U.S. stocks fell on Friday amid a slide in Amazon shares, but the S&P 500 is still on track to notch its sixth straight positive month.

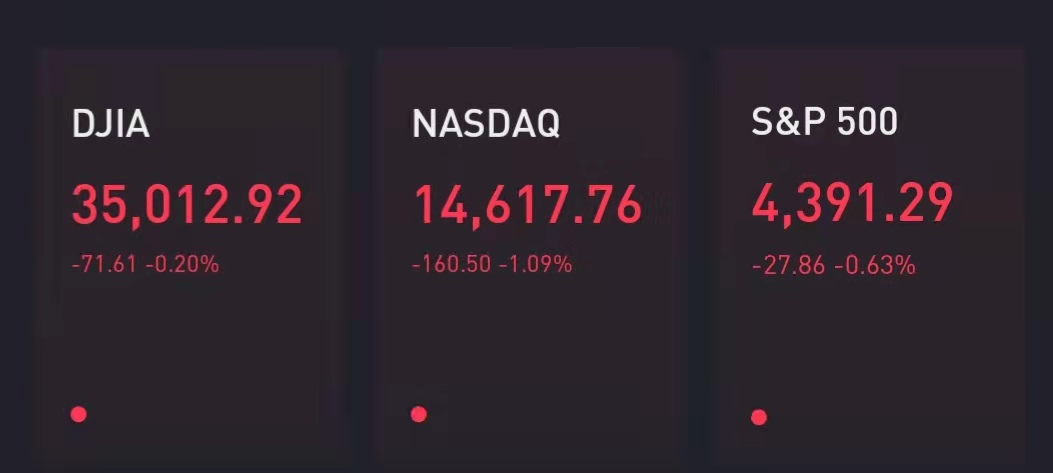

The Dow Jones Industrial Average dipped 72 points, while the S&P 500 fell 0.6%. The tech-heavy Nasdaq Composite slipped 1.1%.

Amazonsank 7.3% after itreported its first quarterly revenue missin three years and gave weaker guidance.Pinterestfell even further, down 21%, aftersaying it lost monthly usersduring the three months ended June 30.

Investors digested a key inflation indicator that showed better-than-feared price pressures. The core personal consumption expenditures price indexrose 3.5% in Juneyear over year. It marked a sharp acceleration in inflation but came in slightly below a Dow Jones expectation of a 3.6% jump.

Major averages are still on track for a solid month, although volatility has picked up amid concerns about the economic recovery in the face of the spreading delta variant. The Nasdaq and Dow have added 1% and 1.4% respectively in July, while the broad S&P 500 is up 2.2% over the same period. Utilities, health-care, real estate and technology stocks have led the S&P 500 higher for the month, while energy and financials have lagged.

"There has been quite a bit of volatility and price choppiness in the market in recent weeks," Brian Belski, chief investment strategist at BMO, said in a note. "Increased concerns over the delta variant and its potential implications for reopening momentum seemed to play a key role in the price action, while peak themes related to economic growth, earnings, and policy support also remained an overhang on risk sentiment."

Procter & Gamble shares rose 1.4% after the consumer gianttopped analysts' estimatesfor quarterly earnings and revenue. However, the company warned that increasing commodity costs could hit its earnings in the upcoming year.

Weaker-than-expected readings on the U.S. economy further eased concerns about the Federal Reserve dialing back asset purchases.

U.S. second-quarter gross domestic product accelerated 6.5%on an annualized basis, considerably less than the 8.4% Dow Jones estimate. Meanwhile, the latest weekly jobless claims also came in higher than expected.

Fed Chairman Jerome Powell on Wednesday noted that while the economy has come a long way since the Covid-19 recession, it still hasa ways to gobefore the central bank considers adjusting its easy-money policies.

“While shy of expectations specifically for Q2 GDP, broadly speaking as Chairman Powell noted yesterday, the recovery has in many ways exceeded even the most optimistic forecasts,” Stifel Chief Economist Lindsey Piegza wrote Thursday afternoon. “With U.S. businesses reopen for business and American consumers anxious to rush into the marketplace and spend, growth in the first half of the year was solid.”