U.S. equity-index futures declined after stubborn US inflation bolstered the case for more aggressive monetary tightening by the Federal Reserve.

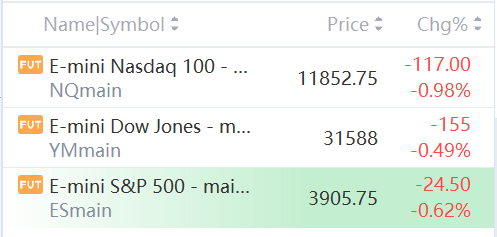

Contracts on the Nasdaq 100 index slid nearly 1%. S&P 500 Futures dropped 0.62% after the S&P 500 Index Wednesday hit the lowest level since March 2021.

Wednesday’s hotter-than-expected US inflation reading has revived concerns of a 75 basis-point rate increase by the Fed, rather than the 50 basis-point pace that markets have come to grips with. Worries about the impact of rising rates on economic growth, combined with the war in Ukraine and slowing Chinese demand amid Covid lockdowns, are battering risk assets.

“Until we get a meaningful move lower in inflation, not only one print, but a consistent two, three, four prints moving in the right direction, this market may remain range bound,” Mona Mahajan, senior investment strategist at Edward Jones & Co., said.

“It was all about the higher than expected U.S. CPI report yesterday which added to Fed rate expectations, as well as hard landing expectations,” said Jim Reid, a strategist atDeutsche Bank.“What will concern the Fed is that there are plenty of signs that inflation pressures remain broad and can’t be pinned on transitory shocks like the spike in energy prices of late.”

The selloff was even more markedin the digital asset space, whereBitcoin,the largest cryptocurrency, fell 7% over the past 24 hours to $28,000, dipping below $26,000 in the trough of volatile trading. Bitcoin hasn’t consistently traded this low since late 2020. Many smaller cryptocurrencies notched losses of 25% over the past 24 hours.