EDV: Pricing-In Long-Term Inflation Of 3-4%, Lowering Downside Risk (Rating Upgrade)

Summary

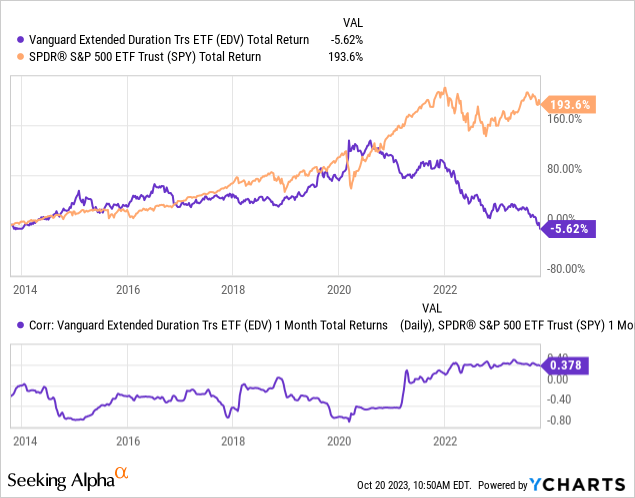

- Vanguard Extended Duration Treasury Index Fund ETF has lost half its value since early 2020 due to rising inflation and a positive stock-bond correlation, as I expected then.

- EDV's losses have accelerated this year with the yield curve's abnormally steepening pattern.

- The rise in the long end of the yield curve and the potential for an inflationary recession are vital factors affecting EDV's performance.

- EDV is now pricing for 3-4% inflation over the next two decades, a reasonable assumption given debt issues and demographic trends.

- The ETF could rebound if long-term rates peak and decline, but runaway inflation risks, debt monetization, and geopolitical strains could cause further decline.

William_Potter

Over the past two and a half years, I have had a relatively consistent bearish outlook on the long-term bond market. Initially, in early 2020, this outlook was due to my view that inflation would rise, causing the stock-bond correlation to turn positive and lead to a significant decline in long-term bond market prices. Despite the temporary decline in long-term bonds during the COVID-stimulus wave, that is almost exactly what has occurred since then, with the Vanguard Extended Duration Treasury Index Fund ETF (NYSEARCA:EDV) losing half of its value. As that article's summary in January 2020 points out, "If inflation rises only 3%, EDV is likely to lose about half of its value." Since then, inflation has risen by approximately 3% (to the 2023 level from the 2019 range), and EDV has lost 53% of its value.

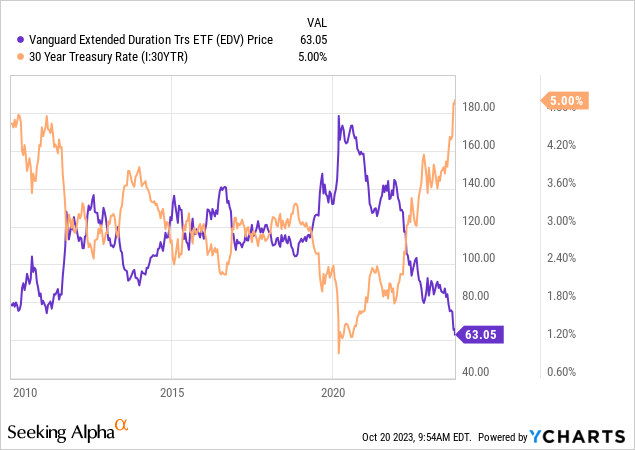

Early this year, I maintained that outlook regarding the Vanguard Extended Duration Treasury Index Fund ETF (EDV) in "EDV: Beware The Coming Yield Curve 'Re-Steepening.'" Since then, EDV's losses accelerated, causing the ETF to lose 26% of its value, making 2023 one of the worst years for the long-term bond market. EDV is very interesting because it invests in extremely long-term Treasury bonds, giving it an effective weighted-average maturity of 24.7 years. While theoretically having little credit risk (though that is debatable), these bonds have extremely high "duration risk." EDV's duration is currently 24.1X, meaning a 1% increase in its yield would cause it to lose around 24.1% of its value. The long-end of the Treasury curve is now at 5%, the highest since ~2011, causing EDV immense downward pressure. See below:

Data by YCharts

Data by YCharts

Compared to stocks, bonds are typically more prone to mean reversion. EDV has a solid yield today at 5% compared to the past, allowing investors to earn that high yield on their current investment. If long-term rates eventually decline, EDV should rise back to its previous levels, or at least those during the typical 2010s range, $100-$140, or 66% to 130% higher than its current price. Thus, while its downside risk remains ample, we must consider its positive potential should inflation and other factors. Depending on our assumptions, EDV may be a great investment today or among the worst.

Has the long end of the Curve Peaked?

Since 2020, there has been a considerable increase in the entirety of the yield curve. Short-term rates have risen more significantly than long-term rates, but only by around 1-2%, whereas the whole curve has increased by ~3-4%. In other words, regardless of the bond's maturity, its yield is likely around 3-4% higher. The Federal Reserve's rate policy effectively sets the short end of the curve, while the long end is more sensitive to economic trends.

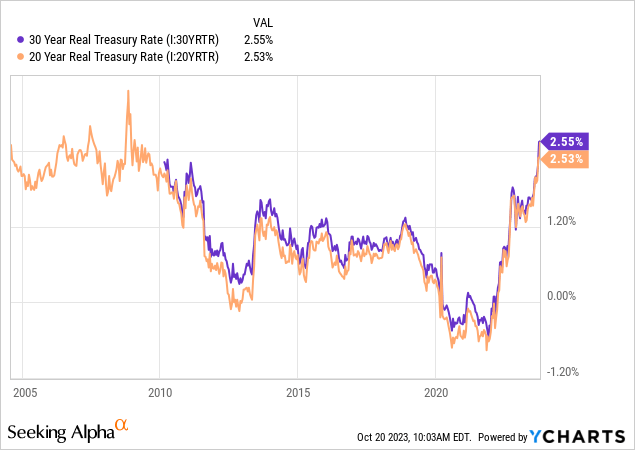

Treasury bonds also come in "inflation-securitized" bonds, which pay a much lower yield but payout any changes to the consumer price index. These lesser-known alternate bonds are essential because they can tell us how much EDV is expected to yield after long-term inflation. For example, in 2020, when rates were meager, this figure almost declined to -1%, meaning EDV had a negative expected return after inflation. It is around 2.54% today, the highest after-inflation return seen in around thirteen years. See below:

Data by YCharts

Data by YCharts

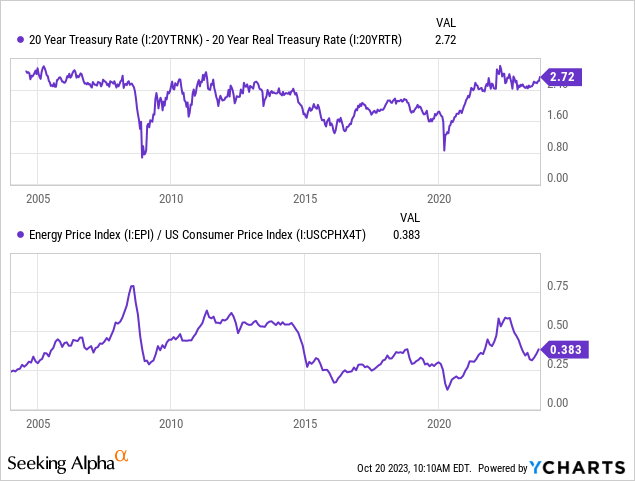

Fundamentally, EDV is a better opportunity when this figure is higher, so long as we do not expect inflation to continue to run off. Should the inflation outlook continue to increase, then EDV would lose value as rates would likely rise to keep up with the inflation outlook. Importantly, for EDV, short-term changes in inflation are not necessary, but instead, it is the long-term expectations for inflation over the next ~25 years. That figure is almost always around the Fed's 2% target but usually correlates to commodity prices because those inflationary factors are outside the Federal Reserve's control. See below:

Data by YCharts

Data by YCharts

The long-term inflation outlook is elevated today due to numerous enduring inflation forces. One is the upward pressure on energy prices, coming off very low energy prices during most of the 2010s. Technically, energy commodities like oil and gasoline are about average compared to consumer prices. However, in light of numerous domestic and international issues, there is some risk that they will rise higher soon and push the long-term inflation outlook. Secondarily, inflation is likely to remain high over the coming decades due to the government's great need for some inflation due to its extreme debt burden. Even more, population aging and a shrinking workforce-to-consumer ratio are expected to continue to promote inflation through chronic (skilled) labor shortages.

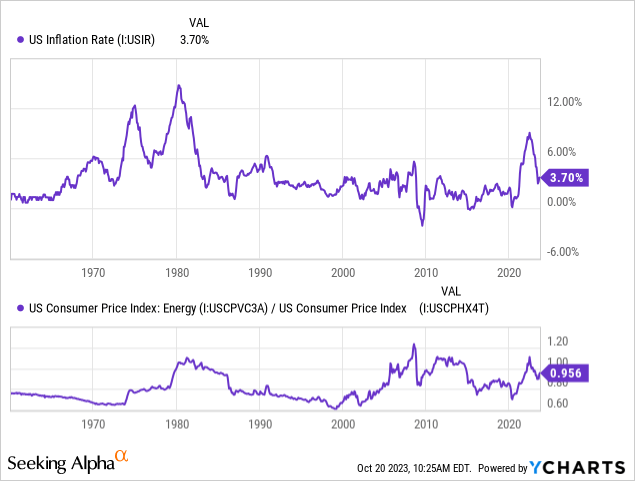

Inflation today is much lower than it was during the peak last year. Many attribute that change to success in the Federal Reserve's effort to combat inflation through higher interest rates and quantitative tightening. Indeed, those efforts have moderated inflation. QT has also likely significantly lowered EDV's value because the Federal Reserve stopped supporting that market through long-term Treasury purchases. However, historically, inflation can fall before rising even higher. This occurred twice during the 1970s, likely one of the most relevant periods to today in recent history. See below:

Data by YCharts

Data by YCharts

The core cause of the inflation spikes during the 1970s was the increase in energy prices stemming from the Arab oil embargo, which occurred to the week, exactly forty years ago. The embargo was caused in protest to the US military support for Israel. Over recent days, Iran has once again called on OPEC to pursue this action, starting with shipments to Israel but likely including its allies. In my view, investors must consider the eerily similar events between the situation then and today. Of course, there are key differences. One, OPEC is a bit more friendly with the US because most of those countries have become much more wealthy since then. Two, the US is a net oil exporter, insulating the US from a global energy crisis if the US reenacts an export ban. Third, immense growth and price declines in the EV market should tilt oil toward a glut over the coming decade. Still, should escalations continue, I expect EDV to take a hit since geopolitical pressures amongst commodity exporters are almost always inflationary.

Yield Curve Steepening Accelerates

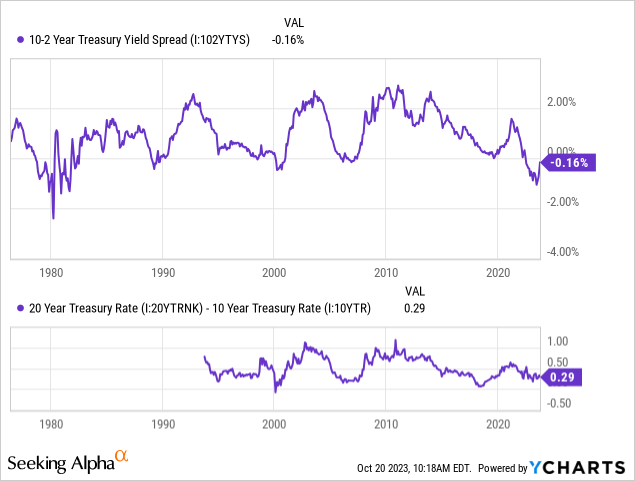

The secondary factor facing EDV is the steepening of the yield curve. Historically, the yield curve steepens as the US economy slows, with recessions usually occurring when the curve crosses back into positive territory. Thus, while an inverted curve predicts a recession, a "re-steepening" is the best immediate indicator, and that is precisely what we're seeing today. After falling to around -1%, the lowest level since the late 1970s (another parallel), the "10-2" curve is now at -16 bps and should reach zero within a month at its current pace. The "20-10" curve is relatively flat at 29 bps. See below:

Data by YCharts

Data by YCharts

The "20-10" curve is technically relevant to EDV because its yield will rise and fall with that figure and the "10-2" spread. That said, the spread between ultra-long and long-term bonds usually does not change too much over time because inflation and GDP growth expectations are unpredictable after 5-10 years. Still, as in most market cycles, we're seeing a steady re-steeping of the yield curve today, a significant indicator of a recession. Historically, recessions are slightly bullish for EDV because the inflation outlook usually falls during GDP declines. That said, that is more true for the 5-10 maturity segment, not the 20-30 year segment, because inflation expectations are less exposed to short-term economic changes that far out. Still, a sizeable economic depression that lasts a decade, such as that of the 1930s, could be bullish for EDV, as long as the Treasury does not need to monetize debt in such a scenario (a distinct possibility).

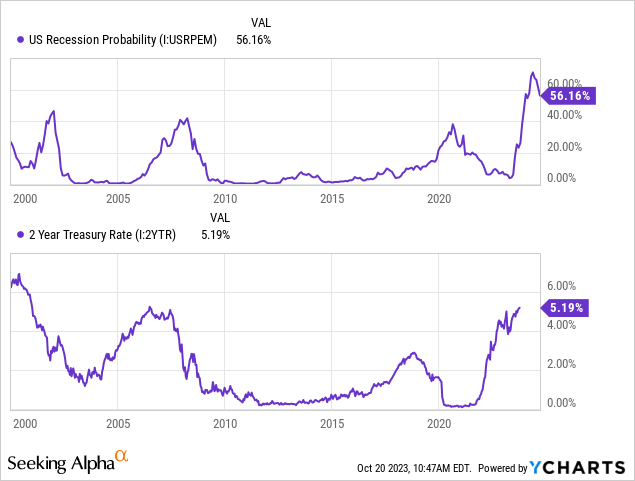

To that point, one significant anomaly today is the rise in the short-end of the yield curve over recent months despite the steepening yield curve. Usually, the yield curve rises in response to a negative outlook in the Federal Reserve's interest rate changes. In other words, the yield curve increases because investors expect the Federal Reserve to cut short-term interest rates while the long end of the curve remains unchanged. However, the short end of the curve is still rising today, but the curve is rising because the long-term rates are increasing more quickly. See below:

Data by YCharts

Data by YCharts

Historically, rising recession risks cause the Federal Reserve to make dovish shifts to reduce interest rates, bolstering the yield curve. Today, recession odds are very high, but we're not seeing the average declines to the 2-year Treasury rate. Instead, we see even higher long-term rates, pushing ETFs like EDV lower. That is a sign that the bond market is starting to price in a rare "inflationary recession" where the Fed cannot cut rates despite a recession due to inflation persistence. That only occurs when supply-side issues in the economy are growing, historically stemming from geopolitical issues (trade conflicts, wars, embargos, etc). Another sign of this is the alarmingly positive correlation between stocks and EDV. See below:

Data by YCharts

Data by YCharts

In January 2020, when the EDV-S&P 500 correlation was very low, my outlook was that the correlation would eventually become positive due to a rise in inflation. That is essentially what has occurred since then, despite the many black swan events from 2020 to today. Fundamentally, those black swan events have either decreased inflation (COVID-19) or increased it (the wars, money printing, supply chain, etc); however, I expect long-term inflation will continue to rise fundamentally due to debt and demographics.

The Bottom Line

The most crucial factor for EDV is the long-term outlook in inflation and the shorter-term economic cycle. The fact is that EDV's 25-year maturity makes disinflation from a recession a relatively small but potentially bullish factor. Historically, EDV has risen in value during past slowdowns, but that was partly due to Federal Reserve stimulus efforts, which are currently unlikely. Still, a 1% decline in EDV's yield should cause it to rise by over 25% (and vice versa), so there is bullish potential from EDV, given a recession.

I think EDV is more likely at its fair value today after losing half of its value since 2020, as I initially expected. If we assume that bonds "should" pay 1-2% over inflation in the long run (a historical norm), and EDV's yield is currently ~5%, then EDV is essentially pricing in 3-4% inflation over the next 25 years. Even if the Federal Reserve is officially targeting a 2% rate, it is highly likely to lift that target to 3-4% at some point soon.

With a 120% debt-to-GDP, the US likely is unable to repay its obligations (which are what EDV owns) without diluting the currency over the long run. That could be achieved by allowing inflation to remain slightly elevated for many years, which would be relatively neutral for EDV, given it effectively discounting prolonged 3-4% inflation. However, my concern is that, in a recession, decreased tax receipts combined with skyrocketing interest costs cause the US government to continue to lose credit rating status. In such a scenario, the situation could quickly become unmanageable, leading to an uncontrolled increase in inflation, which, historically, often occurs with overleveraged fiat-currency governments. Any extreme monetary deviation would make EDV lose all or most of its current value. Therefore, I am not bullish on EDV today. Still, I am not as bearish as earlier this year because it now appears appropriately priced for a reasonable long-term economic scenario.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.