How will Chinese ADRs Perform? Know the History, Risks, Cycles, Opportunities Now

Hi Tigers, This article mainly focuses on Chinese ADRs with four major risks, two positive perspectives from both China and US market, Long term and shortterm outlooks, when the bear market will ends and how to choose potential winners during recession.

Disclamer: The opinions in this article are for exchange only. If you have more questions to this article, welcome to write your comment, Thanks.

"We're not looking to decouple from China. We're looking to reduce risk and diversify our relationship with China," U.S. President Joe Biden told a news conference after the G7 leaders' summit on Sunday. The G7 group has reached an agreement on China, and Biden has hinted that he may soon meet with the Chinese president.

The communication with China and easing of relations are bound to be necessary actions for the continuation of US interests in China. The same that many companies in China will also benefit from the positive shift between China and the United States, especially Chinese companies listed in the United States.

Investors would continue to pay attention to some communication issues between China and the US in the future. In the near term, regarding the issue of auditing of Chinese concept stocks, we may see exchanges and cooperation between China and the US regulatory agencies.

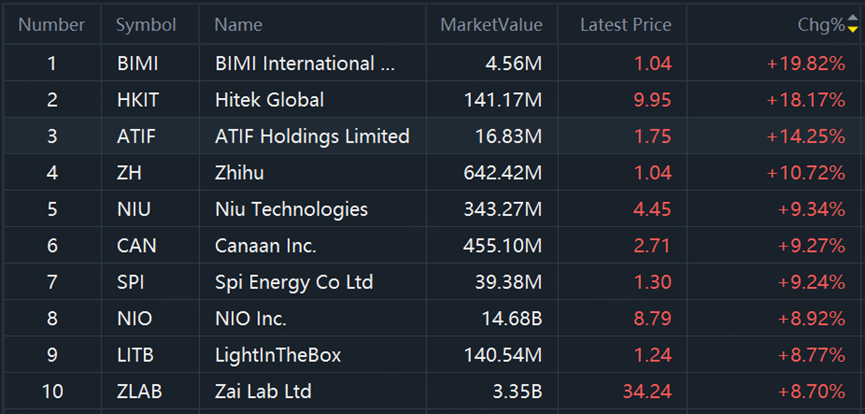

As of May 22, on Monday's trading day, most Chinese concept stocks rose.

The top 10 day winners of Chinese ADRS are $BIMI International Medical Inc(BIMI)$ $Hitek Global(HKIT)$ $ATIF Holdings Limited(ATIF)$ $Zhihu(ZH)$ $Niu Technologies(NIU)$ $Canaan Inc.(CAN)$ $Spi Energy Co Ltd(SPI)$ $NIO Inc.(NIO)$ $LightInTheBox(LITB)$ $Zai Lab Ltd(ZLAB)$

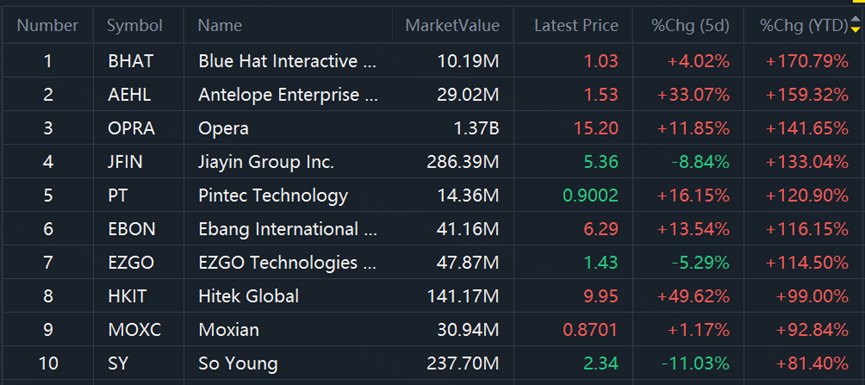

As of Monday Trading the top 10 YTD Chinese ADRS winners in 2023 are $Blue Hat Interactive Entertainment Technology(BHAT)$ $Antelope Enterprise Holdings Limited(AEHL)$ $Opera(OPRA)$ $Jiayin Group Inc.(JFIN)$ $Pintec Technology(PT)$ $Ebang International Holdings Inc.(EBON)$ $EZGO Technologies Ltd.(EZGO)$ $Hitek Global(HKIT)$ $Moxian(MOXC)$ $So Young(SY)$

Speaking of Chinese ADRs, since 2023, the entire market has indeed fluctuated greatly, and the low point this year was on May 10. The performance was not only a great shock to Wall Street investors, but also shock to some friends in Europe and the Middle East.

$Invesco Golden Dragon China ETF(PGJ)$ $CSI China Internet ETF(KWEB)$

Previously, on March 17, I was in New York, USA, and made a sharing on the factors of volatility and future development of Chinese ADRs.

My core point of view is: "Chinese ADRs have experienced a lot of challenges in recent years, including policy changes in some industries, regulatory agencies' requirements for financial information disclosure, and the impact of tensions in Sino-US relations. At the beginning of the year, China gradually relaxed At the same time, some Chinese concept stocks announced that their financial report performance exceeded expectations, and the overall Chinese concept stock sector rebounded. After then stocks keep low momentum. I still suggest that investors can start to analyze the financial and valuation conditions of individual stocks, and seek stocks with fundamentals will improve to achieve better investment returns in future!"

The following is about the listing history of Chinese ADRs, the four major risks they are facing, when will the bear market of China concept stocks end? and some thoughts on how to make valuations for Chinese ADRs.

Currently, The market value of Chinese ADRs has fallen to about 1 trillion US dollars, down from a $2.5 trillion in early 2022. There used to be more than 500 Chinese companies listed in the United States, and now are about 225 companies. More than 1/2 have been either merged and acquisitions, or delisted, or privatization, etc.

1.There are about four waves of upsurges for Chinese companies to go public in the United States.

The first wave was in the 1990s when mainly Chinese state-owned enterprises were transformed into corporations and then listed in the United States to obtain certain foreign capital. Looking at the Chinese ADRs in this wave most have stable performance in the medium and long term with dividends relatively normal.

The second wave was around 2000 which the situation was very different. The wave of Chinese ADRs IPOs were entirely based on private companies, especially the Internet industry, corresponding to the US Internet boom, you must heard some well-known companies, such as $SINA Corp(SINA)$ $NetEase(NTES)$ $Renren(RENN)$ and so on. After 2001, the U.S. economy entered a recession, and then the Internet bubble burst, which led to a wave of downturns in Chinese ADRs. I remember that many Internet companies fell by 80% to 90%. Until a gradually recover in 2003 and 2004, then a new wave of bull market drives the third wave of Chinese companies listed in the U.S.

The third wave around 2005 was more interesting: it mainly includes some US-funded emerging companies that are benchmarking against the US companies. For example, everyone said that $Baidu(BIDU)$ was competing with $Alphabet(GOOG)$ , so as the companies such as China’s $Amazon.com(AMZN)$ , $NetEase(NTES)$ , and China’s $Netflix(NFLX)$ . The listed companies in this wave can be said to be the core companies of China concept stocks listed in the United States. Which also includes the famous $Alibaba(BABA)$ , $New Oriental Education & Technology(EDU)$ and so on. Then in 2014 and 2015, the European debt crisis emerged, and several countries in southern Europe experienced economic and financial problems, which led to turmoil in the global stock market. Therefore, the listing of Chinese concept stocks was considered to have stopped at that time.

Enters 2016, the fourth wave of Chinese ADRs listing boom, both in the amount of financing and the number of listed companies, it is the hottest wave in more than 30 years. You may know some chain coffee shops brand, EV batteries companies, Internet insurance companies and etc. This wave have the widest coverage of industries of Chinese company. Then in the 2018 and 2019, the boom have indeed reached a peak. Besides IPOs, there are also some spin-offs. This wave has basically ended after 2020. The main reason is that after the outbreak of the global pandemic happened.

2.Next, I would like to talk about four major risks faced by Chinese ADRs.

In general, I think regulation, geopolitics, interest rate hikes, and the pandemic are the four major risks that investors in Chinese concept stocks must face and consider about.

The first risk is regulatory, which I think the reason is for the sharp drop of Chinese ADRs in 2022. The risk was started to show at the end of 2019. It involved Sino-US trade negotiations, and also involved some regulatory issues of Chinese ADRs. As for the regulatory risk, it must divided into two parts: one is the regulatory risk in the United States, and the other is the regulatory risk in China.

Among the regulatory risks in the United States, all listed companies need to submit the PCAOB audit, which is the audit report of an accounting firm approved by the US Securities Regulatory Commission. The audit report includes the research on working papers and so on. Traditionally, Chinese ADRs have been treated relatively loosely in this regard. However, since some accounting problems occurred in a coffee chain company, the US Securities Regulatory Commission began to require companies that provide audits of Chinese ADRs to review the working papers of financial reports. During this review process, the issue of whether the data can be exported is involved. This is from the perspective of US regulatory agencies.

From the point of view of Chinese regulatory agencies, this involves the issue of data security. There are a lot of data in the financial statements of these listed companies, and whether these data involve personal privacy and other issues. The supervision in China and in the United States is a very huge legal challenge for Chinese ADRs. In my opinion, uncertainty of supervision is the core reason for the decline of Chinese ADRs in the past two years . Especially after the changes in regulations in the education industry last year, it can be said to be a devastating blow to the entire education industry. Some stock prices have fallen by more than 90%, or even more than 95%.

Therefore, the first and biggest risk of Chinese concept stocks is policy risk, which is faced by both China and the United States. Is there a solution to policy risk?

I personally think there are. I have also seen news recently that the securities regulators of China and the United States have some dialogues. I believe that this problem will eventually find a solution. Because after all, it is also a sector with a market value of 1 to 2 trillion US dollars, there should be some final solutions. Regarding audit papers and data security, there are so many listed companies around the world that actually have data security issues. I believe that a solution can be found.

The second risk that Chinese ADRs facing are the reason for China ADRs plummeted in 2023: global geopolitical risks.

Ukraine is now in a crisis of war. For institutional investors, they put positions Chinese ADRs, Ukraine, Russian stocks, and other emergency market stocks all together. When there is a crisis in an emerging market, investors will reduce their positions simultaneously at the same time. Therefore, this risk still exists. However, this not only corresponds to risks, but also opportunities. When the situation in Ukraine was eased, global stock markets may rose sharply, and when emerging market stock markets begin to recover, Chinese ADRs will also rise sharply.

The third risk I think is systemic risk, which is mainly related to the global interest rate hike. Everyone knows that the Federal Reserve has been raising interest rates this year. Before that, the Central Bank of Canada and the Bank of England raised interest rates, and the European Central Bank and Japan's interest rates were also rising. When global funds are raising interest rates, the cost of capital rises. Of course, the reason is inflation. When the cost of capital rises, it will have a negative impact on all stock markets, including Chinese ADRs. Therefore, I think this is a big risk that Chinese ADRs are currently facing this year. When there is a policy shift round, we may see a better liquidity situation.

The fourth risk still involves the issue of the Coronavirus. Although the most dangerous time of the global pandemic may have passed, some problems still occur from time to time. From the perspective of the risk of the pandemic, I think the solution is to slowly get out of the pandemic as the pandemic is gradually brought under control In the future, this risk of Chinese ADRs will be eliminated.

3. Of course, it is true that all Chinese ADRs cannot be killed with one stick. This sector has many positive meanings to both the United States and China.

From the perspective of China's economy, Chinese ADRs are actually a very important part of attracting foreign capital to the Chinese economy. For any economy, the investment of foreign capital has a very positive meaning to economic growth. Foreign investment in Chinese ADRs is actually a very convenient way to invest in the Chinese economy, without sending money to China to open a factory or provide some services. Overseas investors can also invest in China by buying Chinese ADRs. Therefore, Chinese ADRs are good way to the Chinese economy to attracts international capital inflows. From this point of view, China definitely need to support Chinese Companies list on US market.

From the perspective of the United States, Chinese ADRs should also be supported. The number of listed companies in the U.S. stock market in the past, from 1995 to 2010, reached a peak of 8,000 listed companies. By 2014, the total number of listed companies had dropped to around 4,000, and it has risen again in recent years. There are now a total of 4,600 listed companies in the United States (except for the pink sheet market). With these listed companies, the number increased, liquidity increased, and job opportunities also have been created, which has promoted the service industry, etc., including lawyers, accountants, investment banks, financial services, etc.

From these perspectives, Chinese ADRs in the United States are actually very positively evaluated by many American securities companies and exchanges. That’s why on the wall of the entrance hall of the New York Stock Exchange, there are photos of important companies listed on it in history and the largest one is the photo of Alibaba’s listing on the New York Stock Exchange.

Therefore, it can also be seen that Chinese ADRs are important to the US stock market. Both the Chinese economy and the US economy are helpful and positive.

4. Next, It's about my outlook on the future of Chinese ADRs market

From the perspective of medium and long-term investment, I think that if the long-term money, such as Mr. Munger, Mr. Buffett's partner, they bought $Alibaba(BABA)$ , he may not have this money for three to five years, seven or eight years. For example, in the first quarter, Hillhouse significantly increased its holdings in $Pinduoduo Inc.(PDD)$ , $SHELL PLC(RYDAF)$ , and $Alibaba(BABA)$. I think it is okay to buy some shares in some core Chinese companies in the medium and long term.

In the short term, I think the risks are still very, very huge right now. The risks were mentioned before as the geopolitical conditions, regulations are not in a clear solution. Therefore, from a short-term trading perspective, you can buy at bottoms. I think it will take some time for Chinese ADRs to welcome all these problems solved then entering a new upward cycle.

Markets, Investment: The Risk Of Delisting For The US Listed Chinese ADRs - Forbes India

5. So When will the bear market of Chinese ADRs ends?

I think the biggest risk this year is actually raising interest rates. When inflation is severe, the stock market is very, very difficult to trade. The last round of inflation at this level was in the 1970s. As we all know, in the 1970s, at least from the perspective of US stocks, there was no rise for more than ten years, U.S. stocks really started to rise when the interest rate reached its peak in 1981 and 1982, that is, after Volcker raised the U.S. federal funds rate to 18%, the U.S. economy entered a recession, and after a large number of companies went bankrupt, a new round of bull market began .

At present, as Powell also said, the inflation in the United States is the same as the inflation he experienced 50 years ago. Inflation corresponds to the need to raise interest rates, and corresponds to the deterioration of profits, including a serious increase in corporate costs, and so on. From the perspective of the stock market, Chinese concept stocks and U.S. stocks are also highly correlated in this regard and are affected by this risk.

There have been four waves of upsurge in Chinese ADRs in the United States for more than 30 years, and each wave lasts for 2 to 3 years. After the upsurge, there is a cooling-off period of about 3 to 4 years or a bear market period. The fourth wave ended at the end of 2020. The year 2022 and 2023, China concept stocks were very, very difficult. From a time perspective, I think there are still about a 2 to 3 year adjustment period, or the bottom area. After that, there should be a fifth round of new upsurge in Chinese ADRs. The financial market has always been cyclical, and this wave of huge financing and market boom in 2020 will take some time to calm down.

6. How to make a reasonable valuation on Chinese ADRs?

Some investors are concerned about how to reasonably value Chinese concept stocks that are still losing money? Let me give you a framework for thinking about this issue. In 2000, when the Internet bubble burst, a large number of companies also fell by 90% to 95%. In 2002, the U.S. ended its economic recession and began to recover in 2003. These stocks, including $Amazon.com(AMZN)$ at the time, rose by hundreds of thousands of times, including $NetEase(NTES)$ , etc. They were all one yuan at the time. Later it rose hundreds of times.

I think the most important thing now is to distinguish which companies can survive, and which companies may be delisted, or merged with other companies, or choose to be privatized, etc. Like case in 2008 or 2000, after the severe systemic risks at that time, as long as the companies survived, the stock prices rose very sharply afterwards.

Therefore, for this question, I think you must to choose, to pick those Chinese ADRs that everyone clearly believes will survive. As long as they can survive this round without going privatized, delisted, or merged, I think the next step for these companies is very, very large room for growth. Investors can also refer to the impact of the past few economic recessions on the stock market as a template to make investment choices.

Finally, if more readers are interested in Chinese ADRs, welcome to read a new book "From Trump to Biden and Beyond" written by myself and several authors on the Sino-US capital market in 2022. Thanks.

From Trump to Biden and Beyond

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Is it possible for Chinese ADRs to experience a similar growth trajectory as companies like Amazon did in the early 2000s? 🚀

What lessons can we learn from past economic recessions to make better investment choices in Chinese ADRs? 📈

How do we identify which Chinese concept stocks are likely to survive the current economic downturn? 🤔

What are the risks associated with investing in Chinese ADRs, and how can we mitigate them? 🛡️

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

这篇文章不错,转发给大家看看

Great ariticle, would you like to share it?

Sharing

👍👍👍