Why 25bps is still the top option for Sep. FOMC meeting?

The market is highly focused on the last non-farm payrolls data ahead of the upcoming September FOMC meeting, as this data will have a decisive impact on the risk of a future recession and the magnitude of the Fed's rate cut.

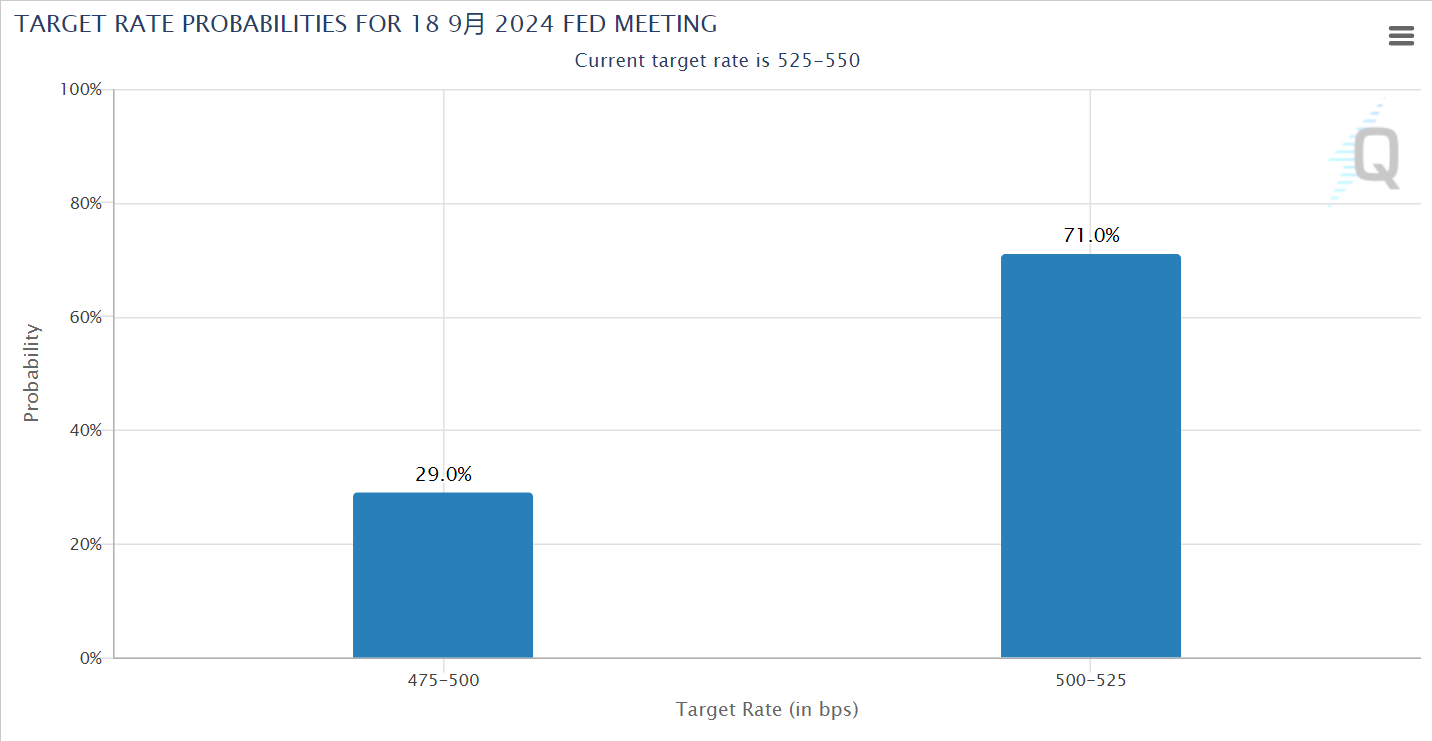

The market is discussing whether the Fed will cut rates by 25 bps or 50 bps, especially after Powell reiterated the importance of the job market to policy decisions at the Jackson Hole meeting, the possibility of a rate cut is in the spotlight.However, the market's reaction did not form a unified trend, and the performance of various asset classes is not the same.

As of now, the probability of a 25 basis point rate cut in September reflected in CME interest rate futures has risen to 71%, while the 50 basis point rate cut is expected to fall back to 29%.Meanwhile, the 10-year U.S. Treasury rate stayed at 3.7%, gold retreated after significant volatility, and U.S. stocks fell again, while the U.S. dollar index posted a modest gain.

Non-Farm Payrolls and Rate Cut Expectations

The failure of the latest non-farm payrolls data to provide clear economic signals has made it difficult for the market to form a consensus opinion, but looking at employment or unemployment, a 25bp or 50bp cut seems to be the exact opposite answer.

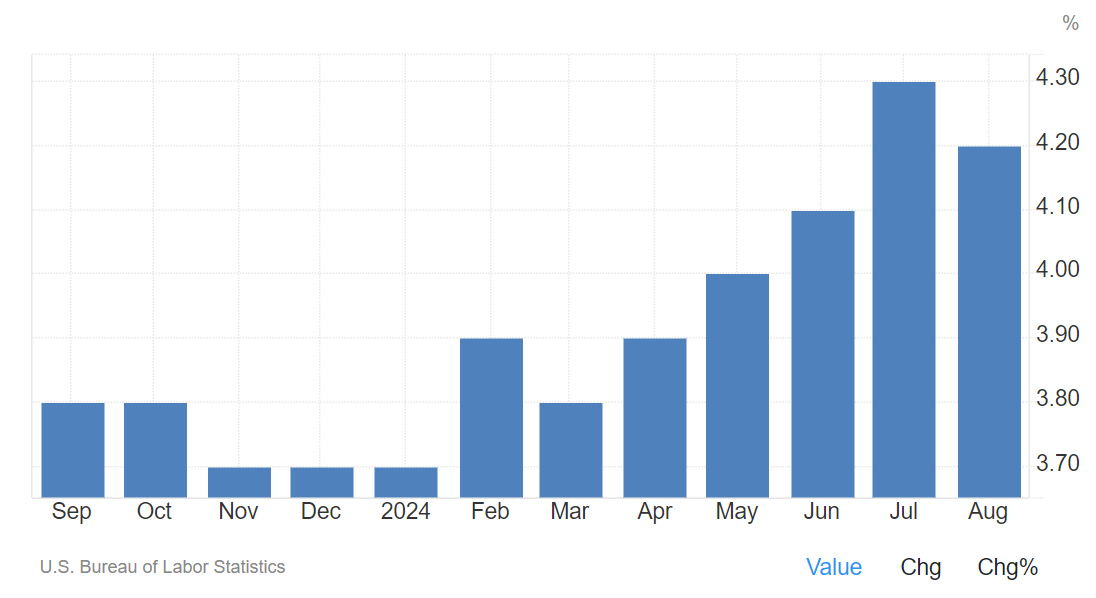

Unemployment rose to 4.3% in July, triggering the "Sam Rule" and making markets more sensitive to the size of subsequent rate cuts.

The non-farm payrolls data fell short of expectations, but were not entirely negative.Only 142,000 new jobs were added, below the 165,000 expected, and the previous month's figure was revised sharply downward to 89,000 as well.

In August, the unemployment rate fell slightly by 1 percentage point to 4.2% from 4.3%, and the number of temporarily unemployed fell by 190,000, partially making up for previous weather-related job losses.

Initial jobless claims for the weekly frequency remain low, layoffs are still at historically low levels, and the July layoff-firing rate moved up slightly to 1.1% still below pre-epidemic levels.

The number of rate cuts is now the focus of market attention

The market is clearly divided when discussing the magnitude of the rate cut.A 25 basis point cut remains the benchmark expectation, mainly because there are no signs of a deep recession.

While a 25 basis point cut in interest rates may not completely remove recessionary concerns from the market, the risk of a 50 basis point cut is that it could trigger a greater economic panic.

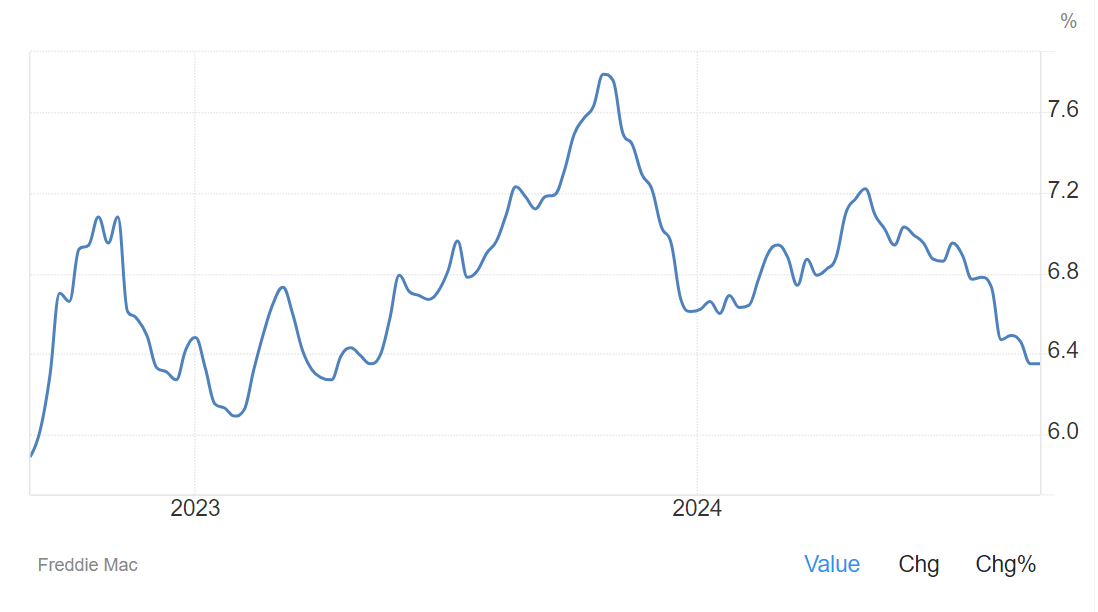

Meanwhile, while the Fed has not yet begun to formally cut interest rates, the market has begun to feel the effects of easing, particularly in the real estate market and financing conditions.

This has been demonstrated by the fact that as the 10-year US bond rate has fallen, the 30-year mortgage rate has fallen to 6.4%, below the average rental return of 7%.This has fueled a rebound in U.S. manufactured and new home sales, which rose 10 percent in July from a year earlier.

In addition, refinancing demand has recovered as mortgage rates have fallen.On the direct financing side, credit spreads on high-yield and investment-grade debt are at historically low levels, and falling financing costs have contributed to a significant increase in credit bond issuance, which rose 20.6% year-over-year in the U.S. between May and August.

How much do assets factor into rate cut expectations?

Currently, different assets in the market are reacting differently to the expectation of a rate cut.

As measured, United States interest rate futures have factored in 225 basis points of rate cut expectations, with gold factoring in 83 basis points, copper 77 basis points, and United States bonds and United States equities 75 basis points and 29 basis points, respectively.

$US10Y(US10Y.BOND)$ $US12M(US12M.BOND)$ $US30Y(US30Y.BOND)$ $S&P 500(.SPX)$ $SPDR S&P 500 ETF Trust(SPY)$ $SPDR Gold Shares(GLD)$ $Gold - main 2412(GCmain)$ $Invesco QQQ(QQQ)$ $NASDAQ(.IXIC)$

This means that, unless there are new recessionary pressures, the market has more than fully accounted for rate cut expectations.As rate cut expectations materialize, the market will gradually shift from safe assets such as gold and U.S. bonds to risky assets such as equities and industrial metals.

Looking back at the 2019 rate-cutting cycle, a similar scenario has occurred.

Prior to the Federal Reserve's first rate cut in July 2019, the 10-year U.S. bond rate had fallen from a high of 3.2% to 1.5%.Although risk assets experienced multiple pullbacks during this period, gold gradually topped out and U.S. stocks and copper prices began to rally as economic expectations improved and long bond rates bottomed.Similarly, in the current cycle, the market expects a similar change in asset rotation as interest rate cuts materialize.

Summarizing

To summarize, market expectations for a rate cut at the September FOMC meeting remain highly uncertain.While a 25-basis-point rate cut is widely recognized as the baseline scenario, expectations of a 50-basis-point rate cut have not yet fully subsided either.

Asset prices may experience volatility as economic data are gradually disclosed and market expectations continue to be adjusted.Overall, however, the market has already partially factored in the expectation of interest rate cuts, and future investment opportunities may focus more on assets that may benefit from interest rate cuts, such as equities and industrial metals.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.