‘The demise of the 60/40 portfolio has been a long time coming, and it’s finally here,’ says John Silvia of Dynamic Economic Strategy

Rising stagflation risks in the U.S. and Europe are raising the possibility of a “lost decade” for the 60/40 portfolio mix of stocks and bonds, historically seen as a reliable investing choice for those with moderate risk appetites.

Such a “lost decade” is defined as an extended period of poor real returns, says Goldman Sachs Group Inc. portfolio strategist Christian Mueller-Glissmann and his colleagues Cecilia Mariotti and Andrea Ferrario. Since the start of 2022, 60/40 portfolios in the U.S. and Europe are down more than 10% in real terms, the Goldman team wrote in a note released Friday.

Risks of slower growth plus inflation are being amplified by the ongoing the conflict between Russia and Ukraine, and are already taking a toll on many investors. The three major U.S. stock indexes are off by 5% to 12% this year, with the tech-heavy Nasdaq Composite dropping the most. Meanwhile, bonds are also having a rough time — with the 10-year Treasury note putting in its worst year-over-year performance since 2013 as of Thursday, which has pushed its yield above 2.1%. That’s diminished the performance of the 60% allocation to equities and 40% allocation to bonds.

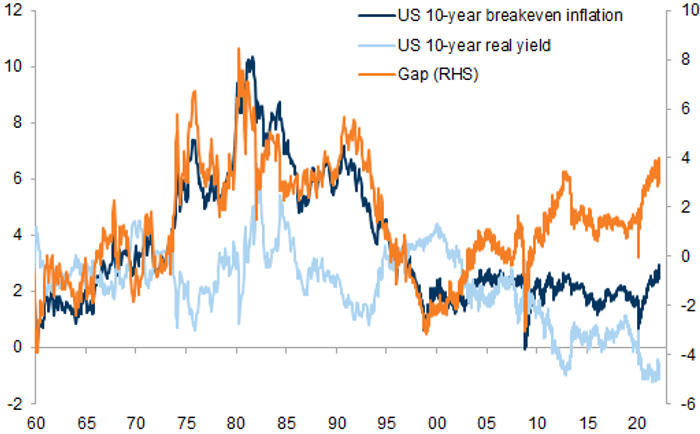

Signs of stagflation worries are evident in rates markets. The 10-year U.S. breakeven inflation rate, a gauge of inflation expectations, has reached its highest level since the 1990s, according to Goldman Sachs. Meanwhile, inflation-adjusted real yields remain near their lowest levels in decades, reflecting pessimism about economic growth in coming years. And the widely followed spread between 2-year and 10-year Treasury yields is inching its way closer to an inversion, typically a harbinger of recession.

“The No. 1 problem with the 60/40 portfolio is that the pace of inflation means real returns on the bond side will be negative,” said John Silvia, founder and chief executive of Dynamic Economic Strategy in Captiva Island, Fla. “And slower economic growth means slower profit growth, which means the stock side of the portfolio gets hit as well.”

“So the total portfolio performance will probably be disappointing relative to past years, and it could entirely last a full decade,” Silvia said via phone. “The reason is that you’ve had arbitrarily low interest rates for four to five years, and a lot of speculation in the marketplace with people reaching for yield. The demise of the 60/40 portfolio has been a long time coming, and it’s finally here.”

The lost decade envisioned by Goldman Sachs marks a turnabout from the last cycle, which benefited from what Mueller-Glissmann and colleagues call a “structural ‘Goldilocks’ regime.” That’s when low inflation and real rates boosted valuations and profit growth, despite relatively weak economic growth. Equities and bonds each performed well side-by-side — with real returns on the 60/40 mix coming in at roughly 7% to 8% each year during the last cycle, compared with a 5% long-run average, they said.

The thinking behind the 60/40 mix in the first place has been the notion that bonds can act as ballast to the riskiness inherent in equities. Private pension plans are one investor category that has continued to cling to the mix and have “rarely deviated from it,” according to Deutsche Bank researchers.

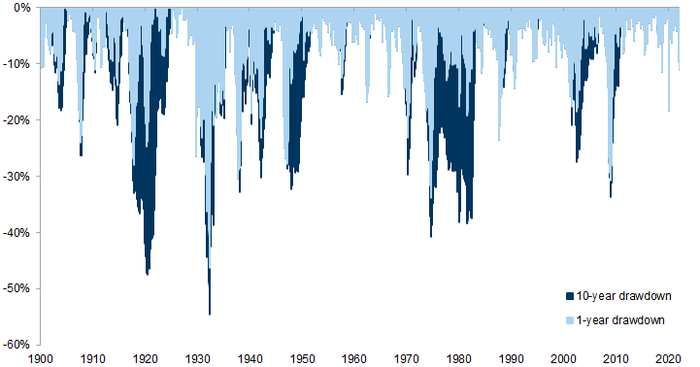

But lost decades are more common than many think, according to Mueller-Glissmann, Mariotti and Ferrario. They’ve occurred during World War I, World War II and the 1970s — following strong bull markets marked by elevated valuations. And the likelihood of a lost decade rises in the face of stagflation, they said.

The following chart reflects 1-year and 10-year drawdowns in the 60/40 portfolio through the decades.

A combination of other investments can help reduce the risk of another 60/40 lost decade for investors, the Goldman team said. They include allocations to “real assets” such as commodities, real estate and infrastructure, as well as greater diversification in overseas markets. Investors should also consider value and high-dividend-yielding stocks, as well as convertible bonds, according to Goldman.

To be sure, not everyone’s on board with the idea of a prolonged period of poor 60/40 returns. Thomas Salopek, a strategist at JPMorgan Chase & Co. who warned in January that the 60/40 mix was “in danger,” says he thinks the U.S. will avoid actual stagflation. “We believe,” he said, “there will be no lost decade for the 60/40.”

“For now, the environment is still high growth and high inflation,” he wrote in an email to MarketWatch on Friday. With yields historically rising during a Fed rate-hike cycle, “there is a healthy stock vs. bond risk premium that can finally be harvested as risk aversion recedes. So stock outperformance should more than make up for bond weakness, once risk appetite recovers.”

On Friday, Treasury yields turned mixed as investors factored in the prospects of slower growth.