Has Walmart back to last december?

Retailer giant$Wal-Mart(WMT)$ posted strong Q3 result.

Offline business performed well, inventory issue improved significantly, made operational efficiency higher, and the guidance for the next year also raised. At the same time, the repurchase plan of 20 billion US dollars was announced, so it won back the preference of investors.

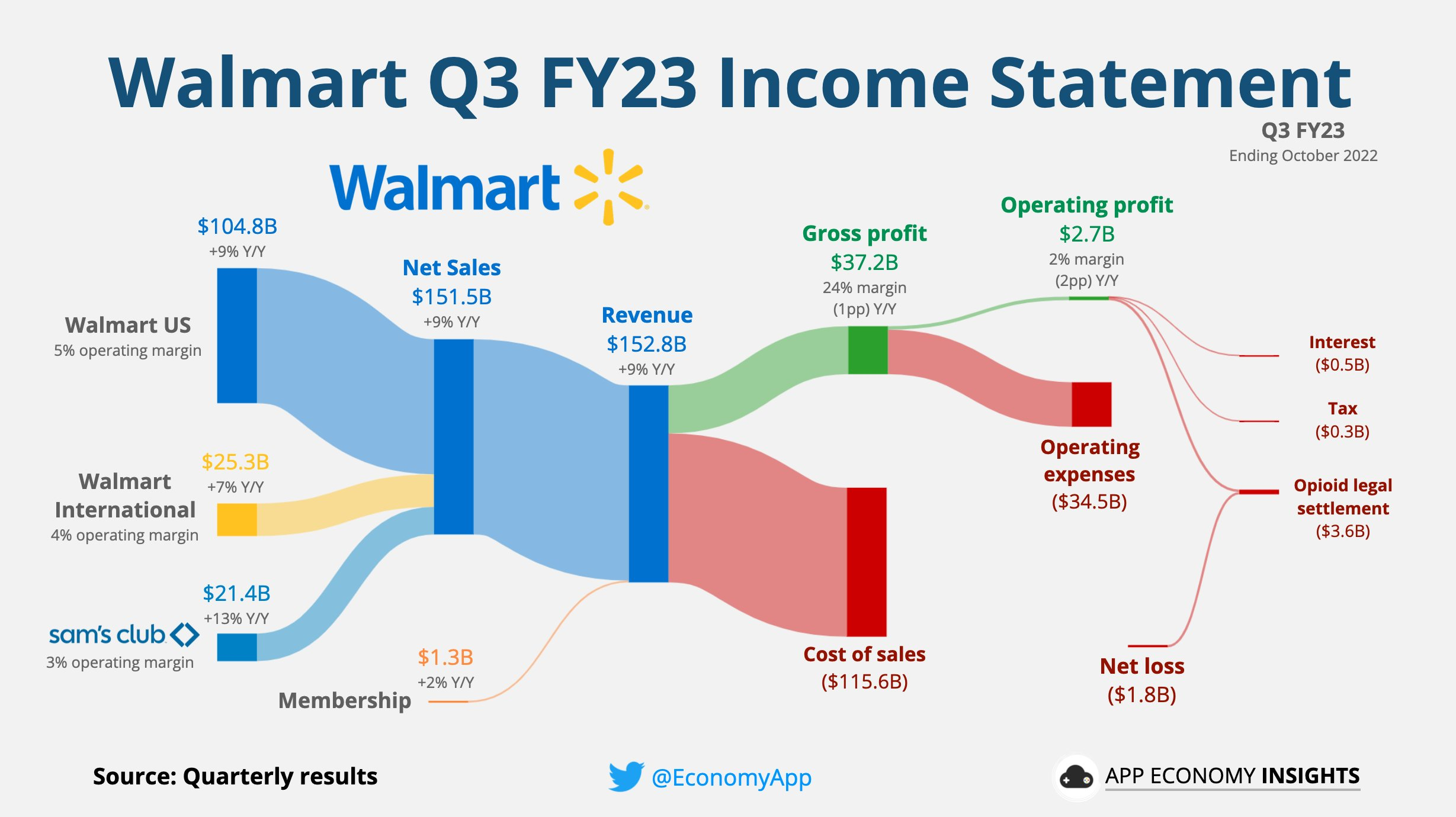

Q3 fiscal quarter ended October 31, 2022

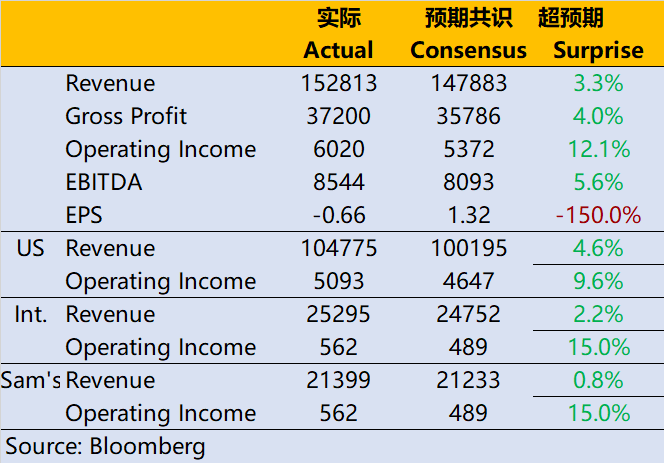

- The overall revenue was 152.81 billion US dollars, an increase of 8.74% year-on-year, higher than the growth rate of the previous quarter and higher than the market expectation of 147.88 billion US dollars;

- Same-store sales increased by 8.5%, higher than the market expectation of 4.35%; Among them, the volume and price of American stores rose, up 8.2% year-on-year, higher than the market expectation of 3.46%, and the same-store sales of Shan Mu member stores increased by 8%, higher than the market expectation of 7%;

- Business in different regions, Wal-Mart's US revenue was US $104.78 billion, an increase of 8.5% year-on-year, higher than the market expectation of US $100.2 billion; The operating profit in the same period was 5.09 billion US dollars, a year-on-year increase of 4.8%, which was higher than the market expectation of 46.47 billion US dollars, and it was also the growth rate after the decline in the first two quarters;

- The revenue of Shan Mu member stores was US $21.4 billion, a year-on-year increase of 12.8%, slightly lower than the market expectation of US $1.32 billion, and the operating profit was US $560 million, higher than the market expectation of US $490 million;

- At the same time, the international business revenue was US $25.3 billion, up 7% year-on-year, higher than the market expectation of US $24.7 billion, and the operating profit was US $860 million, down 1% year-on-year, slightly lower than the market expectation of US $900 million.

- China's e-commerce business performed well, with net e-commerce sales accounting for 41% of Wal-Mart's total net sales in China, with a growth rate of 63%.

- The EPS is-$0.66, and the adjusted EPS is $1.50.

Obviously, Q3 has made great efforts in operation compared with the previous two quarters, improving its operational efficiency and getting rid of the previous redundancy. However, the overall retail environment is also very complicated under the dual pressures of inflation and recession.

First, the profit margin. Gross profit margin decreased by 77 basis points, which was mainly due to the price reduction and discount of some commodities in the North American market, especially daily necessities, adding points, clothing, etc., and the inventory in this part was also under the greatest pressure. At the same time, the competition among major supermarkets makes it difficult for the prices of these commodities to follow the overall CPI growth rate. In the Chinese market, the company also mentioned that the sales of more "low-priced goods" hurt the gross profit margin. In terms of operating profit, due to the reduction of epidemic-related costs, operating leverage will be improved to a certain extent, while labor costs still have certain influence.

On the whole, the improvement of operational efficiency can at least alleviate investors' worries about falling profits to some extent

Second, macro impact. The impact of exchange rate on international business is still relatively large. The growth rate of Q3 international revenue is 7.1%, 13.3% in the original currency, and the operating profit is-1. 1% in US dollars and +3.2% in the original currency.

In fact, the business in China is relatively strong, especially the member stores in Shan Mu, while the growth rate of e-commerce in other regions is also relatively fast.

For the United States, because offline activities recovered faster than expected, the growth of offline member stores was relatively high, while online stores were somewhat less than expected.

At present, both CPI and PPI in the United States show a certain downward trend, which is a good thing for Wal-Mart. After all, the current wage growth rate has not caught up with CPI. For general goods purchased by the public, the price increase is not large, and the decline in raw material prices will also increase the company's profit margin.

Therefore, the company also improved Q4 and the performance guidelines for the next year.

Q4's same-store sales are expected to increase by 3%, and the same-store guide will increase to 5.5% in 2023 (previously 4.5%), while the operating profit guide will increase from-2% to-1%, and the EPS guide will increase from-8% to-10% to-6% to-7%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- pandalinden·2022-11-17Great ariticle, would you like to share it?4Report

- sailors·2022-11-17thanks much1Report

- Nickheng·2022-11-17👍LikeReport

- kerukel88·2022-11-17Ok1Report

- CharWF·2022-11-17[Great]1Report

- Prohui·2022-11-17Ok2Report

- PKPink·2022-11-17Noted1Report

- Rainy_Diary·2022-11-17Up1Report

- Khikho·2022-11-17[微笑]1Report

- tyng8825·2022-11-17好的1Report

- Eagle88·2022-11-17Good1Report

- TangKL·2022-11-17[smile]1Report

- Aaronykc·2022-11-17👍2Report

- Beng14·2022-11-17Great2Report

- Adenphua·2022-11-17ik2Report

- ckcheng·2022-11-17👍LikeReport

- JohnsonYeo·2022-11-17ok1Report

- ngph·2022-11-17👍1Report

- Bek·2022-11-17👍1Report

- 888Investor·2022-11-17👌🏻2Report