Demystifying Options Part 1

What are options?

Options are contracts/agreements between 2 parties, the buyer and seller. The buyer pays the seller a premium to purchase the right to buy or sell shares at an agreed price. The seller accepts the premium and promises the buyer to buy or sell his/her shares at the agreed price. Options are very similar to insurance. The buyer of the insurance pays the insurance seller a premium to purchase the right to claim compensation when a certain event agreed by both parties happen. The seller of the insurance accepts the premium and promise to pay compensation when the event occurs.

Where are options traded?

Options are available for most stocks listed on the major US exchanges. Each option contract is worth 100 shares. This is only applicable in the US market. Other markets such as HK exchange have options, but their contract size can vary between 100 to 500 shares. I will only be referring to US options contract.

Where can I buy or sell options?

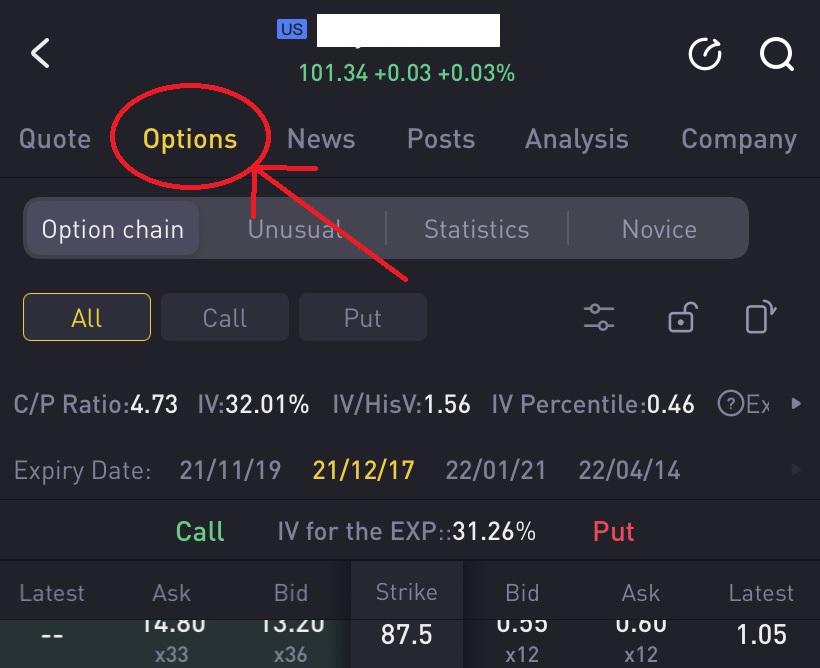

If you have a brokerage account with margin (such as tiger broker margin account), you can buy or sell options. See the red circle with arrow on where to find options on Tiger.

What are the different types of options available?

There are 2 types of options - Put option and Call option. You can buy and sell both of them. I will only be explaining the most basic of all option trading. For advanced strategies, there are professional traders out there who can explain them better than I do, so do follow them to learn.

When do I sell put options?

When I am waiting for a share price of a company to drop to my desired purchase price. I will sell put options to get cash flow while I wait.

When do I buy put options?

When I have shares of a company and I am afraid that the share price will crash, so I buy "insurance" to protect against the drop in price.

When do I sell call options?

When I have shares of a company and I want to get some cash flow while I wait for the price to go up.

When do I buy call options?

When I think the share price of the company will go to the moon and I want to lock in the price of the share now. Typically, buy call are for traders who trade options instead of stocks.

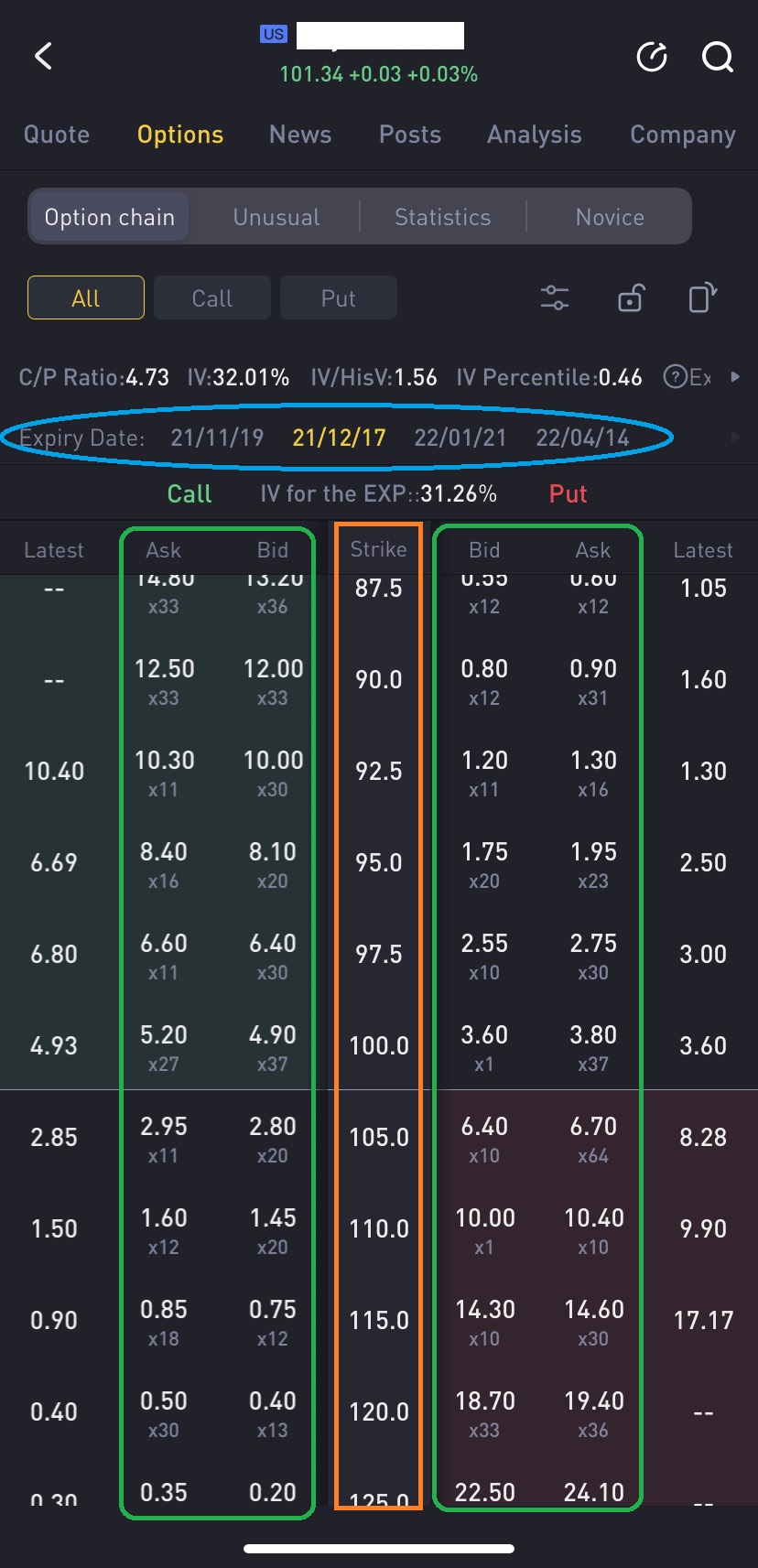

The basic terms to know before you start your option journey:

- Strike price - The price that the buyer and seller both agree for the option contract.

- Expiry date - Every option contract has an expiry date. This is the date that the contract is valid until.

- Bid and Ask price - The sell and buy premium of the option contract. A contract becomes valid when the buyer agrees to pay the seller the premium.

Here is where you can find the strike price (Orange rectangle), expiry date (Blue circle), bid and ask price for both put and call options (Green rectangles) on Tiger broker phone app.

In part 2, I will be explaining how to trade each type of options in more detail on tiger broker. Stay tuned..

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

If price moves against me, the most I lost is the premium I paid for the options, no further obligation.

Please advise whether my understanding above is correct or wrong.

Thank you

Then close my position to make profit/loss.

Great ariticle, would you like to share it?

Good read