Demystifying Options Part 2

This is part 2 of Demystifying Options... If you are not familiar with options, I would suggest reading my first post: Demystifying Options Part 1.

A short recap on the types of options available...

There are 2 types of options - Put option and Call option. You can buy and sell both of them.

This post will be discussing about SELLING put options.

I noticed that some authors are not clear about the terms in their postings. They would say they are buying options when in fact they are selling options and if you follow them blindly, it could be a costly mistake. There is a BIG difference between SELLING options and BUYING options. It is very important that you understand what you are doing before you execute the trade, otherwise it is almost guaranteed that you will lose money.

Selling Put Options

There are 2 IMPORTANT rules when SELLING PUT Options. Violating ANY of the 2 rules means you have a very high chance of losing money.

Rule 1: You want to hold the shares of the company. If you have no intention of holding the shares of the company, you might end up "accidentally" owning the shares and having to sell it at a loss.

Rule 2: You have the money to buy the shares of the company should the option be exercised. I will explain this in detail below. If you do not have the money, you might be faced with margin calls and forced to liquidate your position at a loss.

Lets use Alibaba as an example company for all descriptions below.

The current price of Alibaba is $164 per share in the screenshot as shown.

Let's say you are interested to buy 100 shares at $150 per share. You have 2 choices.

Choice 1: You can set a buy limit at $150 for 100 shares and wait for the price to fall to that price or lower. Once the price falls to $150 or lower, your trade will be executed and you have 100 shares.

Choice 2: You can sell 1 put option contract with a strike price of $150 with an expiry of your choosing and get paid a premium while you wait for the share price to drop to below $150.

Remember Rule 2: Every option contract is 100 shares. Therefore, if you sell put option at $150 dollars per share for 1 contract, you need to have $15,000 in your account before you execute the sell put option.

Some terms you might have heard before but not sure what it means...

Covered Put: If you have $15,000 in your account before you sell 1 put option, this is called covered put. This is ok.

Naked Put: If you DO NOT have $15,000 in your account before you sell 1 put option, this is called naked put. You are violating Rule 2. This is NOT RECOMMENDED!

Lets go through the entire process of selling put option:

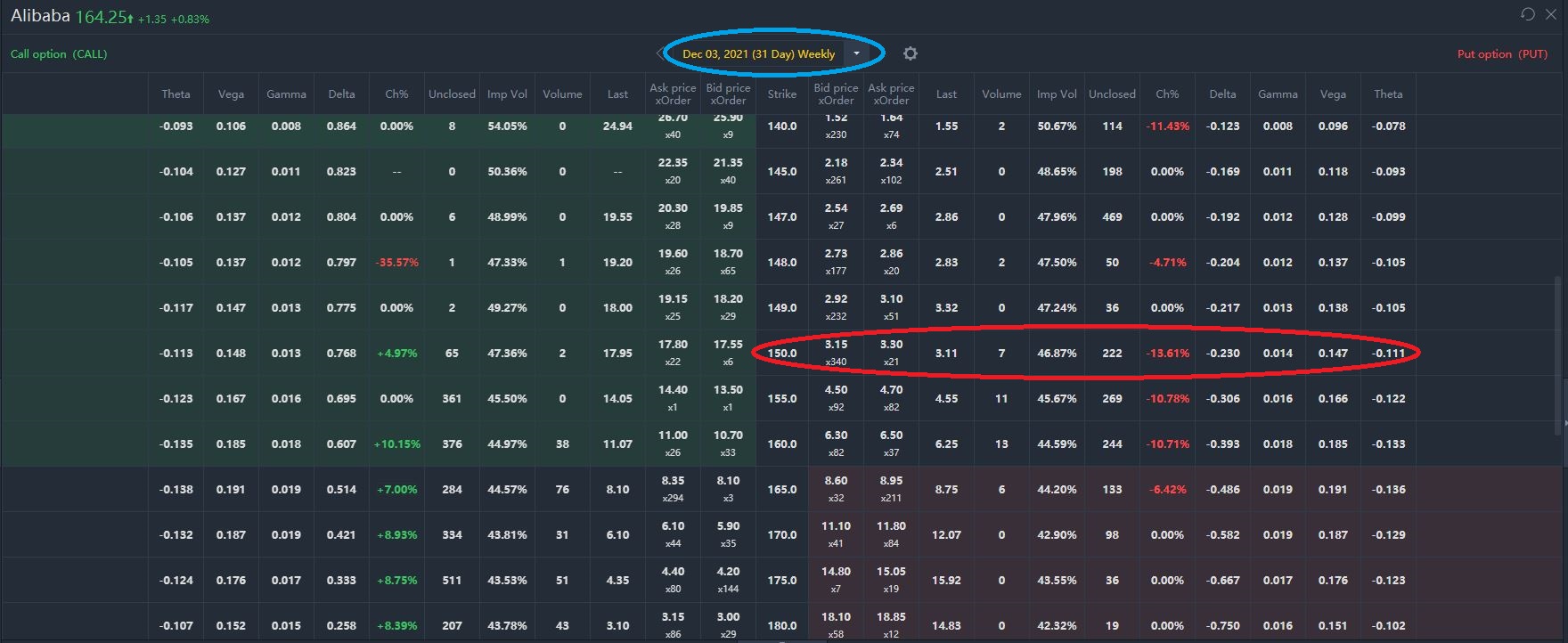

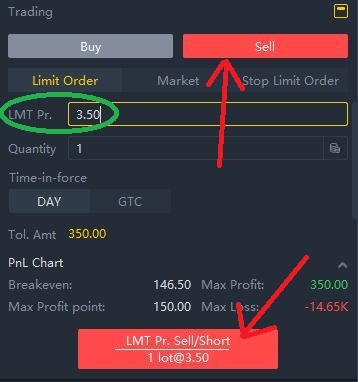

Step 1: I am using the desktop version of Tiger Broker for demonstration. I prefer to use the desktop version as it is easier to see more things and less likely to make mistakes. Select an expiry date from the list (circled in blue), the strike price you decide (circled in red), and enter the premium you want to collect (circled in green). This premium is for 1 share. The total premium will be multiplied by 100. Remember that you are SELLING PUT option, so click on SELL shown with the red arrow.

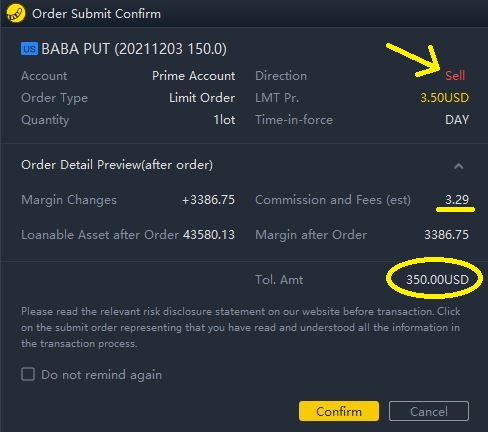

Step 2: The next screen is the confirmation screen of your sell put option. You can expand the order detail to see how much the commission and fees (Yellow underline) and the total premium you will collect. Note that the amount you collect will be the total amount subtract the commission and fees. In this example, the total premium you will collect is $350 (circled in yellow). Note the yellow arrow indication of the direction of the option (SELL)

Step 3: If a buyer decides that the premium you ask for is acceptable for the duration of the contract, he/she will pay you the premium and the contract becomes valid. You will get the premium immediately. This will be reflected in your tiger account USD cash position.

Step 4: You wait until the expiry date of the option. The share price can go up and down during this period of time. It does not matter on tiger platform. In other brokerage, the buyer can choose to exercise the option at any time until the expiry date.

Step 5: On the day of expiry at market closing, 2 things can happen.

1) If the share price on the day of expiry at market closing is the same or above the strike price ($150 or higher), the contract expires worthless. This means that you keep the $xx premium you collected and you can repeat Step 1 again.

2) If the share price on the day of expiry at market close is the below the strike price (less than $150), the contract gets exercised. You will pay $15,000 to the buyer of your put option and you get 100 shares of Alibaba. Even if the share price is $100 dollars per share, you will still pay $150 per share because you promise to buy the shares at $150 per share as per the option contract. You will still keep the $350 premium you collected. So, effectively, your purchase price of the share is $15,000 - $350 premium = $14,650, or $146.5 per share. This is what is termed as "break even" price of the contract.

You may also notice that there is a max profit of $350 and max loss of $14,650. What exactly does this 2 numbers mean?

Max profit is the premium that you are paid.

Max loss is the amount that you paid to the buyer to get the 100 shares after subtracting the premium. So why is it called a loss?

The reason it is called a loss is because in case the company goes bankrupt the day after and the shares of the company goes to $0 dollars. You will lose the entire sum you paid. This is not a loss if you have the intention of owning the shares (see rule 1) and you have the money to buy the shares (see rule 2).

If you do not have the money to buy the shares (Naked Put), you will buy the 100 shares at $150 per share using margin (i.e. Tiger will borrow you money to buy the share and charge you interest). If you exceed your margin allocation, you will get a margin call from tiger and your other positions in tiger will be liquidated to get the money required to buy the shares. BE VERY CAREFUL when you trade on margin!!

Note that this is the most basic form of Selling Put options. There are advanced option strategies that professional traders use which I will not discuss here because there are more qualified traders who can explain it better than I do. Most of them involved a combination of sell and buy options and they trade option contracts instead of waiting for it to expire, i.e. they will sell and buy contracts and profit off the difference in the contract premium. Do follow those professional traders and observe their trade.

Always remember.. If you do not understand what is happening, do not blindly follow and execute the trade!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

take care n stay safe

Did you mean that in Tiger Broker, they do not exercise the option early till last date of expiration?