Options Spy | Big Amazon 0DTE call options orders ahead of earnings

The market continues to focus on tech earnings and economic data. Jpmorgan Chase CEO Jamie Dimon slammed central banks on Tuesday for being "100 percent wrong" in their economic forecasts last year, as he took a very cautious view of next year's economic outlook. "The combination of factors has made it more difficult to forecast the economy, and you have to be prepared for possibilities and probabilities rather than just one scenario, which I don't see anybody doing right now."

The U.S. economy is coming off its hottest summer since 2020, according to economists surveyed by The Wall Street Journal, who are renewing fears of an impending recession.

However, Joseph Quinlan, chief market strategist at Bank of America Wealth Management, said that historically, U.S. recessions tend not to last for long periods of time, which could be a favorable entry point for U.S. equity investors.

Quinlan said the average length of a U.S. recession since World War II has been about 10 months, but that hasn't stopped the S&P 500 from bouncing back over several months and Posting solid returns. In the 12 post-1945 U.S. recessions, the S&P 500 managed to bounce back from its lows even as the economy remained weak, returning an average of 19.7% in the three months following the bottom, 28% in the six months and 43.7% in the 12 months.

On average, the S&P 500 tends to peak 13 months before the start of a recession, bottom out some time before the recession officially ends, and even begin to recover when some data still show contraction. Quinlan describes this kind of recession as a "reboot/revitalization period," which usually leads to a stronger economy in the aftermath.

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

Microsoft's first-quarter results for fiscal year 2023, announced after hours on Tuesday, beat Wall Street expectations and boosted profits due to a slowdown in operating expenses, prompting shares to rise nearly 6 percent after hours.

Driven by a rebound in its advertising business, Alphabet on Tuesday (24) reported an 11% annual increase in revenue last quarter, reaching double-digit growth for the first time in more than a year, but the cloud business performed far less than expected, dragging down its shares by more than 6% after hours.

NVDA said on Tuesday (24th) that new US export restrictions took effect on Monday that will prevent its advanced artificial intelligence (AI) chips from being sold to China. NVDA, however, did not expect the new restrictions to have a short-term impact on its revenue, but did not say why the U.S. government shortened the time the new ban would take effect.

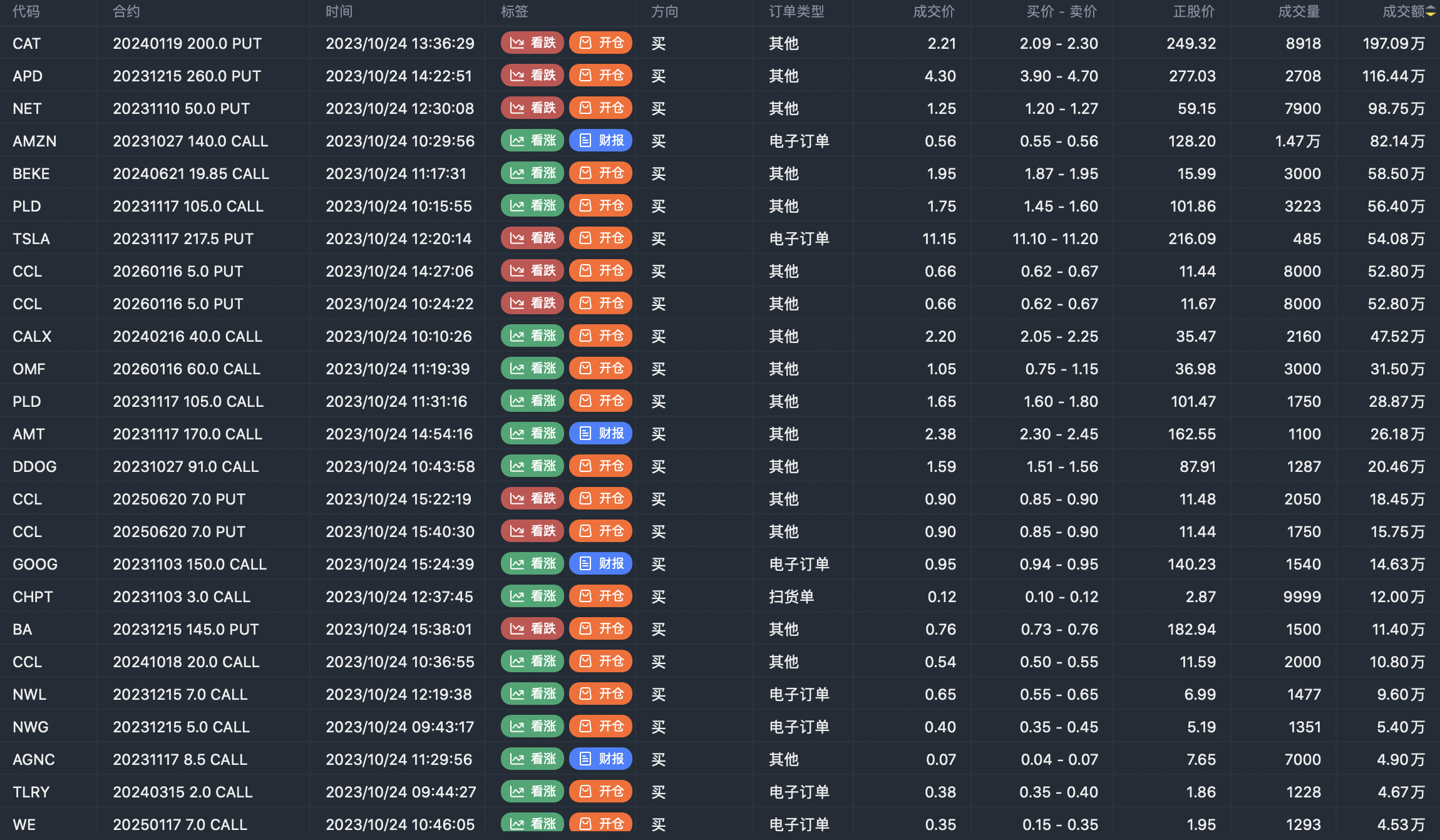

Option buyer open position (Single leg)

Buy TOP T/O:

$CAT 20240119 200.0 PUT$ $APD 20231215 260.0 PUT$

Buy TOP Vol:

$AMZN 20231027 140.0 CALL$ $CHPT 20231103 3.0 CALL$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

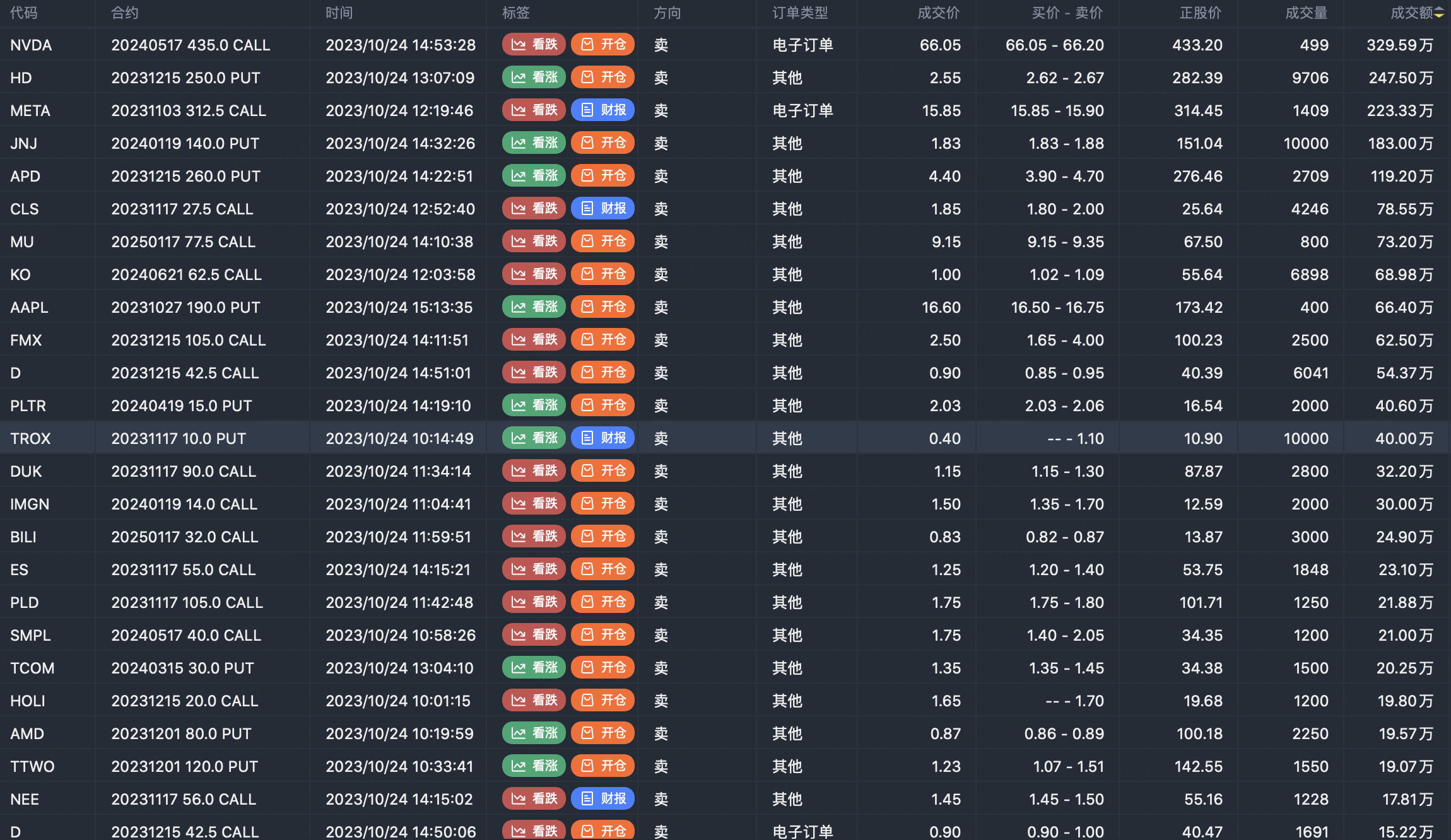

Option seller open position (Single leg)

Sell TOP T/O:

$NVDA 20240517 435.0 CALL$ $HD 20231215 250.0 PUT$

Sell TOP Vol:

$JNJ 20240119 140.0 PUT$ $TROX 20231117 10.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

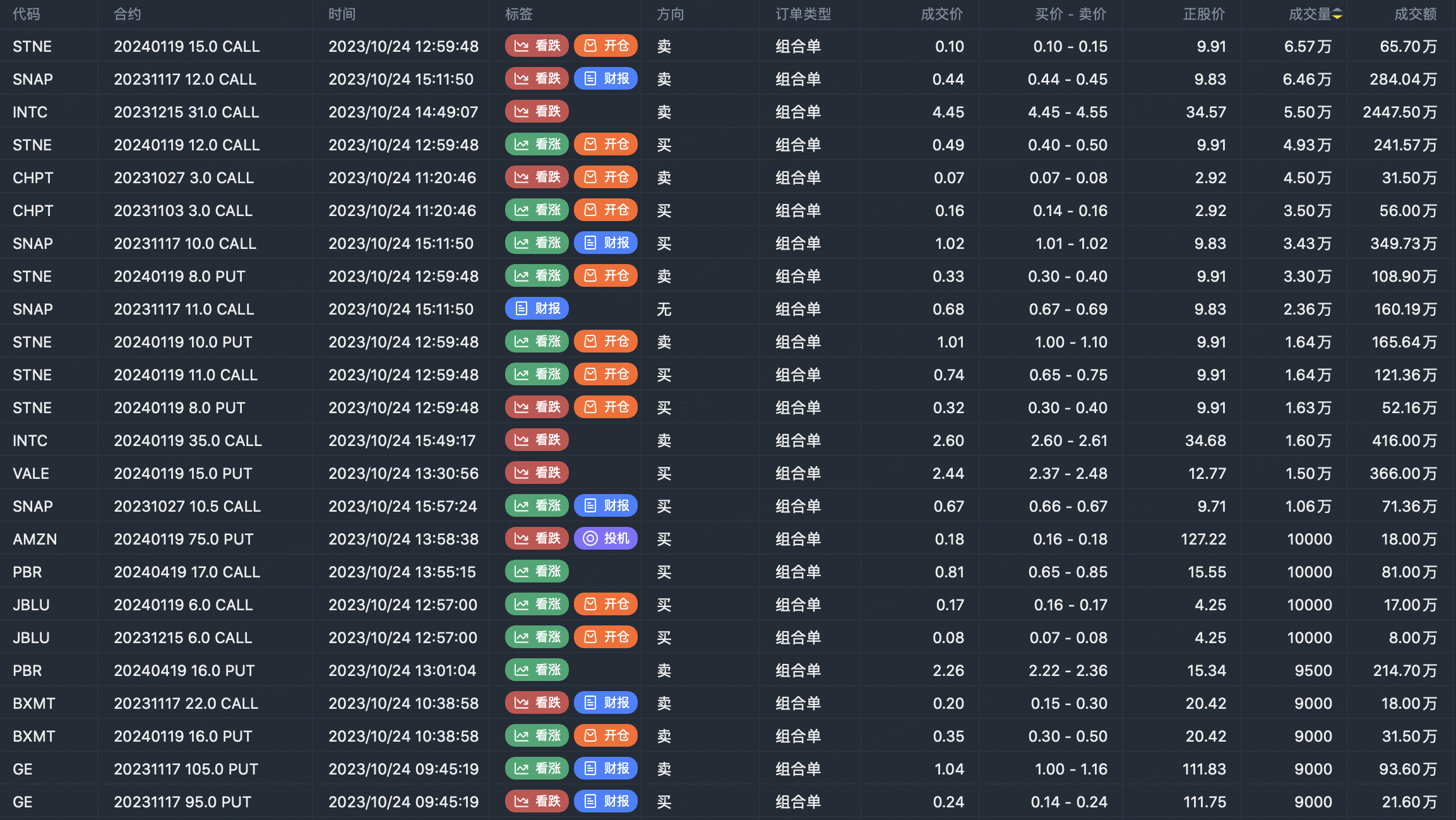

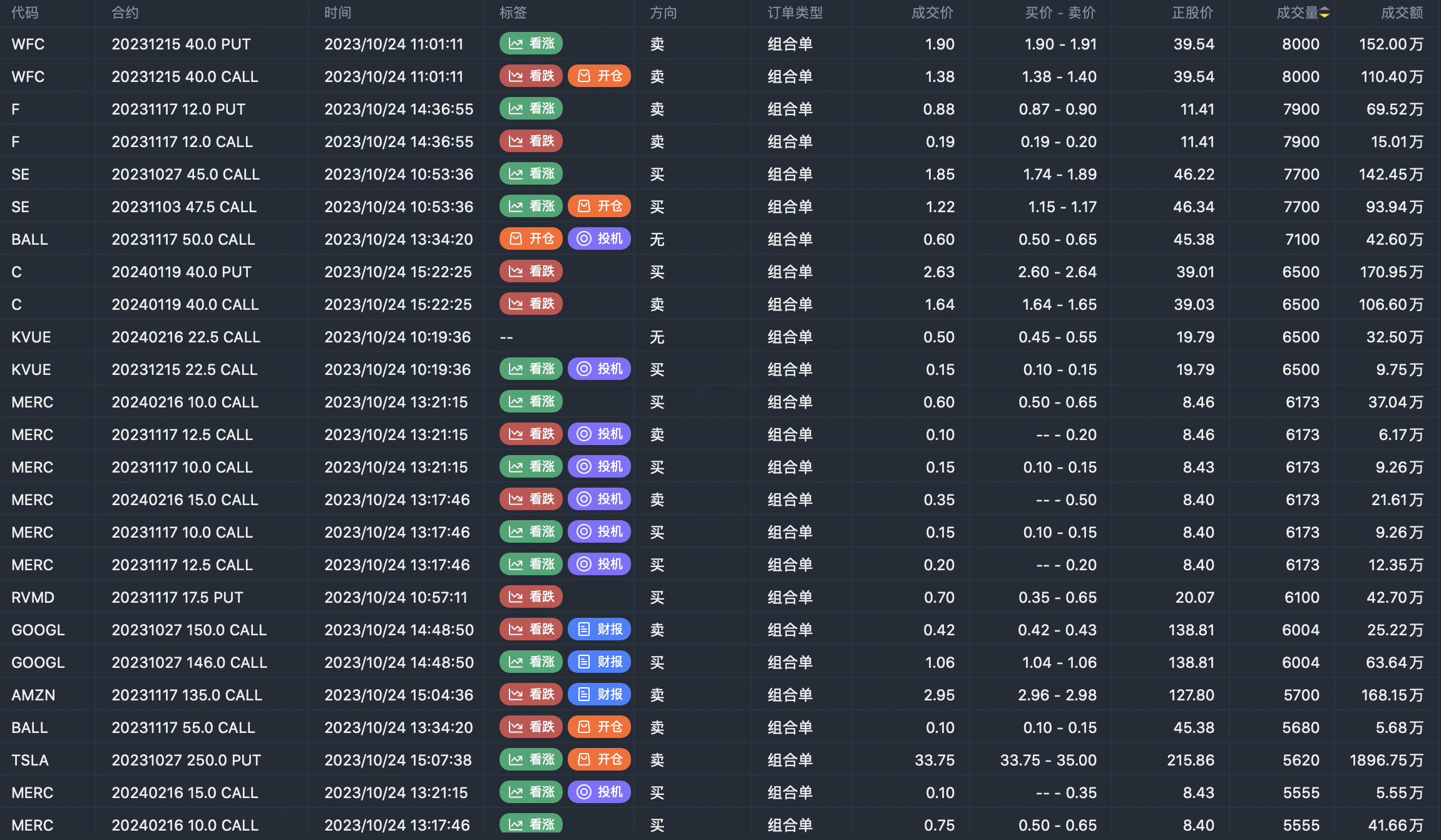

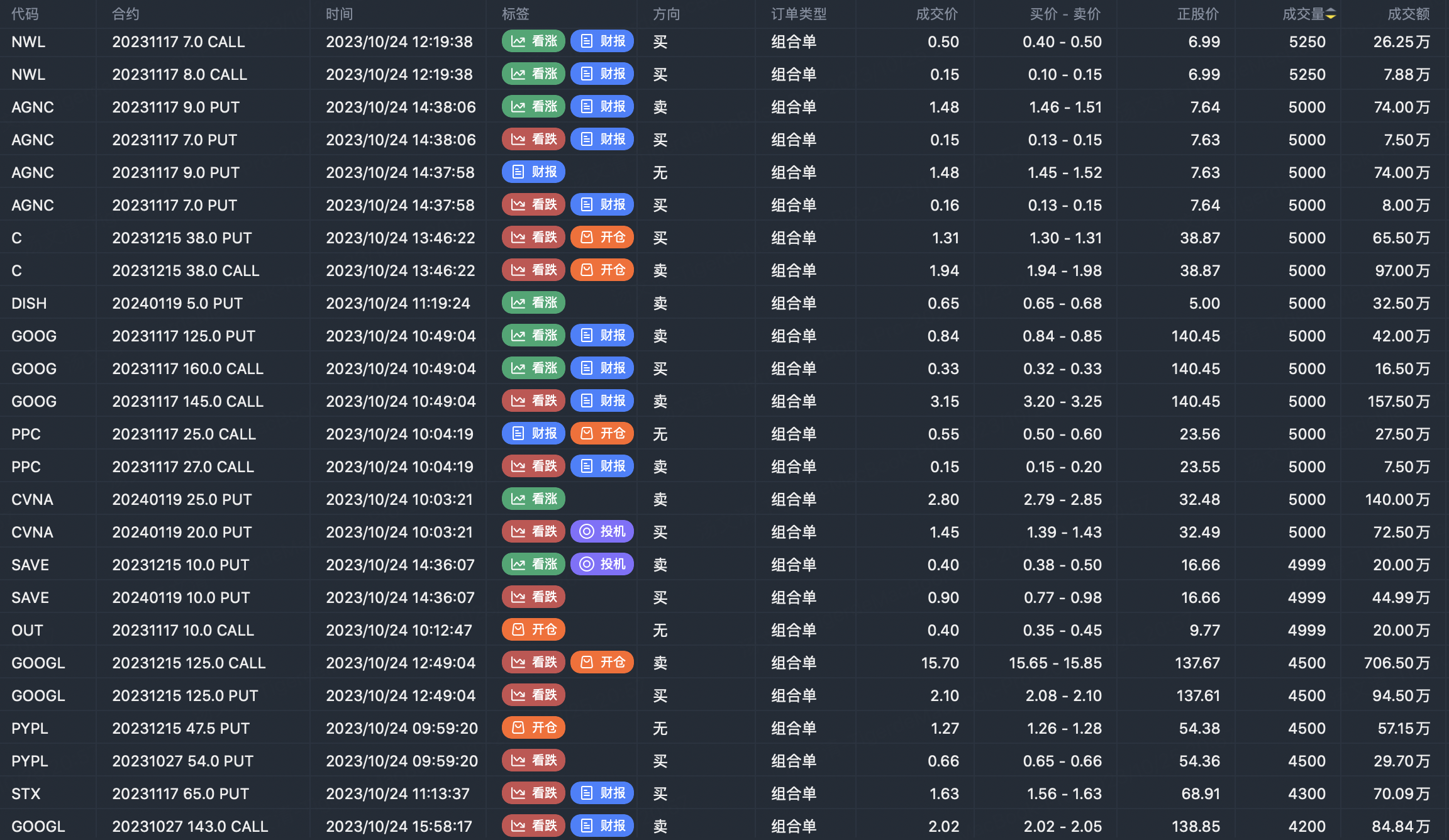

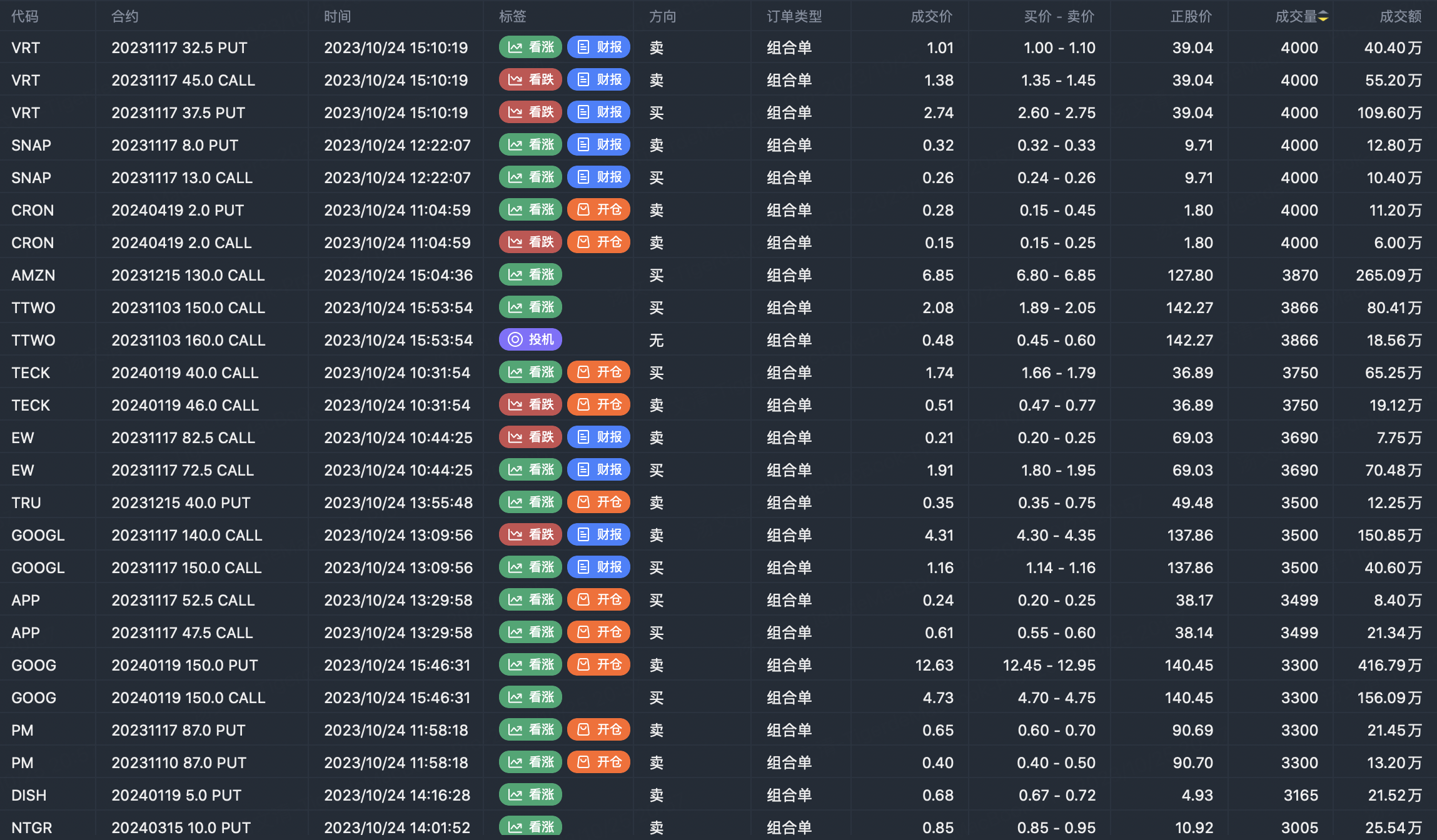

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Friday... Fright day

Good job

Good