Options Spy | Apple's puts are extended, Microsoft continues to be bullish

Us Treasuries rose after economic data met expectations of a soft landing, reinforcing expectations that the Fed's interest rate hike cycle is over, and the main index of US stocks closed almost all higher on Thursday (16th).

On the political and economic front, the U.S. Senate on Wednesday passed a two-stage appropriations stopgap spending bill proposed by House Speaker Jeb Johnson, which will be sent to Joe Biden to sign into law by a weekend deadline that risks extending the federal government until January.

Reuters exclusively reported that Fed governors Philip Jefferson, Lisa Cook and Adriana Kugler wrote in a letter to Senator Rick Scott, It is unclear how long the Fed's balance sheet reduction process will last, but there is scope to continue, with the size of the balance sheet dependent on funding demand.

Speaking at the Asia-Pacific Economic Cooperation (APEC) summit in San Francisco on Thursday, U.S. President Joe Biden said a stable relationship between the world's two largest economies would not only benefit the two economies, but also the world.

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Apple(AAPL)$ Repeatedly trade put options orders $AAPL 20231229 185.0 PUT$

$Meta Platforms, Inc.(META)$ Sell calls and buy puts $META 20251219 415.0 CALL$ $META 20240517 280.0 PUT$

$Microsoft(MSFT)$ Sell put options $MSFT 20231215 410.0 PUT$

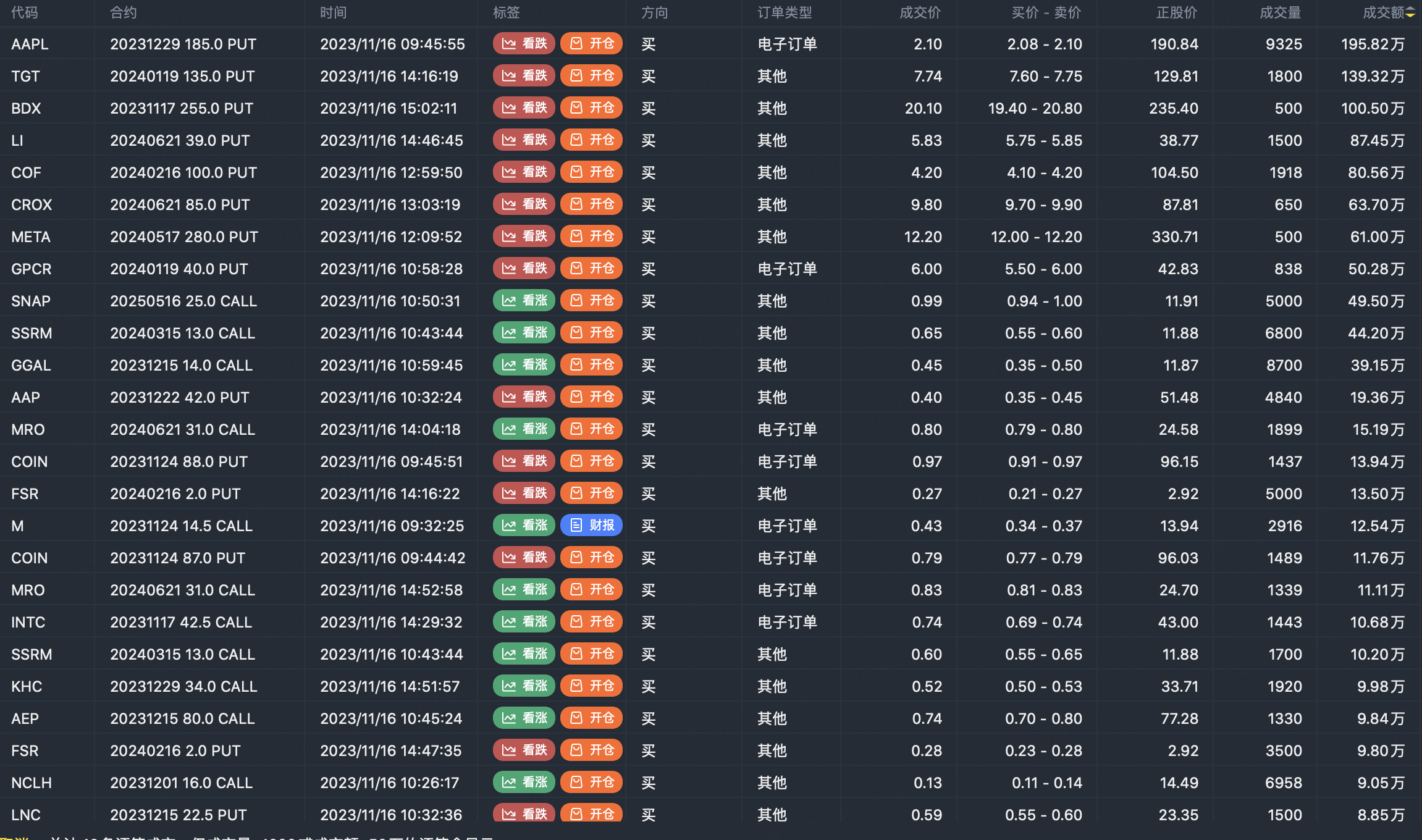

Option buyer open position (Single leg)

Buy TOP T/O:

$AAPL 20231229 185.0 PUT$ $TGT 20240119 135.0 PUT$

Buy TOP Vol:

$AAPL 20231229 185.0 PUT$ $GGAL 20231215 14.0 CALL$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

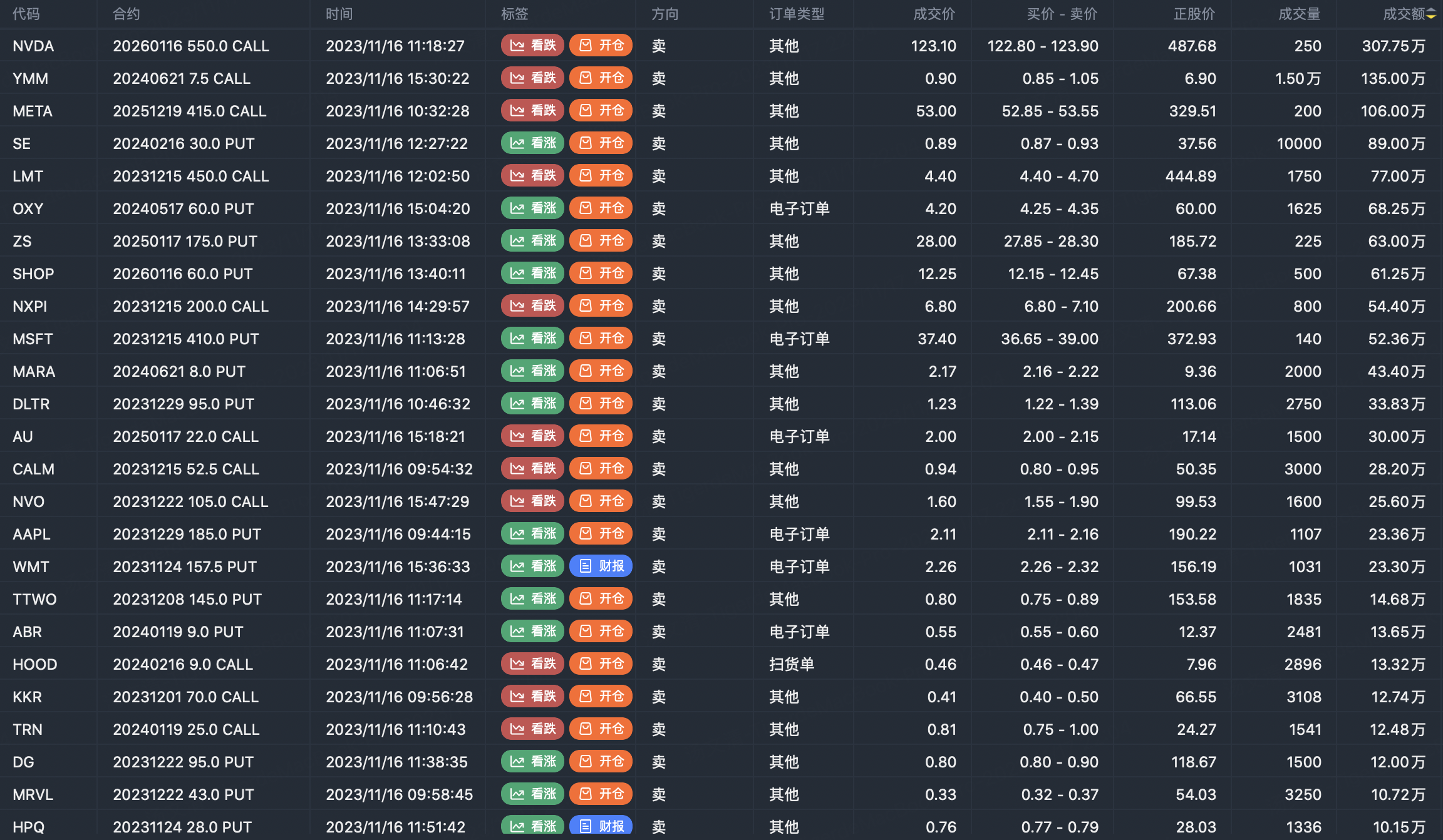

Option seller open position (Single leg)

Sell TOP T/O:

$NVDA 20260116 550.0 CALL$ $YMM 20240621 7.5 CALL$

Sell TOP Vol:

$YMM 20240621 7.5 CALL$ $SE 20240216 30.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

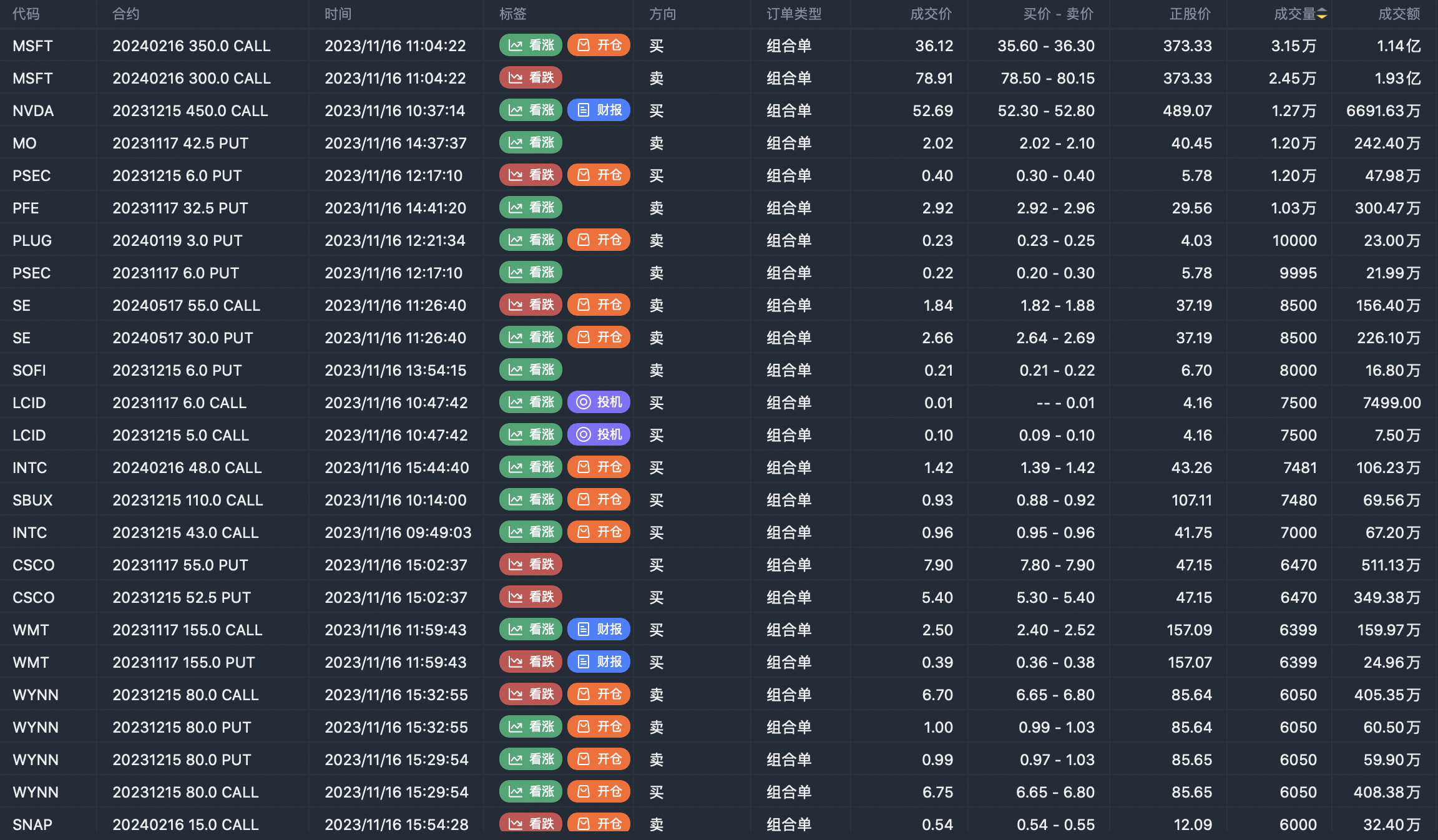

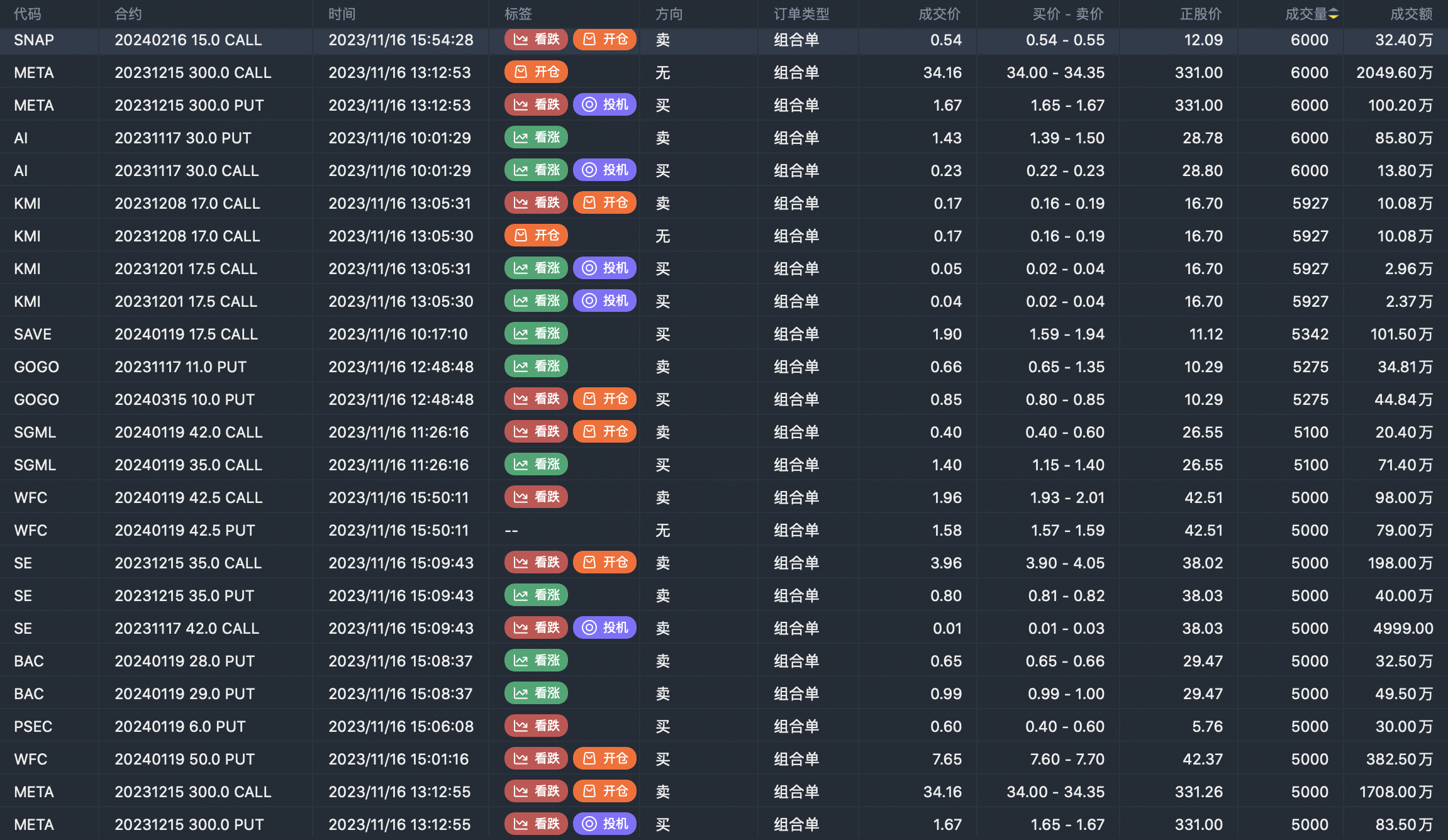

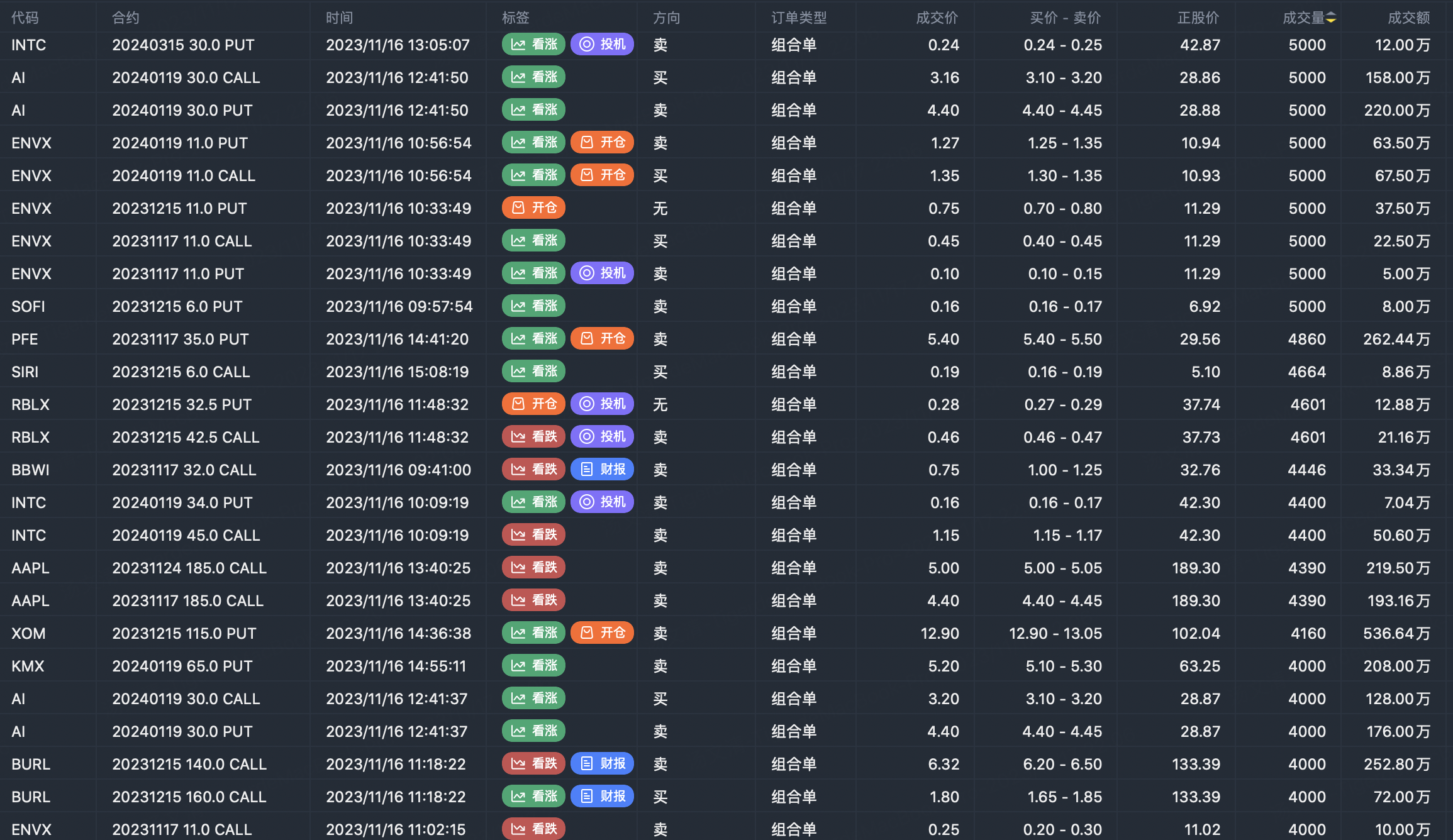

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?