Who is selling Louis Vuitton? Can I buy the dip?

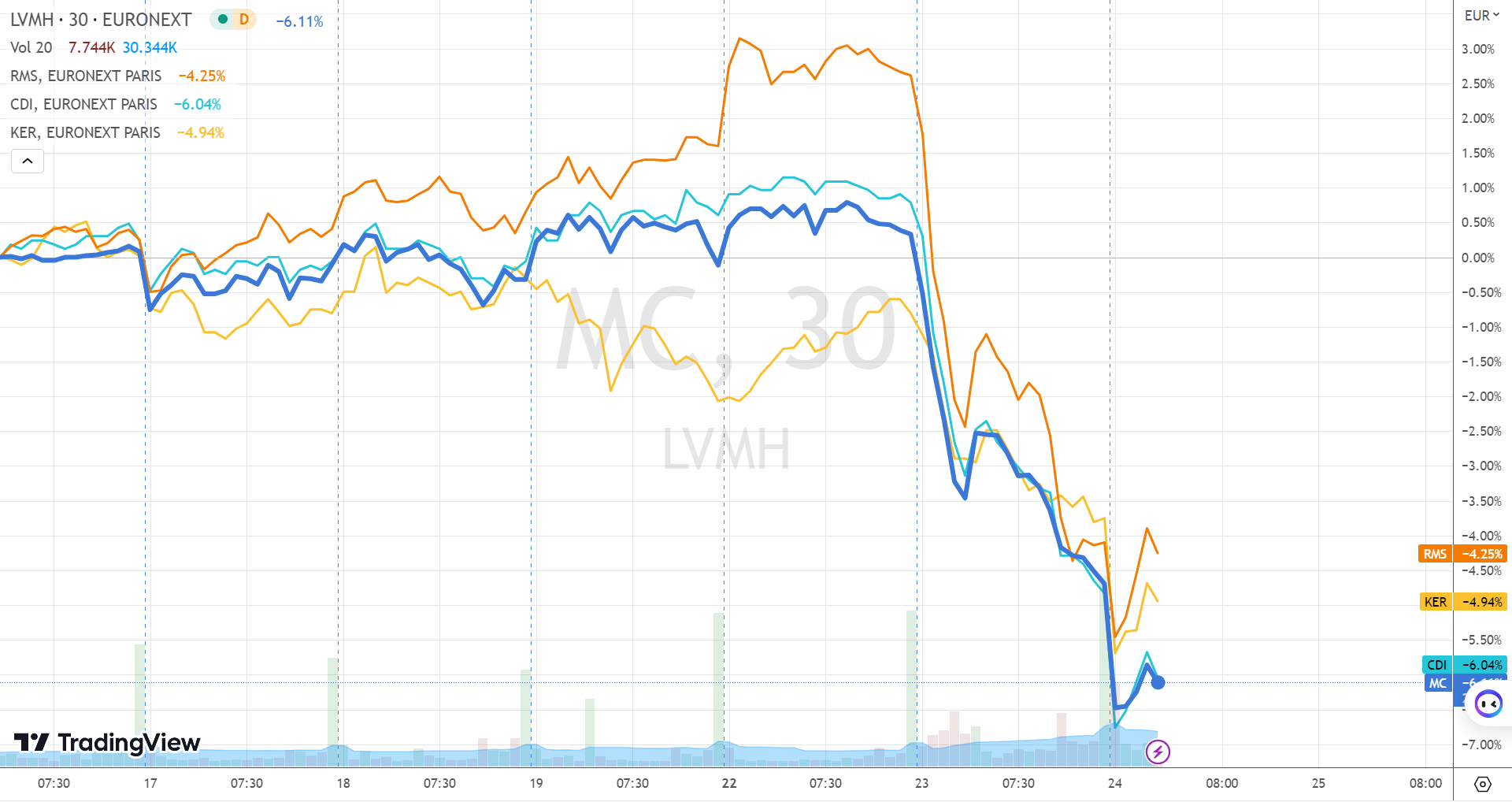

European luxury retailers represented by $LVMH-Moet Hennessy Louis Vuitton(LVMHF)$ and $Hermes International SA(HESAY)$ plunges on May 23, continue to crash after US opening, makign the largest single-day decline in a year.

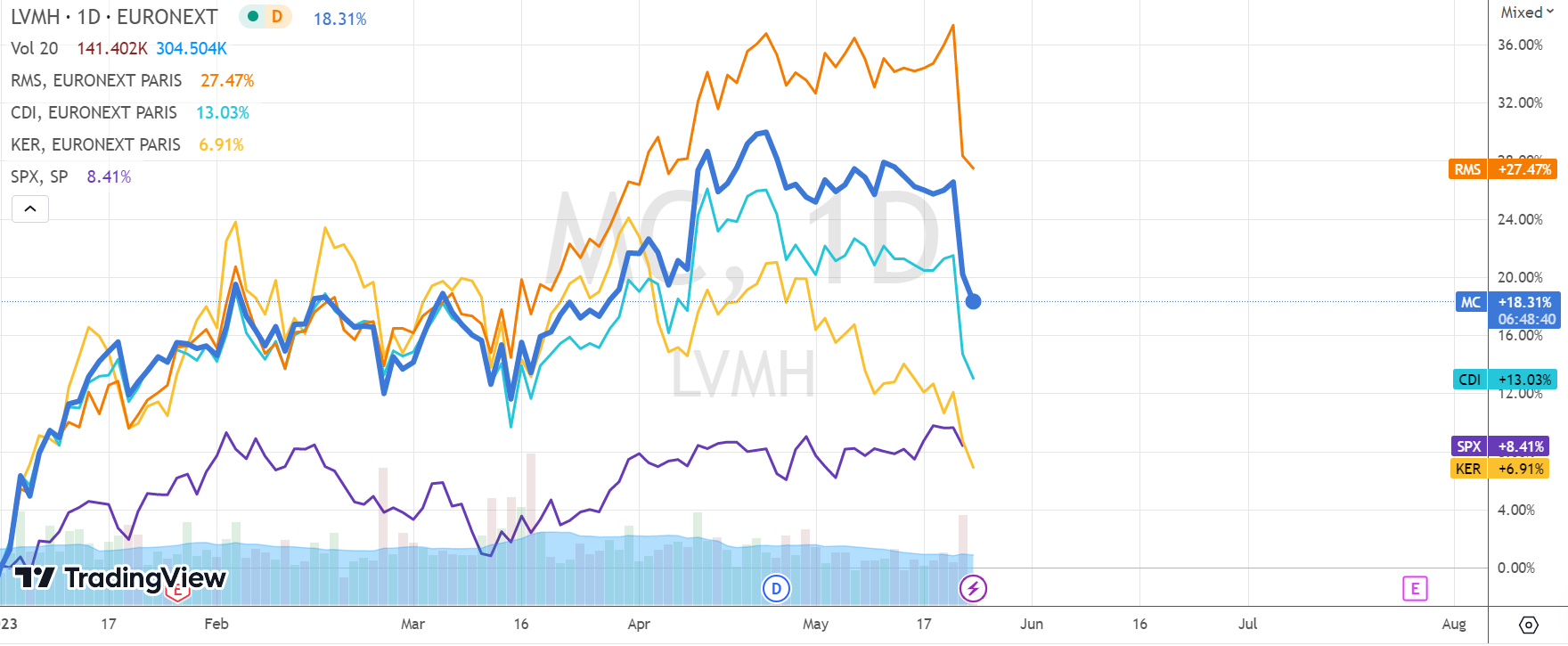

Most luxury goods companies are still performing better than the broader market in 2023, cuz they are different from other consumer products, their prices sometimes correlate with demand and have some anti-inflationary effects during inflationary periods. For example, LVMH raised its prices more than five times between 2019 and March 2023, each time boosting sales.

What caused this selling?

Firstly, luxury product prices do not necessarily reflect stock prices; rather it is investors' expectations for industry performance that drive them down.

Investors saw early warning signals such as multiple price increases by luxury groups and varying degrees of global inflation slowdowns which inevitably led to lower growth expectations in future. As a result, investors made decisions to reduce holdings accordingly. For instance, growth in America's market share - which accounts for 27% of LVMH's global sales - has slowed down while demand for entry-level luxury products (products that middle-class consumers can afford) has also weakened.

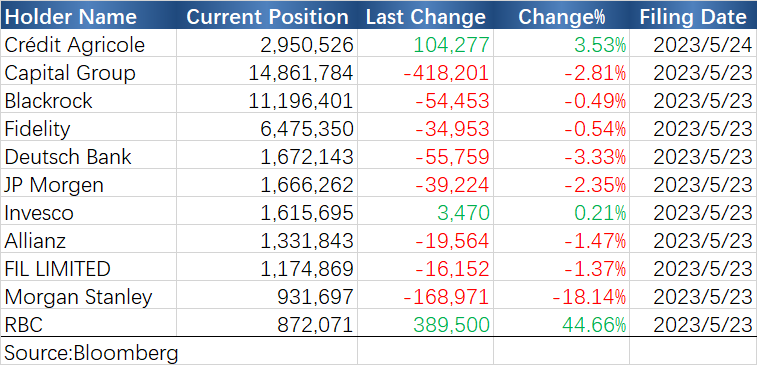

Secondly, low circulation ratios lead to chain reactions brought about by institutional portfolio adjustments. Lowered sales expectations are neither secret nor sudden revelations but rather well-known facts within investment circles regarding industries where institutional investors tend to hold large positions such as those found within Luxury Goods Stocks like LVMH listed on France’s exchange at €850 per share making it difficult for retail investors who lack pricing power compared with institutional ones.

On May 23rd , $Morgan Stanley(MS)$ and $Bank of America(BAC)$, two leading brokers ranked among top performers accounted for over thirty percent daily trading volume shares held by LV, RMS (Hermes) and CDI (Dior).

According to the latest disclosure documents, major institutional shareholders of LVMH such as Capital Group, $BlackRock(BLK)$ , Fidelity, Deutsche Bank(DB), MS and $JPMorgan Chase(JPM)$ have all reduced their holdings to some extent. Among the top 25 shareholders, MS sold more 18% its stake, while $Royal Bank of Canada(RY)$ took a counterparty against them.

Were these institutional investors planning on reducing their positions simultaneously on May 23rd? Obviously not, it was more likely a chain reaction where one investor saw another reduce its holdings triggering quantitative indicators that forced others to follow suit.

Is this a good opportunity to buy?

Fundamentally, current concerns are only about the decline in "American market" sales but there is strong support from China's newly opened markets which account for larger sales than America.

If investment banks lower expectations for the next few quarters it may provide an opportunity for subsequent performance exceeding expectations. Therefore this wave of portfolio adjustments is unlikely to continue without further business performance support and will probably result in repeated fluctuations.

However luxury goods stocks have already performed very well since the beginning of this year mostly outperforming $S&P 500(.SPX)$ index thereby overextending future earnings expectations making it difficult for them to continue reaching new highs or returning back to previous ones thus creating significant resistance.

Therefore luxury goods stocks can be part of anti-inflationary holdings (to avoid CPI exceeding expectations again) or targets for liquidation if they were purchased within two years prior at floating profits then taking advantage by reducing positions would be wise.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

If not how could student loans be a national issue that could be weaponize during election campaign fodder? Just saying...

Is the decline in American market sales a temporary or long-term issue for luxury goods companies?

What factors contribute to the correlation between luxury goods prices and demand?

How do institutional investors impact the luxury goods market?

What is the impact of China's newly opened markets on luxury goods sales? 🤔

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?