Options Spy: BABA, Nvidia options bullish orders surge

Risk markets were also dampened by a rise in the US 10-year Treasury rate, the anchor of global asset pricing, above 4 per cent, the highest since November. U.S. stocks ended lower on Thursday as investors remained cautious ahead of a fresh batch of corporate earnings and non-farm payrolls data.

Technology stocks pared some losses as investors bought semiconductor stocks on dips. Energy stocks moved higher as oil prices found support after Saudi Arabia extended production cuts again.

Qualcomm's latest earnings were poor, with its shares plunging more than 8 percent and PayPa tumbling more than 12 percent, and the company's adjusted operating margin was 21.4 percent last quarter, worse than the previous quarter's performance. Amazon on Thursday reported second-quarter profit and revenue that beat analysts' expectations and issued guidance showing accelerating revenue growth, sending its shares up nearly 10 percent after hours.

On the data front, investors digested data showing the labor market remained strong ahead of the latest U.S. nonfarm payrolls report. The Labor Department released its latest jobless benefits data on Thursday. Initial claims for state unemployment benefits last week came in at an adjusted 227,000, in line with market expectations but down from 221,000.

After Fitch cut the U.S. debt rating to AA +, U.S. Treasury Secretary Janet Yellen on Thursday again slammed the ratings agency's decision as "completely unjustified" and would not change the fact that U.S. debt remains the preeminent safe and liquid asset.

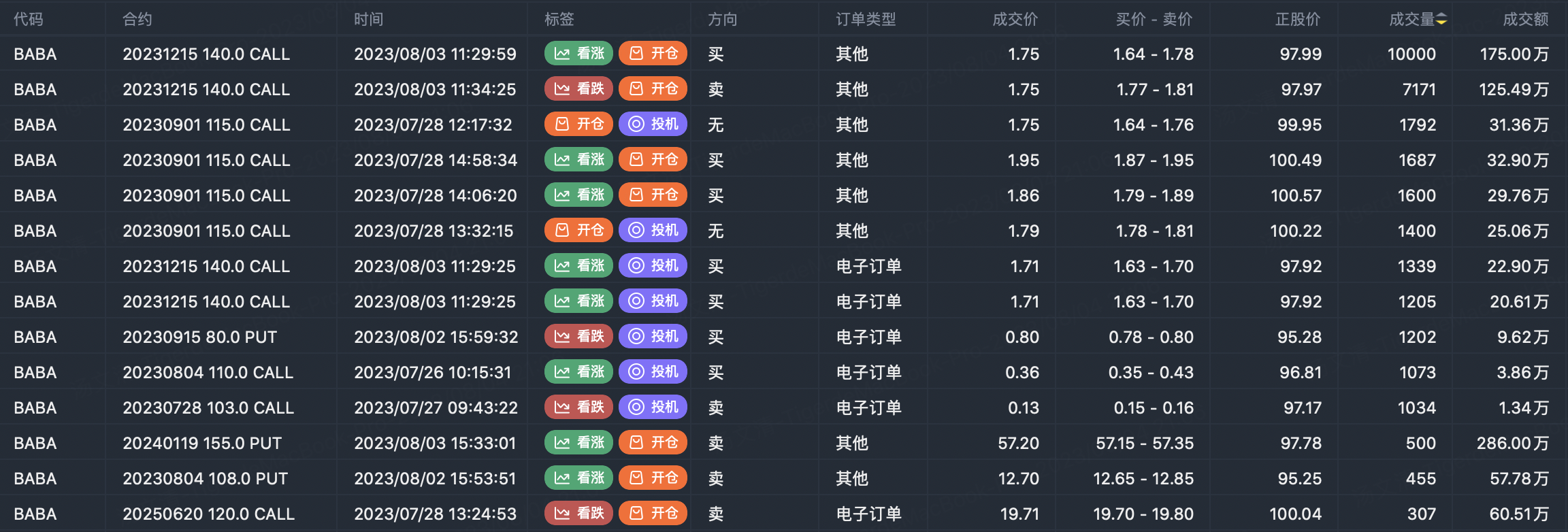

Alibaba's options transactions are mainly based on call options. September and December expiry call volume increased, options order strike prices are 115 and 140, respectively.

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

Option buyer open position (Single leg)

Highlight order:

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Highlight order:

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

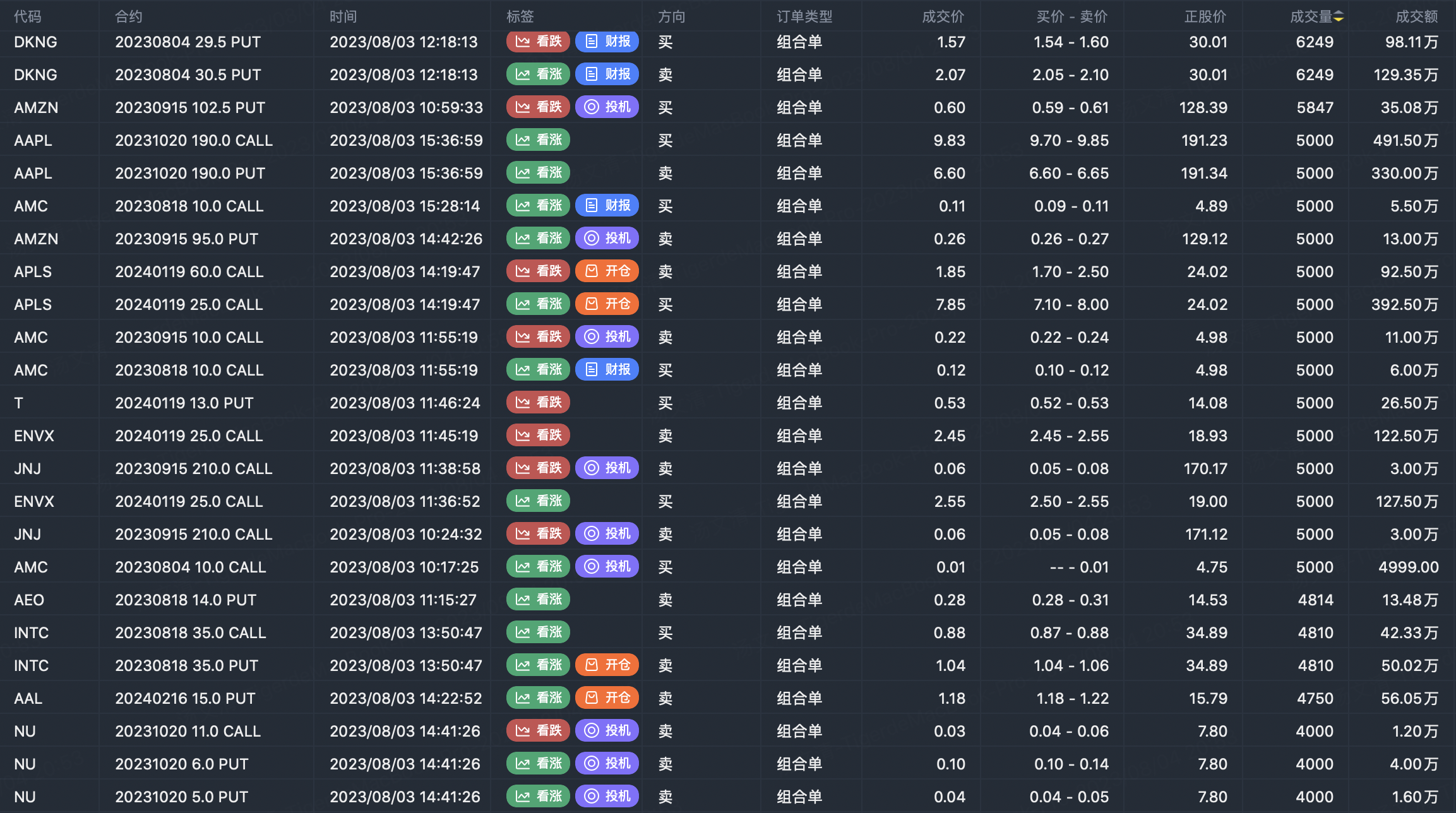

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

这篇文章不错,转发给大家看看