How to change my portfolio through Apr CPI?

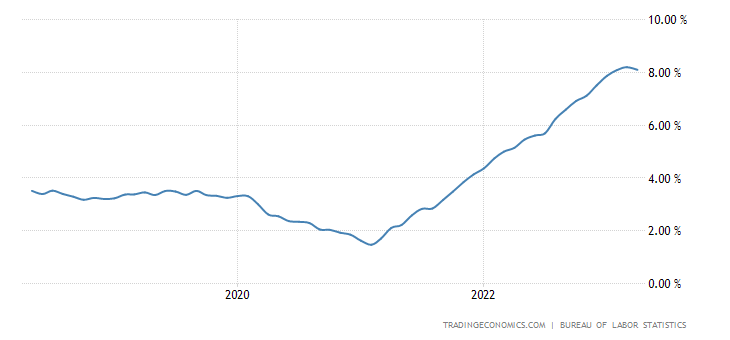

On Wednesday, the US Bureau of Labor Statistics released data showing that April's CPI rose 4.9% year-on-year, marking the 10th consecutive monthly decline since its peak in the second half of last year and the smallest increase since April 2021. This was lower than expectations of 5% and the previous value of 5%. Meanwhile, CPI increased by 0.4% month-on-month, in line with expectations.

However, while overall CPI has declined slightly, core CPI only decreased by a small margin of 0.1% compared to last month and has remained around 5.5% for four consecutive months. The recent three-month annualized rate is still as high as 5.1%, indicating significant stickiness in inflationary pressures. At this rate, there is still a long way to go before inflation reaches its long-term target of 2%.

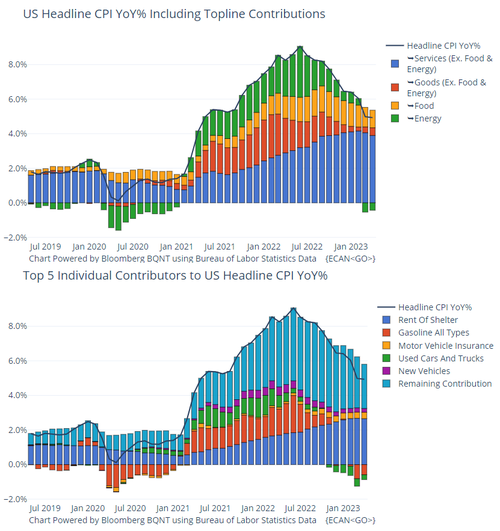

Looking at individual components within CPI reveals different trends across industries.

Energy was the main driver behind declining prices; energy index fell by 5.1%, making it one of this year's worst-performing sectors along with $Energy Select Sector SPDR Fund(XLE)$ . After all, these companies had performed exceptionally well last year with record-high stock prices and profits but have been increasing dividends this year to maintain shareholder enthusiasm amid falling oil prices due to weak demand. Thus, companies in the energy industry such as $Exxon Mobil(XOM)$ , $Chevron(CVX)$ $ConocoPhillips(COP)$ , $EOG Resources(EOG)$ $Marathon(MPC)$ are not good targets this year.

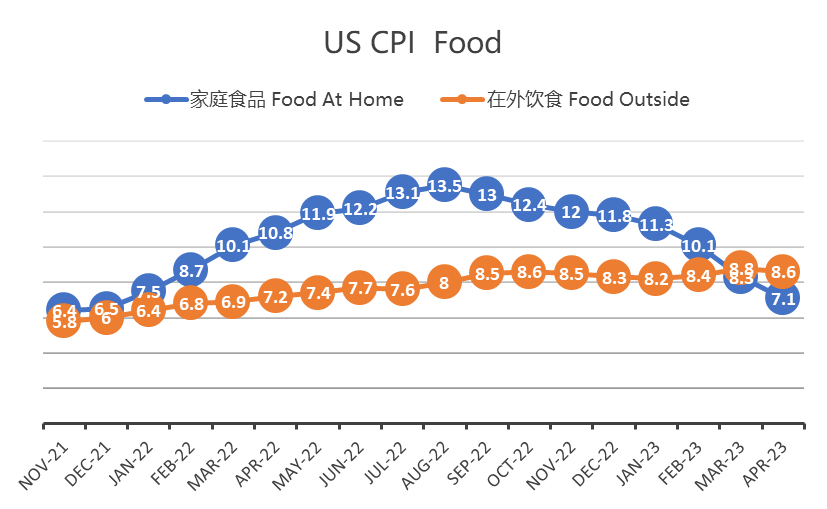

Food prices rose overall by7.7%, higher than other categories but also showed signs of slowing down recently due to limited elasticity in demand after price hikes.

The food category includes both "eating at home" and "dining out." The cost increase for dining out has been consistently lower than eating at home during times when food prices are rising; therefore more people are choosing to dine out instead which puts greater pressure on ordinary food industry players rather than restaurants or related supply chain companies such as $Pepsi(PEP)$ $Coca-Cola(KO)$ $McDonald's(MCD)$ $Shake Shack(SHAK)$.

Housing remains the main driver of CPI growth. Rent for primary residences rose from 0.5% to 0.6% month-on-month while owner-equivalent rent remained unchanged at 0.5%. The index for lodging away from home fell by 3% in April, but the market is still waiting for a significant drop in rental prices which may take another quarter to fully materialize.

However, this lag effect means that any slowdown in rental inflation after June could be a bigger consensus among investors. In addition, owner-equivalent rent increased by 8.1%, setting a new record and adding some confusion to the downward trend.

The real estate sector such as $Real Estate Select Sector SPDR Fund(XLRE)$ and REITs related to mortgages are still under pressure with mREITs like $Annaly Capital Management(NLY)$

In terms of entertainment services, travel industry experienced some pullback in April; hotel accommodation prices fell from an increase of 3.1% last month to -3 .4%, indicating more like monthly fluctuations rather than long-term trends since there is evidence showing strong demand for hotel bookings during summer vacation season this year which suggests that hotel accommodation prices may not continue falling significantly further down the road.This could benefit companies such as $Airbnb, Inc.(ABNB)$ $Booking Holdings(BKNG)$ $Uber(UBER)$ $Expedia(EXPE)$.

Interestingly enough, Airbnb just released its financial report last week lowering expectations for next quarter due to recessionary concerns so it remains unclear whether they will exceed expectations or not.

Among other declining indices were airline ticket prices which decreased by the largest margin of2 .6%, mainly due to lower oil prices affecting aviation sectors such as $U.S. Global Jets ETF(JETS)$ , $Southwest Airlines(LUV)$ $American Airlines(AAL)$ $United Continental(UAL)$ $Delta Air Lines(DAL)$ However, Boeing( $Boeing(BA)$ ) belongs to the industrial sector and is not significantly affected by the aviation industry.

New car prices fell by 0.2% month-on-month while used car prices rebounded from a decline of 0.9% last month to an increase of 4.4%, indicating signs of bottoming out but still down year-on-year due in part to falling oil prices which have helped new energy vehicle companies such as $Tesla Motors(TSLA)$ and $Rivian Automotive, Inc.(RIVN)$ adjust their pricing somewhat amid rising raw material costs; traditional automakers like $Ford(F)$ and $General Motors(GM)$ are still facing challenges.

Communication index decreased by 0.1% $Communication Services Select Sector SPDR Fund(XLC)$ compared to the previous month, with little change. The basic healthcare index remained unchanged in April, while it decreased by 0.3% in the previous month. After a 0.4% decrease in March, the $Health Care Select Sector SPDR Fund(XLV)$ medical service index increased by 0.5% in April. The prescription drug index rose by 0.3% in April as well.

The medical industry is relatively resistant to inflation and fluctuations have correspondingly decreased after the end of the pandemic outbreak. Labor-intensive projects such as garbage collection (0.6%), hospital services (0.5%), motor vehicle maintenance (0.5%), laundry and dry cleaning (0 .5%) still have higher price growth rates on a monthly basis, indicating that high wages continue to affect service inflation.

Overall, core inflation remains sticky but excluding rent, service inflation has weakened somewhat which is a relief for the Federal Reserve and may lead them to consider pausing rate hikes from June to July temporarily.

Slowing down of inflation is a positive signal; however, we still need to observe how quickly core inflation slows down.

Last Friday's non-farm payroll data was still strong and workers' income continues to rise which helps sustain consumer spending expansion.

In addition, most industries still have strong pricing power for their products except for some industries where raising prices is difficult.Q1 financial reports show that many companies can maintain high profit margins despite falling upstream product prices so they do not currently have any motivation for lowering prices.

Most technology companies such as $Apple(AAPL)$ $Microsoft(MSFT)$ $Alphabet(GOOG)$ $Amazon.com(AMZN)$ $Meta Platforms, Inc.(META)$ $Netflix(NFLX)$ are performing well and become good choices for investors seeking balance amid uncertainty within consumer industries.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

In theory, tourism should take off when flights resume, but Airbnb's performance has truly surprised me

记住CPI和PPI,它们在评估价格时都有优点和缺点。

PPI cannot totally predict what’ll happen to consumer prices.

Thank you for sharing, I now have new ideas for my investment portfolio.

$Tesla Motors(TSLA)$