$Coca-Cola(KO)$ released Q2 earnings before Tuesday open. As the best representative of consumer staples, it means a lot.

From Q2 earnings, Coca-Cola is convinced no longer an ordinary consumer product. For most consumers, it is a necessary like daily necessities, te Demand elasticity of necessities is quite low, that is, people are extremely insensitive to price changes. An 10% (probably a few cents) price raise will not change any demands.

Although Coca-Cola is bearing inflation like others (such as $Wal-Mart(WMT)$ ), it can easily raise its price with sales volume still strong.

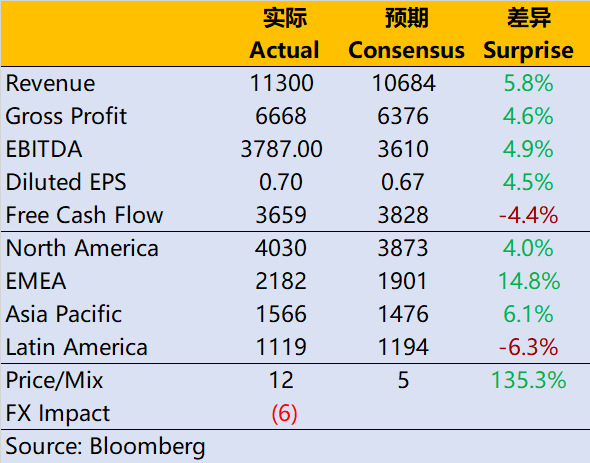

For Q2, price/mix metric jumped 12%, with an 11.9% jump in revenue pushed $730M above expectations, bolstered by an 8% jump in case volume.

At the same time, profit indicators are also higher than expected. Although the gross profit margin decreased from 61.4% in the same period last year to 59% due to more expensive raw materials (such as bottles), it was also slightly higher than the market expectation. The diluted EPS is 0.7 USD, which is higher than the market expectation consensus of 0.64 USD.

It is worth mentioning that Coca-Cola's withdrawl from the Russian market in March. Although there may be some finishing work to be done in Q2, it is obvious that the overall sales impact is not great.

Geographically,The income growth rate of Europe, Africa and the Middle East was 8.1%, ranking second among the four major regions, and beat market estimates. However, the company expects the impact on EPS to be about 0.03 US dollars.

The biggest impact on Coca-Cola should be the forex, which gives Q2 a -6% headwind. But more importantly, the company is still very optimistic about the performance in the second half of the year, so it raised the annual performance guidelines, and the growth rate of organic income was raised from 7-8% to 12-13%, and the growth rate of EPS was also raised to 5-6%.

In a word, Coca-Cola's users are too sticky, almost becoming a necessity, and its price elasticity is very low.

Of course, although inflation is high in the United States at present, the overall salary level is still not low, which is why consumer goods can still maintain strong purchasing power. If Coca-Cola's performance has declined, it may be that the recession has really started.

Comments

Yayayaya papaya

For those TLDR

Here is the main points

1. Coke is recession proof as

2. Coke drinkers are unlikely to switch brand even if price increases This is known as inelastic demand

3. It has a strong fan loyalty - high stickiness factor