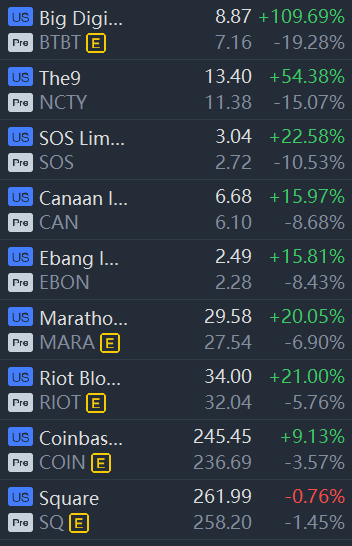

Crypto Stocks tumbled in premarket trading on Amazon denimg report of accepting bitcoin as payment.Bit Digital,The9,SOS Ltd,Canaan,Ebang international,Marathon Digital Holdings,Riot Blockchain,Coinbase Global and Square plunged between 1% and 19%.

Bitcoin fell after briefly rallying past $40,000, as Amazon.com Inc. pushed back against speculation it will accept the token for payments this year, offering investors another reminder of the coin’s volatility.

The largest digital currency dropped as much as 3.5% and was trading at about $37,100 as of 1:44 p.m. in Hong Kong, extending a late reversal in U.S. trading. Rival coins including Ether and Litecoin also retreated.

Bitcoin’s latest roller-coaster ride accelerated Monday as traders digested an Amazon executive job posting linked to crypto, sending prices soaring. The rally quickly ran out of steam hours later, after a company spokesperson denied the token will be accepted for payments this year.

Investors rushing to cover bearish bets helped propel Bitcoin’s earlier advance to a peak of $40,545, its highest since June 15. More than $950 million of crypto shorts were liquidated on Monday, the most since May 19, according to data from Bybt.com.

“Shorts were piling up as we were moving down, assuming we were looking at a minimum of $25,000, which was expected across the board,” said Vijay Ayyar, head of crypto exchange Luno’s Asia Pacific business. “But then there was heavy accumulation in the $29,000 to $30,000 region, which caught a lot of those shorts unaware and hence led to the spring upwards.”

Bitcoin’s price volatility is part of a wider, multi-wave correction since a record high was reached in April, Ayyar said. The price could rebound as high as $45,000 in the near term before another potential drop, he said.

“We’re still seeing the correction play out,” he added.

The latest gyrations came amid concerns about a chill in the crypto industry after Bitcoin’s hot run to a record of almost $65,000 faded amid rising regulatory and environmental concerns. There are plenty of factors traders can point to for this week’s moves, as proponents look for the next catalyst to break the coin out of its tight trading range of $30,000 to $40,000 in recent months.

“Bitcoin‘s biggest risk this week could be a hawkish surprise from the Fed, which might explain why prices have not yet been able to clear the psychological $40,000 level,” said Edward Moya, senior market analyst with Oanda Corp. The Federal Reserve will announce its next rate decision Wednesday.

Bloomberg News earlier reported a U.S. probe into Tether is homing in on whether executives behind the token committed bank fraud.

Ether was down as much as 5%, reversing Monday’s earlier advance ahead of an upgrade due on Aug. 4 that will reduce the amount of outstanding tokens by destroying some of them every time it’s used to fuel transactions on the world’s most-used blockchain.

On Binance, the largest crypto exchange, Bitcoin perpetual contracts jumped as much as 30% over an hour in early New York trading, a sign of extreme volatility in one of the coin’s most liquid derivatives.

Sentiment also got a bit of a boost last week after Tesla Inc.’s Elon Musk said his firm was likely to eventually accept Bitcoin again and that his space exploration company SpaceX owns the digital token. Bitcoin bounced back above the 50-day moving average for the first time since May on the weekend.