Summary

- Rivian stock has dropped more than 25% since our last Neutral call.

- The company reported a slight production target miss in its FQ3 earnings call. However, we don't think investors should be overly worried.

- We discuss why we think RIVN stock is a Buy now.

Investment Thesis

Rivian Automotive, Inc. (RIVN) recently released its first earnings reports for FQ3'21 as a public company. Notably, the company missed its 1,200 vehicle production target by "a few hundred vehicles." However, we weren't surprised, given the current supply chain bottlenecks and the challenges in ramping production. Moreover, we don't think investors should be unduly concerned about its short-term production goal. Management was clear as it emphasized that its long-term production targets remain unaffected.

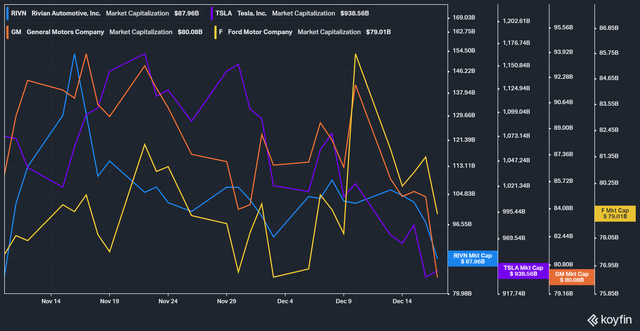

Nevertheless, we believe that ramping production successfully will continue to be a key hurdle facing CEO RJ Scaringe & Co. Investors sent the stock tumbling after its earnings report, which we believe the market took the opportunity to pare down risk. After all, RIVN stock had traded at an incredible market cap of $112.8B when we wrote our previous article. Following the recent sell-off, Rivian's market cap has dropped to $88B. Therefore, we believe it's an appropriate time to revisit our thesis on RIVN stock post-FQ3 earnings.

We also discuss why we think the stock seems fairly valued now.

Rivian Market Cap Trend

Readers can quickly glean that Rivian's market cap has dropped dramatically back to where it started life as a public company. It last registered a market cap of $88B, while it began trading with a market cap of $83.6B in early November.

Nevertheless, Rivian's market cap still exceeded Ford (F) and General Motors (GM) market cap even as it just started making deliveries in September. Some investors find it incredulous that a company that hasn't even ramped production could be worth more than both the US auto leaders.

Why We Think Rivian Investors Remain Optimistic Post-FQ3

Rivian's report card wasn't a disaster, even if the company missed its production guidance for 2021. CEO RJ Scaringe offered assurances as he emphasized (edited):

For 2021, we expect to produce a few hundred vehicles short of our initial 1,200 vehicle production target. We do not believe any of our supply chain challenges represent long-term systemic issues. We remain well-positioned to capture and drive the accelerated large-scale adoption of sustainable transportation. However, a small number of suppliers or small number of components may be ramping a little slower, creating constraints or bottlenecks. Those challenges have been really a focal point for us over the last two and a half, three months. But, these issues are short-term in nature and they are solvable problems. So, we don't see any long-term systemic challenges associated with ramping the supply chain. (Rivian's FQ3'21 earnings call)

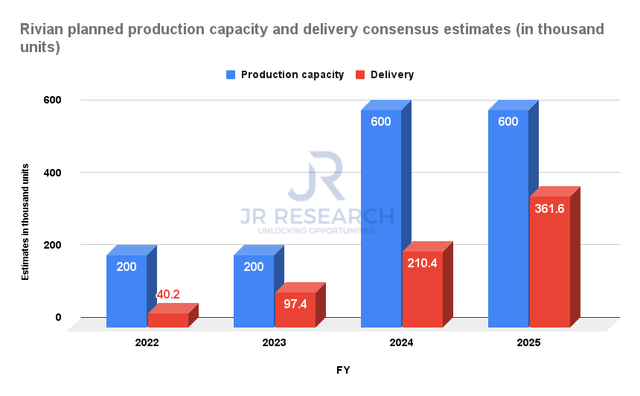

Rivian telegraphed that it would be commencing its new Georgia production facility in mid'22 and ready to begin production from 2024. Georgia's planned annual run rate is estimated at 400K. Therefore, it would afford Rivian a collective annual production capacity of 600K if we include its Illinois facility. Nevertheless, the company did not specify how long it would take to ramp production to its planned capacity. However, consensus estimates point to a relatively positive ramp through FY25. As a result, Rivian is estimated to deliver about 40K of vehicles in FY22. However, it would reach the 360K milestone by FY25, registering an estimated delivery CAGR of 108%. Its 360K estimate includes the 100K EDV orders from its exclusive last-mile delivery partner and cornerstone investor Amazon (AMZN).

There's little doubt that the delivery cadence estimates look very aggressive. But, if done well, it's also not impossible. Keen investors should recall that Tesla (TSLA) took just two years to ramp Giga Shanghai from zero to its current 600K annual run rate. It has even recently made new investments to enhance its production capacity further. Rivian also seems highly confident that they can ramp successfully, as CEO RJ Scaringe emphasized (edited):

We've architected the product development to be capable of running more than one program and launching more than one program at once, but also to have those fast feedback loops between the different programs. So with that, the commercial van has actually learned a lot from the R1 platform and the R1 platform launch. What you see in terms of the facility in Georgia, is key for us from an expansion point of view. We're quite confident in the path ahead. All three of our vehicles have been certified for sale and they're being produced on two different production lines. The organization was architected to facilitate running and operating multiple programs at the same time. And so as we now look at what the ramp will look like for both R1T and R1S into next year, it really positions us to rapidly grow through the course of 2022. (Rivian's FQ3'21 earnings call)

While it's still early, Rivian investors are undoubtedly confident that the company can deliver on its production cadence to meet its delivery milestones. The company is not facing a demand issue compared to short-term supply constraints. They updated that R1 orders have climbed to 71K from 55K in the previous update. Nevertheless, these are cancelable orders, as their delivery timeline has been stretched to 2023 if a new order is placed now. Given that auto leaders General Motors, Ford, and Tesla will also be expected to compete with their pickup trucks soon, Rivian must maintain its production cadence. Therefore, we encourage investors to monitor their production milestones very carefully moving ahead.

Investors Must Carefully Monitor Amazon's EDV Range

The partnership with Amazon is critical to jumpstarting Rivian's ambitions into the commercial fleet segment. Not only does it offer the opportunity of massive fleet sales, but it also sells its fleet management subscriptions as part of its commercial sales. Consequently, it introduces a recurring software revenue stream component on top of its hardware revenue. It also applies to the Amazon fleet, as Rivian accentuated: "That software subscription goes live basically now on the commercial side."

Rivian is expected to deliver 10K EDV by 2022 following "months of testing in 15 cities." Investors should remember that Amazon retains the right to change its number of orders. Therefore it's critical that Rivian can meet Amazon's expectations. We believe it has also driven Rivian to ramp production quickly. Given how quickly they secured their second production facility, we believe that the company seems confident in meeting its production targets, and consequently, Amazon's orders.

Rivian emphasized that its EDV is capable of 201 miles range, and it is on track to deliver its vehicles to Amazon. However, a previous report by The Information highlighted some challenges in Amazon's testing, on top of its battery draining problem. The Information reported (edited):

Rivian said the Amazon vans would have a range of between 120 miles and 150 miles depending on their size. But one driver involved in testing the vans said the range could be much less, depending on the weather. The driver who spoke to The Information said the battery drained about 40% faster than normal if the van’s heating or cooling was on. As a result, drivers have been testing the vans on what they dubbed “nursery routes,” where vans didn’t venture too far away from the contractors’ headquarters. (The Information)

Nevertheless, Amazon's director of Global Fleets and Products, Ross Rachey, noted that once the vans are in production, "they would have a range of 150 miles, which is double the range of the majority of Amazon's routes." Notably, the company also quickly emphasized that these test vans are not fully developed yet.

We believe a successful launch program with Amazon could open up many potential opportunities outside of the Last Mile segment. Investors should note that Amazon's exclusive partnership with Rivian is limited to Last Mile. But, the commercial space is much larger than the Last Mile segment. Rivian also raved about its market opportunities in the larger commercial space, as Scaringe added (edited):

Amazon represents such a large pool of demand for us.So it's really critical that we do not starve them of vehicles. Nevertheless, the RCV platform was architected and designed fully contemplating vehicles beyond Last Mile, such as in the cargo space, or in the workspace. So there's a whole host of opportunities that exists both in large volumes, but also across a very long spread-out tail of commercial applications. Thus, we also have an eye on launching non-EDV versions on the RCV platform to capitalize on these opportunities. (Rivian's FQ3'21 earnings call)

So, is RIVN Stock a Buy/Hold/Sell Now?

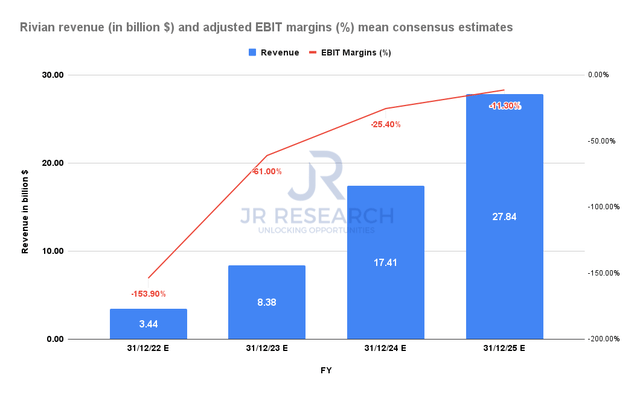

Consensus estimates point to a largely successful ramp, as we explained earlier. As a result, Rivian's revenue is estimated to reach $27.84B by FY25. However, the company is not expected to be profitable based on adjusted EBIT margins by then. Therefore, investors are encouraged to monitor its production ramp and profitability dynamics moving forward carefully.

Nevertheless, its valuations have dropped significantly since its earlier momentum spike. The stock has declined more than 25% since our Neutral call, as we encouraged investors to wait for the dip.

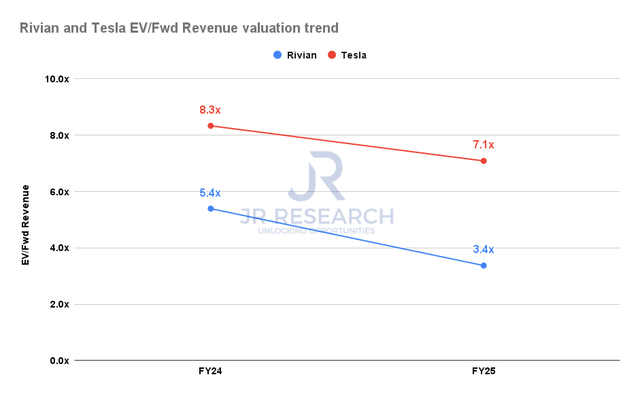

If we consider Rivian's valuations against Tesla moving forward, it may seem more reasonable than the EV leader. However, investors should note that Tesla is already a solidly profitable EV maker. It also has proven its production ramp capabilities exceptionally well. Moreover, its brand value has also increased tremendously globally. Therefore, comparing their revenue multiples directly without adjusting for Tesla's advantages would not make sense.

Based on Rivian stock's EV/FY25 revenue multiple of 3.4x, it's trading at 50% of Tesla's FY25 revenue multiple. Therefore, we think RIVN stock looks fairly valued now. Nevertheless, we believe that RIVN stock remains a highly speculative play. However, the company seems to be getting well on track to meet its mid-term production guidance. Therefore, the current weakness could offer speculative investors a potential opportunity to add exposure at a more reasonable valuation.

Consequently,we revise our rating on RIVN stock to Buy.However, we would like to caution that RIVN stock may be suitable for speculative investors only. Moreover, the stock could continue to exhibit tremendous volatility. Therefore, investors are encouraged to add in phases.

This article was written by JR Research.