The Federal Reserve's preferred gauge of rising prices is expected to show decades-high inflation kept falling last month -- but just barely.

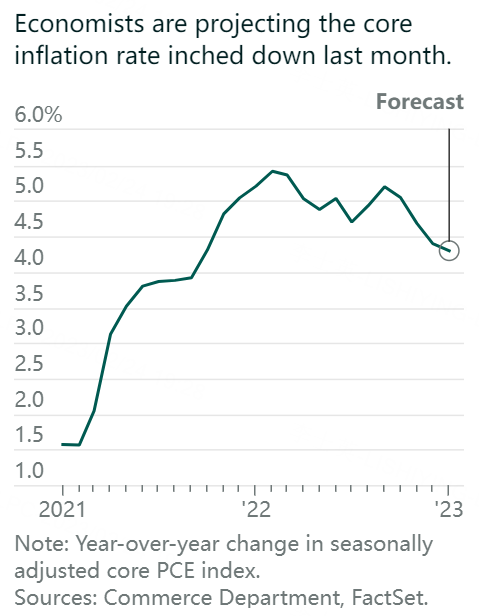

Economists surveyed by FactSet project the core personal-consumption expenditures price index, which excludes volatile food and energy prices, rose 4.3% year over year in January, according to FactSet. That would represent a fourth straight month of declines in the annual rate and a slight deceleration from the 4.4% growth seen in December.

Month over month, the core inflation gauge is expected to rise 0.4% in January, an increase from December's 0.3% rise.

The headline PCE price index, which includes food and energy prices, is forecast to be up 4.9% year over year, compared with 5% in December.

January's data will be released at 8:30 a.m. Eastern on Friday and will be closely watched.

The Fed has embarked on a historic campaign to bring inflation back to its goal of 2% growth by raising interest rates. Since March, the central bank has hiked rates eight times and expects to continue doing so. Minutes from the most recent Fed meeting showed officials' commitment to maintaining a tough stance until "incoming data provided confidence that inflation was on a sustained downward path to 2%." Officials acknowledged this was likely to take some time.

Investors are concerned the Fed's fight is far from over and the central bank will continue to raise rates and keep them there higher for longer. Last year's rate hikes resulted in the worst year for the stock market since 2008. This year was off to a better start until a recent selloff, triggered by concerns about inflation, pushed the Dow Jones Industrial Average back into negative territory this year.

Expectations for the Fed to raise interest rates at its March 21-22 meeting by a more aggressive half of a percentage point have increased to 27% on Thursday from 1.3% a month ago, according to the CME FedWatch tool. A hotter-than-anticipated PCE reading, combined with recent data that showed a strong jobs market and healthy consumer, could increase those odds and spook investors further.

Of course, there's possibility for some relief. Should PCE fall more than expected, it'd provide a counterbalance to inflation data released earlier this month that showed the Fed had more work to do. That gauge -- the consumer price index -- climbed at a 6.4% annual pace in January, a slight slowdown from December's 6.5% pace.