, but the trading market is expected to have more volatility and turbulence. It makes no sense to talk about regional banks as a whole. Despite the turmoil, consumers and businesses are still in good financial condition.

The American Bankers Association (ABA) on Thursday urged federal regulators to investigate the massive shorting of bank stocks, saying they were "out of touch with underlying financial realities."

The current market situation feels a lot like March, with fear and emotion mainly on trading stocks, not on fundamentals.

3. Do you continue to be bearish on bank stocks? Who will be shorted next?

The recent plunge of US banks makes it difficult to ignore the speculative short-selling power in the market.

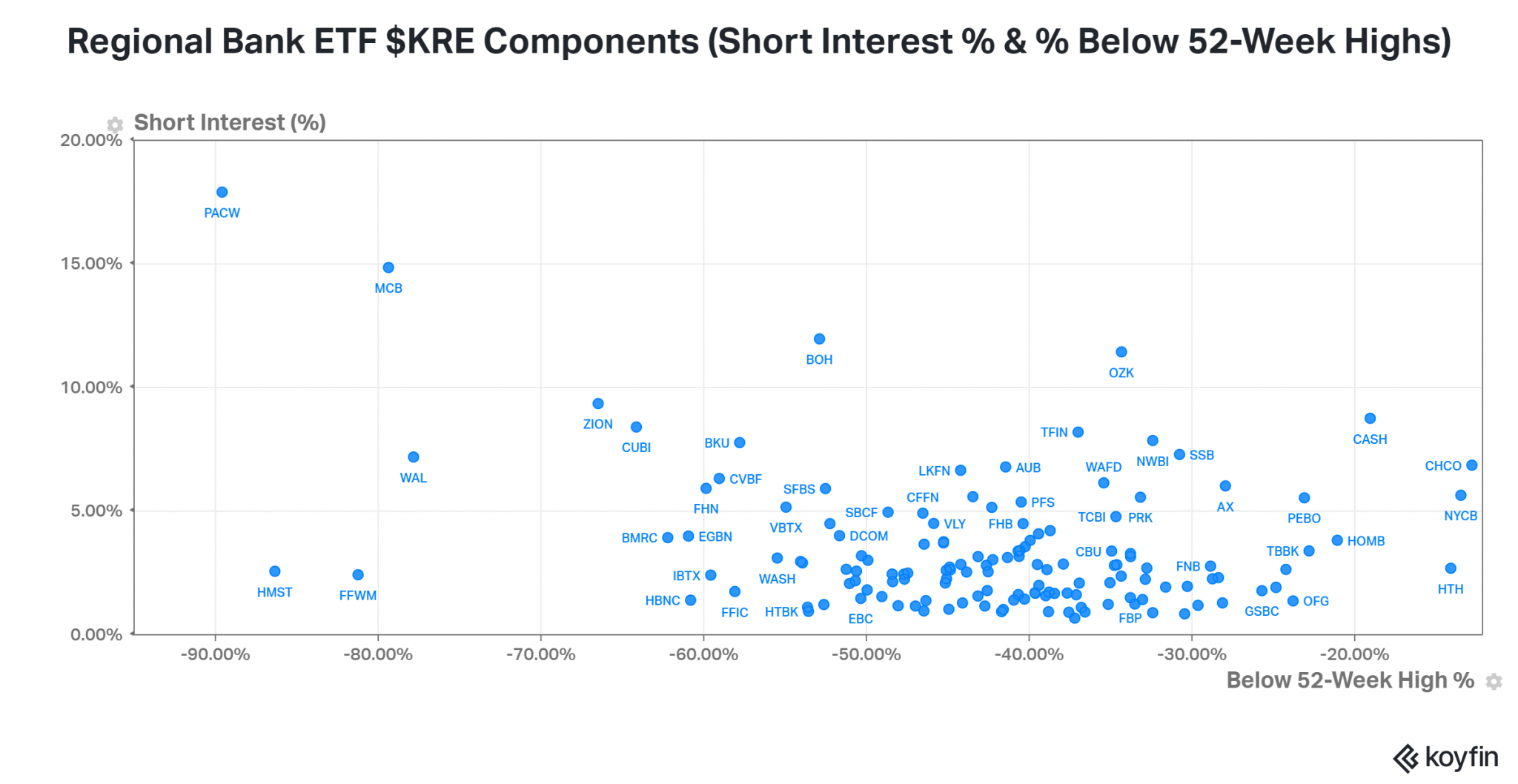

The following figure shows the short-selling ratio of some bank stocks. At the top of the list are$Western Pacific United Bank (PACW) $,$Metropolitan Bank Holding Corp. (MCB) $,$Bank of Hawaii (BOH) $$Ozark Bank (OZK) $,$ZION Bank (ZION) $. at the same time below 52-Week High,$Western Pacific United Bank (PACW) $,$HomeStreet (HMST) $,$First Foundation (FFWM) $,$Metropolitan Bank Holding Corp. (MCB) $,$Alines Western Bank (WAL) $.

Cut as of press release, ETF $Invesco KBW Bank ETF(KBWB)$ has accumulated-28.32% year-to-date. $SPDR S&P Regional Banking ETF(KRE)$ has accumulated-38.53%. XLF fell slightly by 7.7%.

There is still fear in the US banking system.

Previously, the banks that have closed down have several commonalities: too concentrated customer groups, too long duration of profitable assets, too mismatch between negative capital repricing and mature structure, too weak interest rate and liquidity risk management, basically linked business with VC or Startup ecology, too high proportion of uninsured deposits, etc.

So who will be seriously shorted next?

However, the crazy short selling has attracted the attention of the state and federal governments. White House Press Secretary Karine Jean-Pierre said at a briefing Thursday that the administration will pay close attention to short selling pressure on healthy banks.

Calls for a temporary ban on short selling of bank shares have also increased in the banking sector, but an SEC official said on Wednesday that the agency "has not yet considered" such a move.

Rob Nichols, president of the American Banking Association, said that short selling may be a legal financial instrument, but the association firmly opposes short selling that distorts the market through manipulation and abuse.

4. When will the regional banking crisis end?

It can be said that this wave of liquidity-driven bankruptcy of regional banks is the biggest banking crisis after the famous Continental Illinois collapsed due to liquidity run in 1980s in the United States.

The comprehensive reason is that the serious mismatch in the repricing period is intertwined with the serious mismatch in the mature period. In addition, the interest rate rate hike cycle is too fierce, which makes the credit cycle late...

There is no doubt that the domino-like collapse of regional banks has triggered a crisis of confidence in the banking industry and caused a financial contagion affecting the wider economy.

From a series of recently disclosed data on capital flows, it is very likely that the wave of deposit runs in the US banking industry is still not over.

According to the bank stock market value data (Finviz), since January 2022, the market value of regional listed banks in the United States has plummeted from $480 billion to $100 billion, which has dropped. Of the 321 publicly listed regional banks in the United States, 309 have a market value of less than $10 billion, and 265 have a market value of less than $2 billion.

Ackerman, the new "king of hedge funds" and CEO of Pershing Square, wrote in a tweet this week, "Confidence in financial institutions takes decades to build, but it will be destroyed in a few days. As more dominoes fall, the next weakest bank begins to crumble."

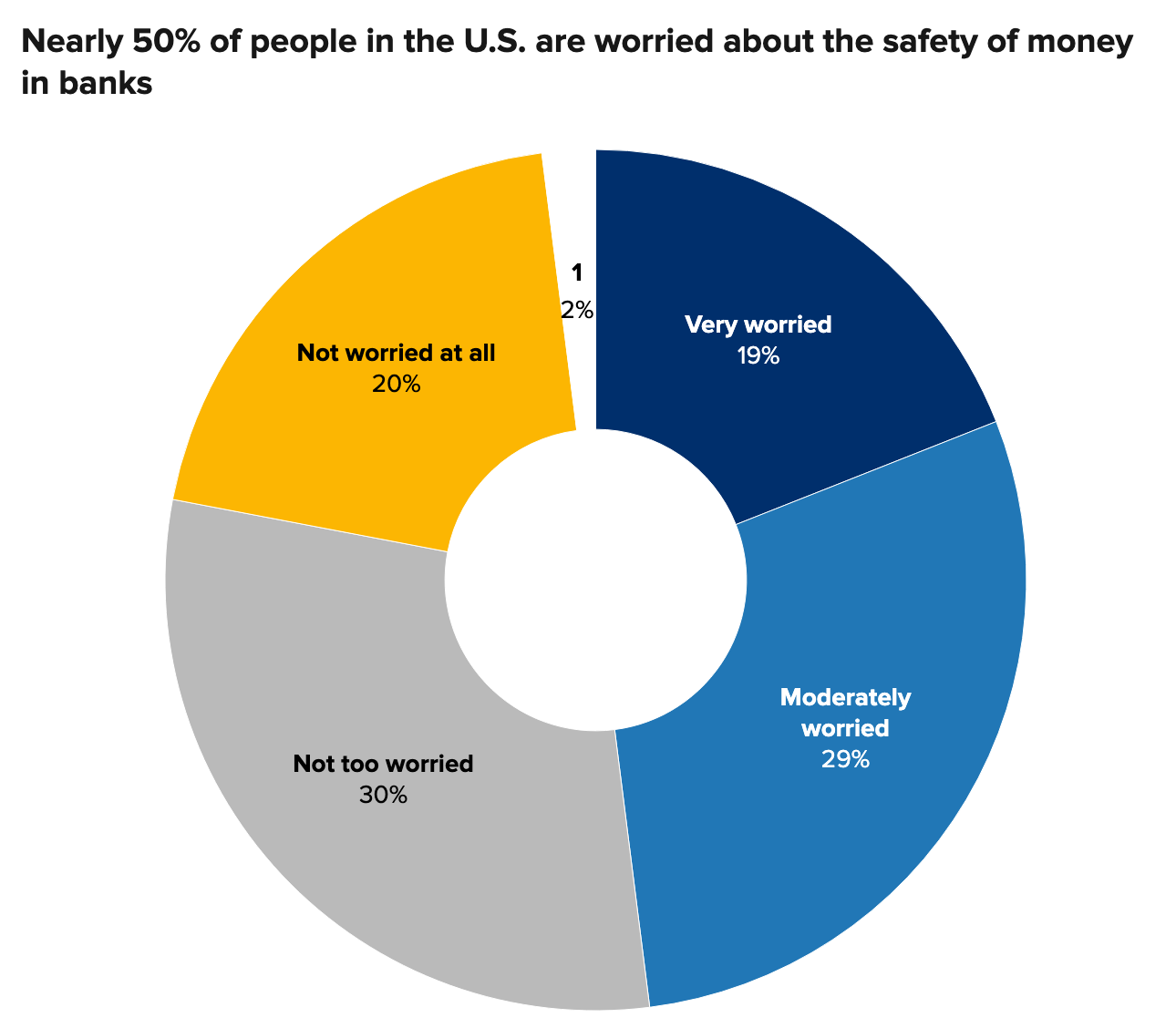

In the recent spate of U.S. banking failures, nearly half said they were "very concerned" (19%) or "generally concerned" (29%) about the safety of their money in banks or other financial institutions, according to a Gallup survey.

According to the survey, the level of concern about bank deposits is similar to that in the immediate aftermath of the collapse of Lehman Brothers in September 2008.

A recent paper by the National Bureau of Economic Research compared the behaviour of regulators in the current crisis with their responses to nearly 2,000 historic banking interventions in 138 countries since the 13th century, and came to their conclusion that they are at the beginning of what they call a "systemic banking crisis event".

The paper points out that a key feature of systemic banking crisis is that it takes a long time to solve the crisis. On average, the past 57 banking crises, most similar to the current one, have lasted months or even years. This is an ominous omen, because the current crisis is less than two months old. It is too early for investors to say that the crisis is over.

Fortunately, the government and institutions have also begun to take action:

The Federal Deposit Insurance Corp. is said to require large banks to replenish deposit insurance funds.

Lazard Ltd FinancePeter Orszag, chief executive of the advisory arm (former director of the Obama administration's Office of Management and Budget), called on officials to show they intend to guarantee banks' uninsured deposits for six months, a move that would boost confidence and discourage savers from withdrawing money from small and medium-sized banks.

In addition, former U.S. Treasury Secretary Steven Mnuchin said FDIC protection for bank depositors should be raised to $25 million from the current $250,000 per person, per bank. The DIC said Monday that increasing guarantees for bank accounts used for commercial purposes is a promising potential reform.

If you will continue to be bearish on banking stocks, what stock or related ETFs will be your target?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

The collapse of Firstc Bank is a bad sign for the banking system

I think it's best to avoid investing in banks for now

Buffett selling off his banking stocks is a red flag for me

I'm getting nervous about investing in banking stocks

Wow, the banking industry is really struggling