Should Q3 Earnings make Tencent's Honour back?

$TENCENT(00700)$ announcing its Q3 2023 financial report. After the announcement, $Prosus NV(PROSF)$ , major shareholder of Tencent (hold by $Naspers Ltd.(NPSNY)$ , soared over 4% on the Euronext Amsterdam.

A positive and proactive Q3 report.

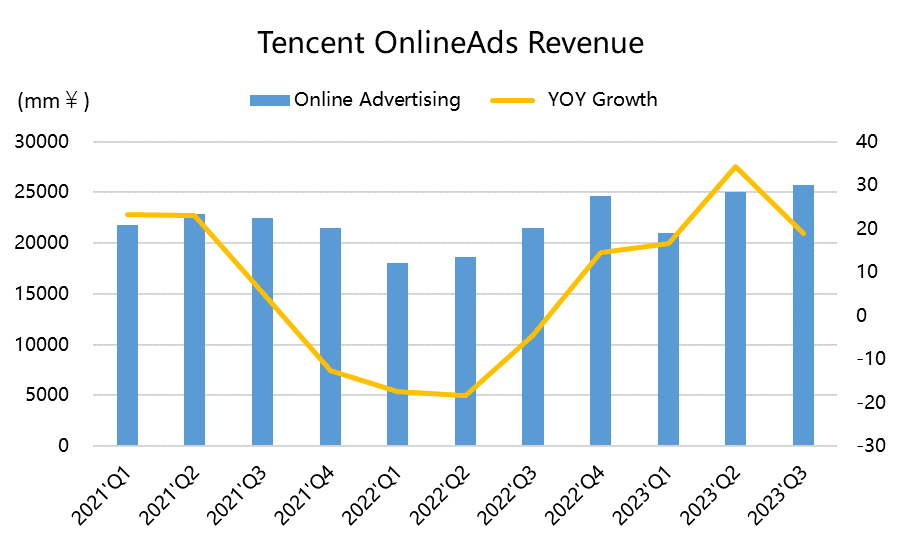

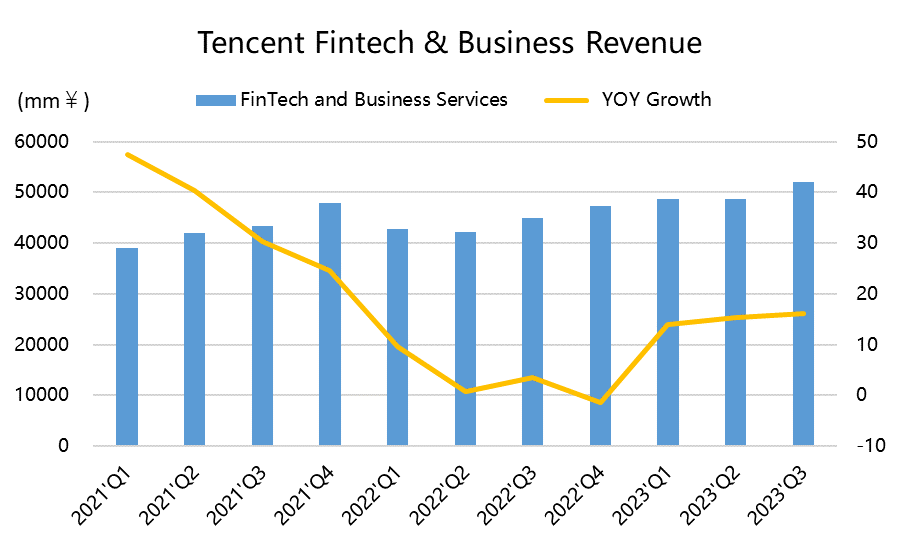

Revenue continued to increase, with strong performance in advertising and financial technology in Q2 leading to higher expectations for Q3. The gaming business remained stable, while international operations continued to grow at a double-digit rate. The advertising business grew as expected, demonstrating the continued effectiveness of the WeChat ecosystem for advertising. The financial technology and enterprise services exceeded expectations, driven by offline commercial activities and opportunities brought by the ecosystem for cloud services.

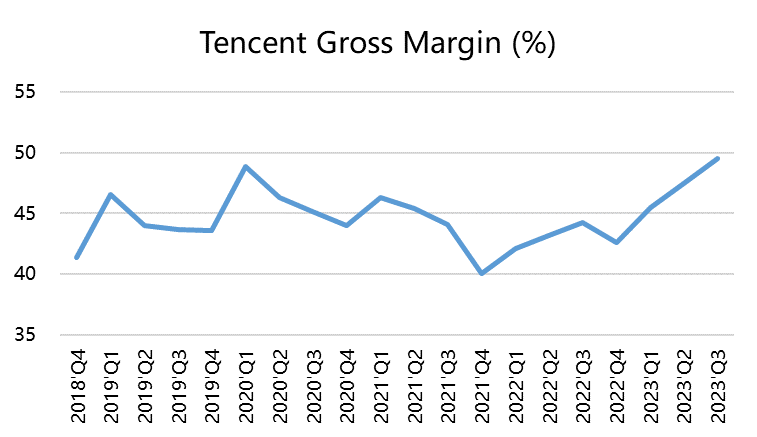

Gross profit margin increased rapidly from 44% to 48% (exceeding the levels during the home isolation period in Q1 2020), benefiting from changes in cost structure. The company actively reduced high-cost businesses such as video, audio, and game livestreaming, while increasing high-margin services such as advertising and e-commerce. The cost increase of projects such as the ecosystem chain and online distribution was lower compared to revenue.

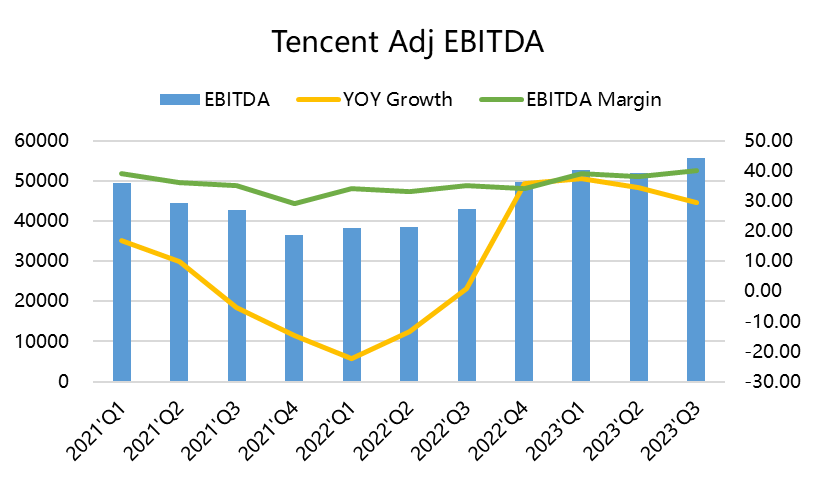

Decline in net profit is due to "hidden expectations", operation margins even higher. The three major expenses were well controlled, with marketing expenses increasing by only 12% and mainly used for advertising and the WeChat ecosystem. The most important profit indicator, EBITDA profit margin, increased to 40%. However, financial expenses and income tax increased disproportionately due to exchange rate gains, interest expenses at high interest rate levels, and the provision for expected income tax. This also includes the impact of previous dividends (such as Meituan-W (03690)), but it is mainly a one-time effect.

In terms of stock price, Tencent has short-term optimism due to the inflow of funds into the Hong Kong stock market. Although major shareholders have not stopped selling, there is support from share buybacks. Interestingly, due to share buyback cancellations, the overall share capital has decreased, but the remaining shareholding proportion of major shareholders has actually increased, leading to a phenomenon of "selling more while holding more".

In terms of valuation, Tencent's profit multiple is still at an extremely low level in the past 10 years. The PE ratio for the past 12 months is 14.3 times, far below the 10-year average of 31 times. The EV/EBITDA ratio for the past 12 months is 9.8 times, far below the 10-year average of 23 times.

Earnings Review

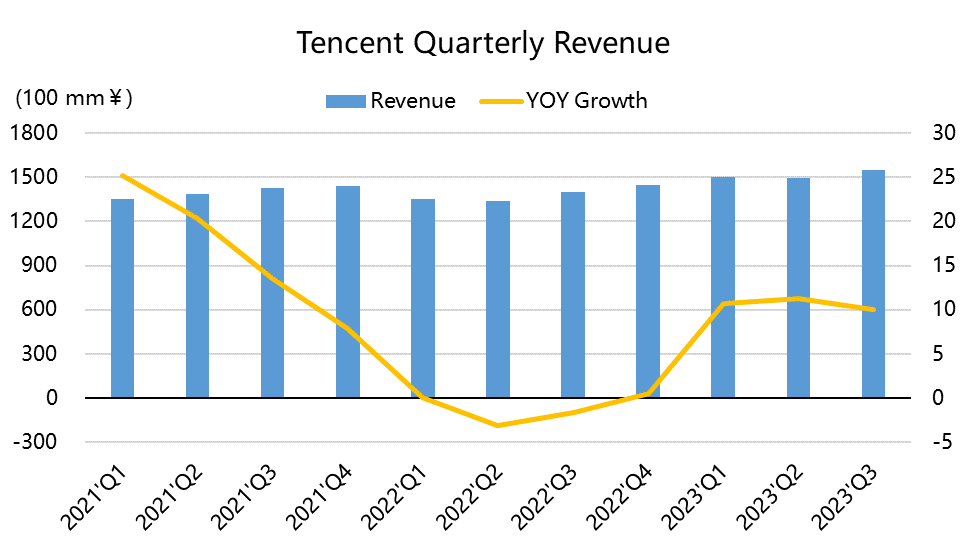

Revenue

Revenue reached 154.6 billion yuan, a year-on-year increase of 10%, which is basically in line with market expectations of 152 billion yuan, and the growth rate is the same as the previous quarter;

Among them, the revenue from value-added services was 75.748 billion yuan, a year-on-year increase of 4%, lower than the market expectation of 77.9 billion yuan; the revenue from domestic games was 32.7 billion yuan, a year-on-year increase of 5%, lower than the expected 33.4 billion yuan; the revenue from international games was 13.3 billion yuan, a year-on-year increase of 14%, slightly lower than the market expectation of 13.6 billion yuan; the revenue from social networks was 29.7 billion yuan, remaining stable, lower than the market expectation of 30.7 billion yuan;

The revenue from online advertising business reached 25.7 billion yuan, a year-on-year increase of 20%, far exceeding the market expectation of 26.2 billion yuan;

The revenue from fintech and enterprise services reached 52 billion yuan, a year-on-year increase of 15%, higher than the market expectation of 50.7 billion yuan.

Profits

Gross profit was 76.5 billion yuan, a year-on-year increase of 23%, higher than the market expectation of 72.7 billion yuan;

Operating profit was 48.4 billion yuan, a year-on-year decrease of 6%;

Non-IFRS profit was 36.18 billion yuan, a year-on-year decrease of 9%;

Adjusted EBITDA was 61.3 billion yuan, a year-on-year increase of 26%, far exceeding the expected 56.8 billion yuan, and the profit margin also increased from last year's 35% and last quarter's 38% to 40%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Jpartz·2023-11-15Great ariticle, would you like to share it?LikeReport

- Newnew·2023-11-16HiLikeReport