Will VIX hit 80 in this bear market?

The market is not expected to fall this week. China announced the evacuation of Ukrainian nationals last weekend. It will take some time to consider the evacuation. I guess the geopolitical friction between Russia and Ukraine will not escalate immediately this week, so we have a one-week buffer time. There is no incentive for the dollar to continue to rise, and exchange rates do not weigh on stocks. At the same time, the market to the weekly 200 average support level rebound demand. Sentiment is strong ahead of earnings this week, so Netflix is expected to fall before rising, with an eye on Netflix's AD revenue forecast and Tesla's Q4 and Q1 sales forecast for next year.

Compared with these two companies, this week's earnings report should pay more attention to early profit warnings, such as SNAP, FB.

But today I want to share with you an idea of "insurance".

On Friday, 70,000 vix calls with a strike price of 100 were bought for a total of $4 million, following the purchase of vix options the week before:

The second idea looks a bit like the first one, but not quite, and that is that bear markets of this magnitude tend to have a high probability of vix hitting 80, so ambush buying VIXcall has a high probability of positive returns.

Because according to the data at the heart of the financial crisis, the highest intraday trading level of the VIX was 89.53.

So the first is suspected of some kind of insider trading, and the second is betting based on probability statistics. I think the latter is plausible, although the first is not out of the question.

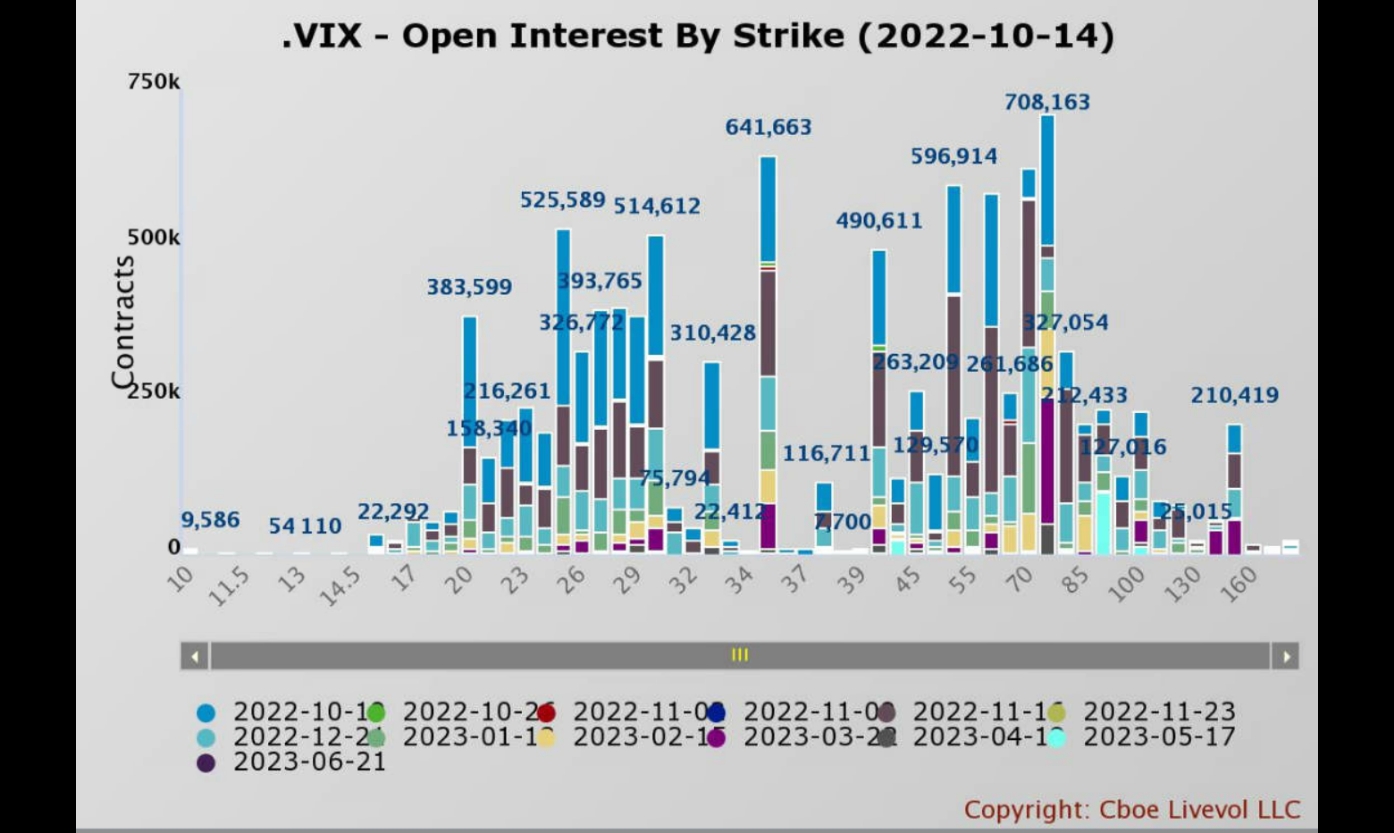

The same is true for average positions in the VIX, where most people are starting to bet on extreme levels of panic. Among all VIX options with strike prices, the largest total open interest is in options with a strike price of 80, or more than 700,000 contracts, compared with 642,000 contracts betting on the VIX trading in the mid-30s, according to Cboe data.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- jat·2022-10-19tks for summarising your thoughts... seem like this week won't give surprises [Like]3Report

- JessieTheresa·2022-10-18Interesting VIX. It was just one person, the insider trading sounds bit of unreal 🤔3Report

- liewtc60·2022-10-18If VIX hit 80, the market may be bottomed out - “the times of maximum pessimism, is the time to buy”.2Report

- Tracccy·2022-10-18Thx for sharing. What is THE volatility surprise...?2Report

- BerryNat·2022-10-18This one week break would be good. Thanks for sharing.1Report

- Jason1616·2022-10-20Waiting for the capitulationLikeReport

- ThaiGirl·2022-10-19No. Not likely.LikeReport

- highhand·2022-10-18nuclear war will make vix hit 80LikeReport

- CSNeo·2022-10-20[财迷]1Report

- CSNeo·2022-10-20[财迷]1Report

- FuraNshi·2022-10-20🤔LikeReport

- SQP·2022-10-20okLikeReport

- ewan0907·2022-10-20👍LikeReport

- T33·2022-10-20ok1Report

- Tiger Wong·2022-10-20Good1Report

- hh488·2022-10-20nice.LikeReport

- xiaochoochoo·2022-10-20MLikeReport

- chang168·2022-10-20upLikeReport

- InvisibleP·2022-10-20Ok1Report

- Alex Tan·2022-10-19okLikeReport