China Stocks Gained Great Rebound, Opportunities or Not?

Last night, Chinese stocks ushered in a long-lost rebound.

$TENCENT(00700)$Although it has not yet stepped out of the consolidation range, However, the key support of the weekly line is firmly maintained, It takes half a year to complete the weekly level double bottom, and it is almost certain that it will not fall below the HK$420-430 line, but it is uncertain where the space above is. First look at the 500-510 line along the upper edge of the interval and then see if it will break through. At this time, a better opportunity is to sell the put of 420 below, and I sell 400, which is relatively conservative during the Chinese New Year. Of course, it is ok to do the band directly without selling put, and the band income brought by Tencent's wide oscillation is also considerable. It should be noted that the company will release Q4 financial report in March, but my intuition is that this financial report will be as bland and calm as last time.

$MEITUAN-W(03690)$There is also a double bottom, but if you sell put, selling Meituan is not as safe as selling Tencent. The biggest thunder of Meituan is that you don't know when Tencent will reduce its holdings, and you can't sit back and relax before this risk is released. If you buy stocks, the current price is only 10% from the bottom of 200, which is OK. The annual line is suppressed above. The first two rebounds are the attempted closing of the annual line, and the band is about 250-260.

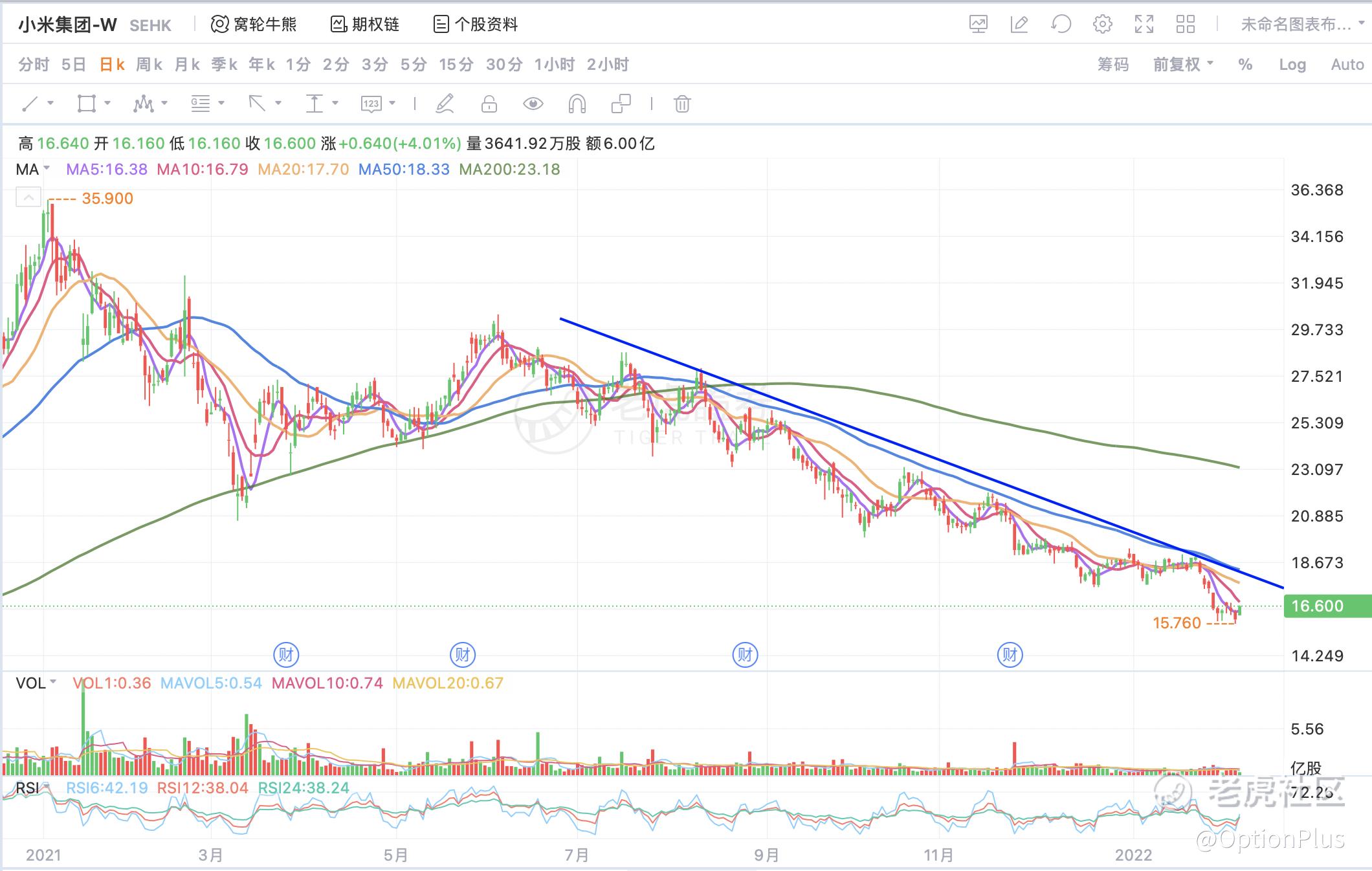

$XIAOMI-W(01810)$Trend is too bad, i would abandon it.

$KUAISHOU-W(01024)$The bottom polish is too perfect, falling from more than 400, and a good rebound will not reach 150 to 120. I have bought, is a buy call, in the last wave of rally I did 80-100 band.

Tell me why I don't do sell put in Aauto Quicker. The main reason is that the put outside the price is too cheap and the right gold is not fragrant. If the exercise price is too close, in case the price of Black Swan is uncomfortable, the bottom is more than 60, and my buying cost is 89. In case the market plummets and goes to the triple bottom, the floating losses I have to bear are not worth the royalties I earn. Buy the call for months directly, Aauto Quicker has fallen for so long, iv is not high, the cost of call is very low, and the total loss is limited.

$Pinduoduo Inc.(PDD)$Pinduoduo and Bi Li are the best elastic ones, but like Meituan, Pinduoduo Huateng's thunder of when Tencent will reduce its holdings hasn't exploded yet, so he can call for fun in a small position. If you really want to be serious, follow Duan Laoda as a long-term shareholder. Duan Laoda sold 50 put due on January 21 in Pinduoduo before, and closed at around 60 on that day. There was no exercise to earn royalties for nothing. All the logic of this operation is whether you are willing to take over Pinduoduo, but I am not willing for the time being. Compared with Tencent, I certainly chose sell put Tencent.

$JD.com(JD)$I am a user of the three major e-commerce companies in JD.COM. Of course, I prefer JD.COM. This wave will fall. JD.COM is relatively more resistant to falling. I am considering buying JD.COM's shares. JD.COM is cheap and has no policy risks. Tencent's reduction of thunder has exploded. The institutions that should be thrown away are thrown away. Spring Festival Evening sponsors, on the whole, I prefer JD.COM at present.

Electric Sambo, as I said before, the seasonality of tram sales is obvious, and Spring Festival is the off-season, so the performance is relatively low, and it is better after spring. Take a look in the near future, if the stocks are ambushed first, it is not impossible.

$NIO Inc.(NIO)$As the monthly sales volume has been continuously surpassed by Tucki and Ideal, the latest January data has dropped to the fourth place, and the graphics of Weilai are also very poor, but for Weilai, I pay more attention to the scheduled follow-up sales news of new products. What about new products? Is the sales volume good? Will Weilai's shipments catch up after spring? I will not participate in this stock without knowing it.

In contrast, the ideal is more stable and Tucki is more fierce.

$Li Auto(LI)$$XPeng Inc.(XPEV)$Although it also fell, But when it falls to a certain position, it oscillates in the interval. At present, there is nothing particularly clear to enter. If you have to choose, I think Tucki's catching-up posture will be better, and the monthly data will be the first in a row, which proves that it is not an accident. Today, Hong Kong stocks in Tucki are included in the Hong Kong Stock Connect, and a wave of northern water strikes. Tucki is relatively more popular with capital in terms of delivery and capital flow.

That's all for today. To sum up, I have some operations in Tencent and Aauto Quicker at present. As the consumption data bottomed out, the e-commerce association returned to warm, so I considered choosing JD.COM, because there is still a Tencent reduction in Pinduoduo that has not yet landed, and the tram stock will be in official website for the time being.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- gohtk·2022-02-10Short term target for $NIO Inc.(NIO)$ is $27, mid term is $31.2Report

- koolgal·2022-02-11感谢再次分享您的期权交易策略。看看有什么可用的可能性是非常有用的。1Report

- QArmieeQ·2022-02-10i am holding $Alibaba(BABA)$ and $XPeng Inc.(XPEV)$ still.2Report

- Oldhead·2022-02-11Share price is not one way traffic. What went down will come up unless the company is a junk and doomed.LikeReport

- asr68·2022-02-10hope it sustain2Report

- kiore·2022-02-09此时不跑,更待何时?!3Report

- ANNIEPLTAN·2022-02-12Thanks for sharing - its great information for me whom is unfamiliar with Chinese stock.LikeReport

- GhordofWar·2022-02-10good analysis with explanation1Report

- Oldmanjenkin·2022-02-09China market bullish?1Report

- 期权散户王·2022-02-12对老手而言,不论涨跌都是机会LikeReport

- cfybao·2022-02-11Kuai shou is worth a tryLikeReport

- MTamil·2022-02-09👌棕榈👌棕榈👌棕榈👌棕榈LikeReport

- 来真的·2022-02-09Hope is the start of a bull runLikeReport

- WillyT·2022-02-14[微笑]LikeReport

- Rjn828·2022-02-12Good infoLikeReport

- kenjoe·2022-02-11Thanks.LikeReport

- 夜行星·2022-02-11Nice1Report

- JCJC87·2022-02-11GreatLikeReport

- ws1234·2022-02-11[serious]1Report