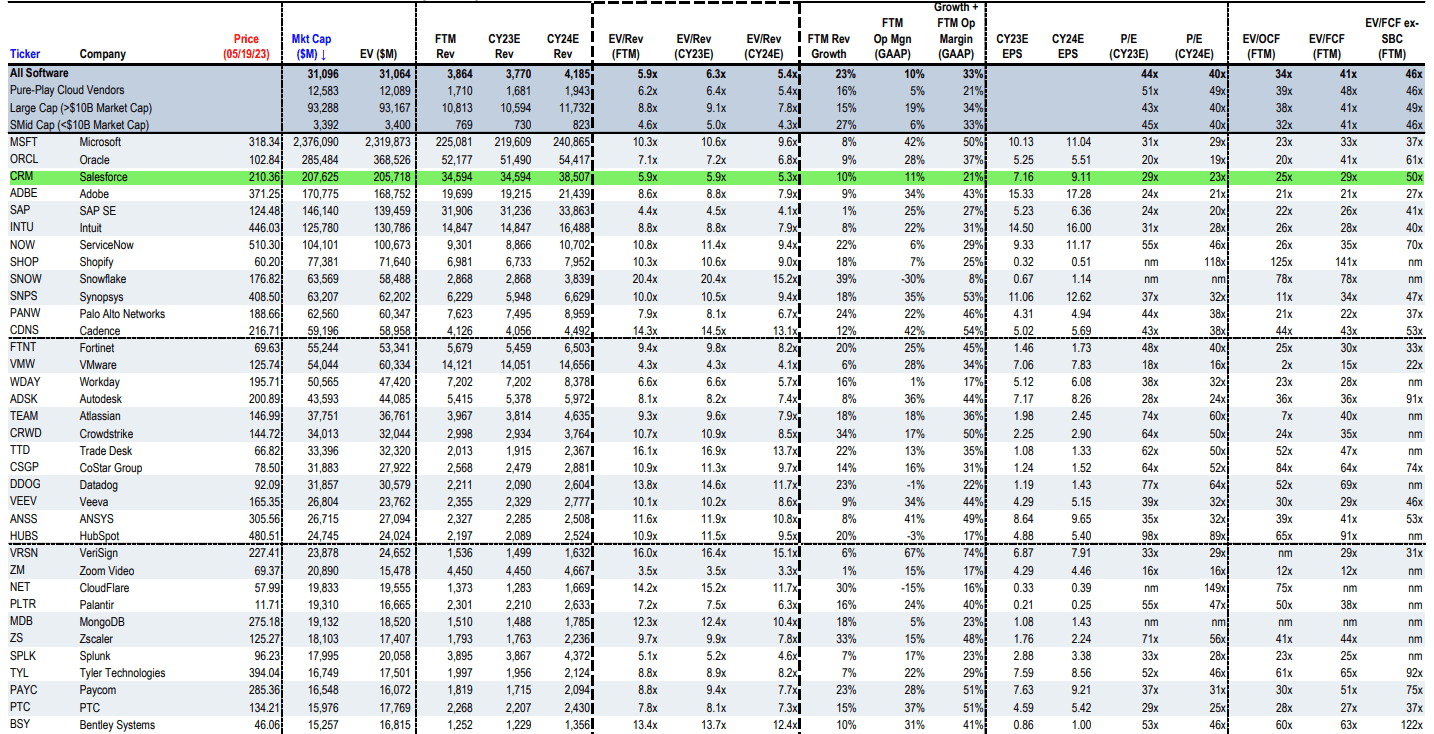

Not AI-Driven? CRM's safe outlook makes valuation more attractive

$Salesforce.com(CRM)$ reported earnings last quarter that significantly exceeded expectations, and the stock price surged without a significant pullback. We mentioned last quarter that CRM still had a potential upside of 66%.

Before the announcement of Q1 FY24 earnings, the market remained relatively optimistic about CRM's performance. Q1 expectations were high, and there was optimism regarding the performance outlook driven by AI. The secondary market price also exceeded $220 before the earnings release.

However, CRM's executives did not intend to oversell expectations. Although the Q1 earnings results still surpassed expectations overall, the outlook for the future was not overly optimistic. As a result, the stock price experienced a 5% decline after the earnings report.

Performance Overview

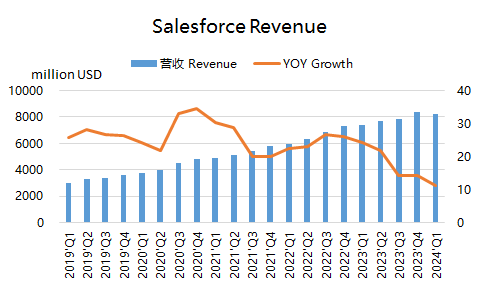

Q1 revenue was $8.24 billion, an 11% YoY growth, surpassing the market consensus of $8.17 billion. In constant currency, the YoY growth was 13%, exceeding the market consensus of 12%.

Breaking down the business segments, subscription revenue was $7.64 billion, an 11% YoY growth, slightly higher than the market consensus of $7.56 billion. Data services revenue was $1.96 billion, surpassing the market consensus of $1.95 billion.

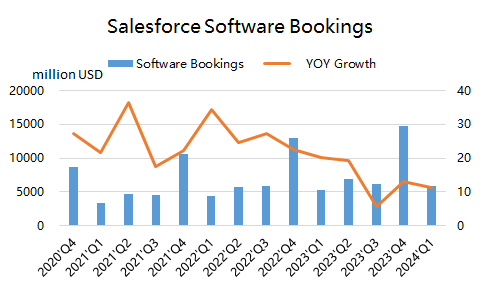

Software billings were $5.94 billion, an 11% YoY growth, reaching double-digit growth for two consecutive quarters and meeting market expectations.

Remaining Performance Obligations (RPO) reached $46.7 billion, an 11% YoY growth, in line with market expectations.

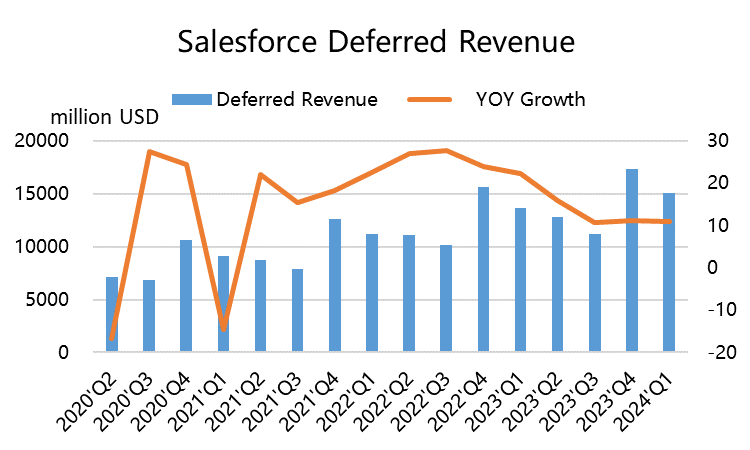

Deferred revenue for software was $15.12 billion, an 11% YoY growth, in line with market expectations.

In terms of profitability, comparable pretax income was $2.27 billion, a 123% YoY growth, exceeding the market consensus of $2.10 billion. The adjusted operating margin was 27.6%.

The company generated free cash flow of $4.24 billion, significantly surpassing the market consensus of $3.39 billion.

Regarding the outlook for Q2 of FY2024, the company expects revenue to be between $8.51 billion and $8.53 billion, higher than the market expectation of $8.49 billion. Non-GAAP earnings per share are expected to be between $1.89 and $1.90, surpassing the market expectation of $1.71.

For the entire FY2024, the company forecasts revenue to be between $34.5 billion and $34.7 billion, with the midpoint slightly below the market expectation of $34.65 billion. Non-GAAP earnings per share are expected to be between $7.41 and $7.43, higher than the market expectation of $7.17.

Investment Highlights

Technology companies are preparing for a challenging period, and software services' current expectations remain conservative. Since the significant outperformance in FY23Q4, analysts have been raising their performance expectations for the company. Therefore, Q1 market expectations were already high, and achieving a slight beat indicates the company's strength and excellent operational capabilities within the industry. Looking at several leading indicators such as RPO and deferred revenue, they are in line with market expectations, maintaining double-digit YoY growth but remaining flat compared to the previous quarter.

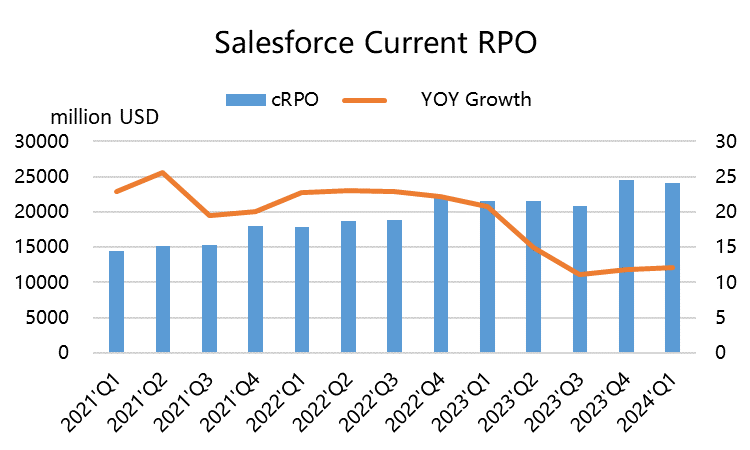

Based on the provided data of RPO and cRPO (Current Remaining Performance Obligations) by CRM, cRPO growth in 4Q FY2023 decelerated to 11.8% YoY compared to the 22.2% YoY growth in 4Q FY2022. This slowdown in growth is attributed to the deceleration in current bookings, which dropped to 11.2% YoY in 4Q FY2023 compared to 21.1% YoY in 4Q FY2022. This trend has led to a deceleration in revenue growth. However, in 1Q FY2024, cRPO grew 12% YoY, showing a slight improvement compared to the previous quarter. In the short term, the impact of cost reduction and efficiency improvement in various industries may have already subsided, but it is still important to monitor future changes.

The company has a conservative outlook for the full year, especially in the second half, as it has accounted for some recessionary expectations. The management is more focused on profitability. Despite the recent hype around AI, the company has not incorporated these factors into its performance outlook for the time being. Therefore, regardless of whether a recession actually occurs, the management's focus is more on profitability than revenue growth. The company has significantly exceeded market expectations in terms of profitability and free cash flow for these two quarters, which aligns with shareholders' demands in the current environment.

The acquisition of Slack will help the company gain a competitive edge in the AI era. The acquisition of the office instant messaging application Slack, which Salesforce acquired in 2015, will become the company's most promising business in the AI era. The company will add a series of generative AI features to Slack, including "SlackGPT," which can summarize information, take notes, and even help improve the tone of messages. As early as March, the company had already released Einstein GPT, integrating OpenAI's generative AI technology into its own AI products.

Valuation

Currently, CRM's trailing twelve months (TTM) P/E ratio is 41 times, slightly higher than the industry average. However, relying solely on TTM valuation may not be meaningful because the company aims to improve its profit margin. Future earnings per share growth is expected to be much higher than TTM earnings per share.

According to CRM's earnings outlook for FY2024, the adjusted EPS is expected to reach $7.42, implying a 42% YoY growth. If we consider the estimated EPS for FY2024 and the current price of $210, CRM is trading at a P/E ratio of 28 times, lower than Microsoft's 34 times and the software industry average of 44 times.

Furthermore, as mentioned before, the company's EV/Sales ratio for CY2023 is 5.9 times, also lower than the average EV/Sales ratio of large-cap software companies at 9.1 times. Therefore, the current price of CRM is still considered reasonable.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

MSFT is excellent in all financial parameters i.e. P/E, operating margin, revenue growth rate, etc; thus, MSFT is much undervalued. Buy NOW or else buy MSFT $390 by December

MSFT has long been & continue to be the SW leader of the world, well-established with more than 230K employees world-wide, a trusted name in stock. Buy now & hold long term to be up sharply in the future

历史数据和MSFT图表证明,MSFT随着时间的推移显著升值。长期投资MSFT总是安全且有利可图的。购买更多的好机会,并保持到退休。

added to the short when microsoft was up. Closed my shorts just now with a decent profit and reverted to long. Like being long better anyway. Will see wether I regret or not, but feel like the bottom for the day was set

I wonder exactly how well monetarily MSFT's doing in monetizing AI into all of its products. Someone will come up with something to give us more accurate guidance for investment decisions, and, I'll bet it'll be on almost a daily, or sooner, basis as Generational AI permeates our lives. I'd like to know exactly how well MSFT's monetizing AI before its next 1/4ly report on July 24.