What Will Happen to the NASDAQ After the Special Rebalance? Maybe Nothing...

On Monday, the Nasdaq 100 Index will undergo the final "special weight adjustment", and the overall weight of technology stock giants will be lowered. Will this affect the rhythm of long-term US stocks, and will it cause relatively large fluctuations in the day?

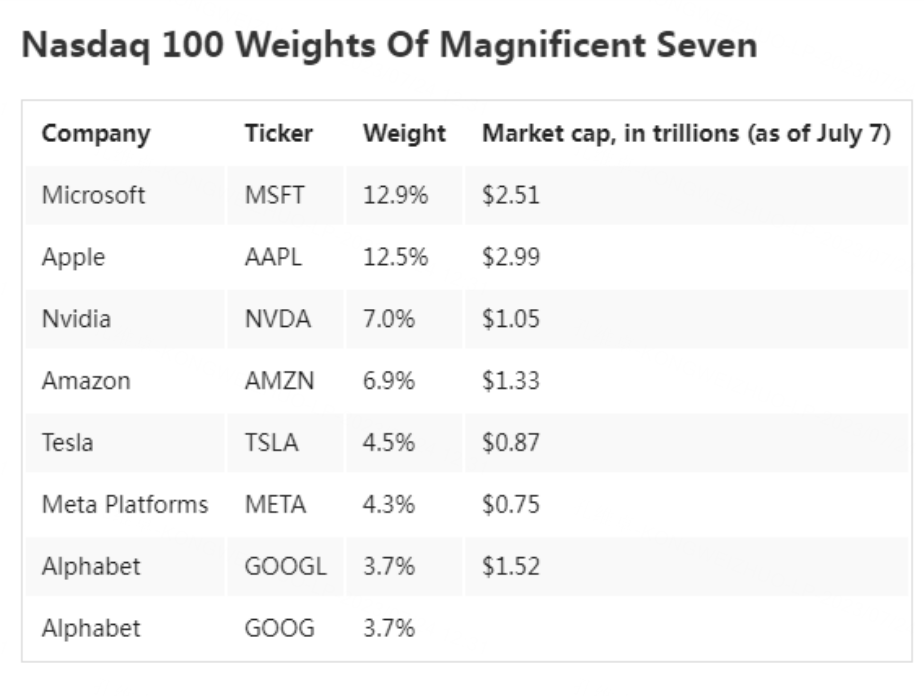

According to the market value rebalancing rule, among the 100 constituent stocks of Nasdaq,The weight of a single component cannot exceed 24%; At the same time, the total weight of constituent stocks with a single weight exceeding 4.5% cannot exceed 48%, otherwise it will be reduced to 40%. Since its establishment, Nasdaq has only made two special power adjustments, namely December 1998 and May 2011. According to Goldman Sachs' previous forecast, the total weight of seven major technology stocks, including NVIDIA, which caught fire this year, will drop from 55% to 43.7%While Broadcom, Adobe and Pepsi will have higher weights.

(Nasdaq refers to the "Big Seven")

As for the short-term market, we have noticed that the US stock index has declined slightly in the past two trading days,It can be said that it is tepid and does not show the precursor of abnormal fluctuation. In fact, Nasdaq announced the news in the middle of this month. It can be said that the market communication is enough, and the selling pressure of the market for technology blue chips is very short. It is worth noting that Apple's weight was as high as 20% in the last time, but after the weight was greatly adjusted to Microsoft, Apple's stock price did not fluctuate significantly.

For institutional investors, although they will make due adjustments with the trend, the fund management scale based on Nasdaq 100 is relatively small, far less than the scale of tracking S&P 500 index. In other words, the short-term impact of power adjustment on individual and institutional investors is within a predictable and limited range. Associated stocks and Nasdaq have basically been priced in advance in the past 2 weeks or so.

(Nasdaq refers to the performance of the message node and the first 2 trading days of the message)

So, in the long-term trend, will the index change due to adjustment?

The answer is probably no. We also refer to the last adjustment of Apple. After 2011, both Apple's stock price, Nasdaq and the general direction of US stocks have maintained the previous trend. Judging from the current mainstream hot topics (AI, etc.), it is difficult to shake the limelight of technology companies unless the black swan factor appears in the whole economic or political field.

On the whole, the adjustment of Nasdaq is in line with its original pricing (weight) model, and it also makes the market make certain preparations in advance in communication. Based on this, we judge that there will be no ups and downs in the upcoming actual power adjustment day. In addition, after the adjustment of power, we also believe that the problem of excessive concentration of star companies will not be easily solved. Because even if Nasdaq 100 undergoes rebalancing, its constituent stocks with a weight of more than 5% will have a total weight of 32%, which will still be too concentrated.

$NQ100 Index Main Connection 2309 (NQmain) $$SP500 Index Main Connection 2309 (ESmain) $$Dow Jones Main Link 2309 (YMmain) $$Gold Main Link 2308 (GCmain) $$WTI Crude Oil Main Link 2309 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- VivianChua·2023-07-26okLikeReport