What does a stronger than expected non-farm Payrolls mean for the market?

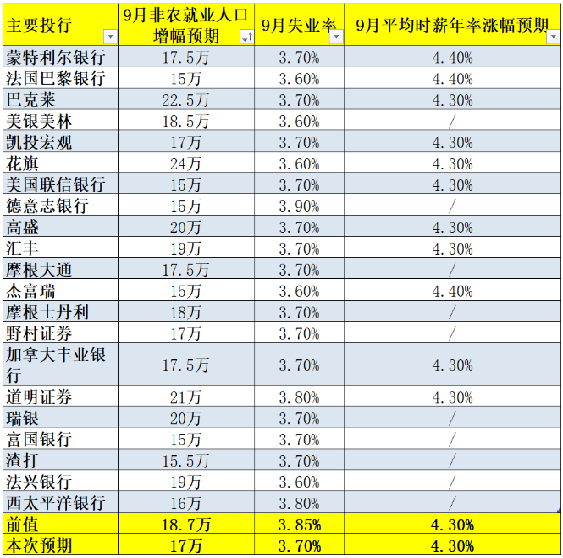

According to the forecast of 23 large investment banks, the increase of non-farm payrolls in the United States is expected to be between 150,000 and 240,000, the unemployment rate is expected to be between 3.6% and 3.9%, and the average hourly wage is expected to increase at an annual rate of 4.3%-4.4%.

The final data showed that the number of non-farm payrolls in the United States increased by 336,000 in September, the largest increase since the beginning of this year.Far exceeding the expected 170,000, the value was 187,000 in early August.

What is even more exaggerated is that the employment data of the previous two months has also been greatly revised upwards: the number of new people in August was revised up by 40,000 to 227,000; The number of new people in July was greatly revised from 157,000 to 236,000. The total number of people in July and August increased by 119,000 compared with the previous report.

Do you dare to believe such strong non-farm data? !

As the off the charts of non-farm employment growth will further strengthen the Fed's expectation of tightening, after the data was released, US stocks and US bonds once experienced a "flash collapse", the US Dollar Index rose, and non-US and gold and silver dived.

Let me show you the official explanation: The market has absorbed the impact of strong employment growth data, and besides employment, this report also shows that the unemployment rate did not fall and stabilize as expected in September.The unexpected slowdown in salary growth in August and September is good news that may stop the Fed's rate hike.If CPI and PPI inflation are moderate next week, along with job growth, that would be good news. Now the focus shifts to next week's inflation data.

After reading it, do you have the feeling of shooting an arrow, then drawing a target by yourself, and then saying that you hit the ten rings? If the market hadn't reversed overnight, then maybe the media reports you saw today should be: strong non-farm payrolls data, expected warming of Federal Reserve rate hike, sharp drop of US stocks, sharp rise of US bond yields and so on.

In fact, after the release of the non-farm payrolls data, according to the data tracked by CME group (CME), traders in the federal funds futures market will be before the end of the yearThe probability of rate hike has increased to about 44%. Swap prices show that the market has fully digested the Fed's interest rate cut from July to September next year.

There are technical analysis and explanations of time and space, which I have already said very straightforwardly; In fact, the focus is not on the technical side. Otherwise, why is October 3rd itself a window for changing the market? However, we didn't see a large rebound in the market on that day, but we needed to wait for the biggest non-farm data to land before the bulls launched a counterattack.

Therefore, the answer lies in the fundamentals. I need to spend so much space to explain to you-

Why is the US Congress fighting against each other?

What does the ouster of House President McCarthy mean?

Is it possible for Trump to be elected speaker?

What does Pelosi's direct expulsion from congressional offices after McCarthy's ouster mean?

Senate Majority Leader Chuck Schumer and other senior members chose to visit at this time node, which means what may happen next?

Believe it or not, such strong non-farm data,Perhaps many of you haven't realized that the prelude of the real big market is ready to open slowly.

$NQ100 Index Main Connection 2312 (NQmain) $$SP500 Index Main Connection 2312 (ESmain) $$Dow Jones Main Connection 2312 (YMmain) $$Gold Main Connection 2312 (GCmain) $$WTI Crude Oil Main Connection 2311 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Bank’s data itself are complex as bankers. so does its figures

Does so many non-farm employment thing matters!