Is Gold in the Beginning of a Historic Short Squeeze?

With the publication of comments from two important Fed directors overnight, the market speculation that the Fed will cut interest rates in 2024 is more intense.

First,Governor Waller, one of the Fed's toughest officials, said that the policy is in place to return the inflation rate to the Fed's target of 2%, indicating that policy makers may not need to rate hike again.

Second,Bowman, another Fed governor, said she is still willing to support rate hike if inflation stagnates, but did not express her support for next month's rate hike.

It should be said that the speeches of the above-mentioned two directors with permanent voting rights are dovish and hawkish, and the market directly interprets them as all dovish,That is to say, the Federal Reserve has recognized the cowardice and can't bear it, and it will cut interest rates in the near future.

CME group Watch FedWatch tool shows that as of November 28,It is estimated that the possibility of cutting interest rates in May and June next year is 70% and 88% respectively.

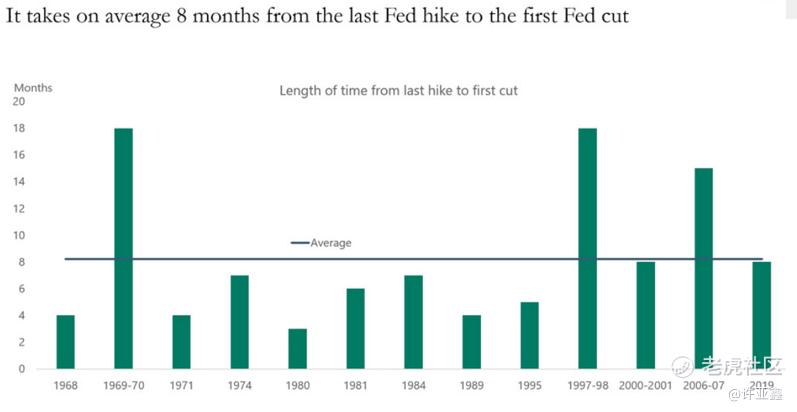

As shown in the statistics above, the average interval between the Fed's "last rate hike" and "first interest rate cut" in each cycle in history is 8 months. Since the market generally expects July this year to be the end of this round of Fed rate hike, doesn't this mean that the market is speculating on the expectation that the Fed will cut interest rates in March next year?

According to the latest data, the market expects the probability of interest rate cut in March next year to be close to 30%, which means that with another important data, the market can basically calculate the interest rate cut in March next year, and the closest important US data,It is the latest non-farm payrolls report of the United States to be released on the evening of December 8th.

Of course, in addition to the selling of the the US Dollar Index overnight, the yield of 10-year US bonds is also declining, and it has been reported at 4.261% so far, which has completely broken away from the high of 5% at the end of October.

The main "players" in the spot market of US bonds include: overseas investors (30%), Federal Reserve (22%), mutual funds (14%) and pension funds (13%), banks (7%), state and local governments (6%), individual investors (5%) and insurance companies (2%).

Although the proportion of individual investors, mainly hedge funds, is not high, it is the most important marginal buying force in the US debt market since the rate hike shrinking balance sheet last year.

According to statistics, from last year to the first half of this year, the Federal Reserve's holdings of US bonds decreased by 1.342 trillion, mutual funds decreased by 686 billion, and overseas investors decreased by 109 billion, with a total reduction of US debt of 2.136 trillion US dollars.Individual investors, mainly hedge funds, increased their holdings of about 1.696 trillion US bonds.

So, have you thought about one thing? What will happen if the subsequent purchasing power of US bonds is not enough and the US Treasury Department faces huge demand for issuing bonds?

Therefore, it is best for the Fed not to "cut interest rates early" as expected by the market next year, because once the Fed is forced to do so, there is a great possibility that some kind of crisis will break out, such as the liquidity crisis in the US bonds‘ market.

To understand this, let's look back at July this year. As the Treasury Secretary of the United States, Yellen, with a flattering smile, was vomited by American netizens to "bend over and bow" to China many times. What do you think about its meaning?

-END-

$NQ100 Index Main Connection 2312 (NQmain) $$SP500 Index Main Connection 2312 (ESmain) $$Dow Jones Main Connection 2312 (YMmain) $$Gold Main Connection 2312 (GCmain) $$WTI Crude Oil Main Connection 2312 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

As long as interest rates are lowered, the bull market in the stock market will come again haha

Let's wait for the interest rate cut to come

I don't think they're going to cut interest rates so soon

Waller's views will have a huge impact on the market

Why have they suddenly become doves?

bagus