A strategy of betting on earnings that costs no money

Focus on AMD and SNAP earnings options move.

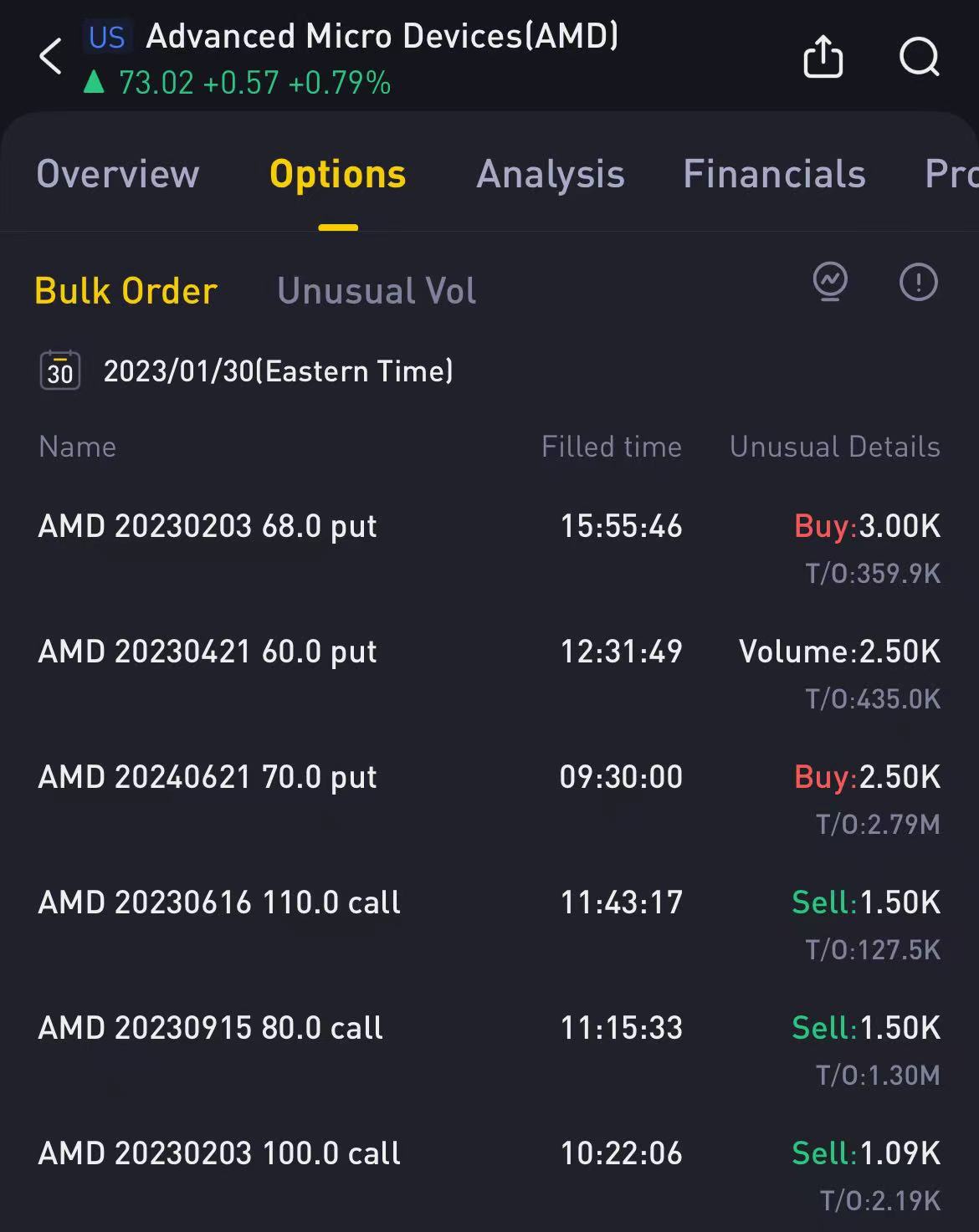

AMD's answer is a simple one. Three features are obvious. Earnings will fall, $68 price target.

Focus on AMD and SNAP earnings options change.

AMD's answer is a simple one. Three features are obvious. Earnings will fall, $68 price target: $AMD 20230203 68.0 PUT$ $AMD 20230203 68.0 PUT$

All three of these features should be known to veteran players. If you don't come to a conclusion, you can think about it. I will publish the answer tomorrow. (A word of caution: this is not 100% correct. It's risky to bet on earnings.)

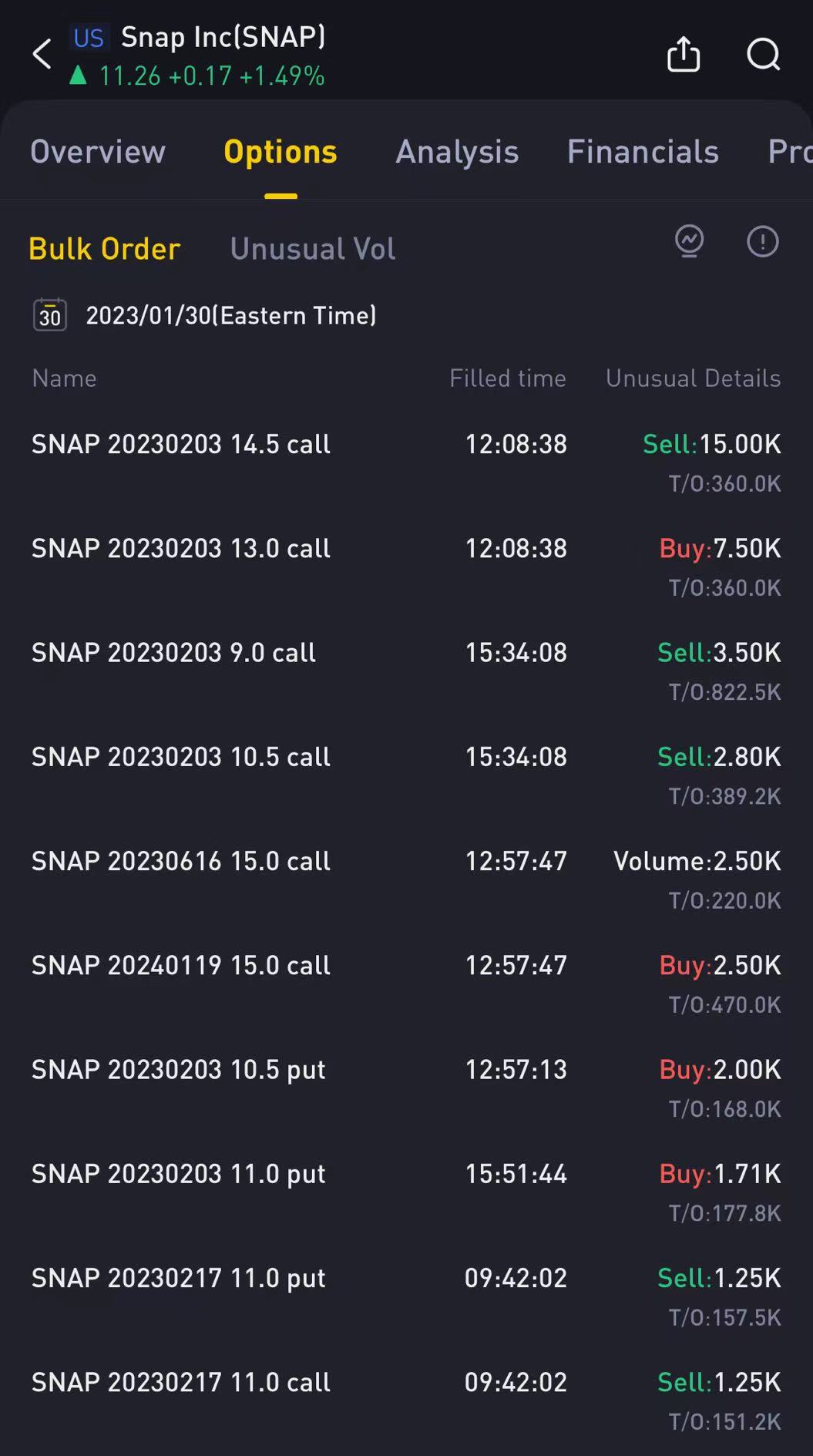

- buy $SNAP 20230203 13.0 CALL$ $SNAP 20230203 13.0 CALL$

- sell $SNAP 20230203 14.5 CALL$ $SNAP 20230203 14.5 CALL$

When SNAP shares rise near or above $13 but below $14.50 after earnings, the trader will double his profit by buying the call, plus a premium for selling the deep out-of-the-money option call.

The trader is betting on SNAP rising between 18% and 32%.

And when SNAP rose below $13 after the earnings report, in general, the depth of the out-of-the-money call‘s premium hedge the game cost of buying the call.

What matters is the total amount of transactions in this strategy.

The total amount of $SNAP 20230203 13.0 CALL$ bought is $360,000, and the premium of $SNAP 20230203 14.5 CALL$ sold is exactly $360,000. That means SNAP is up less than 18%, including a big drop, and the trader is only losing a small fee.

It's the first time I've met such a budget-conscious financial player.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

总额$SNAP 20230203 13.0 CALL$ 买的是36万美元$SNAP 20230203 14.5 CALL$ 售出的正好是36万美元。这意味着SNAP的涨幅不到18%,包括大幅下跌,交易员只损失了一小部分费用。