Options Spy: Institutions sell large Apple put orders, strike target price rebounds to 180

U.S. interest rates eased after a recent surge as investors awaited the annual meeting of global central banks this week. The Nasdaq fell 2.59% on last Friday, its third straight week of losses and its longest weekly decline since December.

The 10-year Treasury rate retreated below 4.3 percent after hitting its highest level since November 2007, but still posted its fifth straight weekly gain.

In political and economic news, investors are mulling the prospect that interest rates could stay higher for longer after Federal Reserve minutes showed the central bank would not rule out further rate hikes.

Clues on the Fed's next move will come from this week's annual gathering of global central bankers in JacksonHole, Wyoming, where Fed Chair Jerome Bauer is expected to discuss the U.S. economic outlook at a symposium on Friday.

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

Option buyer open position (Single leg)

Highlight order:

Buy TOP T/O: $TSLA 20250919 185.0 PUT$ $NVDA 20251219 425.0 PUT$

Buy TOP Vol: $CCJ 20230915 38.0 CALL$ $NU 20230915 6.0 PUT$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Highlight order:

Sell TOP T/O: $AAPL 20230908 180.0 PUT$ $TSLA 20230825 225.0 CALL$

Sell TOP Vol: $AAPL 20230908 180.0 PUT$ $NSPR 20230915 5.0 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

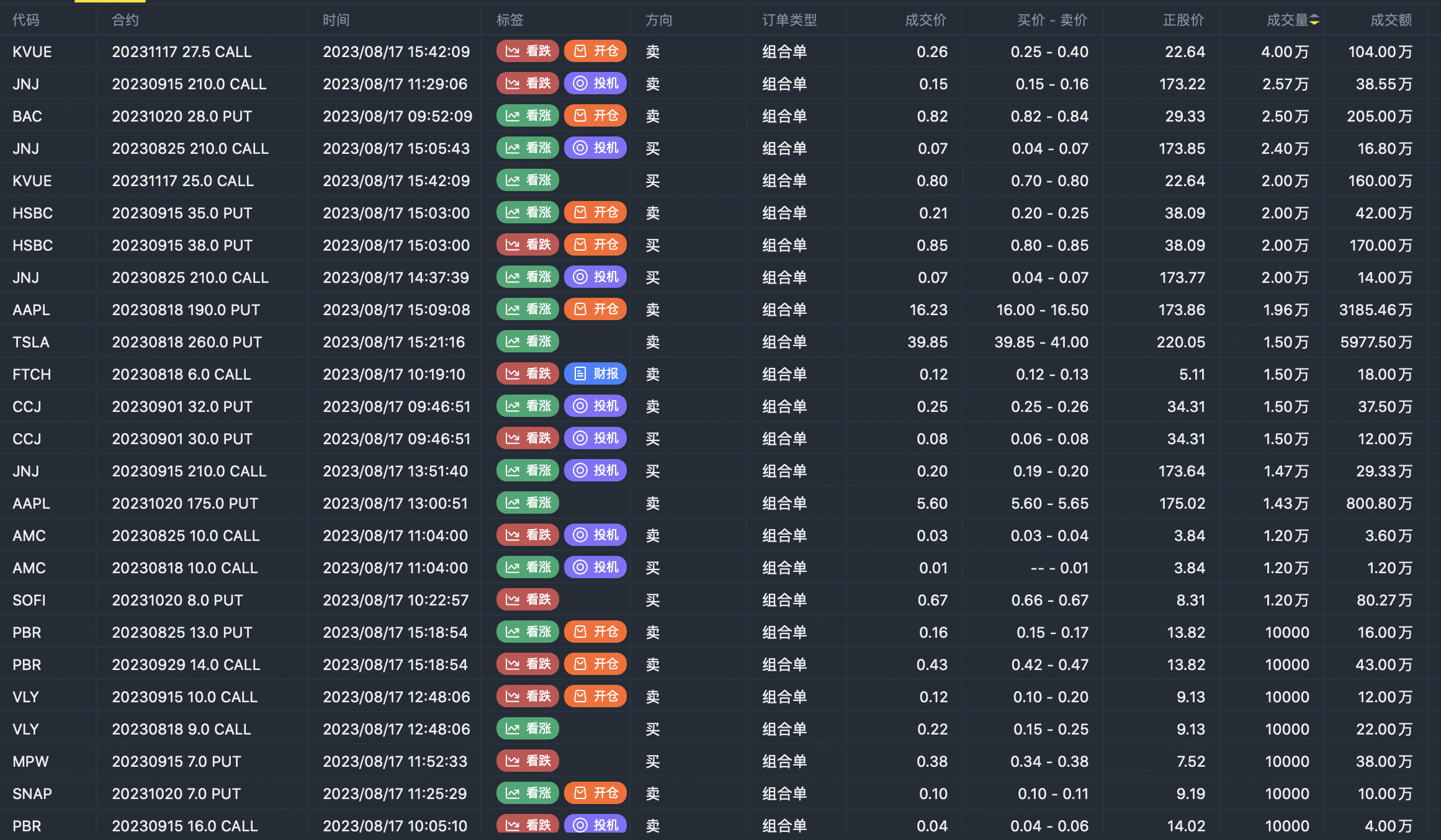

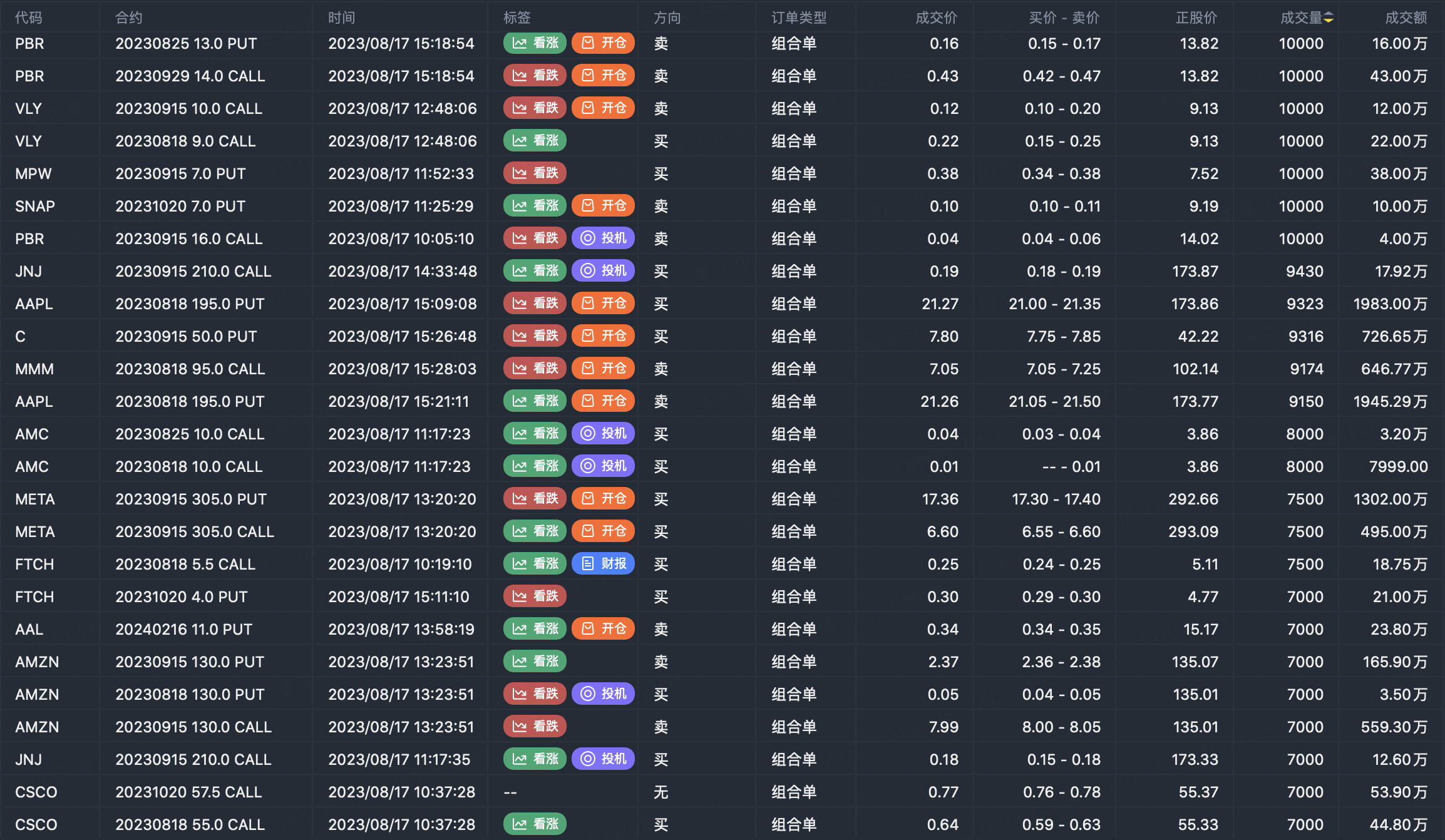

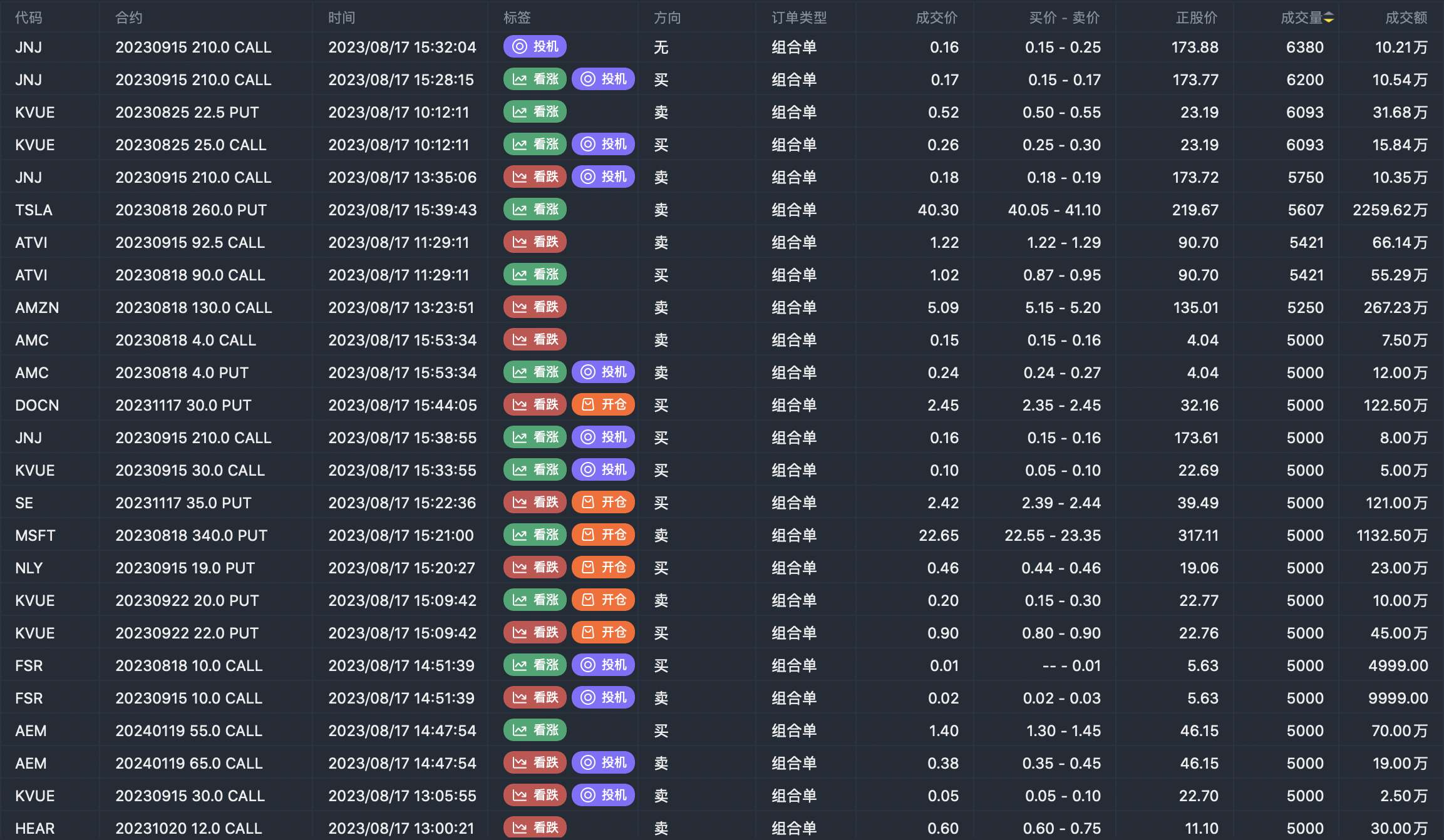

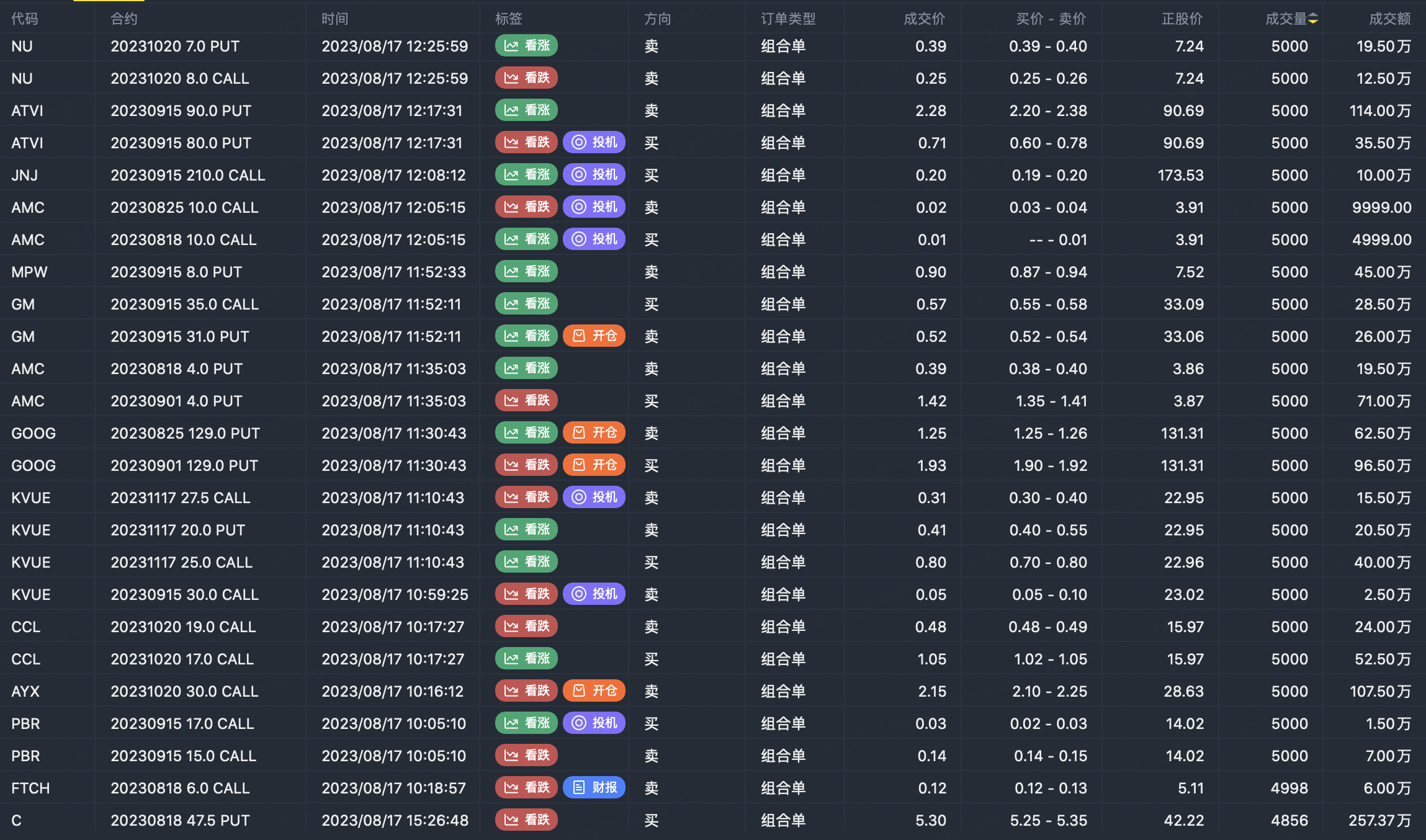

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Long term should be a good counter

Long term should be a good counter

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Artikel yang bagus, apakah Anda ingin membagikannya?

Wow