Here's How The Israeli-Palestinian Conflict May Cause the Next Oil Crisis

US President Biden flew to the Middle East in a hurry, but still failed to prevent the tragedy from happening.

On the 17th, local time, the "Ahli Arab Hospital" (also known as Baptist Hospital) in Gaza City, Gaza Strip was attacked by air, killing at least 500 Palestinians. Jordanian Foreign Minister Safadi announced in the early morning of 18th that he would cancel the quadripartite summit with the United States, Egypt and Palestine.

At the meeting in Jeddah, Iran's foreign minister stressed the need to sanction Israel, impose an oil embargo and withdraw its ambassador.

Affected by this, the risk aversion warmed up across the board. The price of spot gold once climbed to $1,962/oz, and WTI crude oil once surged to $88.57/barrel. At present, both of them have declined.

Of course, due to the fear of further deterioration of the situation in the future, stock markets around the world have been under selling pressure recently, and the yield of the 30-year Treasury Bond in the United States has also climbed to a one-week high of 5.01%.

Up to now, relevant sources of OPEC + said that after the Iranian foreign minister called for an oil embargo against Israel, there is no special plan to hold such actions for the time being.

But the Iranian foreign minister's statement certainly gives people the feeling of dreaming back to the 1973 oil crisis.

At that time, OPEC members, led by Saudi Arabia, announced an oil embargo on countries that supported Israel during the Yom Kippur War. The initial target countries were Canada, Japan, the Netherlands, the United Kingdom and the United States before the embargo was extended to Portugal, Rhodesia and South Africa. The embargo lasted for nearly a year and officially ended in March 1974.

For the Fed,If oil prices are pushed up again because of geopolitical tensions, the efforts made by radical rate hike to fight inflation for more than a year before are likely to be wasted.

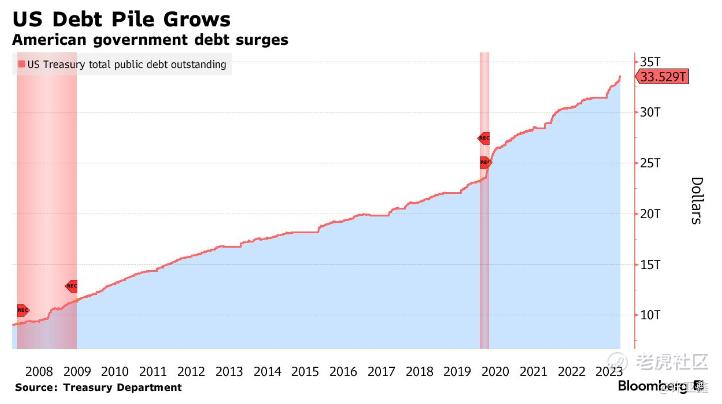

On the other hand,The Fed faces potential policy pitfalls as investor concerns grow over the U.S. government's massive $33.5 trillion debt.Concerns about the US fiscal future have already sent US Treasury Bond yields soaring, surprising policymakers and prompting them to consider temporarily postponing another rate hike plan.

Federal Reserve Chairman Colin Powell will address the New York Economic Club later this week to lay out his views on the soaring yields in the U.S. Treasury Bond.

Fed watchers expect Powell to acquiesce to the consensus among policymakers that higher yields give them an opportunity to keep interest rates stable during their Oct. 31-Nov. 1 policy meeting to assess the economic outlook. But with inflation still faster than the Fed's 2% target, Powell could still keep the possibility of a rate hike later this year.

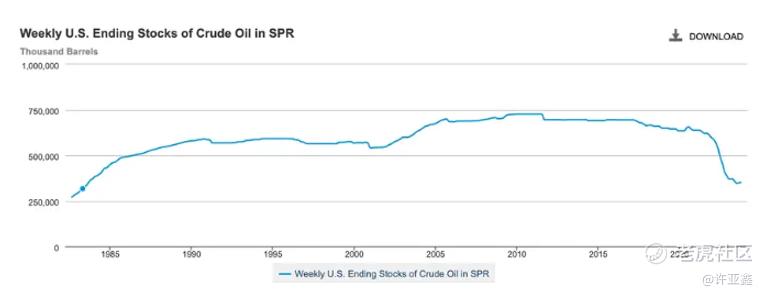

Beyond the Fed's debt woes, the US government siphoned 180 million barrels of crude from its Strategic Petroleum Reserve (SPR) last year in the wake of the Russian-Ukrainian conflict. At present, the crude oil reserves in the United States are 351 million barrels, which is the lowest level in 40 years.That's less than half the all-time high since 2010 and about 40% below the level when it was first used.

This means that if a new round of oil crisis really breaks out in the future, it is likely to be a serious economic crisis or even a financial crisis.

At present, all this depends on whether the Palestinian-Israeli conflict will get out of control further. Perhaps this is why Biden visited the Middle East in person this time.-END-

$NQ100指数主连 2312(NQmain)$$SP500指数主连 2312(ESmain)$$道琼斯指数主连 2312(YMmain)$$黄金主连 2312(GCmain)$$WTI原油主连 2311(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Lfg