An Strategy that Buy Tesla Options for Free

I think institutions have been a little too frugal this quarter, because I keep finding some very money-saving options strategies.

We ended yesterday's post with a look at the theoretical price target Tesla could reach during this rally: 300.

But that target price is unworkable at this stage: if you bought Tesla before, just hold on. That's the most comfortable bullish approach. For those who do not hold positions to open new positions psychological risk thieves.

The dollar won three days in a row without a pullback when January CPI is released next Tuesday. While it's unclear whether the inverse relationship between the dollar and U.S. stocks is as clear this year as it was last year, the dollar's rise does weigh on risk assets in general.

So is there a way to be bullish and lower your bets?

Unsurprisingly, I found the solution in the options movement:

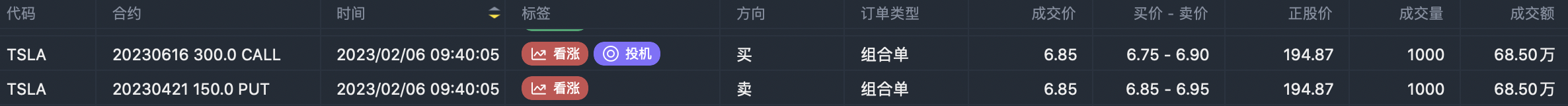

- buy $TSLA 20230616 300.0 CALL$ $TSLA 20230616 300.0 CALL$

- sell $TSLA 20230421 150.0 PUT$ $TSLA 20230421 150.0 PUT$

In my experience, those two labels are probably right. That is, the trader sells a put with a strike price of 150 and buys a call with a strike price of 300.

Both trades were $685,000: the $685,000 premium on the put option was hedged against the $685,000 premium on the buy call. In other words, Tesla didn't hit 300 before April 21, and it didn't fall to 150. The trader didn't pay a penny for this bet.

Why isn't this combination short straddle? If I was shorting, I would choose the option with a closer expiration date, rather than the put option on April 21, and the call option call on June 16, which is longer.

If you're bullish on Tesla's recent rally and want to take a small bet, try this combination. You don't have to if you think it's going to fall.

I don't see particularly aggressive long options, or single-leg out-of-the-money calls, right now. Other strategies that are common these days include selling at-the-money options, for example:

$TSLA 20230210 192.5 PUT$ $TSLA 20230210 192.5 PUT$

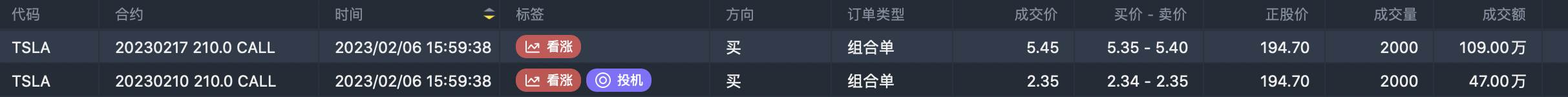

And typical calendar strategies:

- sell $TSLA 20230210 210.0 CALL$ $TSLA 20230210 210.0 CALL$

- buy $TSLA 20230217 210.0 CALL$ $TSLA 20230217 210.0 CALL$

Basically, it's still a bullish pattern against time value wear.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

this strategy is good, on 1 condition: you are willing to buy TSLA shares at $150. Thanks for sharing.