Fourth-quarter earnings season continues this week, with close to 90 S&P 500 companies scheduled to report. So far, earnings are down about 3% from the same period a year ago, per Refinitiv.

Simon Property Group, Take-Two Interactive Software, and Tyson Foods report on Monday, followed by BP, Chipotle Mexican Grill, DuPont,Linde, and Royal Caribbean Group.

Walt Disney, CVS Health,and Uber Technologies will publish results on Wednesday, then AbbVie, Expedia Group, Hilton Worldwide Holdings, PayPal Holdings, and Philip Morris International go on Thursday. Honda Motor and Newell Brands will close the week on Friday.

It will be a relatively quiet week on the economic-data calendar: The University of Michigan’s Consumer Sentiment Index for February, out on Friday morning, will be the highlight. That’s forecast to come in roughly event with January’s figure, which showed widespread pessimism among consumers.

Economists and Federal Reserve watchers will be tuning into a speech from Chairman Jerome Powell at the Economic Club of Washington D.C. on Tuesday. And Tuesday night, President Joe Biden will give the State of the Union address.

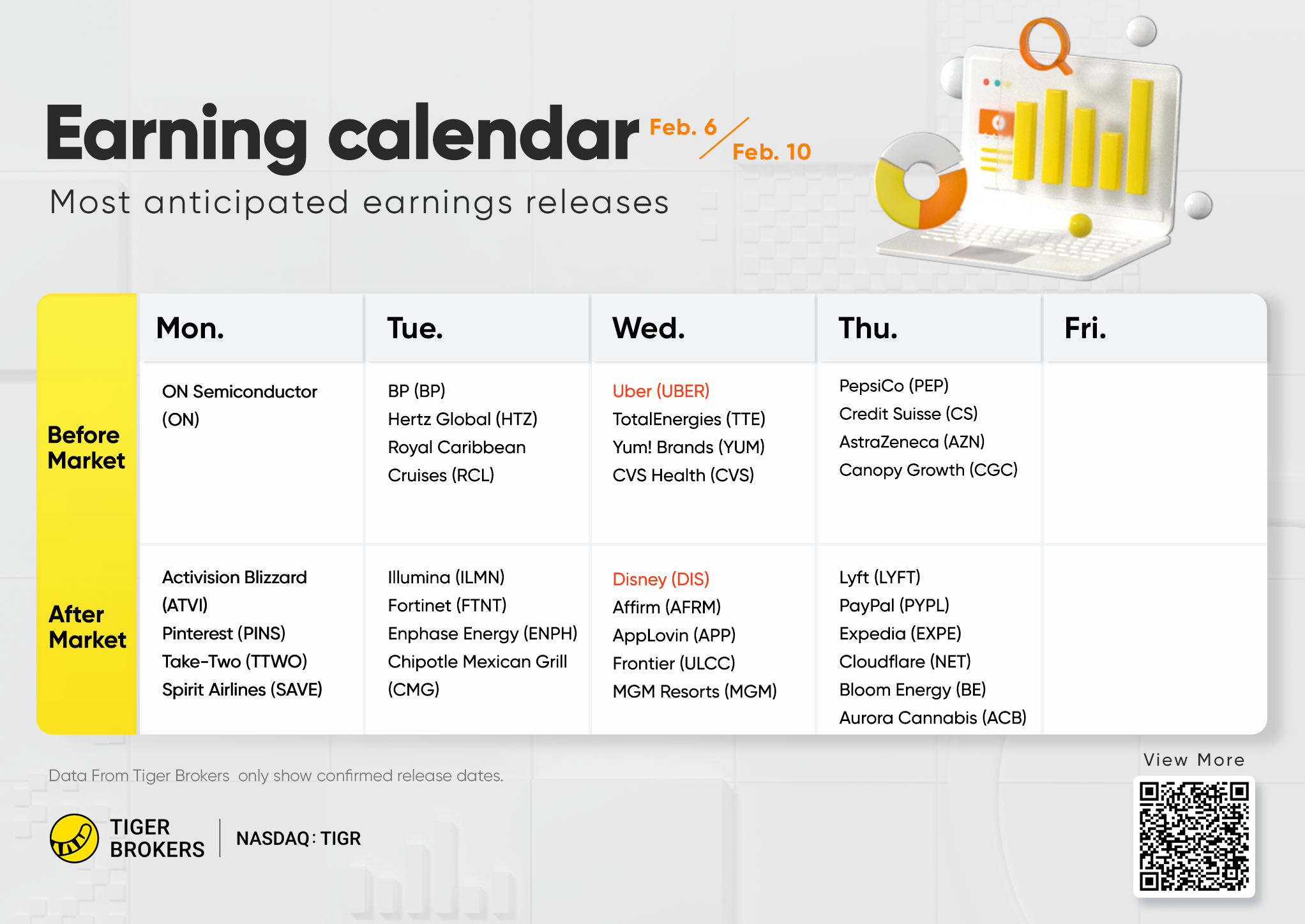

Monday 2/6

Activision Blizzard, Cummins, Idexx Laboratories, ON Semiconductor, Simon Property Group, Take-Two Interactive Software, and Tyson Foods report quarterly results.

Tuesday 2/7

BP, Carrier Global, Centene, Chipotle Mexican Grill, DuPont, Enphase Energy, Fiserv, Fortinet, Illumina, KKR, Linde, Omnicom Group, Prudential Financial, Royal Caribbean Group, TransDigm Group, Vertex Pharmaceuticals, and Xylem announce earnings.

The Federal Reserve reports consumer credit data for December. In November, total consumer debt increased at a seasonally adjusted annual rate of 7.1%, to a record $4.76 trillion. Revolving credit—mostly credit-card debt—jumped 16.9%, as the estimated $2.3 trillion in excess savings that consumers squirrelled away during the pandemic has dwindled to less than $1 trillion.

Wednesday 2/8

Walt Disney reports first-quarter fiscal-2023 results. Shares plunged 43.9% last year, the company’s worst showing since 1974, as investors valued profitability over growth in Disney’s streaming division.

CME Group, CVS Health, Dominion Energy, Eaton, Emerson Electric, Equifax, Equinor, MGM Resorts International, O’Reilly Automotive, TotalEnergies, Uber Technologies, and Yum! Brands release quarterly results.

Thursday 2/9

AbbVie, AstraZeneca, Duke Energy, Expedia Group, Hilton Worldwide Holdings, Interpublic Group, Kellogg, Motorola Solutions, PayPal Holdings, Philip Morris International, and S&P Global hold conference calls to discuss earnings.

The Department of Labor reports initial jobless claims for the week ending on Feb. 4. Claims averaged 191,7500 in January, 26,000 fewer than in December, and remain historically low. Federal Reserve Chairman Jerome Powell, at the FOMC news conference this past week, cited 1.9 job openings for every unemployed person as something that needs to come into better balance. The reported unemployment rate hit a half-century low of 3.4% in January.

Friday 2/10

Global Payments, Honda Motor, IQVIA Holdings,and Newell Brands report quarterly results.

The University of Michigan releases its Consumer Sentiment Index for February. The consensus estimate is for a bearish 65 reading, roughly even with the January figure. Consumers’ expectations for year-ahead inflation was 3.9% in January, the lowest level since April of 2021. The Fed has stated that expectations for inflation play an important role in determining actual inflation. Powell recently said that inflation expectations were “well anchored,” meaning that consumers’ expectations for future inflation aren’t sensitive to current inflation.