Options Spy | Institutions are strongly bullish on Apple's stock price to 250 next year

With the market still digesting earnings and Fed minutes, energy stocks were depressed, Nvidia fell nearly 2.5 percent and Microsoft jumped on news that Sam Altman will return to lead OpenAI. Trading volume slowed ahead of the Thanksgiving holiday.

On the economic front, the number of Americans filing new claims for unemployment benefits fell last week by the most since June, the latest data from the Labor Department showed on Wednesday, pointing to broad signs of employee retention ahead of the Thanksgiving holiday.

In a separate report, orders for long-lasting U.S. goods fell 5.4 percent in October, more than expected and the biggest drop since April 2020, as demand for business equipment weakened and orders for commercial aircraft fell.

Data released by the University of Michigan on Wednesday showed that the final consumer confidence index in November rose from the preliminary reading, but remained at a six-month low. Long-term inflation expectations remained at their highest since 2011, while short-term inflation expectations hit an eight-month high.

In political and economic news, the Organization of Petroleum Exporting Countries and Russia and other oil-producing Allies (OPEC+) postponed their production meeting due to differences in oil production, and the talks originally scheduled for November 26 will be extended to November 30, which raises questions about global crude oil supply, international oil prices fell, dragging down energy stocks.

The OPEC+ meeting, which includes major producers Saudi Arabia and Russia as well as other Allies and members of the Organization of the Petroleum Exporting Countries (OPEC), is expected to consider further changes to a deal that already limits supply until 2024, the sources said.

The minutes of the November monetary policy meeting suggested that monetary policy would remain restrictive and there was no sign of a rate cut in the near term, with traders forecasting a cut in May as the most likely date, according to the Chicago Mercantile Exchange's FedWatch tool.

Big money managers say the recent rally that has lifted U.S. stocks and bonds is more of a year-end rally than a turning point, arguing that fiscal and monetary policy, next year's presidential election and recession fears could begin to weigh on the market.

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Apple(AAPL)$ Buy call options $AAPL 20241220 250.0 CALL$

$Amazon.com(AMZN)$ Buy call options $AMZN 20231215 147.0 CALL$

$Microsoft(MSFT)$ Sell call options $MSFT 20231124 387.5 CALL$

Option buyer open position (Single leg)

Buy TOP T/O:

$AAPL 20241220 250.0 CALL$ $NVDA 20260116 640.0 CALL$

Buy TOP Vol:

$NVDA 20260116 640.0 CALL$ $PBR 20241220 12.0 PUT$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Sell TOP T/O:

$PDD 20240920 145.0 CALL$ $PBR 20240621 15.0 PUT$

Sell TOP Vol:

$CHPT 20231201 2.0 CALL$ $PBR 20240621 15.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

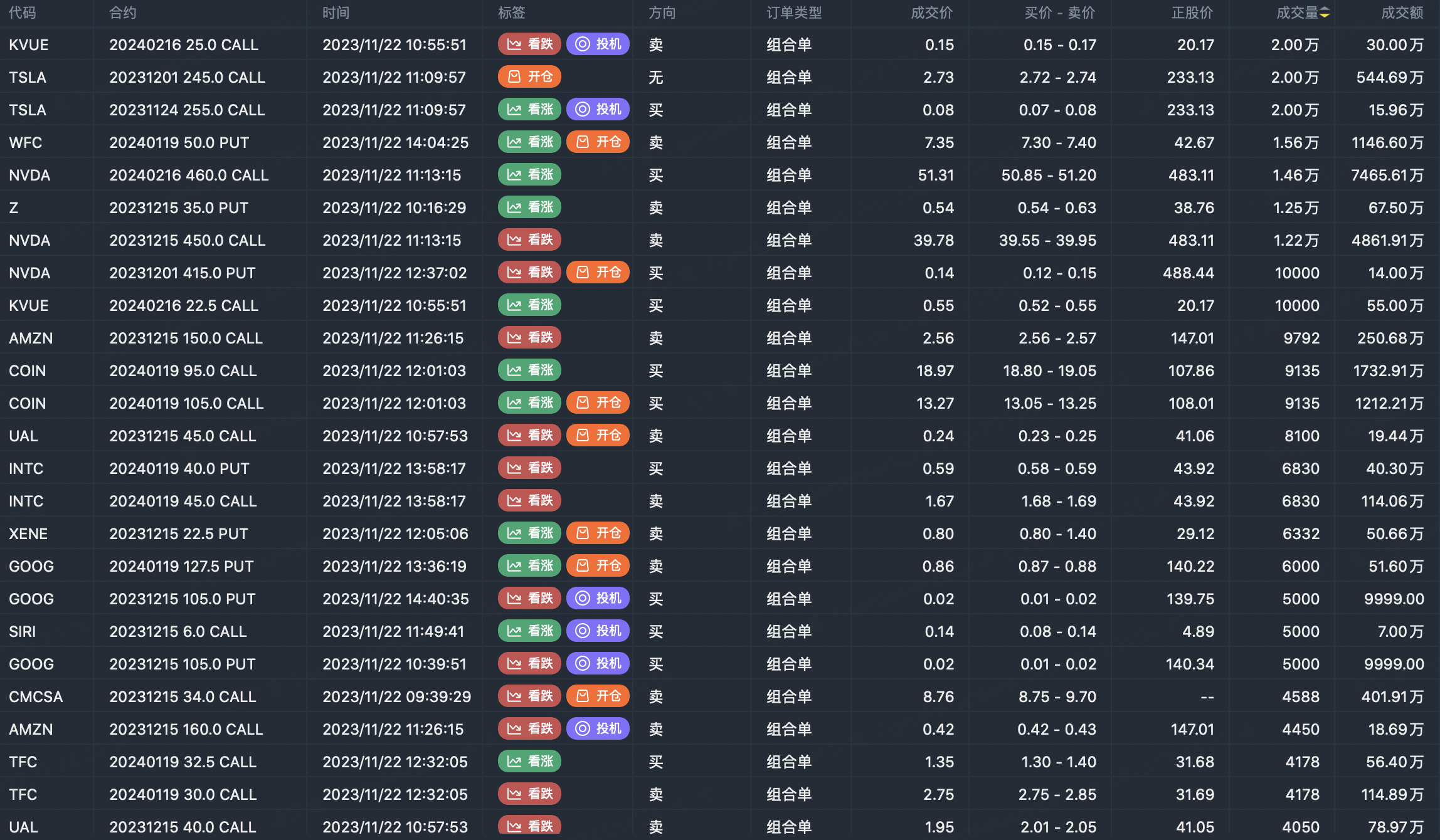

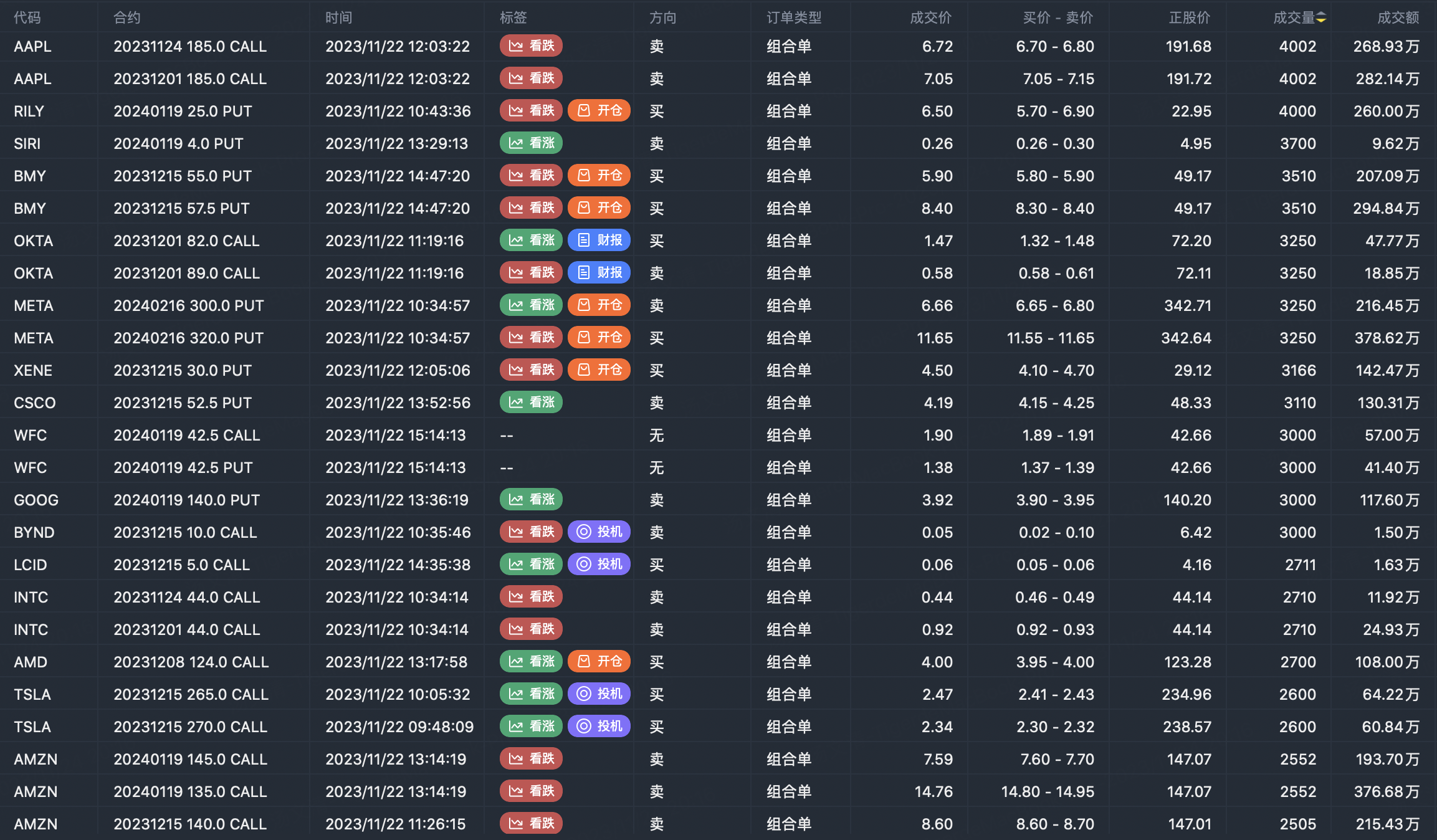

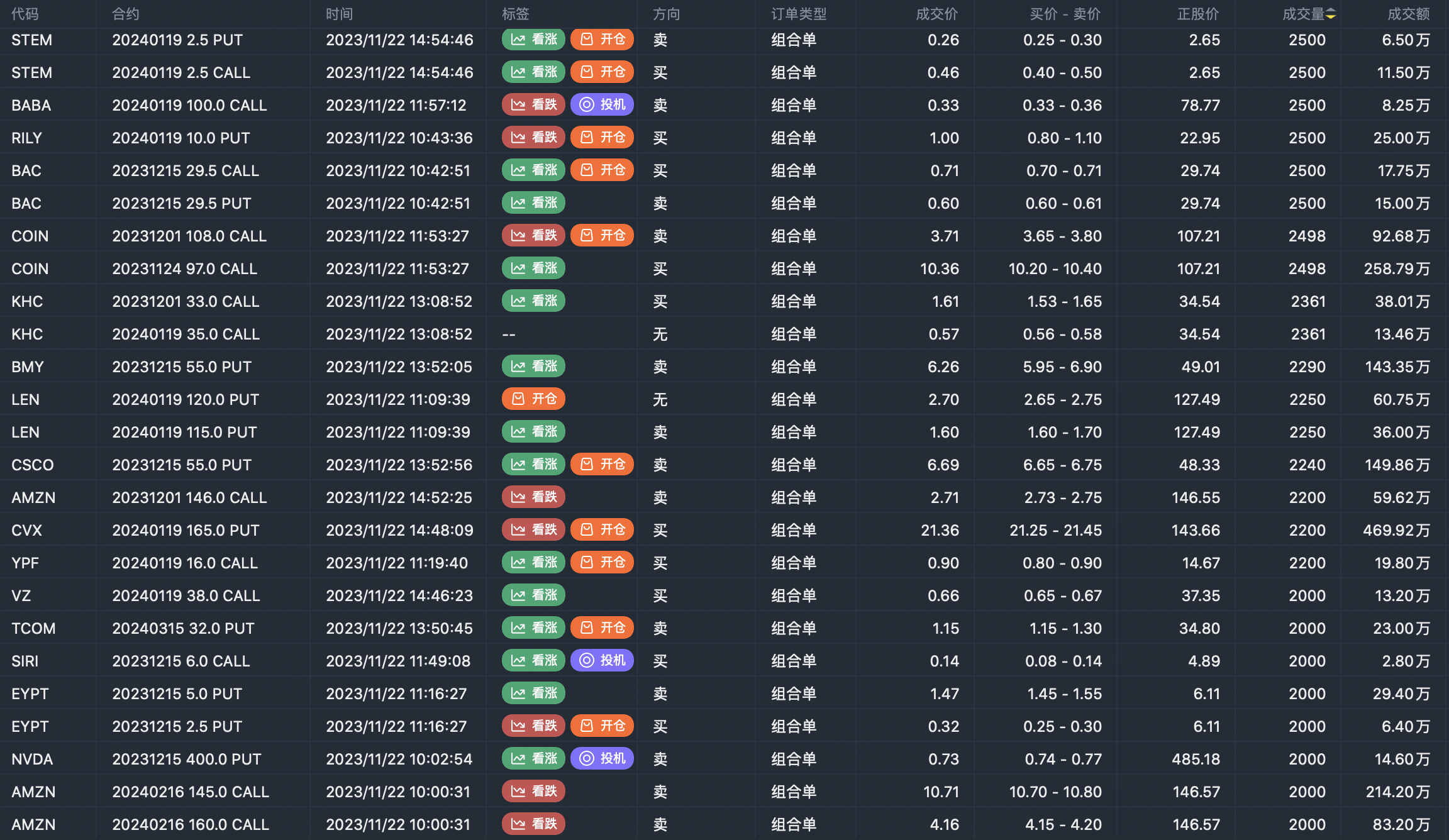

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?