CRH Plc. — Build your Future with this Blue-chip | DataDrivenInvestor

CRH plc, through its subsidiaries, manufactures and distributes building materials. It operates in three segments: Americas Materials, Europe Materials, and Building Products. The company manufactures and supplies cement, lime, aggregates, precast, ready mixed concrete, and asphalt products; concrete masonry and hardscape products comprising pavers, blocks and kerbs, retaining walls, and related patio products; and glass and glazing products, including architectural glass, custom-engineered curtain and window walls, architectural windows, storefront systems, doors, skylights, and architectural hardware.

The company operates primarily in the Republic of Ireland, the United Kingdom, the rest of Europe, the United States, and internationally. CRH plc was founded in 1936 and is headquartered in Dublin, Ireland.

S&P Rating: BBB+

Market Cap: $28.7b

US Ticker Symbol: CRH

EU Ticker Symbol: CRG.IR

Interesting news about the Company:

„ — The share price has dropped over 30% this year but why? Shares in building materials giant CRH and Ryanair, both of which have large exposures to Ukraine, were among the main fallers on the Irish stock market on Thursday as global financial markets were thrown into turmoil after Russia attacked its western neighbor overnight. — 2022 February

CRH’s operating companies include: Oldcastle APG., C.R. Laurence Co., Inc., De Ruwbouw Groep (DRBG) Calduran. Dycore. Heembeton., Oldcastle, BuildingEnvelope, Oldcastle Infrastructure, Tarmac, Irish Cement, Roadstone”

Let’s take a look into the past performance and current situation with the PEG ratio…

CRH’s 5-Year EBITDA growth rate is 8.50%. Therefore, CRH’sPEG Ratiofor today is 2.36.

„In general, a good PEG ratio is one larger than 1.0. PEG ratios greater than 1.0 are generally considered unfavorable, suggesting the stock is overvalued. Meanwhile, PEG ratios lower than 1.0 is considered better, indicating a stock is relatively undervalued.”

Although the explanation says it is other but the overall score for CRH is better than the industry average PEG ratio.

CRH is a decent small grower company. The Stock price is mostly related to how the housing market performs. As you can also see on the Chart 2008 dropped and right now that people are unable to get any kind of Credit, the housing market is slowing down so does the stock price. I consider CRH as a SWAN company — Sleep well at night. The last 20 years of Total Annual Return was 5.9% Annually. The total return on my money is more than 200% with dividends included.

Any time it could be bought with a normalPE ratioand right now the stock is in the good „Margin of Safety” territory.

Dividend Standpoint

CRH has a record of 22 years of dividend payments. The current dividend yield is on every platform a little bit different because of the US stock and on other markets but the original US market is 2.96%. Total maintained years are 5 and they pay dividends out only 2 times a year. The dividend growth rate was a bit volatile over the last 10 years but averaged 6–8% which is a good number for a company like this size. Share buybacks can be a silent killer. If the company does not buy back shares but dilutes them then your investments are worth less over time. It is like a slice of cake where your slice will be smaller if the company dilutes its shareholders.

CRH makes a good job here and they are buying back shares over time:

A payout ratio is a ratio where we can decide if the company is capable to manage its dividend payouts or not. This ratio at CRH was always between 40–50% compared to their Free Cashflow.

Debt

CRH’s debt to equity ratio has reduced from 60.3% to 46.6% over the past 5 years. CRH’s interest payments on its debt are well covered by EBIT (8.7x coverage).

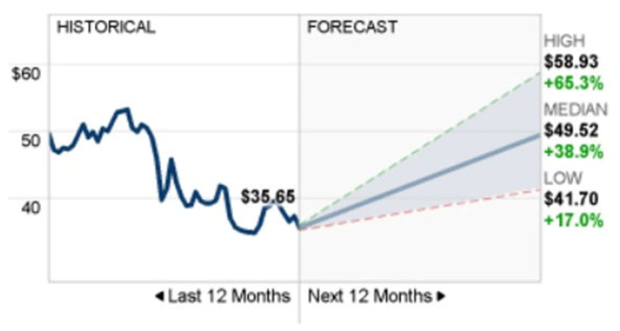

Forecast

The 17 analysts offering 12-month price forecasts for CRH PLC have a median target of 49.52, with a high estimate of 58.93 and a low estimate of 41.70. The median estimate represents a +38.92% increase from the last price of 35.65.

Fair value

I use the most widely accepted method to calculate the fair value of a company which is the Discounted Cash Flow(DCF). It is based on the premise that the fair value of a company is the total value of its future free cash flows discounted back to today’s prices. I use analysts’ estimates of cash flows and assume the company grows at a stable rate into perpetuity. (Total Equity Value = Present value of next 10 years cash flows + Terminal Value = $23.635 + $34.626 = $58.261,32

Equity Value per Share (USD) = Total value / Shares Outstanding = $58.261 / 748 = $77.9

Exchange Rate for USD/GBP: 0.85 = £66.2)

Undervalued by 49.2%. The current fair value is £66.2.

CRH warrants a Buy rating. There is a lot to like about CRH. All Price to Earnings Ratios are good, Forecasts are good, their decent debt level, is below Fair Value and most importantly, this year is a drop maybe you can wait a few months with this stock but the moment the American FED announces some quantitative easing than you can be sure that you will win this stock, not just on dividends but Capital Appreciation also.

The stock’s current valuations are undemanding, and the company’s recent interim financial results and capital allocation actions have been good.

$CRH PLC(CRH)$ $CRH PLC(CRH.UK)$

Follow me to learn more about analysis!!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- SanWangtikup·2022-12-01👌LikeReport

- Jasbump·2022-12-01HLikeReport

- Hazel Lim·2022-12-01👍LikeReport

- AppleSeed·2022-12-01👍🏻LikeReport

- GoldApe·2022-12-01[smile]LikeReport

- YSTX·2022-12-01okLikeReport

- Jack Ng KH·2022-12-01NiceLikeReport

- kianhua84·2022-12-01好的LikeReport

- Zeniv·2022-12-01okLikeReport

- mrmoon·2022-12-01kLikeReport

- Heavenbjorn·2022-12-01OkayLikeReport

- Jeff Ng·2022-12-01OkLikeReport

- FNZX·2022-12-01好的LikeReport

- superduper·2022-12-01OkLikeReport

- YeeSiang·2022-12-01[Miser]LikeReport

- Keshin·2022-12-01ThanksLikeReport

- BlueDaisy·2022-12-01OkLikeReport

- IcyAlchemist·2022-12-01NiceLikeReport