Options Spy | The bulls and bears are extremely conservative on the apple stock price

The United States in August unseasonally adjusted CPI annual rate of 3.7%, a new high since May this year, has risen for the second time in a row; The United States in August unseasonally adjusted core CPI annual rate of 4.3%, the lowest since September 2021, has declined for six consecutive months; The United States in August seasonally adjusted CPI rate recorded 0.6%, the highest since June 2022.

Yesterday Oracle fell by more than 13% due to the cold earnings report, Apple's share price fell after the autumn speech, and the three major indexes of the US stock market closed down on Monday (11).

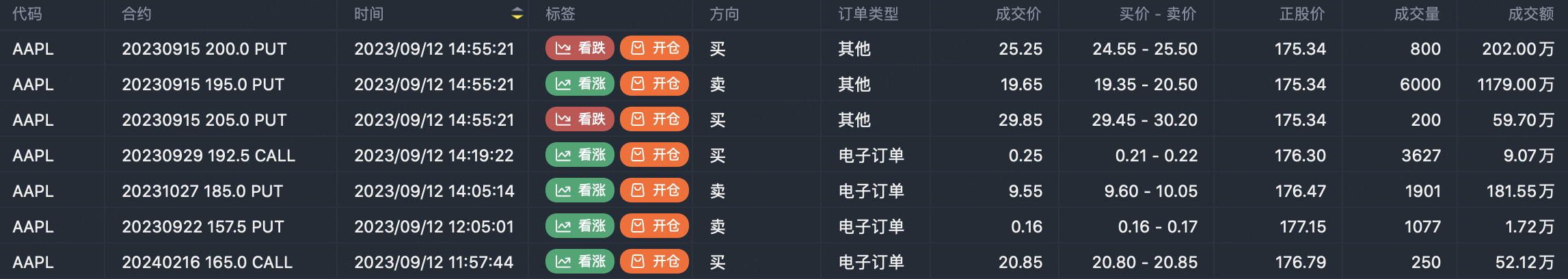

Before the end of the Apple options big order conference, it was mainly bullish, and after the end of the conference at 2 o 'clock, it was mainly bearish:

buy $AAPL 20230929 192.5 CALL$

buy $AAPL 20240216 165.0 CALL$

sell $AAPL 20230922 157.5 PUT$

sell $AAPL 20231027 185.0 PUT$

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

Option buyer open position (Single leg)

Buy TOP T/O:

$AAPL 20230915 200.0 PUT$ $CHPT 20231020 6.0 PUT$

Buy TOP Vol:

$CHPT 20231020 6.0 CALL$ $CHPT 20231020 6.0 PUT$

Other tech stocks:

$ORCL 20231117 105.0 PUT$ $TSLA 20240621 475.0 CALL$ $NVDA 20260116 500.0 CALL$

$ChargePoint Holdings Inc.(CHPT)$ Previously announced the second quarter earnings than expected, the Wall Street bank cut the target price. Citi cuts Chargepoint price target to $8.25 from $10.8; Evercore ISI lowered its price target to $17 from $20.

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Sell TOP T/O:

$AAPL 20230915 195.0 PUT$ $C 20250117 52.5 CALL$

Sell TOP Vol::

$C 20250117 52.5 CALL$ $CSCO 20240621 62.5 CALL$

Other tech stocks:

$ASML 20230915 700.0 PUT$ $CRM 20231020 260.0 CALL$ $ORCL 20231027 105.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

很棒的文章,你愿意分享吗?

Great article you want to share it

Bull or bear?

Vhddryu